But, while 2022 hit cryptos hard, some assets weathered the year well.

Or, at least better than others.

So, which cryptos performed best in 2022?

So, miners had to seek out another avenue.

This asset can still be mined, which makes it a desirable option for ex-Ethereum miners.

Though the various crashes of 2022 also hit ETC prices, the asset weathered this well.

At the start of the year, one ETC was worth around $34.

At the beginning of December, one ETC was worth around $20.

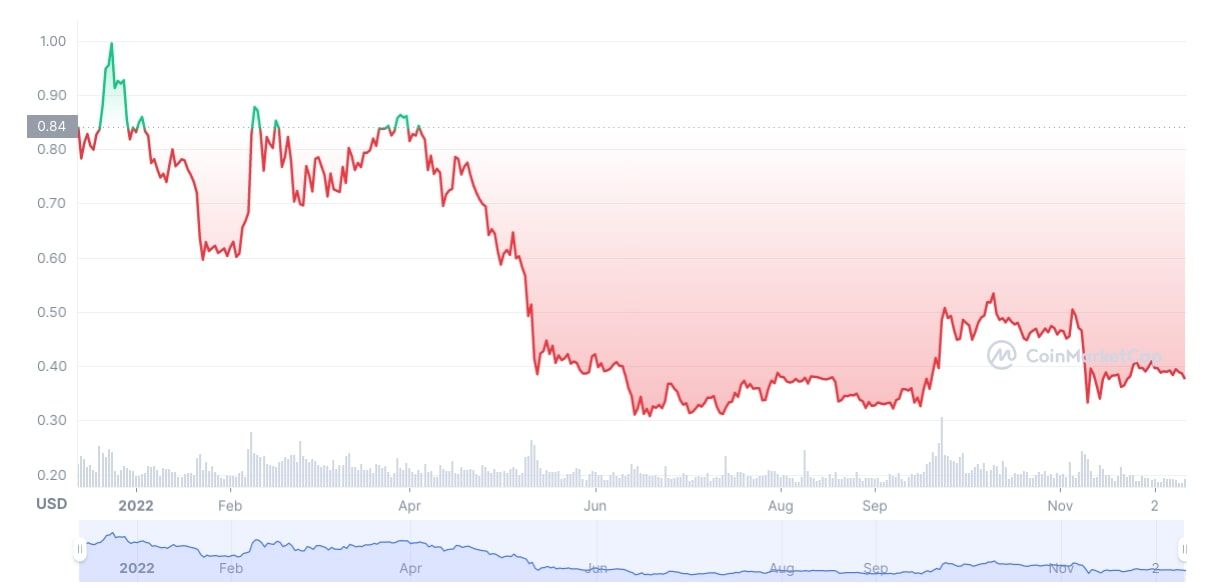

Like most other crypto assets, XRP’s price dropped in 2022.

However, XRP’s price stopped falling mid-year and even began to recover for a short while.

This consists of the BNB Beacon Chain and the BNB Smart Chain.

The former chain is used for governance and staking, while the latter allows for the development of DApps.

