Financial technology, also known as fintech, has overhauled the traditional world of finance.

And the most impressive achievement of the fintech sector is its expansion of employment opportunities.

However, you will need some qualifications to be eligible for a job in this niche.

As such, taking certification courses is a great place to begin.

The courses below will teach you how to put your foot forward in the industry.

The curriculum introduces learners to blockchain mining, use cases, architecture, and other fundamentals.

The course allows you to implement your skills in blockchain applications through its hands-on industry project experience.

Upon course completion, you will have lifetime access to the course content.

You’ll also have 24/7 support for all your queries and a Blockchain Council certification with lifetime validity.

In addition, you could complete the certified blockchain expert course in six to eight hours.

The self-paced training costs $179 and does not need prior knowledge.

Students will also learn to deploy technology and modern investment strategies to produce optimal results.

The specialization has four courses with hands-on projects and certificates attached to each.

Furthermore, this course does not require any background knowledge.

However, a general understanding of finance and financial products may be helpful.

The four courses include DeFi risks and opportunities, DeFi primitives, DeFi deep dives, and DeFi infrastructure.

The training is 100% online and comprises only intermediate-level courses.

Hence, you should have some background knowledge about decentralized finance.

The course contains six mandatory units and assignments you must complete within a fixed deadline.

This is a paid course, with an extra exam fee for the second and third final exam attempts.

The training encompasses 48 hours of two-way-live online sessions.

These sessions include great tools, video content, assessments, and techniques.

Students will also have access to regular Boot Camps over the next 12 months.

Interestingly, successful candidates will intern with Henry Harvin or partner firms.

This internship includes access to over 3 million worldwide solid alum networks.

You also have a 100% placement guarantee with an average salary hike of 80%.

The employment you get upon completion of this course assures you of job security with exceptional growth opportunities.

Henry Harvin Finance Academy guarantees a 100% refund if you’re unsatisfied after the first session.

This certification makes it applicable to members associated with UK-based professional bodies.

They exemplify the research and practical skills students need to launch successful fintech ventures.

You will also enjoy the benefits of real-world applications to build a strategy for a fintech venture.

Finally, enrollment in this course affords you access to the official Oxford Executive Education LinkedIn alumni group.

It is one of the fintech innovations specializations that examines the strengths and weaknesses of current payment systems.

Students will understand the value propositions for new technologies and also relate new technological innovations to current inefficiencies.

Furthermore, this beginner-level course takes approximately seven hours and includes hands-on learning projects.

The deadlines are flexible, allowing you to reset them following your schedule.

The instructors merge the business and technology aspects of fintech.

These mergers show learners the use cases of technological innovation and how to adopt technologies in their careers.

The course considers monopolistic central government financial control obsolete.

Hence, it seeks to establish information technology firms and professionals as innovation leaders in the financial industry.

The course encompasses four sections.

Lastly, you might complete the training in approximately six weeks or longer, depending on your pace.

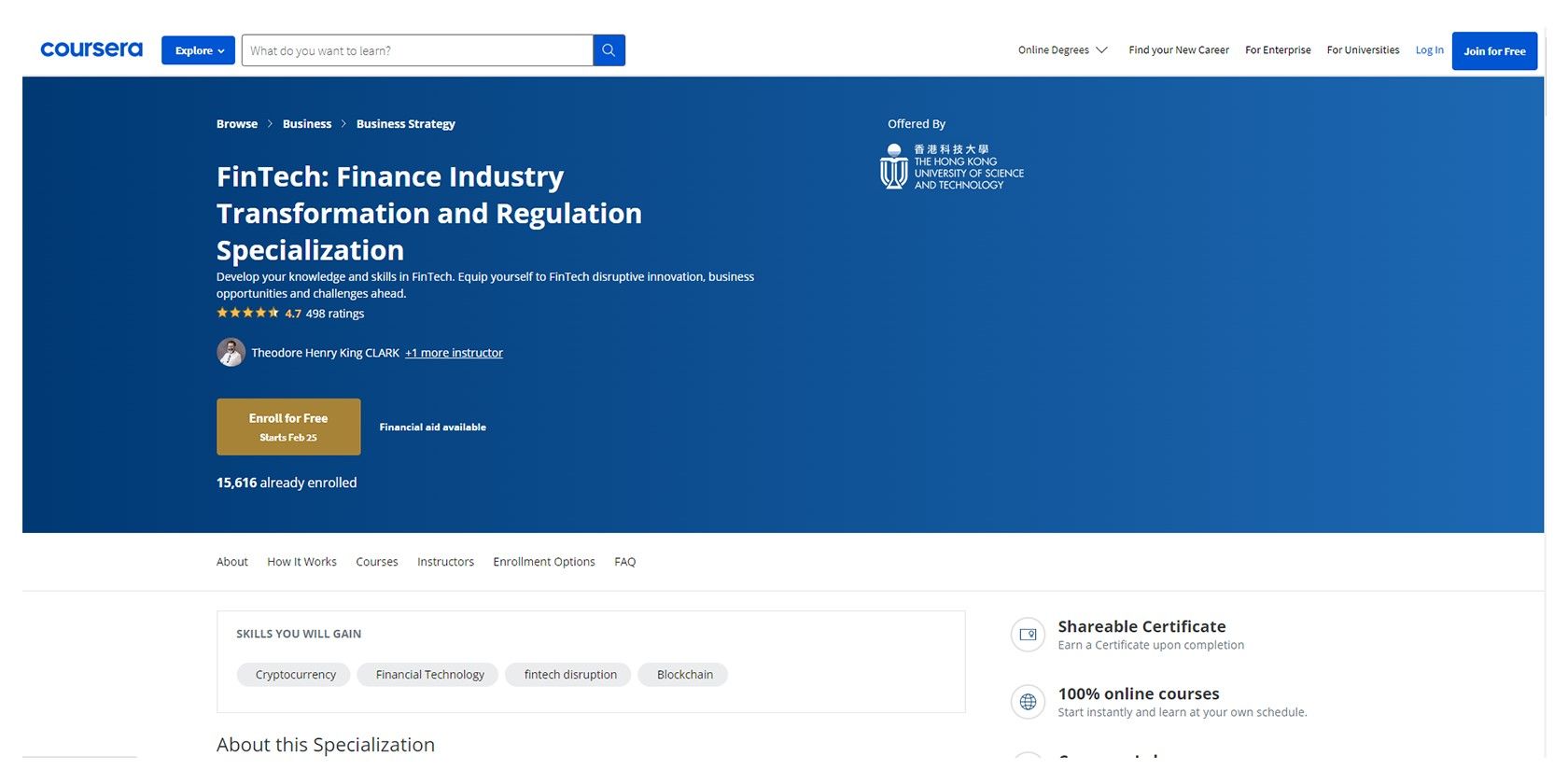

The certification focuses on helping finance professionals understand the foundation and governing regulations of fintech.

These courses guarantee skills in blockchain, cryptocurrency, and fintech disruptions.

This certification requires learners to complete four peer-graded final projects.

These projects demand analysis, research, and recommendations for finance executives.

Also, you could complete the certification within five months at a suggested pace of three hours per week.

Students will be able to practice quizzes and grade programming assignments.

Do Fintech Certifications Attest to Your Expertise?

Certifications are proven ways to acquire new skills, hone existing ones, and upscale.

Many employers require proof of expertise to promote employees from entry- or mid-level roles to senior-level positions.

Certificates are often evidence that you possess the skills that the job roles you’re seeking require.

While traditional degrees are still valid, employers of leading fintech firms continually demonstrate a preference for certified employees.