An order book provides data for cryptocurrency trading analysis.

With it, it’s possible for you to spot important information that can improve your trading decisions.

What Is an Order Book?

Image Credit: tomeqs/Shutterstock

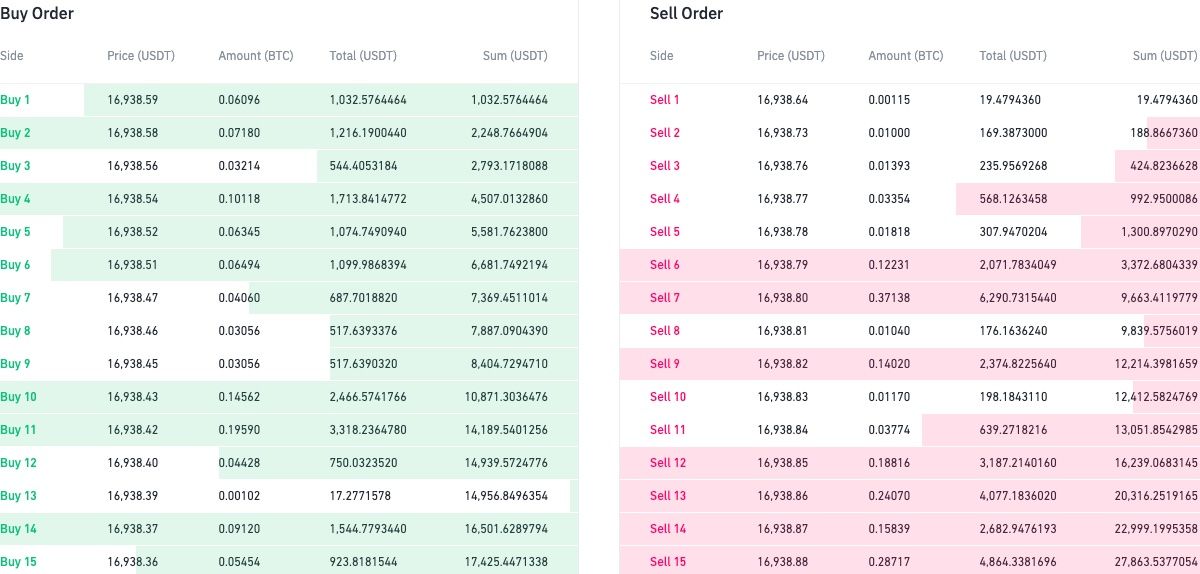

An order book lists buy and sell orders investors have made for a crypto asset on a centralized exchange.

How Does an Order Book Work?

Every time a limit order is placed, it appears in the order book until it gets executed.

The order book has a buy and a sell side, revealing the needed information.

Seller orders are usually in red, while buyer orders are in green.

The market depth chart visualizes the supply and demand for a cryptocurrency at different prices and in real time.

It shows the weight of buy and sell limit orders in an order book.

Just like the order book, it also has a buy side and a sell side.

The market depth chart makes it easy to detect buy and sell walls.

The more buy and sell pending orders placed, the greater the depth of the order book.

A large buy wall shows that traders believe the price will not likely fall below the specific price level.

A large order volume may be enough to drive the price upward if the trades get executed.

The opposite of this is true for the sell walls.

Conversely, having more sellers could mean that a downtrend is imminent.

Combining this with price action and whatever indicators you use could help you make more informed decisions.

How Reliable Is an Order Book in Trading?

It may take some time and practice to understand how it works fully.

Traders can also use the information in an order book to determine the best price to buy an asset.

Limitations of Order Books

Crypto market manipulatorscan deceive traders by providing false clues in the order book.

These cluescan affect market sentimentand cause traders to make poor decisions.

There are some trading details hidden from the order book.

Thus, we can say that it does not provide full transparency.

Consider the tradescarried out in a dark pool.

These trades are very large and can affect the market’s direction.

As a result, they are better negotiated privately.

The trade information is only available after the transaction has taken place.

Order book trends change very fast, especially in markets with large trading volumes.

As such, long-term traders may not find it useful.

A decentralized matching engine works better because it fills orders without depending on external liquidity.

However, reading and correctly interpreting the information in the book requires patience and practice.