MakeUseOf did anoverview of Mintback in 2007 when it was in its beta release.

Since then, it has grown and added more features so it’s time for an update post.

Mint is a free, automatic online finance tracking andbudgetingplatform much like Microsoft Money and Quicken.

Mint does all the personal accounting work for me.

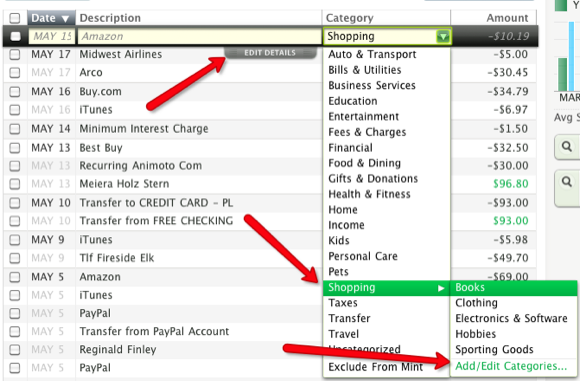

Using your past transactions, Mint assigns your transactions to various categories.

For example, credit or debit card transactions you make at Target will be assigned theShoppingcategory.

A transaction from Best Buy will get assigned toElectronics & Software.

Here’s how to do it.

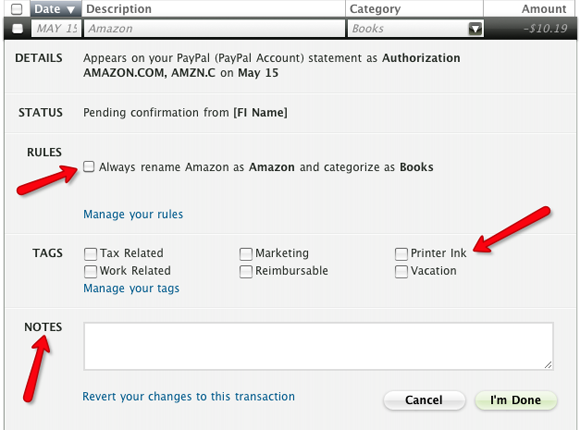

In the resulting dialog box, select “Always renameAmazonas Amazon and categorize asBooks.”

This new rule will change all existing and future Amazon transactions.

By clicking “Manage your tags”, you might change, add, and delete tags.

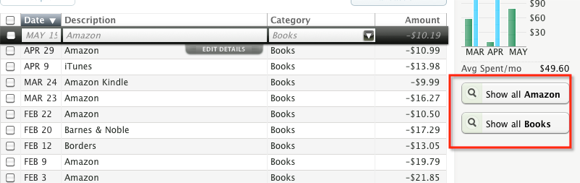

Taking the time to set up rules for uncategorized transactions will inevitably help you monitor your spending.

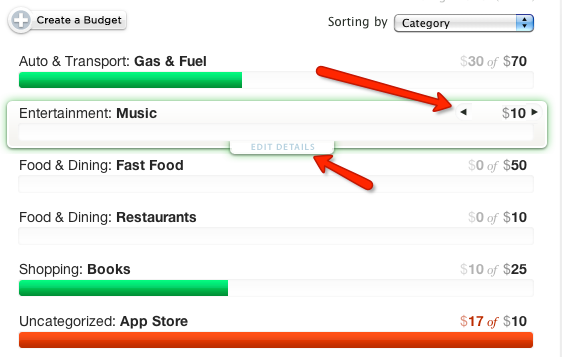

To do this, click onPlanningin the menu bar of your account’s page.

snag the budget you want to change or update.

Or click theCreate Budgetbutton to create a new budget.

Almost everything about Mint is automatic.

So once your transactions are updated for your accounts, all your categories and budgets get automatically updated.

You never have to manually input that data.

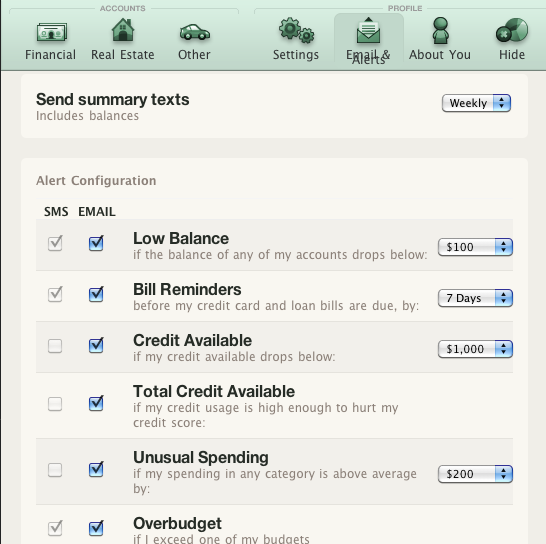

it’s possible for you to configure the prefs for alerts by clicking onYour Profileon your accounts page.

In the drop-down box, selectEmail and Alertsto set up changes.

Transactions, however, may not immediately show up on your Mint account.

It may take an hour or two to get updated.

But using the mobile app also allows you to add tags and/or change categories for new transactions.

Your new alerts also show up in the app.

You have to download the data and then set up a spreadsheet to create reports.

Hopefully the developers of Mint will address this problem in future updates.

Let us know if and how you use Mint.com.

Has it helped you budget your spending?