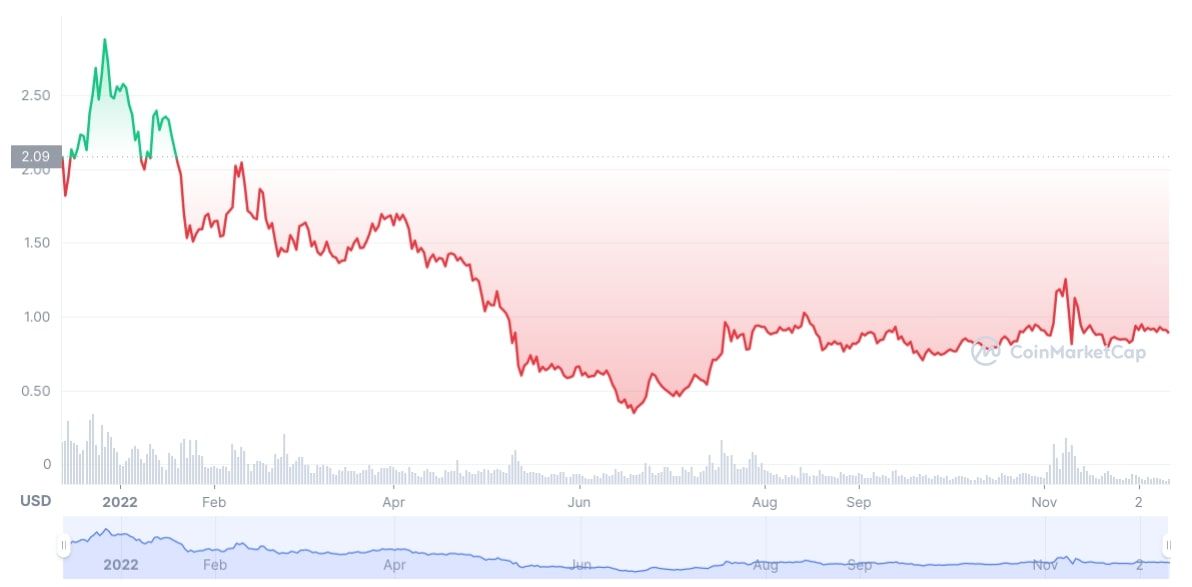

LDO’s price suffered significantly between May and June 2022 but then started to recover.

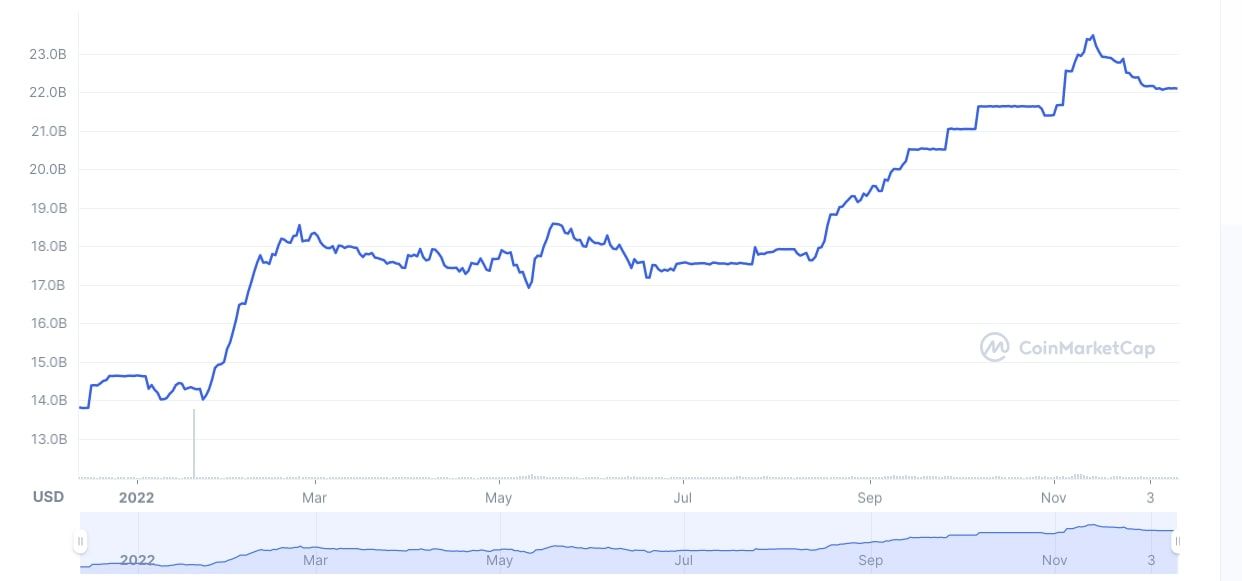

Therefore, if Binance USD’s price were to rise (or fall!)

drastically, it would be bad news.

The market cap multiplies the value of the asset by its circulating supply.

As you’re free to see above, Binance USD’s market cap grew significantly throughout 2022.

In fact, it grew by over 50 percent!

