Or maybe you’ve been planning an epic multi-country trip to explore exotic destinations.

Maybe you want all of the above!

What Is a Zero-Based Budget?

Don’t get me wrong; there aremany other helpful Excel templates that can help you manage your money.

How to Make a Zero-Based Budget

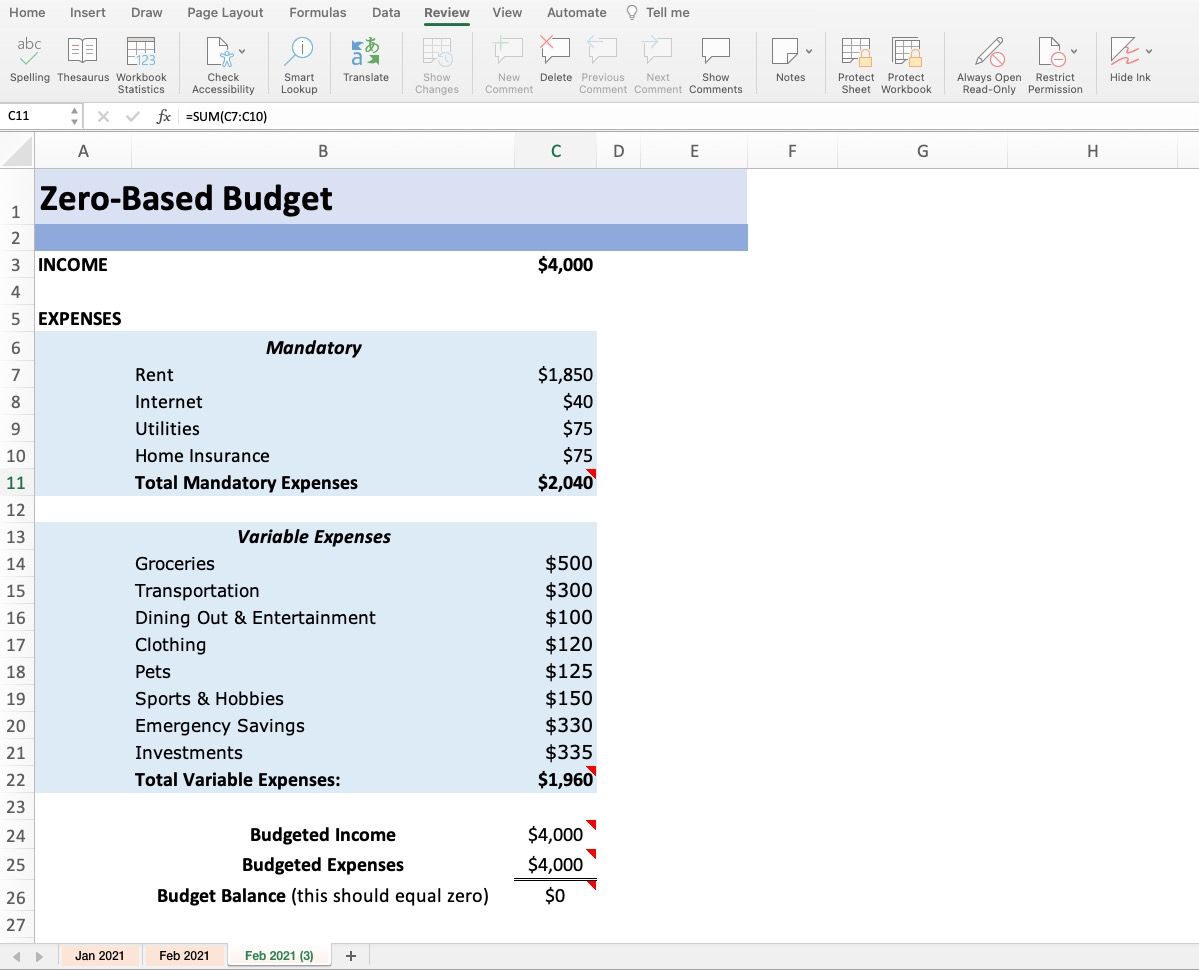

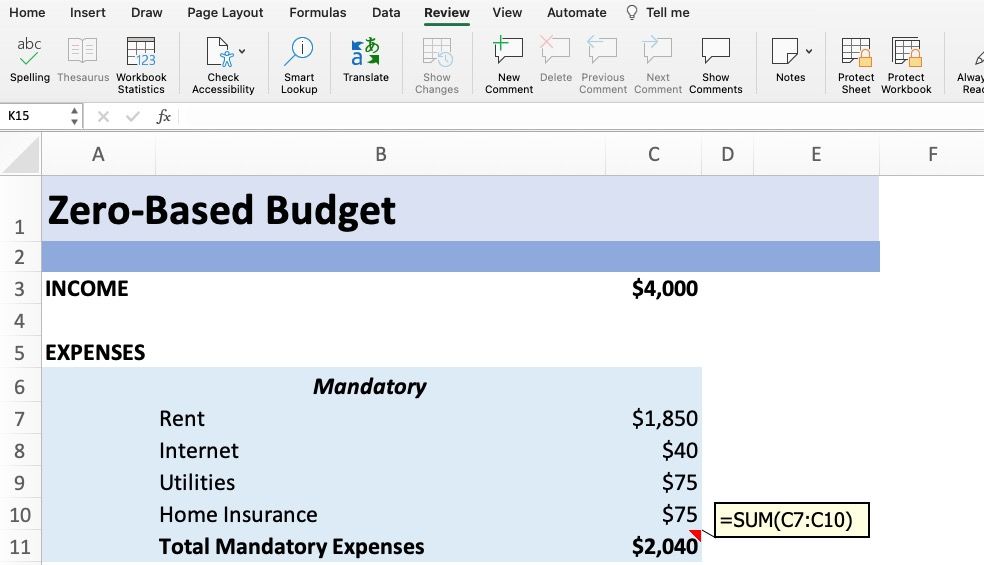

Here is an example of a completed zero-based budget.

List Monthly Income

Your after-tax monthly income is the amount of money you have to work with.

