In 2019, rumors were buzzing about a new credit card designed not by a bank but by Apple.

Many people were excited by the idea of a tech company like Apple entering the world of banking.

And in the years since its launch, over 6.4 million people have become Apple Card users.

The Apple Card has definitely been a huge success for Apple, but is it worth it for you?

Apple Card Overview

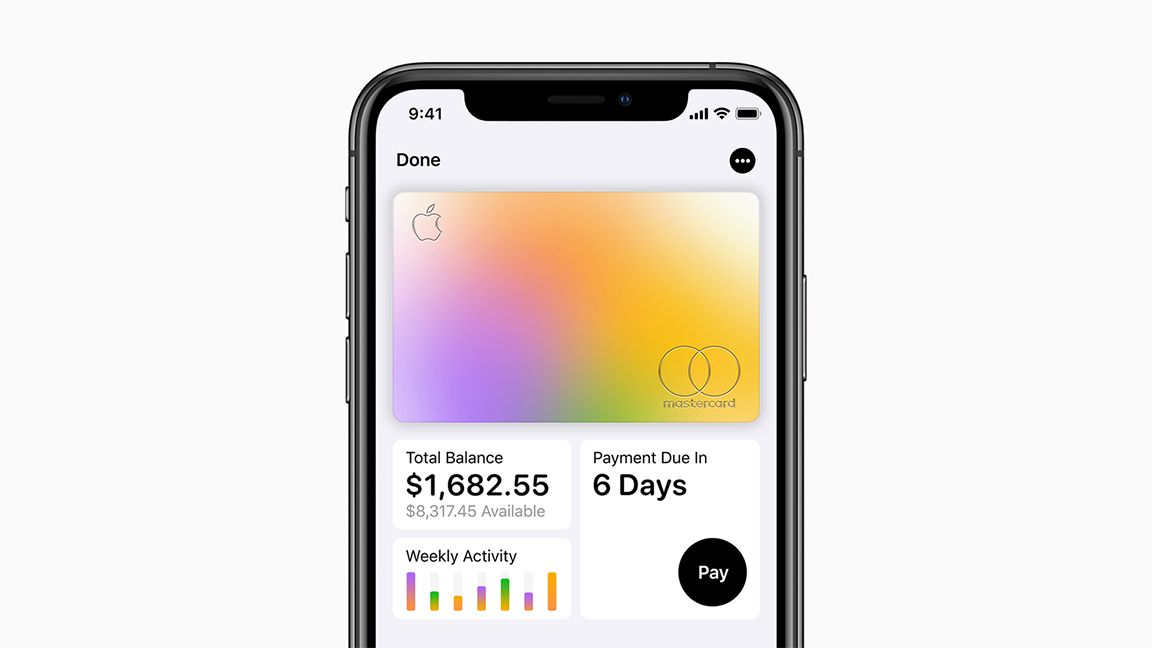

From the ground up, the Apple Card was designed to be simple.

The Apple Card operates on the widely-accepted Mastercard connection and doesn’t have any upfront costs or hidden fees.

Image Credit:Apple

The Apple Card is built as a cash back card.

There are no points or miles programs to keep track of.

When it comes to the physical card’s design, Apple knocked it out of the park.

Image Credit:Apple

That said, managing your Apple Card is extremely easy.

it’s possible for you to even see your spending organized by purchase category.

Making payments on the Apple Card is also very intuitive.

Image Credit:Apple

But unlike most credit cards, Apple tells you exactly how much interest you’ll end up paying.

That’s a great transparency feature that can save you money.

You’ll only be able to score the full 2% cash back when you use Apple Pay.

Included are apparel giant Nike, gas stations like Exon and Mobil, along with Uber and Uber Eats.

All purchases directly from Apple will net you 3% cash back.

That means spending $1,000 on a new iPhone will immediately pay you $30 back.

But the Apple Card isn’t just for buying new devices.

All purchases made on the App Store and iTunes Store are eligible for 3% cash back.

Even better, everything else you buy through the App Store also falls under this category.

That includes purchases and subscriptions to third-party apps like streaming services and VPNs.

However, many credit card issuers have products that offer similar or better rewards without any extra steps.

It delivers 1% daily cash back and earns another 1% after you pay your bill.

With the Apple Card, you won’t get either.

Should You Apply for the Apple Card?

Whether the Apple Card is worth it depends on who you are.