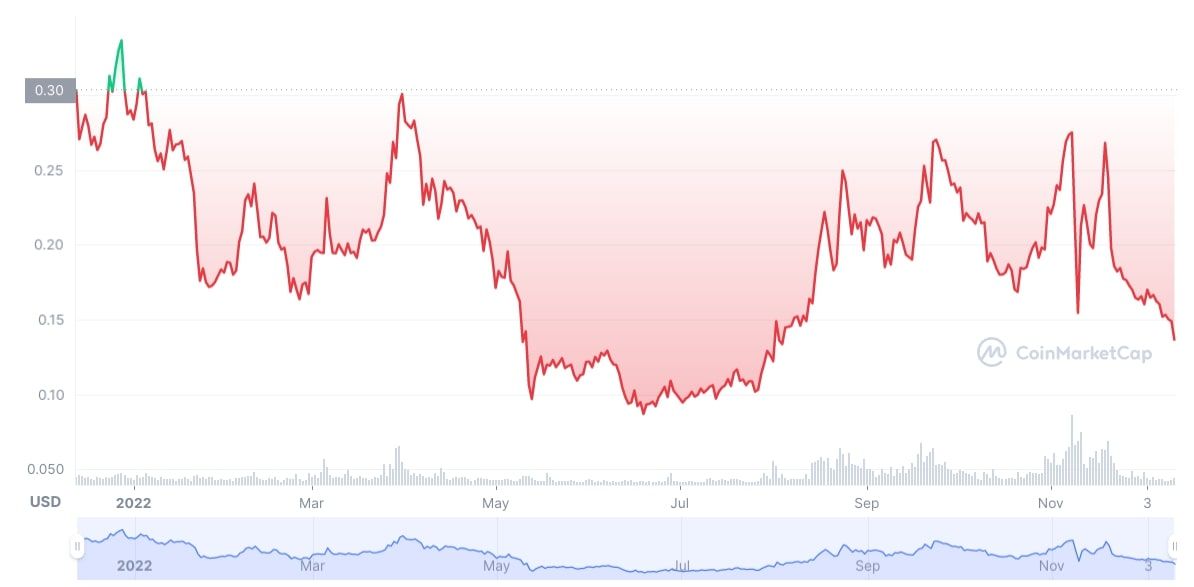

The web link’s native asset is an ERC-20 token known as CHZ.

CHZ did pretty well throughout the second half of 2022 after suffering considerably during the May crypto crash.

However, the FTX bankruptcy case had a detrimental effect on the price of Chiliz.

At the time of writing, one CHZ is worth $0.15.

This may improve in 2023, though there is no way of knowing for sure.

Polygon (MATIC)

ThePolygon blockchainallows blockchain Ethereum-compatible networks to connect and scale.

Polygon’s native cryptocurrency is MATIC, with a current value of $0.92.

But MATIC is now recovering again and may reach a dollar in value soon.

Uniswap (UNI)

