The internet is a wonderful but sometimes scary place to be.

Many of us are at greater risk online than we truly realize.

Scammers, fraudsters, and hackers prowl the internet looking for easy targets.

Scams are dangerous and can lead to severe consequences, such as identity or monetary theft and blackmailing.

In this article, weve summarized all of the LGBTQ+-targeted online scams you gotta be aware of.

Here are the easy and tricky signs to watch out for and how to protect yourself.

An Easy Target for Scammers

True, were all vulnerable online.

No one is safe from online scams, but why are some groups easier to target than others?

While it might seem innocent at first, its anything but.

Scammers will exploit this information in return for monetary gain or control.

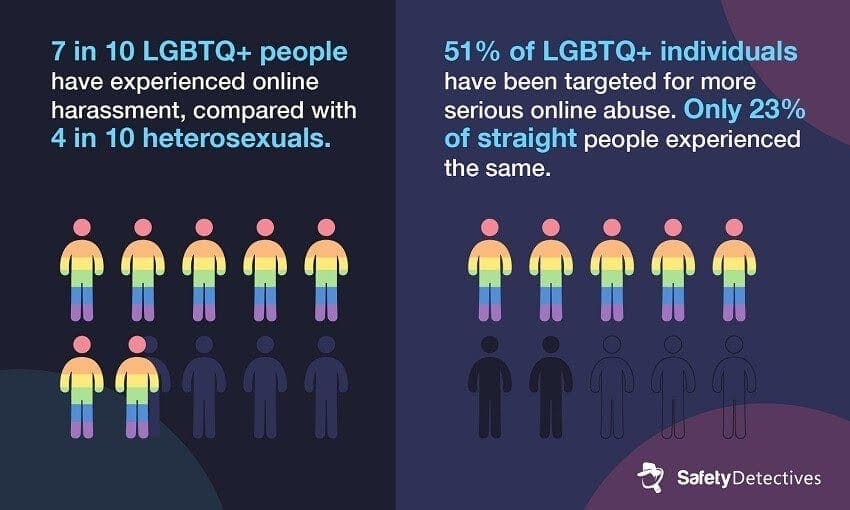

For the LGBTQ+ community, the risks of online harassment are much higher too.

In fact, around 7 out of 10 LGBTQ+ people are the target of online harassment.

For heterosexual people, this figure drops to 4 in 10.

Although its not happening in the physical sense, it doesnt make it any less serious.

But these apps are hotspots for scammers looking to connect with you and offer false promises.

One LGBTQ+ app in particular recently fell vulnerable to online scams through phishing attempts.

Scammers set up fake profiles to steal money from Grindr individuals by offering fraudulent or non-existent services.

John* met a man on the Grindr app, and they matched almost instantly.

But within a week, he was forced to send over 20,000.

They began messaging on the Grindr app, but the scammer quickly suggested moving to WhatsApp.

The scammer started telling John how he could invest in crypto trading to make money.

It started with setting up an account with Binance, a cryptocurrency exchange company.

The screen appeared legitimate, showing John that he had made a payment to Binance.

The payments continued, until something appeared off.

John tried to access his Binance account, but it was showing as locked.

He paid the fine, then after 24 hours, tried to withdraw his money.

But the money never appeared in his account.

*Example name used for case study purposes only.

Romance and dating crimes are pervasive among scammers.

But there are many other online scams to be aware of, too.

Besides phishing, scammers use all sorts of cybercrime tactics to trap you.

And fake profiles on dating apps are surging.

The people behind these profiles look to build emotional connections with you by offering a false sense of security.

Scammers are very clever and manipulative, and typically encourage you to send money through irreversible money transfers.

This might include gift cards, handing over your PIN, or sending cash directly through WIRE transfer.

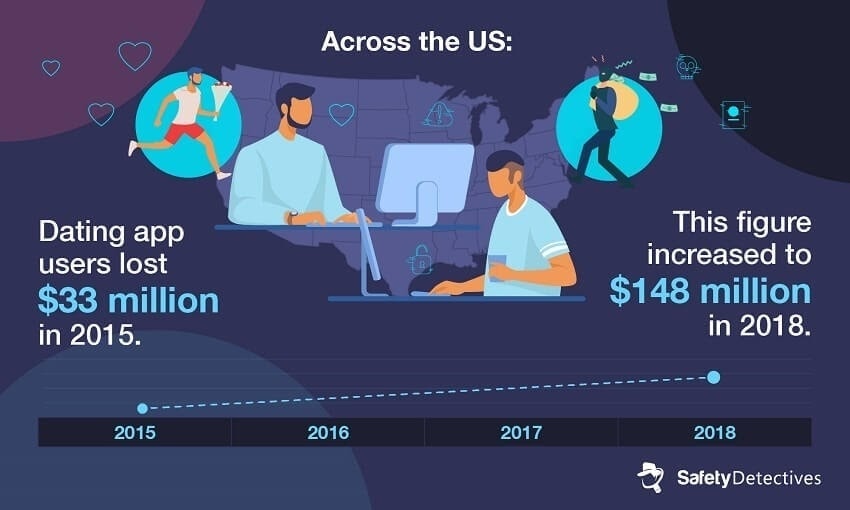

In 2015 across the US, dating app users lost around $33 million to romance scammers alone.

