Crypto staking offers the prospect of earning passive income on idle crypto assets.

So what are the best crypto platforms to stake your cryptocurrencies?

The exchange also employs several state-of-the-art security methods to secure you and your assets.

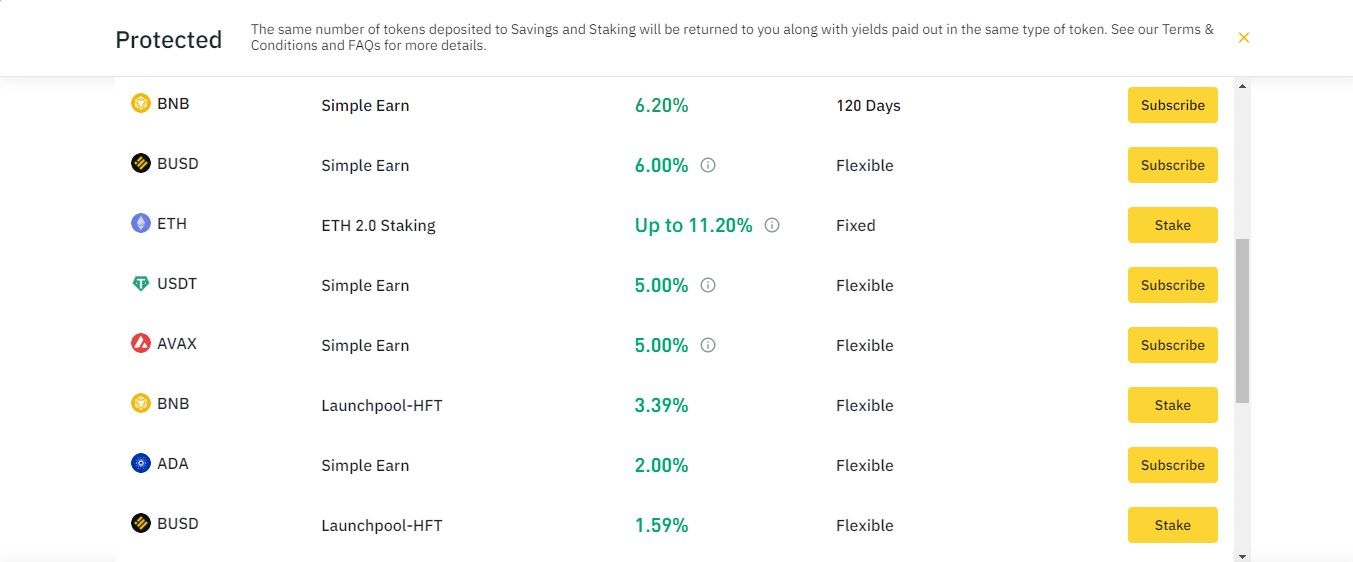

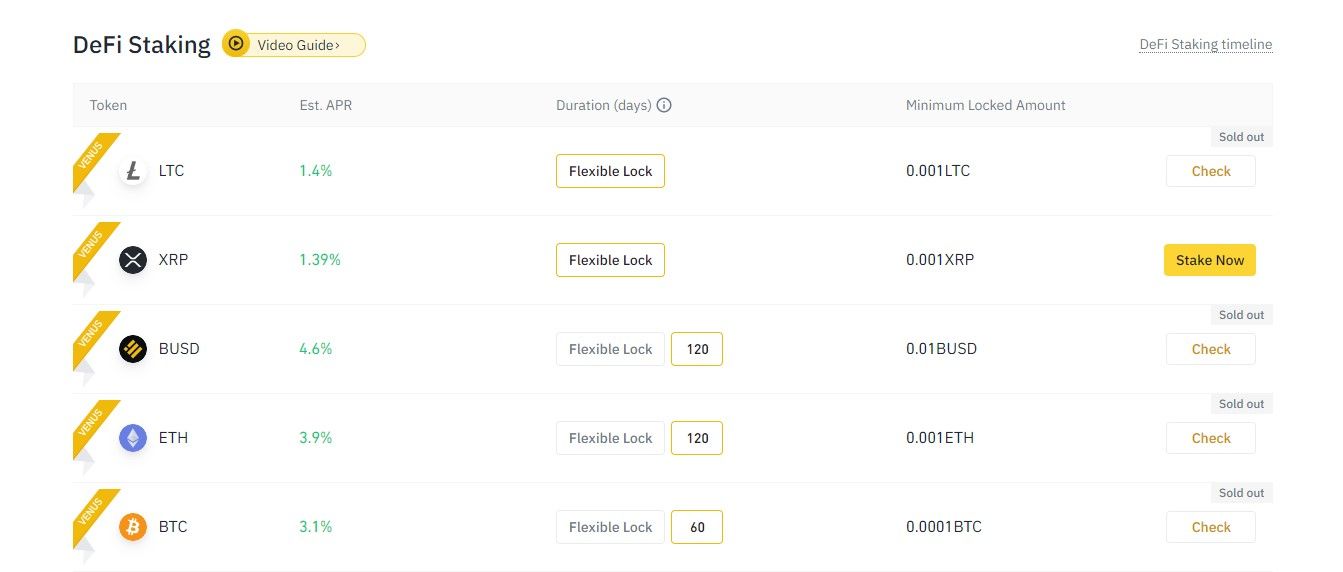