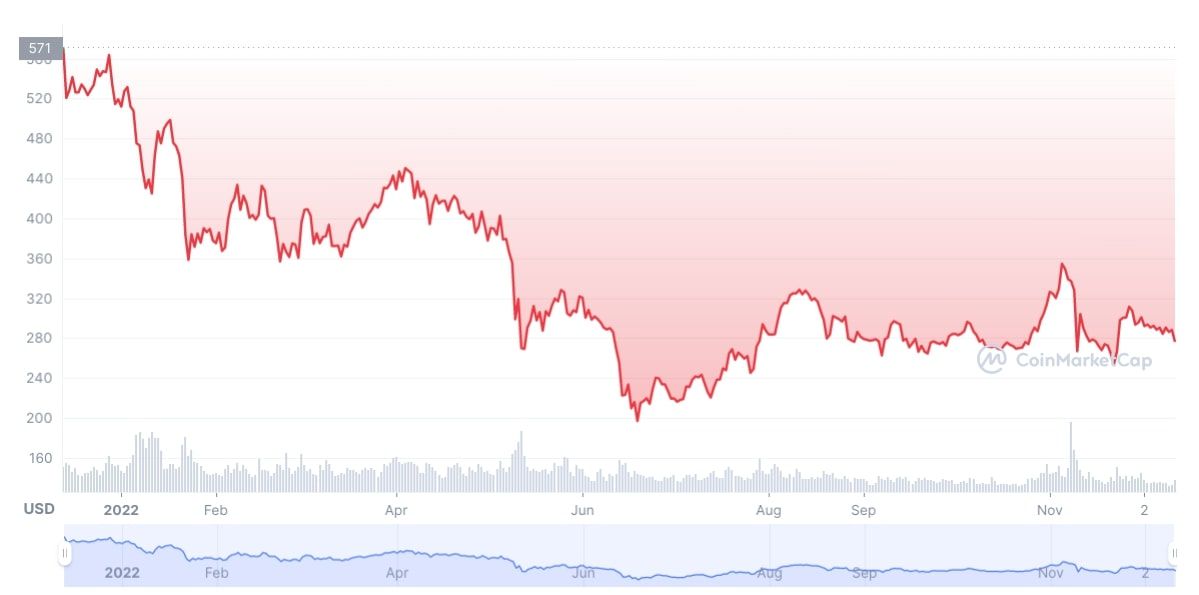

UNI is the native token of theUniswap decentralized exchange.

The Uniswap DEX is currently the biggest in the industry and stands at the forefront of the DeFi realm.

It also had a tough time in November amid the FTX fiasco.

Trust Wallet has developed its own asset, known as TWT, for its governance process.

Those who hold Trust Wallet Token can participate in governance to have their say in how Trust Wallet progresses.

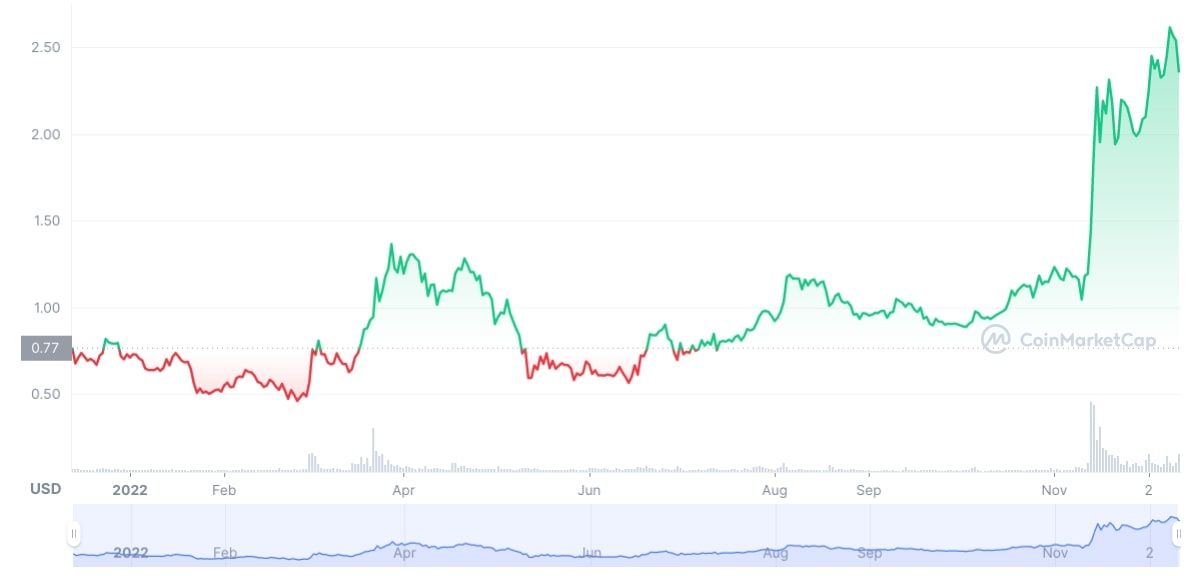

As Trust Wallet’s popularity has increased, the price of TWT has grown significantly.

For example, between June and December 2022, TWT’s price rose from $0.67 to $2.65.

This increase of nearly 300% was incredibly good news for the platform and investors.

In fact, TWT barely took a hit during the crash ignited by the FTX bankruptcy.

Since the start of November, TWT’s value grew by $1.45.

TWT’s market cap is also continuing to rise, along with its trading volume.

Things are looking hopeful for this asset, which may continue to do well throughout 2023.

Cosmos (ATOM)

The Cosmos networkhas a focus on providing blockchains with interoperability.

Essentially, it provides blockchains with the ability to communicate with each other.

ATOM is the native cryptocurrency of the Cosmos ecosystem and is a pretty popular asset.

But this wasn’t curtains for Cosmos.

But numerous cryptos weathered this year well, especially those with a good deal of utility.

Always conduct your own due diligence and consult a licensed financial adviser for investment advice.