This has increased rapidly over recent years, too.

In 2018, this figure rose to a total monetary loss of $148 million.

Scammers are only getting better, and were falling victim to their traps.

Romance scams take many forms and arent always easy to spot.

Sugar Daddy/Momma

Sugar daddy/momma scams are typically targeted at younger people.

Victims are encouraged to hand over their cash, too.

Often, this is in the form of prepaid gift cards.

Of course, the cheque never arrives.

Once they have this sensitive information, theyll disclose that theyre much younger than you first thought.

And then, theyll threaten to expose you if you dont do what they say.

Birthday Gifts

A common tactic used by scammers is asking for birthday gifts.

They then persuade you into sending them money for a false occasion or buying them a gift.

Either way, its a simple and easy way to get you to hand over your hard-earned cash.

Knowing a scam when you see one is essential not just to protect yourself but your money too.

As with most online scams, the aim is to steal your details and money.

This is an easy way to get you to bring up the email.

At the end of 2020, this figure sat at around 140,000.

While phishing is an old tactic, its increasing.

Although all industries are vulnerable to phishing, banks are the most targeted.

If you see a suspicious-looking email from your bank, dont open it.

Even if you do and it looks legitimate, always be vigilant.

Many scammers have moved onto other online websites, such as streaming platforms.

In the LGBTQ+ community, one of the most well-known phishing emails is for an LGBTQ+ crowd funder organization.

Your money actually just goes in the scammers pocket.

And they know how to con you with click-bait information.

So, what do you better look out for?

Phishing emails have tell-tale signs that make them easy to identify.

Since they give a shot to mimic organizations, scammers often try too hard to appear professional.

Remember that organizations will never ask you to hand over personal details via email.

Spear Phishing

Spear phishing is another key in of fraudulent email, but its very targeted.

But spear phishing is a little different.

Theyll ask for more details from you with a very convincing message.

Smishing

Smishing refers to fake text messages sent directly to your cell phone.

Or, that a small fee is needed to receive your parcel.

In other words, hand over your bank details directly to a scammer.

Vishers also rent or clone local numbers to get you to pick up the phone.

Some may even ring you and hang up immediately, in the hope youll ring back.

Once you do, youre connected to a new local number that incurs hefty charges.

Vishing calls can be compelling and persuasive.

Its not always as easy to detect a false call compared to a fake text or email.

Posting your phone number and email address is risky, especially on LGBTQ+ dating apps and social media sites.

Unless absolutely necessary, avoid making your contact details public knowledge.

Youre giving scammers the green light.

If you fall victim to smishing and vishing, you’re free to take steps to protect yourself.

First of all, immediately block any numbers you dont recognize that contact you.

And dont call or text back any unknown numbers.

If youre sent a text message, and a link looks suspicious, it probably is.

Dont click any links youre unsure of.

Always double check first.

Remember, its not only you thats vulnerable to online scams.

If you see a scam, always report it via the appropriate channels.

That way, you might help prevent scammers from reaching out to anyone else.

Social Media Scams

Social media sites help you connect with anyone, from anywhere.

Unfortunately, this also includes scammers.

On Facebook, you might also see an ad for the Facebook dislike button.

This doesnt exist, but its an easy way to tempt you into clicking a link.

You might also come across fake friend requests and followers.

That way, only people youve accepted can view your profile.

Remember: only accept friend and follower requests from people you know, too.

Avoid posting your personal details online or oversharing information about yourself on social media.

Doing so only makes you an easy target for identity theft and other scamming tactics.

If you see anything suspicious, be sure to report it.

Shopping Site Scams

Anyone who shops online loves to find a bargain, and scammers know this.

Fraudsters have gotten clever at creating copycat websites for well-known brands that offer huge discounts and deals.

However, youll be losing money rather than saving it.

They also demand payment via electronic transfer, rather than by card.

Many scammers use subscriptions to keep taking payments off you.

And they dont make it easy to cancel either.

Or make you a victim of identity theft.

Sometimes, the URLs look very similar to the brands genuine site.