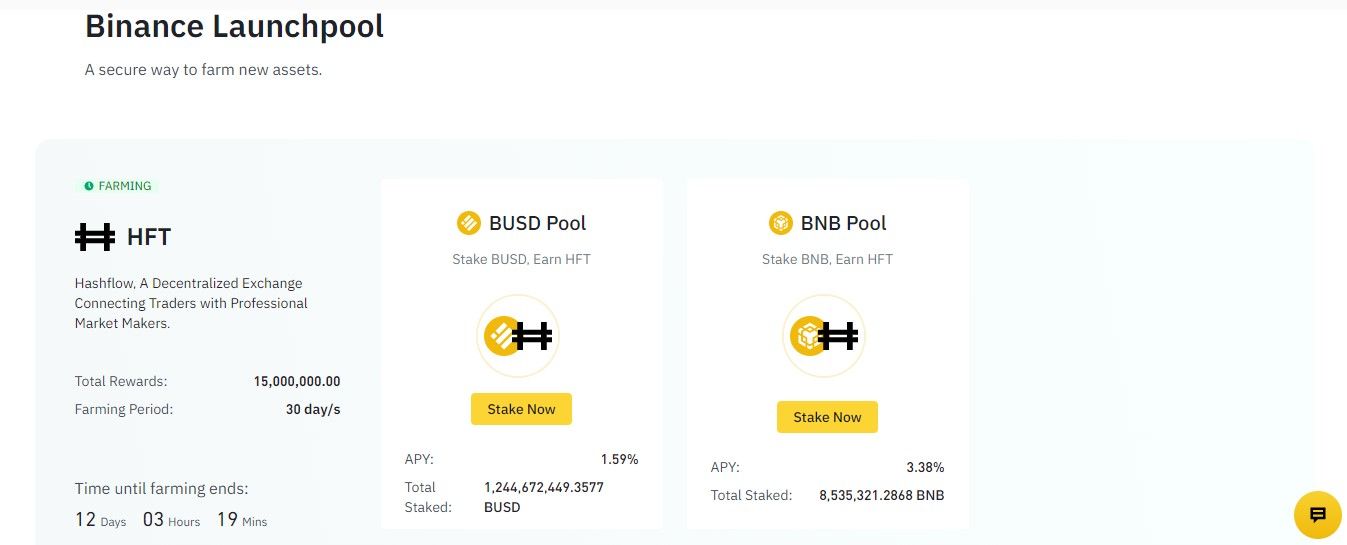

There are several staking opportunities available on Binance.

The rewards are deposited into your spot wallet daily between 12am and 8am.

Staking these assets helps to farm new tokens.

With this plan, you’ve got the option to only stake for a locked term.

