In crypto trading, trends and patterns say it all.

Trends begin, end, and even reverse.

Crypto Trends Explained

Crypto prices massively depend on trends.

When a certain coin or token amasses popularity, a wave of investors may move to buy it.

This bumps demand for the token, driving up its value.

In general, you either have abearish or bullish crypto market.

Bear markets lead to price drops, whereas bull markets lead to price hikes.

You must knowhow to identify primary, secondary, and tertiary crypto trendsto help you trade more effectively.

And there are times when these trends reverse unexpectedly.

Reversals can technically be big or small but usually involve more significant price shifts.

Smaller reversals are more commonly referred to as pullbacks.

But what exactly is a crypto trend reversal, and how does it affect the market?

What Is a Crypto Trend Reversal?

Such shifts in price can be quick and short-lived or may span months or years.

Longer trend reversals can be harder to spot, as they happen gradually and discretely, not suddenly.

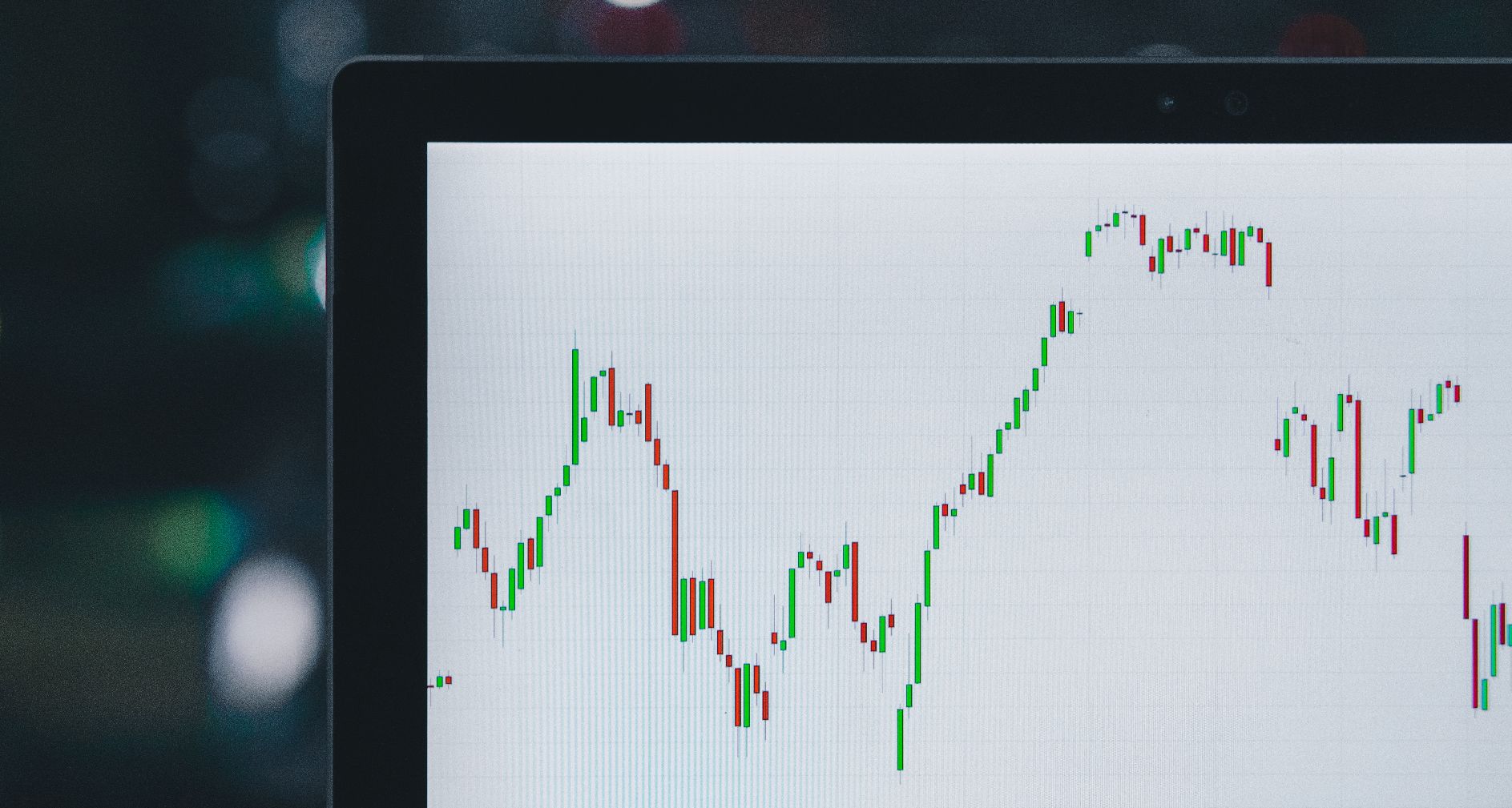

A candlestick graph consists of thick vertical lines attached to thinner lines.

Because of their appearance, they are known as candlesticks.

In a candlestick graph, the bars can be either green or red.

Green bars indicate price increases, while red bars indicate price decreases.

So, how do trend reversals display themselves in candlestick graphs?

As labeled on the graph, this point is where the trend reverses.

A typical model of crypto trend reversal is known as theHead & Shoulders pattern.

Below is an example of a Head & Shoulders price shift experienced by Ethereum.

On the left of this pattern, you’ve got the left shoulder, followed by a slight dip.

Then, the biggest increase forms the head of the pattern.

Both the left and right shoulders do not reach the high of the head in this pattern bang out.

But regardless of its more gradual occurrence, it does indeed display a trend reversal.

The Head & Shoulders model can be either bearish or bullish.

Like the Head & Shoulders model, a Sushi Roll can be either bearish or bullish.

So, crypto trend reversals can come in various forms, but can you spot them before they occur?

Can You Spot a Trend Reversal Before It Happens?

Sometimes, no one sees a price hike or price drop coming.

So, you might’t see any warning signs of a trend reversal, right?

Before a trend reversal gets underway, there is a short window indicating the oncoming change.

Various factors, includingmoving averagesand volume indicators, may indicate an oncoming trend reversal.

Moving averages represent the recent closing prices of a cryptocurrency.

A shift in an asset’s moving averages can suggest that a trend reversal is in the midst.

On top of this, volume indicators can also come in handy.

24-hour trading volumes are the most commonly used and could indicate oncoming trend reversals.