But what does it mean for investors?

And what impact will the Litecoin halving have on the wider cryptocurrency landscape?

Litecoin shares a similar halving mechanism to Bitcoin, which also undergoes a halving event every four years.

What Is a Halving Event?

Firstly, lets take a look at what a halving event is.

Halving events are pre-programmed into cryptocurrencies like Bitcoin and Litecoin.

Although Litecoins halving events are cyclical, theyre only programmed to take place after every 840,000 blocks are mined.

Because of its 2.5-minute block mining rate, Litecoins halving event occurs roughly every four years.

Previously, Litecoins halving events took place in 2015 and 2019, respectively.

When Litecoin was launched, its block reward for miners stood at 50 LTC.

However, the 2015 halving event lowered the payout to 25 LTC and down to 12.5 LTC in 2019.

Whats the Purpose of a Halving Event?

In the cryptocurrency world, halving events can act as an effective hedge against inflation.

What Does the Halving Event Mean for the Value of LTC?

So, what does this halving event mean for investors?

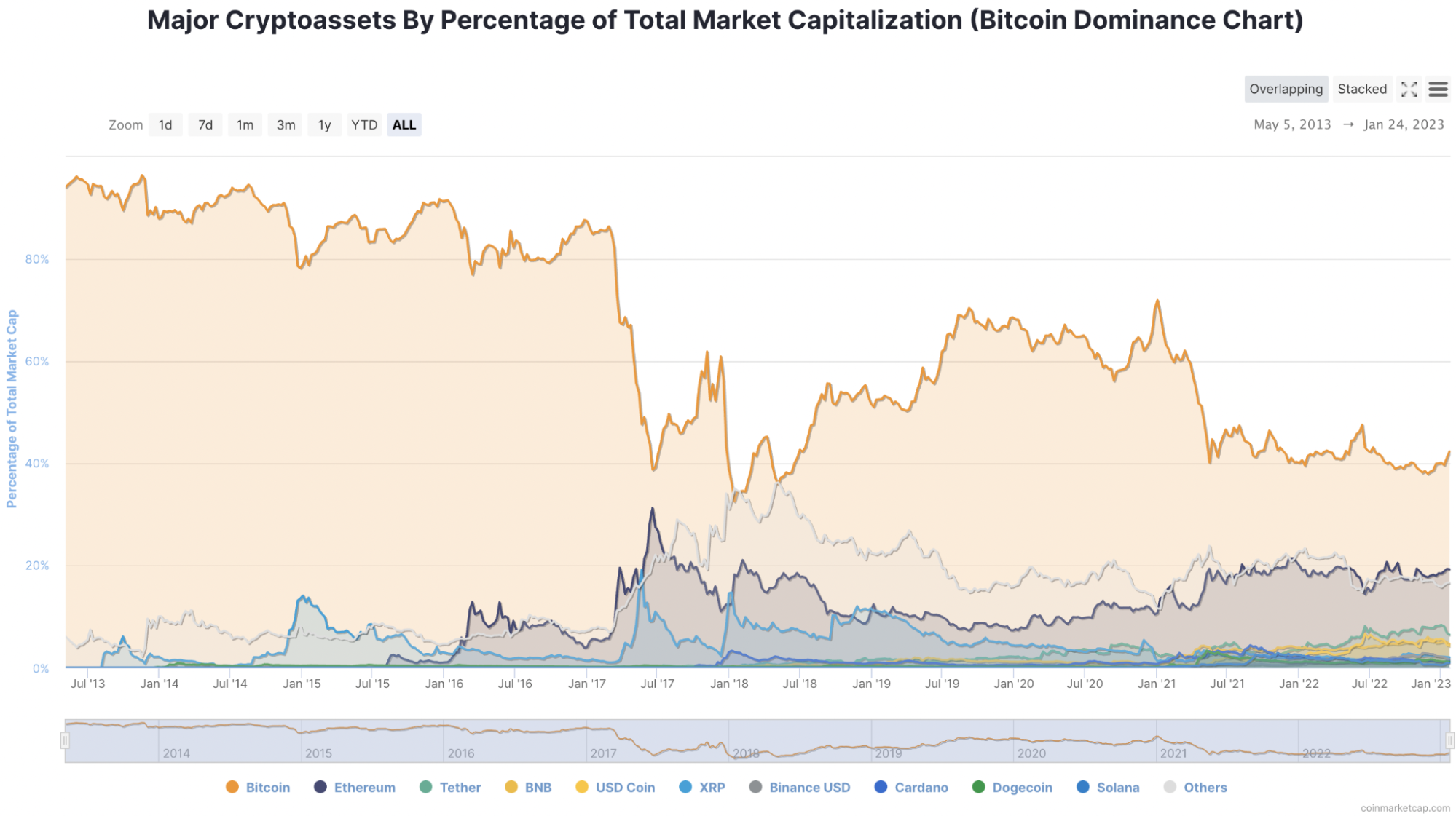

When it comes to dominant assets like Bitcoin, halving events are big business.

Historically, BTC has rallied to significant levels in the months following its halving events.

For Litecoin, however, such correlations are historically harder to track.

Should Bitcoins market capitalization become contested, assets like Litecoin and its halving cycles will command more attention.