When you want to trade cryptocurrency, the first thing you do is place an order.

Orders are instructions you send to exchanges to buy or sell a crypto asset.

Market Order

A market order is a command that automatically executes at the best market price.

It is usually executed instantly or at the next best opportunity.

The current market rate usually determines the price the order initiates in the order book.

An order book displays the demand and supply activities of a particular cryptocurrency.

It is publicly available to users on an exchange to see.

The order book data changes as traders add, withdraw, and modify orders.

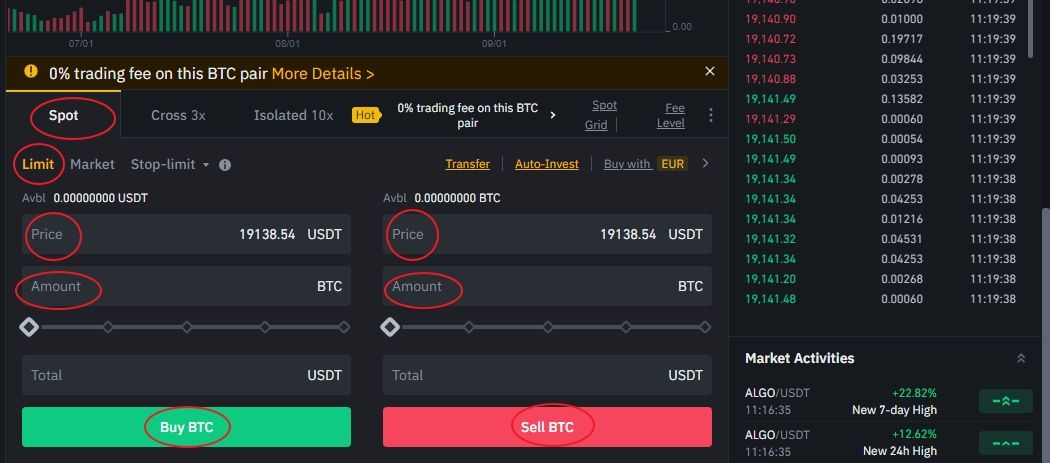

So now, let’s look at how a limit order works.

A limit order can be a buy or sell order.

Thus, we have buy limit orders and sell limit orders.

Stop Order

A stop order buys or sells a crypto asset once the price reaches the stop price.

In this case, it becomes a market order filled at the next available price to lock in profit.

This will prevent you from making more losses by taking you out of the trade before it drops further.

One of the ways to prevent this is to use a stop-limit order.

A stop-limit order is a little more complex than a stop-market order.

Let’s take a look at how it works.

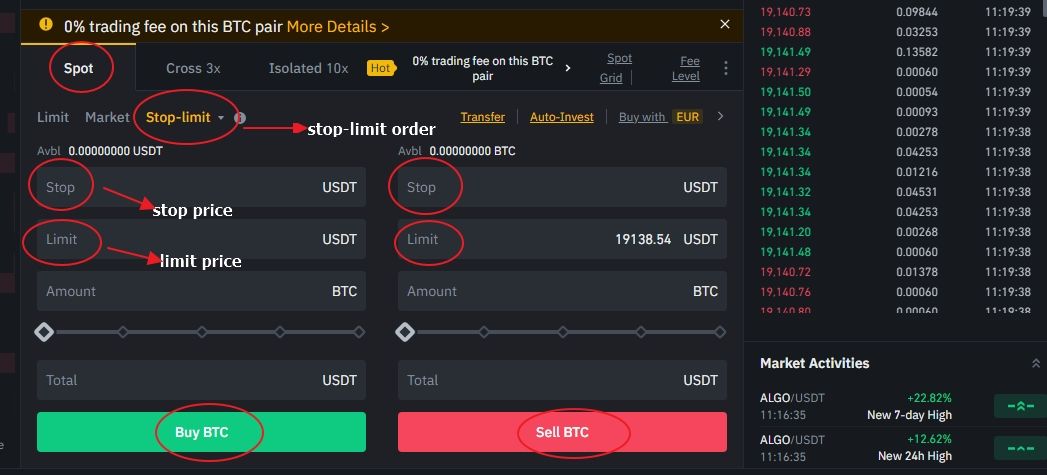

Stop-Limit Order

As the name suggests, a stop-limit order combines stop and limit orders.

It executes limit orders at the predetermined price when the market reaches the stop price.

When using a stop-limit order, you must specify a stop price and a limit price.

The stop price triggers the limit price when the price gets to the stop price.

The order is suitable for traders that want protection againstprice volatility.

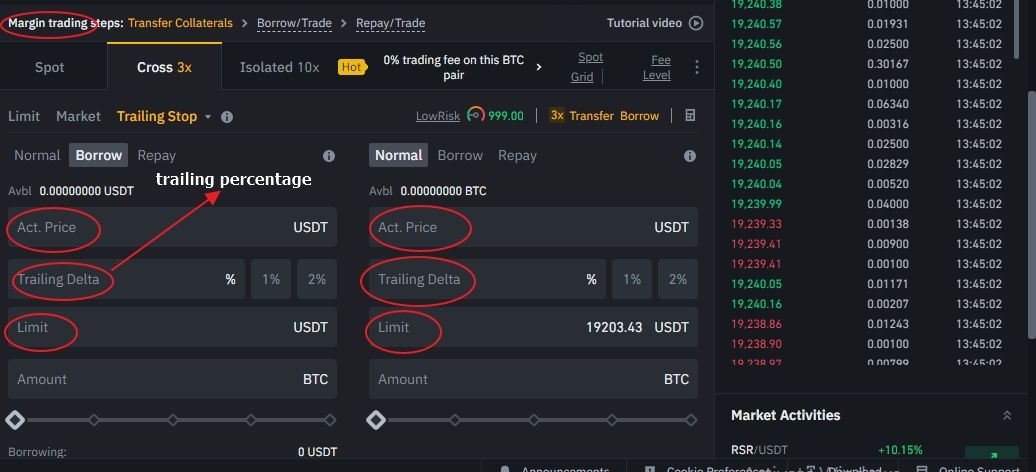

Trailing Stop

A trailing stop helps you lock in your profit and limit your losses when trading.

It is usually set at a trailing amount or percentage from the market price.

As the price moves, the trailing stop price also moves by the predetermined trailing percentage or amount.

A trailing stop can be a limit order or a market order.

What, then, is the difference between a trailing stop and a stop loss?

A stop-loss order helps you reduce losses and is usually set manually.

A trailing stop, on the other hand, locks in the profit while reducing the losses.

It is more flexible than a stop-loss and tracks market prices automatically.

They will help you be more dynamic with your orders in different market situations.