We’ll be using $4,000 for illustrative purposes.

For example, as inflation rises, you might want tolearn how to ask for a pay raise.

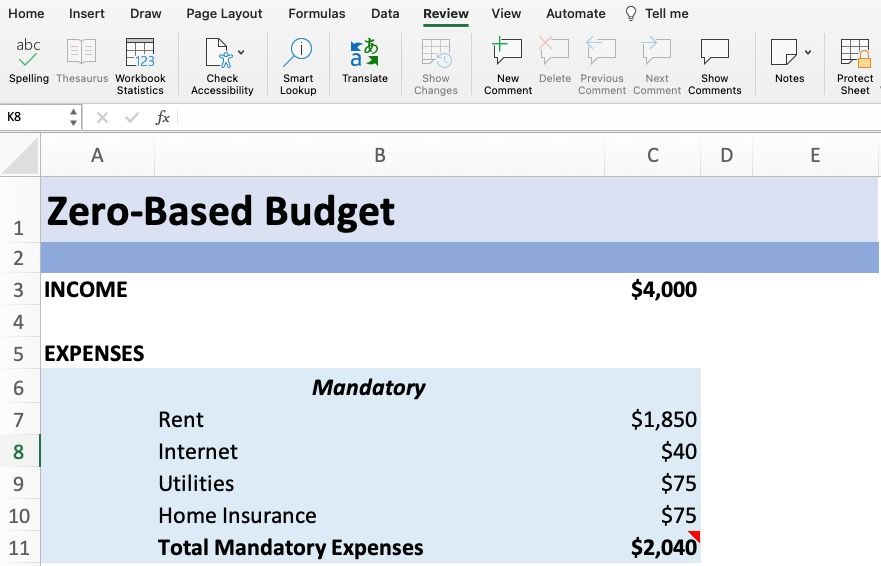

List Mandatory Expenses

Your mandatory monthly expenses include all non-discretionary spending.

These costs normally stay the same month over month.

Just like your income, these expenses may change over time.

For example,you may use one of these websites to find a cheaper apartment to rent.

