The idea of central bank digital currencies (CBDCs) has been brewing over the past few years.

CBDCs are virtual currencies authorized by central banks that can potentially revolutionize the world economy.

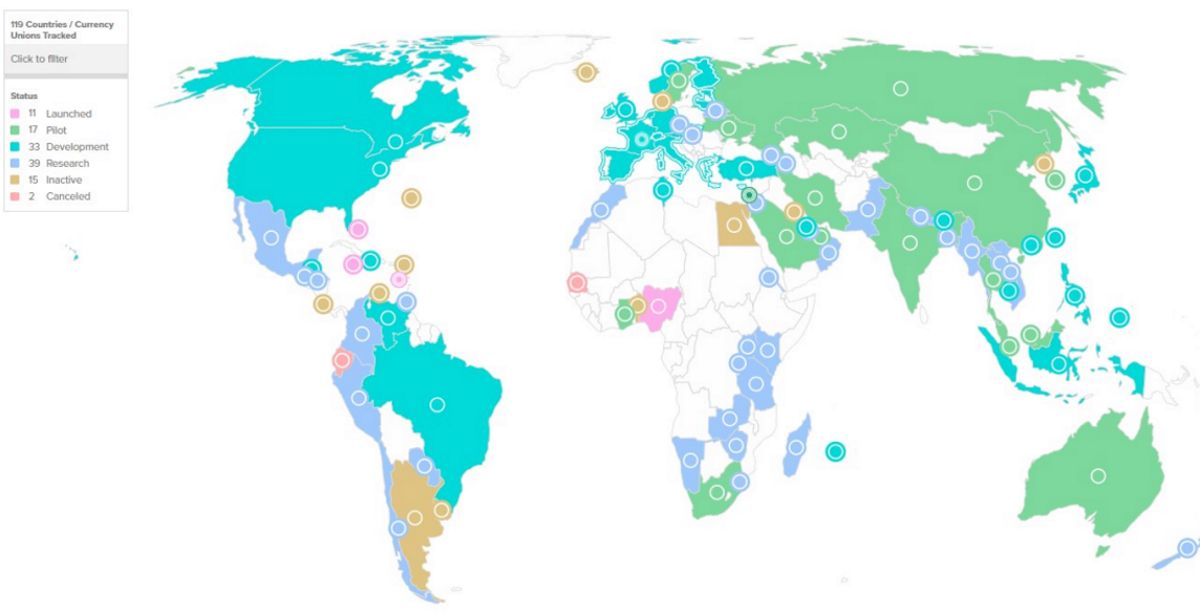

Although CBDCs are not widely adopted, many countries have taken substantial steps to introduce CBDCs.

The main reason behind it is the importance of CBDCs for crypto regulation.

Governments believe that digitized fiat currencies can be the future of money.

However, governments' interference in CBDCs conflicts with blockchain’s decentralization nature.

So, what are CBDCs, and how do they work?

What Are CBDCs?

To begin with, “CBDC” stands for “central bank digital currency.”

CBDCs are a punch in of digital asset that represents the fiat currency of a country.

Digital currency can offer various benefits.

For instance, it gives financial safety to investors and helps eliminate crypto volatility.

A CBDC is similar to acryptocurrency stablecoin.

However,these are not algorithmic tokens.

There are severaldifferences between CBDCs and cryptocurrencies.

Unlike cryptocurrencies, one notable difference is that a CBDC has a single authority managing them.

This removes the core decentralized feature of cryptocurrency and blockchain technology from a CBDC.

This key in of digital currency can still play a role in the future of finance.

For example, it can create a financial system that is completely cashless.

How Does a CBDC Work?

Central bank-backed virtual currencies work in the same way as conventional fiat currency.

It is like a digital payment system allowing users to send and receive money instantly anywhere.

However, a CBDC is not only a means of payment but also stores the value of fiat currency.

What differentiates them from digital payment methods?

