OpenSea and Rarible are two of the biggest non-fungible token (NFT) marketplaces.

OpenSea Overview

OpenSeais the world’s first and largest decentralized marketplace forNFTs and crypto collectibles.

It currently boasts tens of thousands of active traders with an estimated all-time trading volume of $20 billion.

Image Credit: Koshiro K/Shutterstock

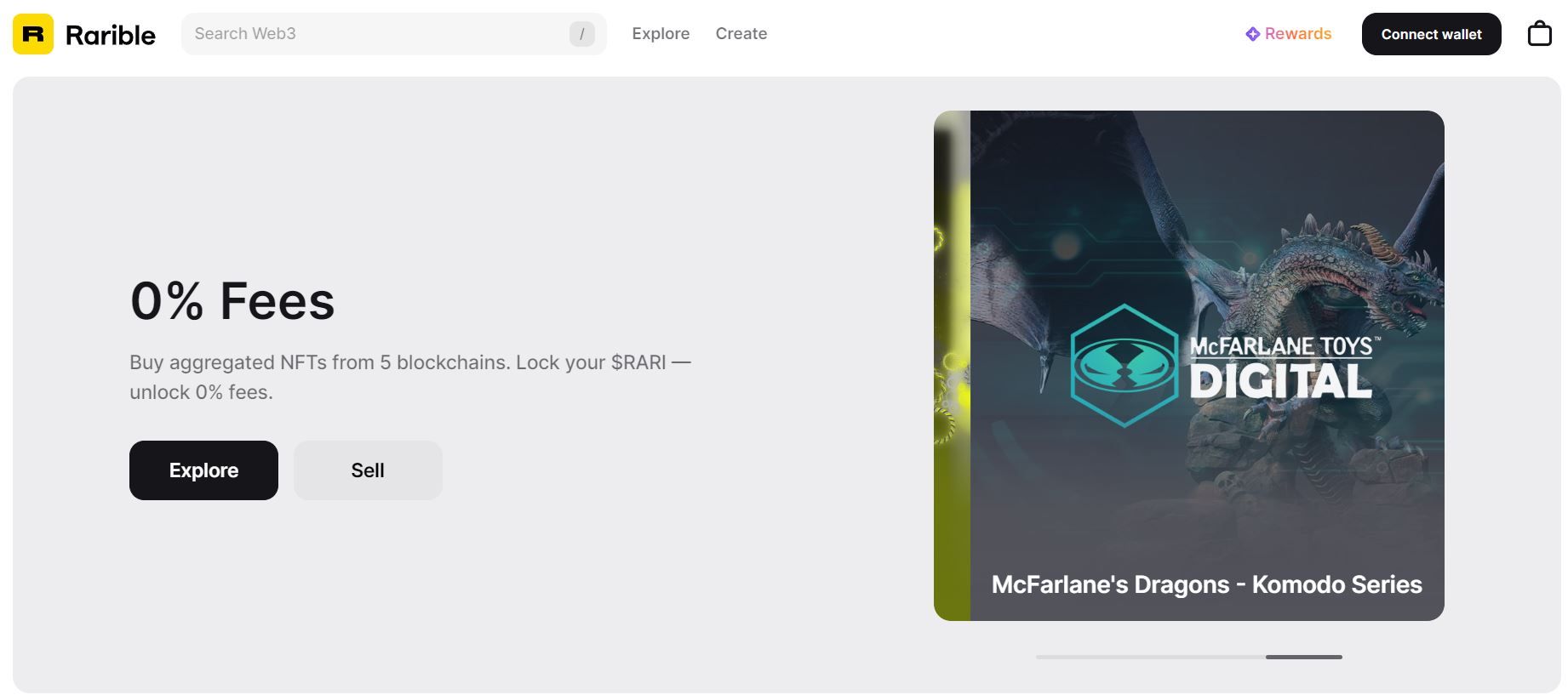

Rarible Overview

Raribledescribes itself as “Web3’s first aggregated NFT marketplace.”

It is a multi-chain, community-centric marketplace for NFTs and digital collectibles.

Users on Rarible are offered a seamless peer-to-peer interface into the NFT market.

Image Credit: Focal Foto/Flickr

The platform is keen on decentralization, with its economy and governance regulated by RARI, its native token.

However, this has led to some questionable decisions being implemented with mixed reactions from the NFT community.

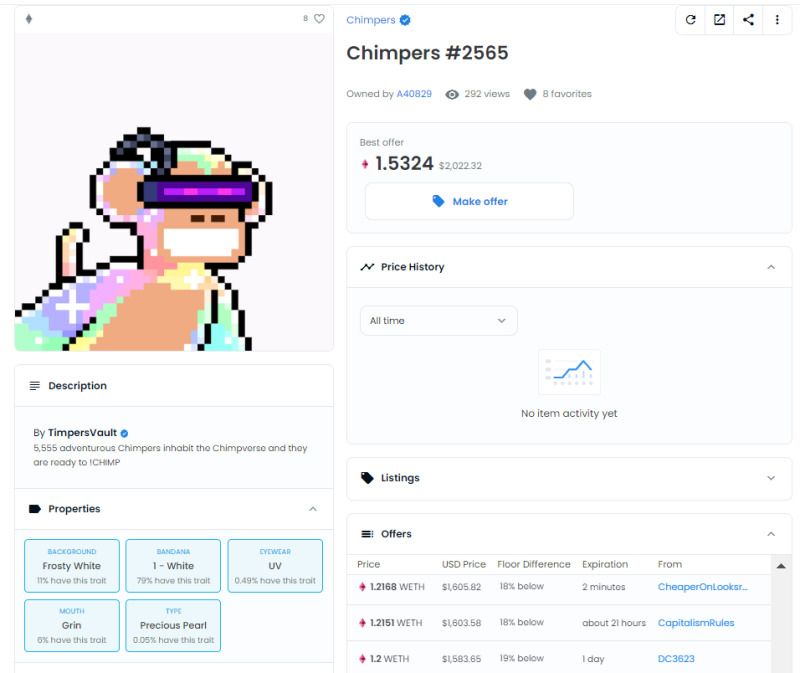

Rarible, on the other hand, does offerdecentralized governancethrough its native token, RARI.

Image Credit: Focal Foto/Flickr

Active users on the platform can earn RARI through trading activities.

This is in addition to connection fees on the associated blockchain.

Royalty fees for NFT creators also differ.

OpenSea’s royalty fee is fixed at 10%.

In contrast, Rarible provides creators the opportunity to receive up to 50% in royalty fees.

OpenSea and Rarible both have gasless minting enabled on their platforms.

OpenSea vs. Rarible: Security

A key talking point when interacting with digital assets is security.

OpenSea and Rarible have multi-chain integrations, so users can explore the NFT ecosystems of multiple blockchains.

OpenSea and Rarible possess strength in simplifying the delicate processes involved in managing and monetizing NFTs.

Both platforms are non-custodial.

The actual NFTs are stored in the user’s wallet.

OpenSea vs. Rarible: Supported Blockchains

OpenSea offers a wide range of cross-blockchain compatibility across several blockchains.

One thing is certain; both platforms are helping to drive mainstream adoption of NFTs and digital collectibles.