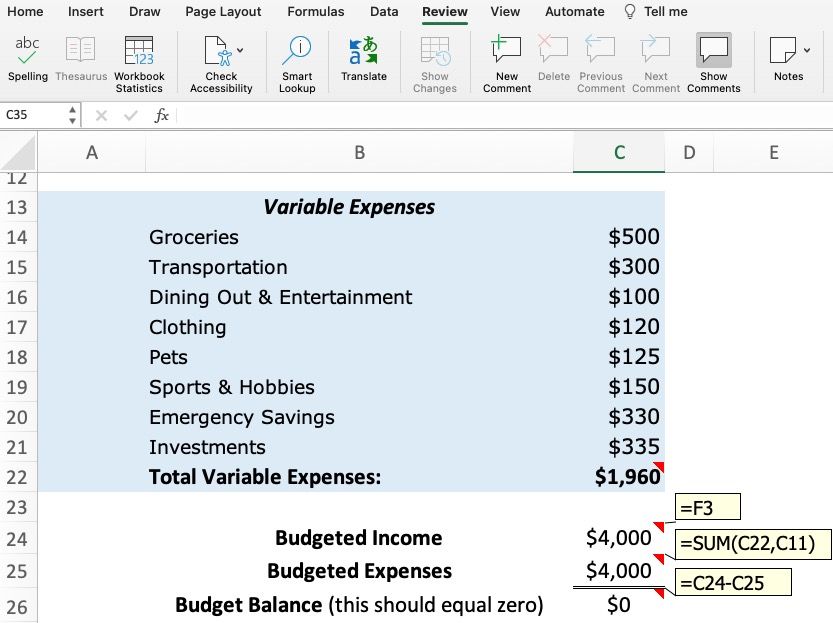

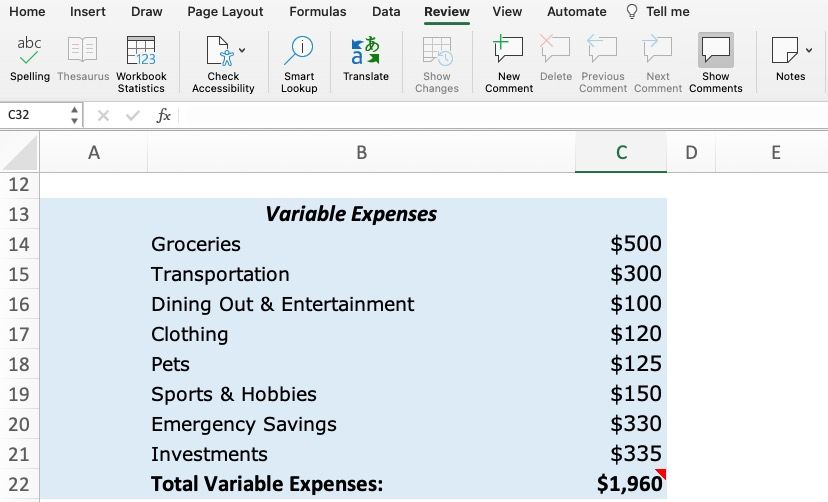

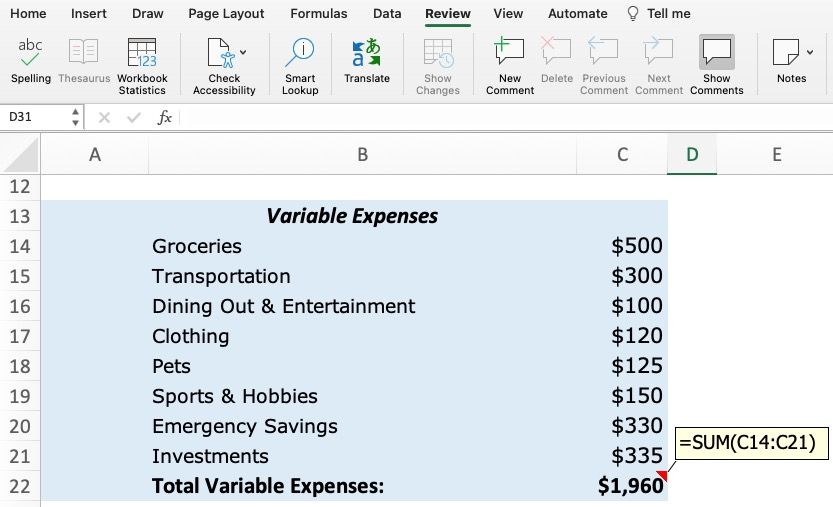

List Variable Expenses

Variable expenses include all non-discretionary spending.

This means any expense that you have some control over.

These costs normally vary month over month, or they may occur once every couple of months.

Insert your list of variable expenses in one or two rows below your mandatory expenses.

You’ll need to choose category names for your variable expenses and establish some spending targets.

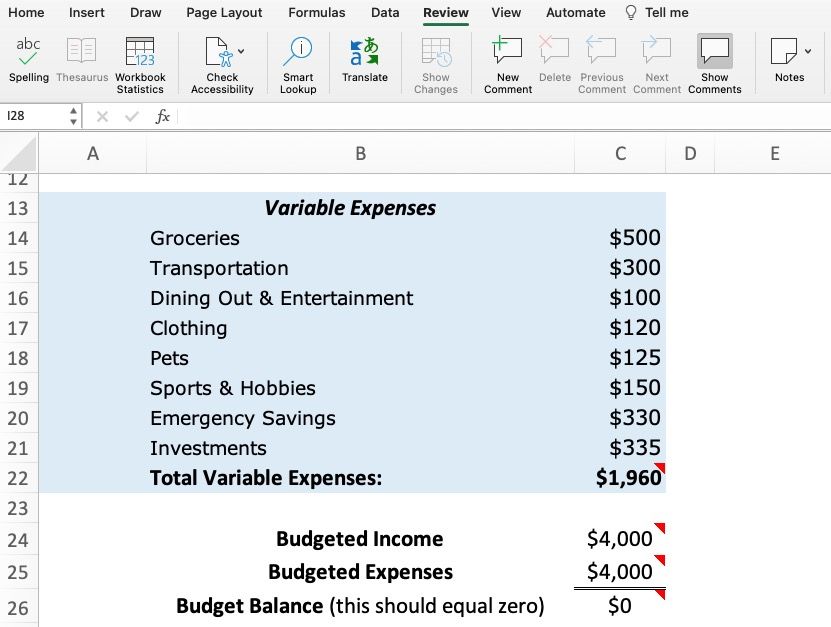

This is where the budget template gets its namethe Budget Balance needs to equal zero.

This is where you get to choose how your money works for you.

If you find your budget balance is negative, it means you will be spending more than you earn.

Alternatively,there are several apps available to help you track your expenses.

In both cases, you’re able to adjust your allocations each month.

Once your Spending Balance equals zero, you’ve successfully set up your first zero-based budget.

You don’t have to recreate your spreadsheet every month.