Well, it’s the relationship between CBDCs and blockchain technology.

Central banks leverage distributed ledger technology to create a digitized token representing fiat money’s value.

It uses the pegging method, which ties the token to fiat money at 1:1.

As a result, each CBDC shows the value of a single fiat currency unit.

Since these coins rely heavily on fiat currency, their value depends on the country’s monetary policies.

It has opened the gateway to financial products and services and made them more inclusive.

However, the technology’s decentralized nature makes it vulnerable to criminals.

Send your crypto to the wrong address?

Well, it’s gone forever, and that’s that.

For these reasons, governments are keen to regulate the crypto market.

In recent years, the focus of crypto regulators has been on the introduction of CBDCs.

Although CBDC may not use conventional DLT, it will adopt some of its features, like transaction history.

It will work as a digital fiat currency offering ease like a cryptocurrency.

Besides, it’s completely regulated by the government and can be used as physical money.

This way, it blends crypto and paper money features and maintains its centralization.

A CBDC could help authorities monitor the country’s macroeconomic situation through the ledger.

Besides, it can facilitate transactions by lowering costs and limiting liquidity risk.

Also, centralized currency allows a secure path for cross-border money transfers.

Therefore, by adopting CBDCs, governments can better regulate the market and provide financial security to consumers.

TheBahamian Sand Dollar, launched in October 2020, was among the first.

Furthermore, 17 countries are in the CBDC piloting phase.

These countries include China, Saudi Arabia, Russia, Iran, India, Australia, and others.

Meanwhile, the 33 countries are currently at the development stage of their central bank-backed coins.

The US is one of the countriesplanning the launch of CBDC.

On the other hand, the trend has also inspired many other countries to begin their research for CBDC.

As of now, 39 countries have started exploring technology.

Why Are Governments Adamant About Launching CBDCs?

There are many benefits of CBDCs for governments around the globe.

That’s why the primary reason behind the adoption of CBDCs is to bring inclusivity and ease of use.

Also, it will help governments to make financial products more inclusive.

Second, governments can gain authority over the digital asset market.

This way, authorities can shape a secure and efficient ecosystem where digitized fiat plays a significant role.

Moreover, it will create a frictionless and efficient ecosystem for cross-border transfers.

Besides, cooperation between governments can help transform the global market.

Eliminates Liquidity & Volatility Issues

Governments can also use them to offer economic safety to crypto investors.

However, cryptocurrencies are highly volatile, which results in financial losses for many crypto users.

In addition, the market is also prone to liquidity issues.

Introducing a reliable digital asset backed by the central bank reserves can offer price stability and improve liquidity issues.

In addition, it may encourage more users to explore the digital asset market.

Drawbacks of CBDCs for Users

There are two major drawbacks of CBDCs.

Control and Privacy

CBDCs are issued and managed by central banks.

For this reason, many users may be wary of the government’s surveillance and hesitate to adopt CBDCs.

Vulnerable to Cyberattacks

Like any digital asset, CBDCs can be vulnerable to cyberattacks.

That’s why central banks must ensure robust security measures to prevent cyber thefts.

What Does the Future Hold for CBDCs?

There are several potential challenges and opportunities for CBDCs.

For policymakers, digital fiat can counter the popularity of cryptocurrencies by integrating blockchain technology in a controlled manner.

It can also help governments to design a financial ecosystem that helps in fiscal policy implementation.

Furthermore, it has the potential to bring inclusivity to the financial system.

However, the concept of centralized digital currency is still in its infancy.

As a result, many countries are still exploring how they can integrate CBDC into their economies.

Additionally, there is a lack of clarity regarding which form of blockchain tech they would adopt.

CBDCs can potentially revolutionize how we think about money and payments.

But their success will depend on various factors, including technology, cybersecurity, regulation, and public acceptance.

Only time will tell how CBDCs will shape the future of finance.

It is still a topic that will continue generating interest and discussion in the future.