The reward will be paid in Beacon ETH (BETH), pegged 1:1 to ETH.

Note that you may receive staking rewards different from the rates published on the subscription date.

It also means that the staking rewards may be less than the on-chain rewards you signed over to Binance.

Kraken

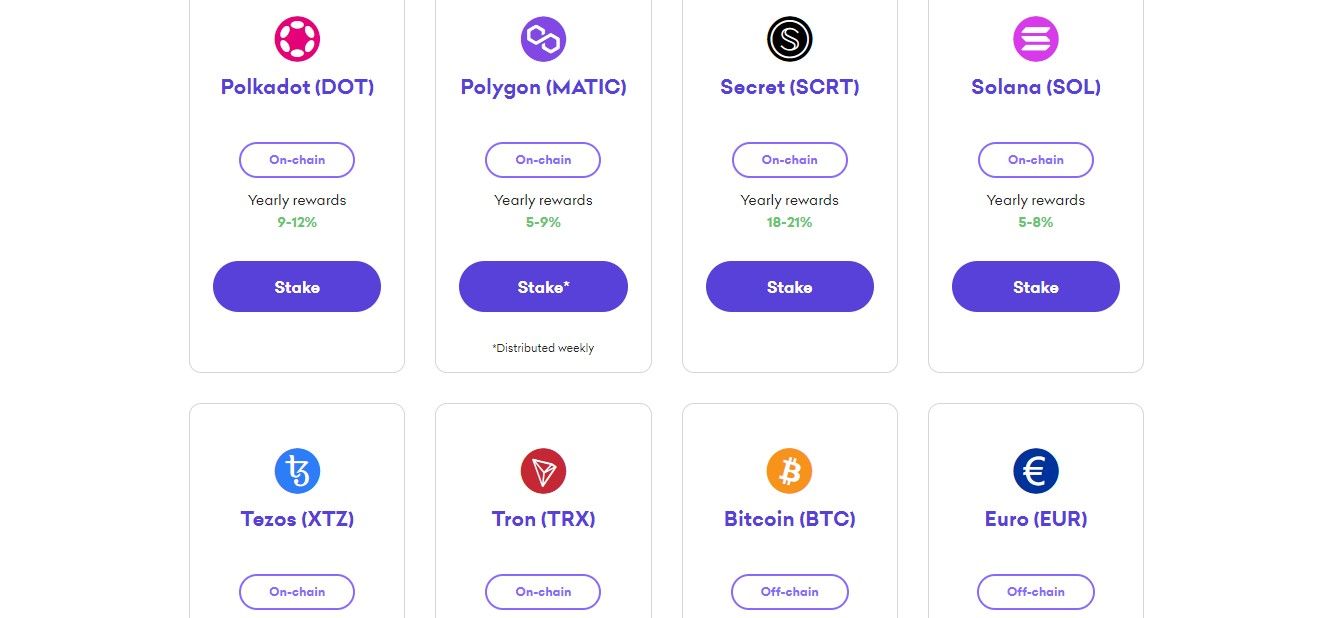

Krakenoffers you the chance to earn up to 21% yearly onon-chain and off-chainstaking.

you’ve got the option to stake your assets on Kraken or Kraken’s internal programs via Kraken.

Off-chain staking is only available for countries that Kraken deems to be eligible.

There are over 15 staking projects on Kraken.

And you might begin staking with a few clicks to earn rewards.

you’ve got the option to also unstake your assets anytime without incurring penalties.

The staked assets must be held in your Kraken spot wallet.

Kraken’s yearly rewards differ based on the project and are subject to Kraken’s terms and conditions.

The rewards are largely paid bi-weekly, although the rewards for some projects are distributed weekly.

However, Kraken offers financial stability, full reserves, strong banking partnerships, and strict legal compliance standards.

