Size no longer matters in determining if a company is good enough to hold your investments.

You are most likely included.

Let’s look at self-custody wallets, how they work, and their benefits and risks.

What Are Self-Custody Wallets?

They are unlikecustodial wallets, which hold your private keys.

By holding your private keys, you alone can ensure the security and privacy of your digital assets.

4 Examples of Self-Custody Wallets

Self-custody wallets differ based on where your private keys are stored.

Different self-custody wallets store them in different places, too.

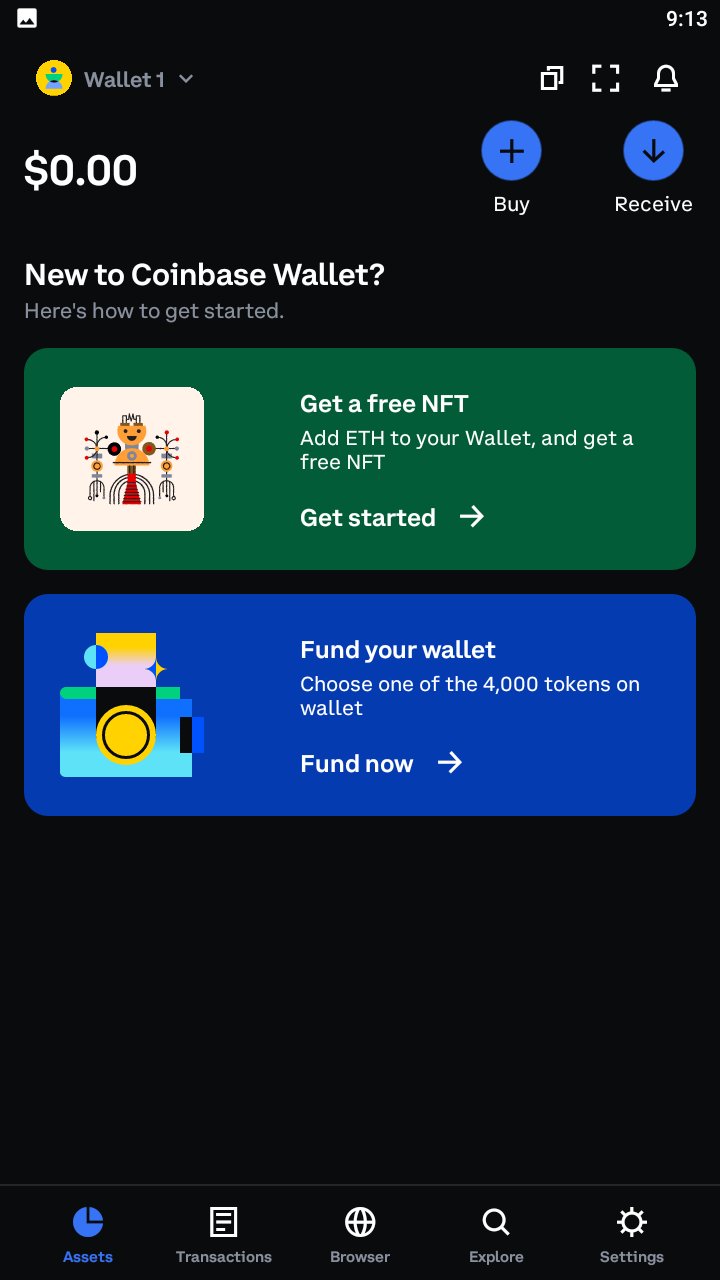

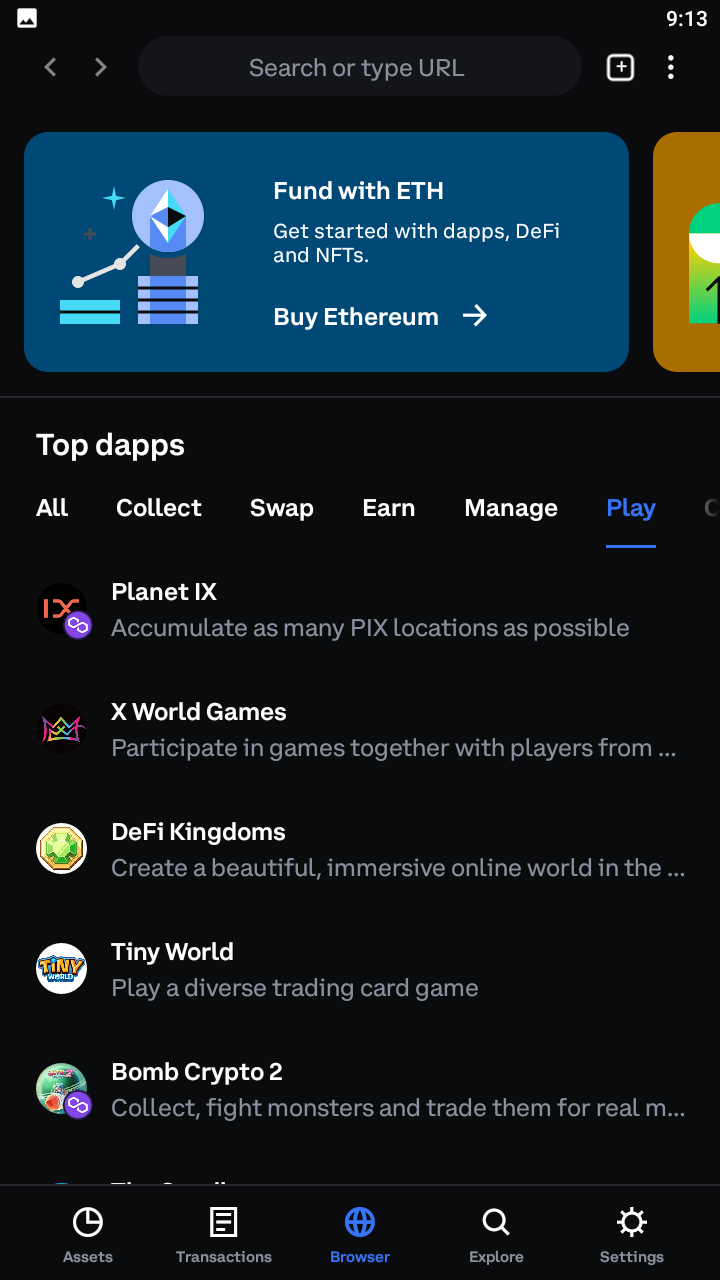

Mobile Wallets

These smartphone apps generate private keys and store them on your phone.

it’s possible for you to back them up and recover them when needed.

They are convenient for users who need to access their cryptocurrency frequently.

Examples includeCoinbase WalletandTrust Wallet.