For example, it might read Amaz0n rather than Amazon.

Be sure to double check the link before you click it.

Insecure websites wont include HTTPS in the name either.

If the offer is too good to be true, then it probably is.

Scammers lure you in with amazing deals, but the brands themselves wouldnt discount their products by that much.

Ridiculously low prices and huge discounts are a red flag.

Check out the payment method, too.

If it asks you to pay for items via bank transfer, you know its a counterfeit site.

More and more of us are applying for positions online, making us vulnerable to job scams and fraud.

Scammers monitor job utility websites and know whos looking for a new career.

But, honestly, no one is safe.

Lots of scams promise high rates for very little work.

Even on legitimate job utility websites, you’ve got the option to still come across false ads.

This is a way to take money from you straight away.

And then theyll refuse to pay you for your hard work.

If youre asked to pay an upfront fee for a job, it should ring alarm bells.

For an overseas job, scammers may even ask you to pay immigration fees or travel agent costs.

Money laundering is undoubtedly one of the most serious job scams out there.

In actual fact, theyre using you to launder illegal money.

It can be very difficult to recover your money in these situations too.

A scammer will arrange a telephone interview with you.

Then youll incur charges every minute youre on the phone.

They might even put you through several fake interviews to rack up fees.

you’ve got the option to be left on hold for a while to add extra charges.

Your future employer wants to know about your skills, qualifications, and experience.

The rest, you might probably leave out until a later date, besides your name.

Some job scams might even ask you for personal information right away in an attempt to steal your identity.

And you dont need to include these on your resume.

Doxxing is highly targeted and can be dangerous.

Vulnerable individuals, especially the LGBTQ+ community, are usually targeted first.

What Are Doxxers Looking For?

Doxxers want any personal information they can find.

This includes:

Finding Your Personal Information

Doxxers use various tactics to dig up your information.

Its actually much easier to find your information than you might think.

Usually, the first place scammers look is your social media.

Thats why having a private profile is very important.

They even look at locations youve been in.

Studying government records is another way to access your personal information.

Doxxers can track your online browsing habits and make a run at intercept your data.

If theyre successful, they can hack your gear and uncover all of your personal details.

Some scammers also use IP tracking, which attaches a code to your IP address.

Once you visit a website, the scammer is notified.

Its an easy way to keep a watchful eye on what youre doing online and who youre engaging with.

Any private messages you send, they can get a hold of.

If you use a regular username across different sites, doxxers can track this, too.

Doxxers rely on phishing emails with click-bait links to lure you in easily.

These sites can be very convincing and even have forms that look entirely legitimate.

Scammers have a go at persuade you into believing that youve won a huge cash prize or gift.

Usually, youre asked to input your details on a form to claim your prize.

The message looks like it comes from you, so the other person is more likely to hit it.

Remember, if your gut is telling you something isnt right, then its probably not.

Do not contact them using the details provided by the phishing attempt.

Actually, they appear to be just what youre looking for.

This includes financial support scams.

If youve been looking at credit cards or loans online, you could bet a scammer knows about it.

Of course, these are not legitimate.

The fraudulent links ask for personal details, including your bank and credit card information.

They might even make you pay a fee.

Sometimes, scammers try other tactics.

All they need is a small upfront fee.

Always keep an eye out for fake lenders.

If they ask for an upfront fee, no matter why, be sure to question it.

If you feel like youre being pressured or rushed into applying for debt help, its usually a scam.

Investment Scams

Investment scams persuade you into handing over your money by promising you a profitable return.

One of the most common is cryptocurrencies, especially Bitcoin investments.

Although the investment does actually exist, the scammer steals your money rather than investing it for you.

All the while, theyre stealing your money.

Its not until you ask for your funds that the scammer disappears.

Cryptocurrencies arent the only bang out of investment scams, however.

There are lots of investment scams you should be aware of.

Here are some of the most common ones:

Travel Scams

Ticket and travel scams are everywhere.

They also know youll be more likely to click a link whether it looks suspicious or not.

Scammers often pose as well-known airlines or hotels in the hope that you will trust them.

In actual fact, the scammer just wants access to your bank.

You should also watch out for fake images on social media.

Scammers will post a photo of an idyllic-looking location on social media, hoping that youll hit it.

These links often lead to a survey, which asks for tons of personal information.

Or, the link downloads malicious content onto your gadget so the scammer can hack it.

Be cautious of any forms asking for lots of personal information or payment upfront.

Especially if the payment is via check or bank transfer.

Thats probably a tech support scam.

These viruses show up as the opposite persuading you to install antivirus software.

If you drop in the antivirus software, it usually provides a hacker with full access to your equipment.

