These exchanges are unsafe, and it is best to avoid them.

What Is a Nested Crypto Exchange?

A nested cryptocurrency exchange provides its customers with crypto services through an account on another platform.

It acts as a bridge between its customers and the services on a chosen crypto exchange.

Nested exchanges do not have exchange machinery of their own but depend on other regulated exchanges.

How Does a Nested Crypto Exchange Work?

Nested exchanges have accounts on popular crypto platforms and allow their customers to trade using these nested accounts.

What nested exchanges gain from their operations is intermediary commissions.

All this is done without the knowledge and consent of the customer.

Many prefer nested accounts because of the speed of transactions and the absence of a strict authentication process.

However, these verification checks could take up to 30 days.

This may cause some users to opt for nested exchanges, whose other attraction is their criminal anonymity.

When you use nested exchanges, your funds have little to no safety guarantees.

You may also be indirectly funding illegal operations like arms dealing and terrorism.

And that’s not all.

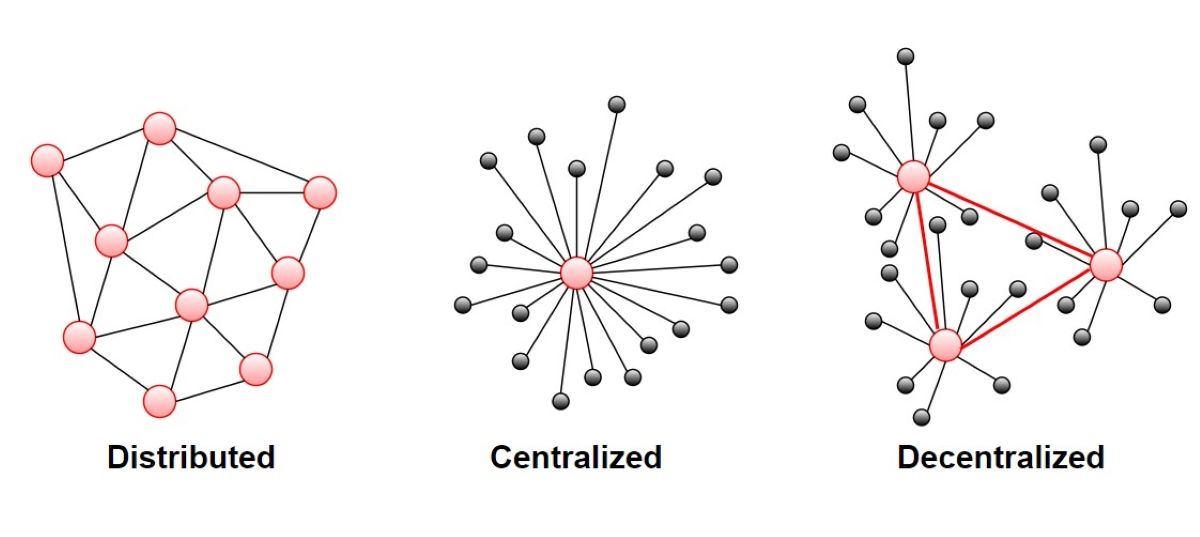

Nested Crypto Exchange vs.

Decentralized Crypto Exchange: What’s the Difference?

But there are notable differences between both.

Unlike nested exchanges, DEXs connect buyers directly to the sellers without holding the cryptocurrency on the exchange.

Decentralized exchanges are fully automated with smart contracts, computations, and complex algorithms.

But a nested exchange will take control of your crypto while engaging the services of another platform.

you’re able to trace transactions made on a decentralized platform back to the source account.

This is because these platforms constantly masquerade as regulated exchanges.

You may be dealing with a nested crypto exchange if there are several variations.

Nested platforms have different accounts on various regulated platforms.

KYC/AML Verification

As mentioned earlier, nested exchanges use the absence of verification processes as an attraction.

KYC and AML verifications usually take hours or several days to complete.

Another telltale sign would be the absence of a transaction cap, even with advanced trading features.

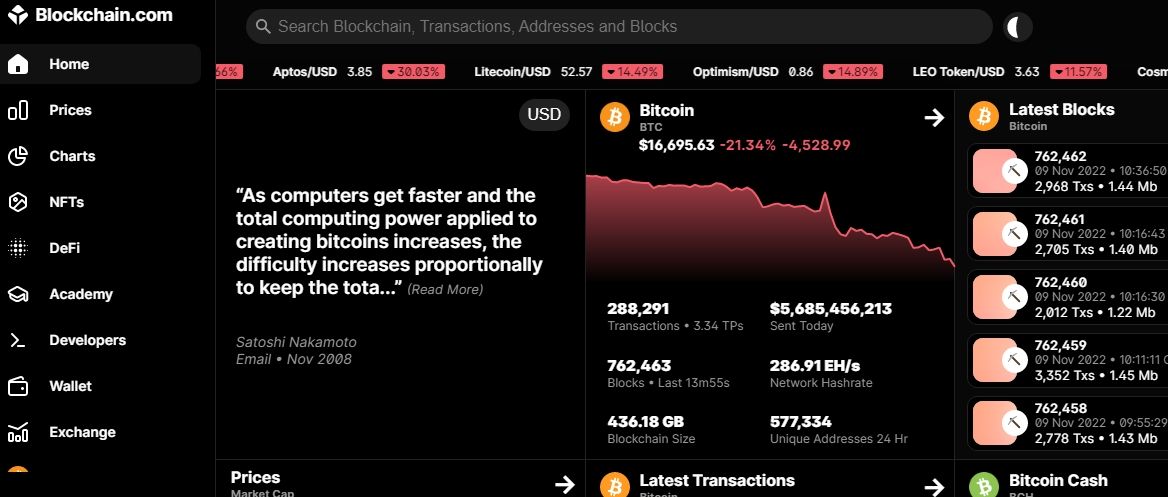

you might do this usinga blockchain explorer.

In addition, the host platforms eventually fish out the nested accounts and close them permanently.

Also, you could face legal consequences if it is discovered that you knowingly consort with nested exchanges.

Supporting Criminal Activities

You may indirectly support illegal activities like cyber crime and terrorism by using a nested exchange.

Avoid Nested Exchanges, Trade with Regulated Exchanges

Don’t use nested exchanges.

Your crypto could disappear without warning, and there would be no way for you to seek recourse.

Always trade with regulated exchanges.

They give guarantees that your crypto is safe.