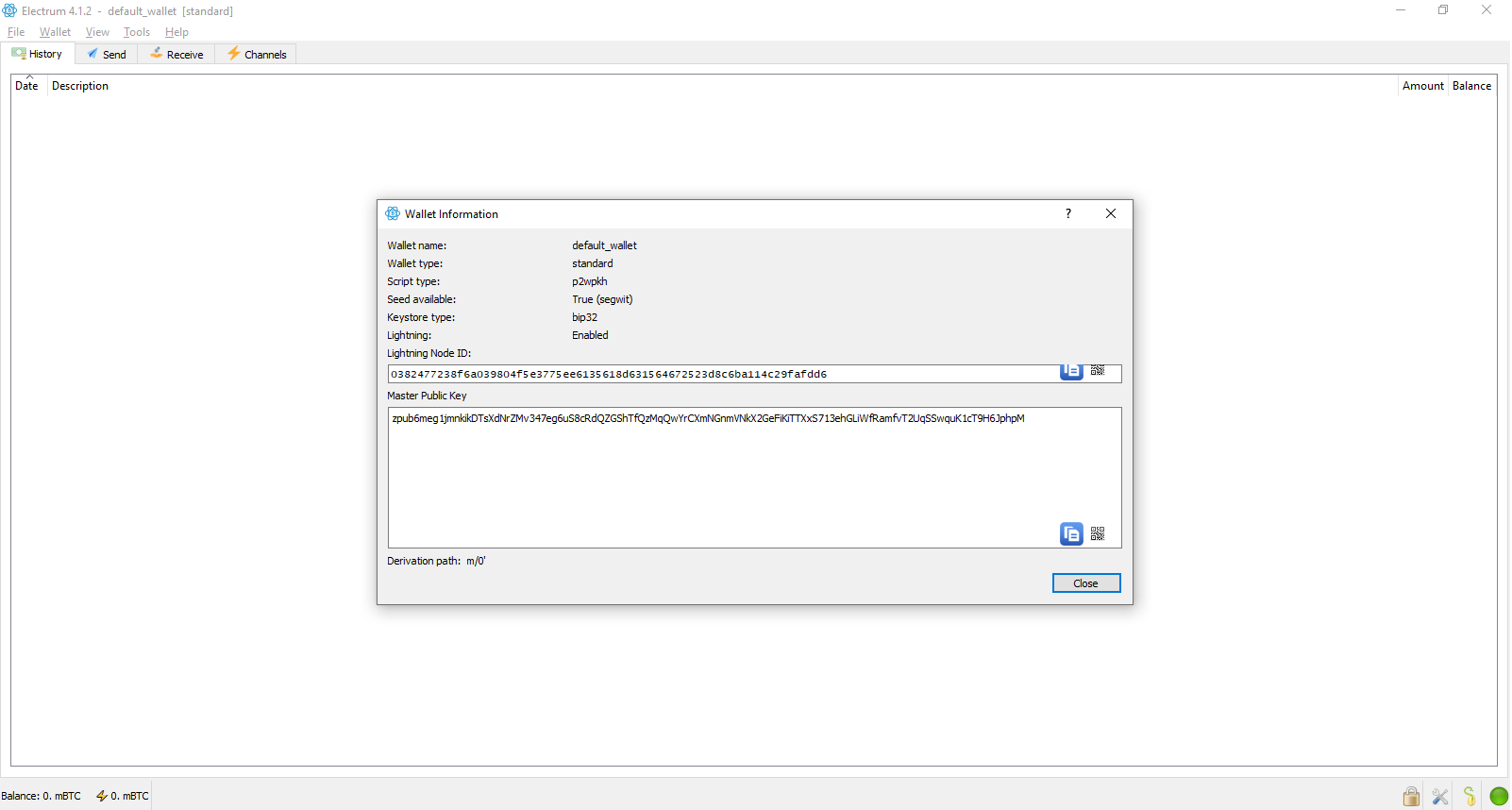

Desktop Wallets

These are computer programs that you install on your desktop or laptop.

They are usually more complex than their mobile versions and offer a higher level of security and privacy.

They generate private keys and store them on the host computers.

In addition, they’re safer than software wallets because the private keys aren’t available on the internet.

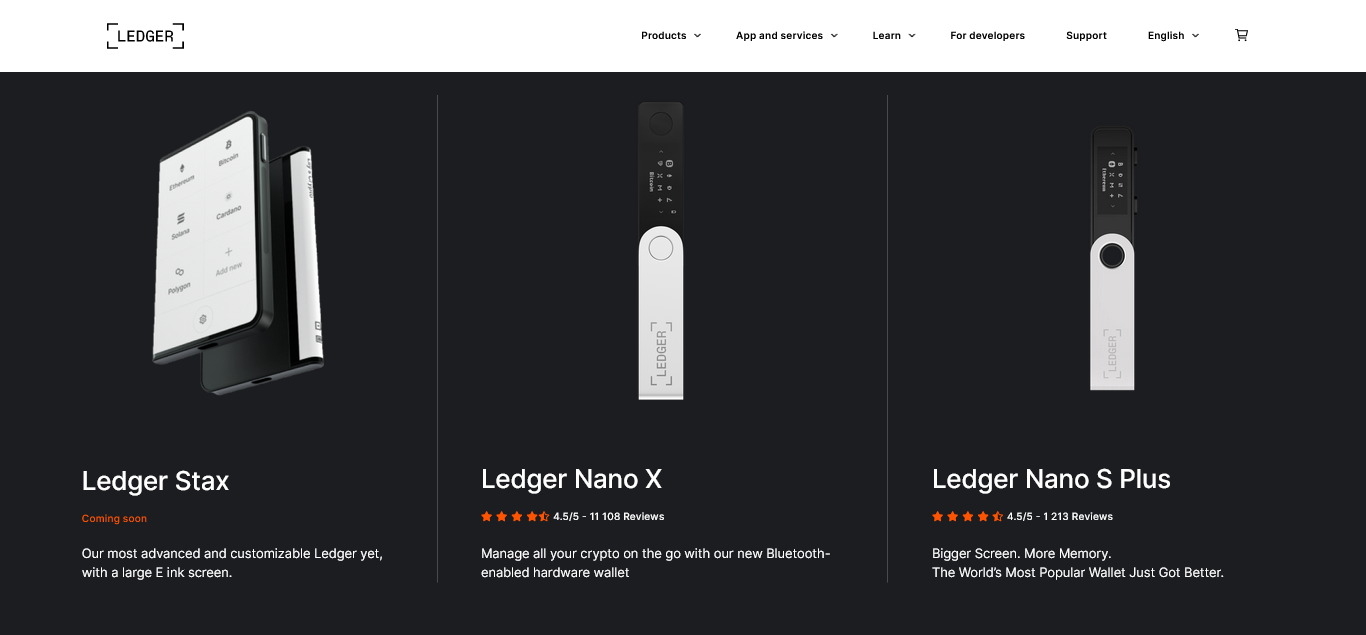

For more information, see ourcomparison of Trezor and Ledger, the two most popular hardware wallets.

It’s completely offline and gives you a high level of security.

However, paper wallets are vulnerable to loss or physical damage.

To create a paper wallet, you need a wallet generator likeBitaddress.org.

What Are the Benefits of a Self-Custody Wallet?

You have your money with you.

What Risks Do Self-Custody Wallets Have?

Of course, no method is perfect.

Should You Use a Self-Custody Wallet?

One ignorant mistake or forgetful moment can lead to you losing your digital assets.

It’s true that when you don’t own the private keys, you don’t own the crypto.

But do you have the skills and habits to own and keep your private keys safe?