Protect yourself from tech support scams by knowing the warning signs.

Check out ourtop 10 recommendationsto use across Windows, Mac, iOS, and Android devices.

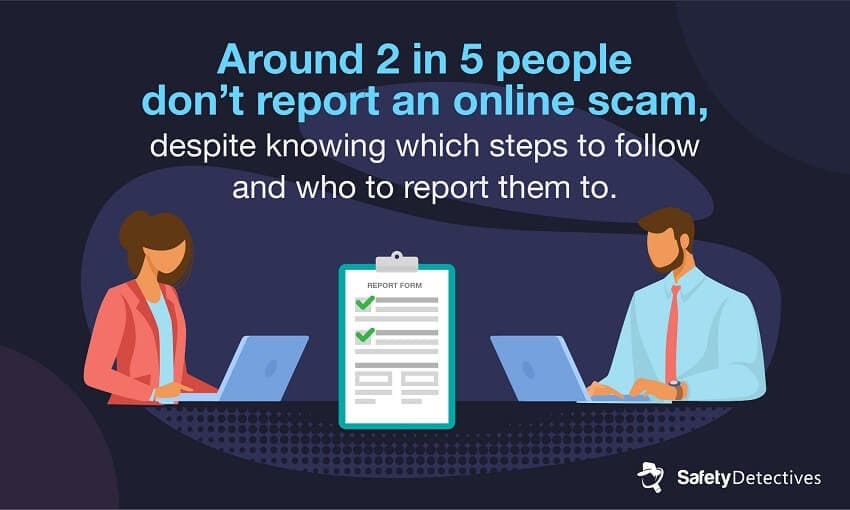

Tracking down a scammer stops them from finding new targets.

So reporting online scams isnt only important for yourself, but for protecting other people online too.

And while some people do know which channels to go through, many simply choose not to.

If you come across a scam, check that you know how and where to report it.

It also varies from country to country.

Facebook has a reporting tool that allows you to report any ad you think is suspicious.

you’re free to also report posts from others and direct messages, using the three dots button.

On Twitter, use the downwards arrow on a Tweet to report it as a scam.

Google has a variety of different methods to report fraud.

For an ad, smack the Why this ad?

button first, then select Report this ad to fill out the appropriate form.

Dont answer a call if you know its a scammer.

Keeping screenshots of emails and text messages is also a good idea.

see to it you change all of your passwords immediately and contact your bank to block your cards.

You should also upgrade your antivirus software to remove any viruses the scammer has installed.

Recovering Your Money

Its scary that scammers can get access to your bank and steal your funds.

There are ways to get your money back.

In some countries, such as the UK, the police have returned lost funds to fraud victims.

Usually, youll need to speak with the banks fraud team and fill out several forms.

You will also need to block your card for the relevant account.

Once youve notified the bank, they will put the money back in your account.

Your bank should also recover the lost funds once they can identify the unauthorized or fraudulent payment.

Usually, this covers anything costing between 100 and 30,000.

Contact your provider as soon as possible to get the credit placed back onto your card.

Youll need to claim in the PayPal Seller Protection area of the site to recover your funds.

However, scammers are clever, and they may set up legitimate-looking PayPal forms that collect your bank details.

Being aware of what you post and see online is key to preventing crooks and protecting yourself.

Give yourself greater protection if anything goes wrong by using payment methods that allow you to recover your funds.

Credit cards are usually the best option.

Wherever you could, avoid paying with cash.

While the message you receive might look legitimate, always check the link first to see if it matches.

And see if it includes HTTPS, so you know its secure.

Be aware of phone calls coming in from unknown caller IDs.

If someone does contact you and you think it might be legitimate, its always worth double checking.

communicate with the organization yourself first and speak to someone else.

Theyll be able to confirm for you whether its a scam or not.

Doing so only allows scammers to keep track of your whereabouts and find ways of contacting you.

Keep yourself private online wherever it’s possible for you to, especially on social media.

Be sure to revamp your passwords regularly and take a stab at use different ones across different platforms.

You could use alow-cost password managerto add extra levels of security and keep hackers locked out.

Keep an eye out for unusual ads while browsing the web, including on social media.

If youre not sure, dont click it.

Always be aware of risky pop-ups on your gadget, too.

Scammers love to over-promise because its an easy way to lure you in.

Although the email might tell you youve won a holiday, the likelihood is you probably havent.

Help stop scammers from getting control of your machine byinstalling antivirus software.

Stay Safe, Keep Scammers Away

Online scams are scary, but theyre very real.

After all, all they want is your money.

And theyll do anything they can do to get it.

Remember, always think twice when you see anything suspicious.