Who Collapsed?

Lets start with the worst outcome shutdowns.

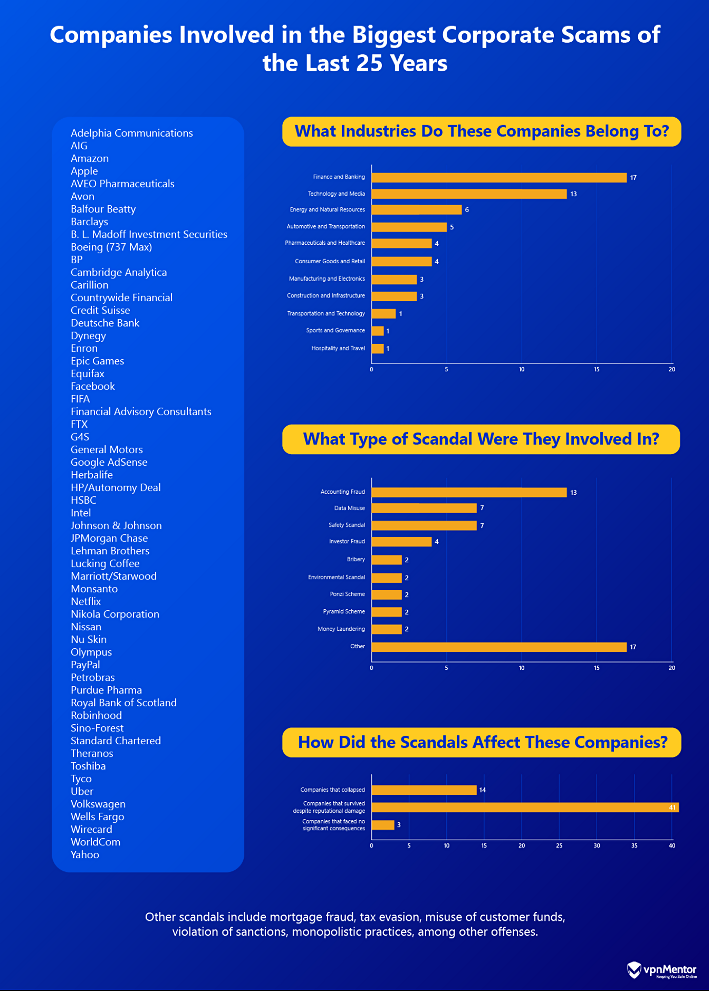

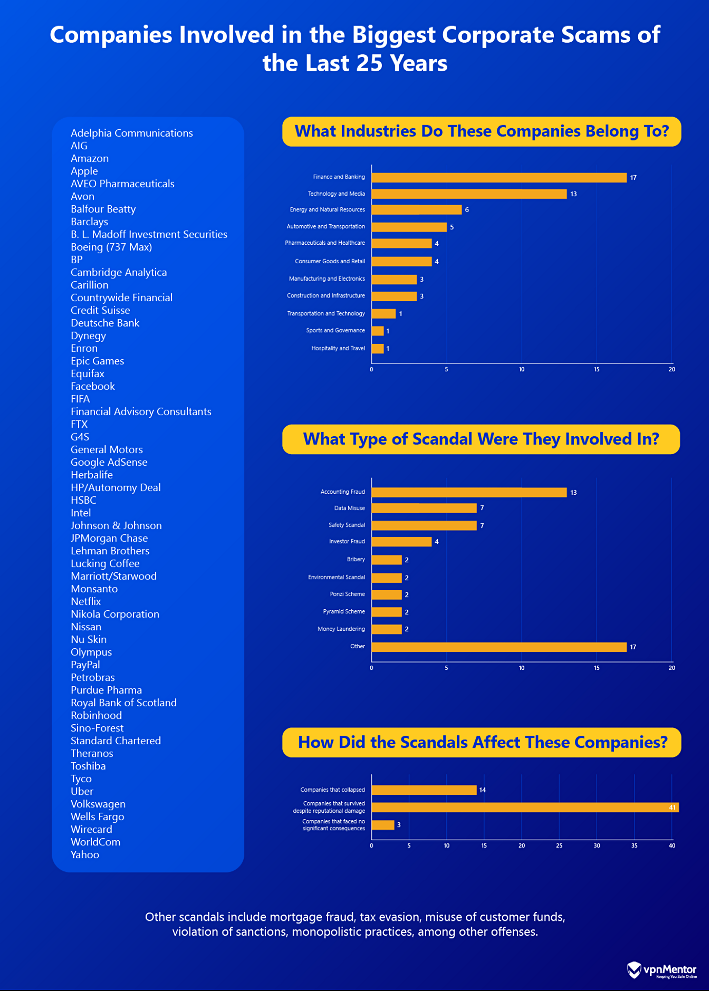

Of all the companies we looked into, only 14 shut down after the scandals they were involved in.

As the housing bubble burst, these securities lost value, which caused significant financial strain.

The data was used to create psychological profiles and target voters during political campaigns.

The company filed for bankruptcy and ceased operations in May 2018.

Sino-Forest

Sino-Forest was a Canadian-listed forestry company that defrauded investors by overstating its timber assets and revenue.

The company filed for bankruptcy in 2012 with$2.4 billion in liabilities, leaving shareholders with massive losses.

The scheme collapsed in 2004 when authorities uncovered the fraud, leading to Lewis arrest and conviction.

No longer able to keep operating, it was acquired by Bank of America in 2008.

Who Recovered?

Here are some of the ones we found most interesting.

The breach led to a $700 million settlement with regulators.

The scandal implicated top FIFA officials in a decades-long scheme involving $150 million in bribes.

The Serious Fraud Office launched an investigation, and G4S eventually agreed to repay 109 million.

After the scandal came to light, the company faced intense scrutiny and paid $900 million in penalties.

The company stopped selling talc-based powders in North America in 2020 and globally in 2023.

This led to significant financial losses for Petrobras, estimated at nearly $17 billion.

Who Thrived?

It also withholds better discounts in favor of deals from partnered retailers.

As a result, Google faced lawsuits and criticism from affected publishers.

Poor risk management and attempts to hide the losses worsened the situation.

The bank admitted fault and paid over $1 billion in fines to regulators.

Despite this, it earned a record profit of $21.3 billion that same year.

Despite these scandals, some businesses have continued to thrive after paying penalties and changing their ways.

like, comment on how to improve this article.