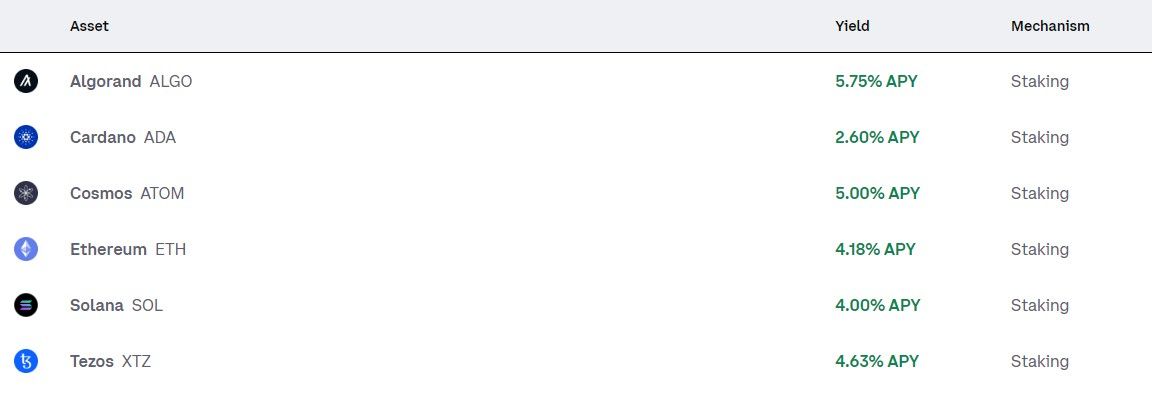

Coinbase

WithCoinbase, you canstake some of the best crypto assetsto earn up to 5.75% APY.

Each crypto project determines a minimum staking amount and APY, which Coinbase deducts a fee from.

Coinbase also receives a commission on staking rewards.

you could unstake your digital assets anytime when you stake on Coinbase.

However, a few crypto projects implement waiting periods after you initiate the process.

Coinbase takes some measures to reduce risks.

However, you will always maintain total ownership of your staked assets.

Alternatively, you’re able to stake off-chain on over 25 networks via Coinbase to earn rewards.

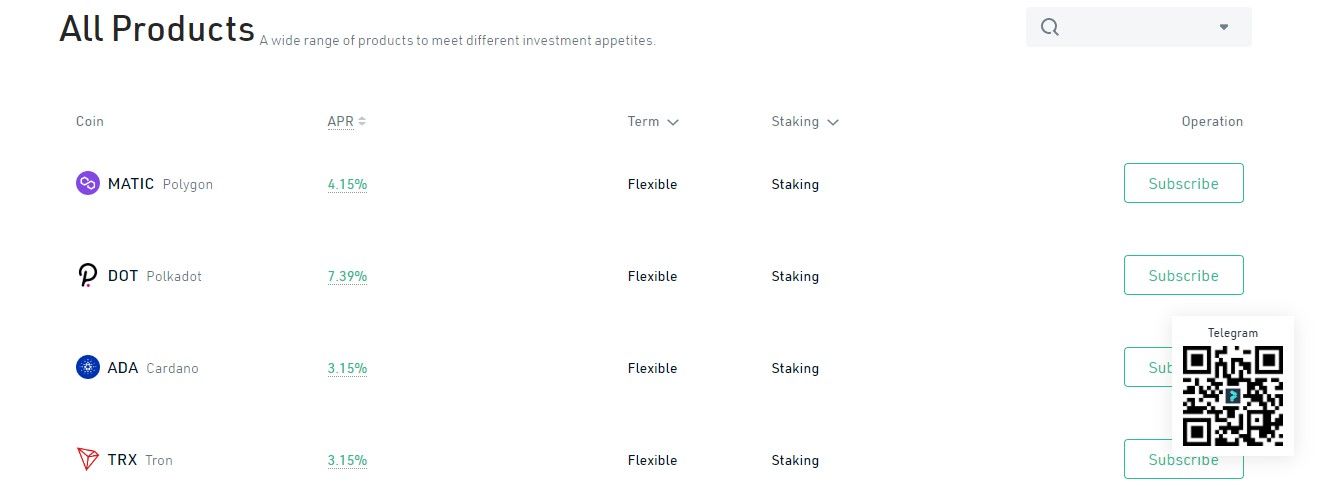

KuCoin

KuCoinoffers flexible and fixed staking terms for over ten crypto projects.

Despite its lack of flexibility, the fixed staking term offers higher yields.

With KuCoin, you could trade your staked tokens in KuCoin’s liquidity trading market.

You may also transfer ownership of your staked crypto assets or redeem them before they mature.

KuCoin uses historical market data to calculate the APR, so it may not reflect your actual profits.

Apart from your staking rewards, you’ll receive Proof Of Liquidity (POL) credits.

These rewards make up your reference annual yield, calculated based on the tokens held in your account.

KuCoin will deduct POL staking fees of 8% from your POL credits.

In addition, KuCoin employs 24/7 monitoring androbust encryption algorithmsto secure the assets of its users.

Also, the platform uses leading industry technologies to ensure platform security.

When you opt-in for a fixed staking term, the APY and staking duration are fixed.

you’re free to only unstake once the plan concludes.

And you’ll receive your crypto assets, along with your yields, after the staking period matures.

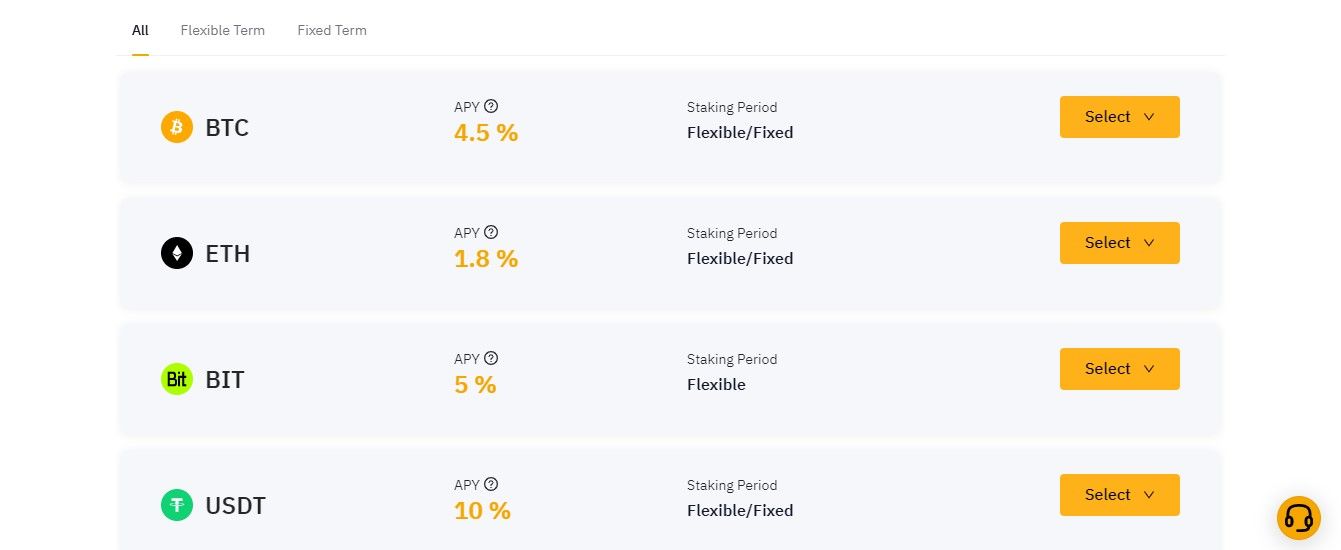

Like Binance, Bybit also offers a launchpool.

Immediately after you stake, Bybit will begin calculating your daily yield.

Lock-Up Periods

When you stake your tokens, a lock-up period is usually required.

However, some platforms enable flexible staking.

When selecting a platform, consider if the lock-up periods favor you and if flexible plans are available.

Staking Rewards and Fees

While most platforms do not charge staking fees, some do.

When selecting a platform to use, subtract any fees from the rewards obtainable to determine your net reward.

Then, combine the net rewards of all the platforms available to you to opt for most profitable option.

If the platform is not secure and hackers attack it,your staked crypto assets will be at risk.