Compound interest is one of the most powerful financial concepts with applications in banking, accounting, and finance.

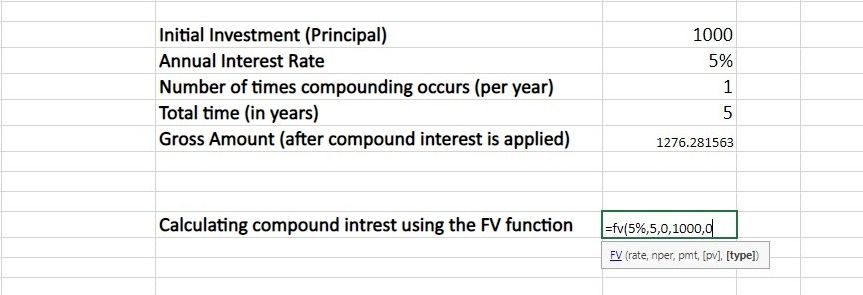

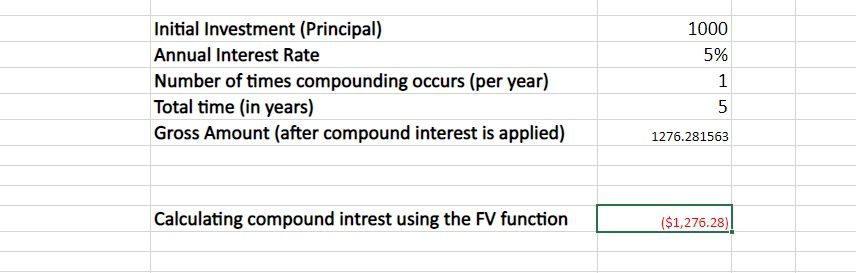

There are two ways you could calculate compound interest in Excel.

How Does Compound Interest Work?

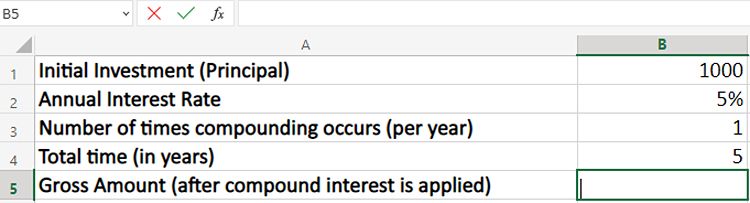

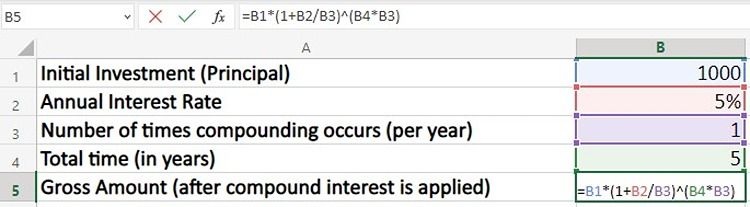

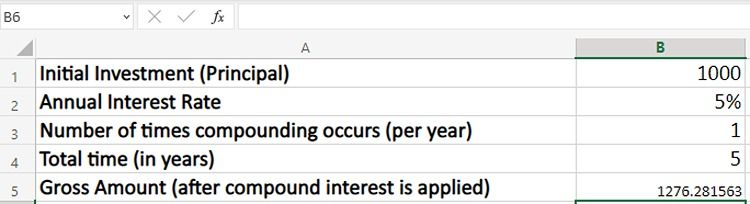

Suppose you invested $1000 with a 5% interest rate that will compound every year.

This will make your gross amount $1102.5.

As this continues, your initial investment (principal) increases exponentially yearly.

Compound interest has exponential increments solely because of this difference.

Now, it’s simply a matter of altering the values to calculate your compound interest.

Note:Don’t forget to place commas between the values.

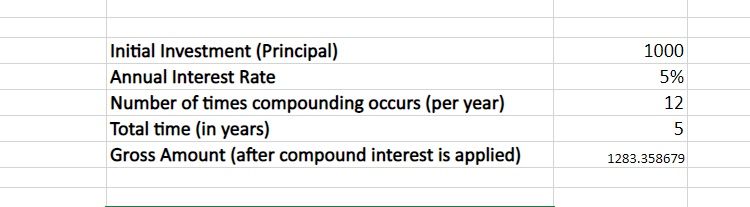

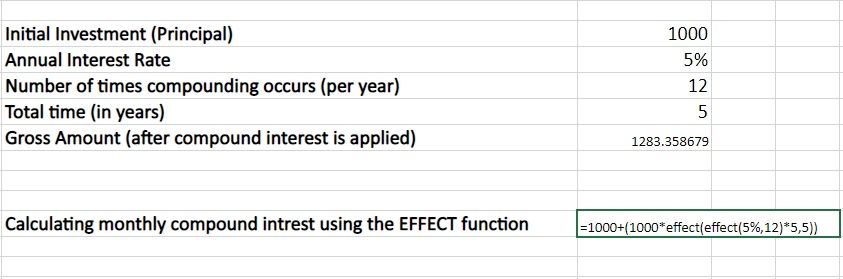

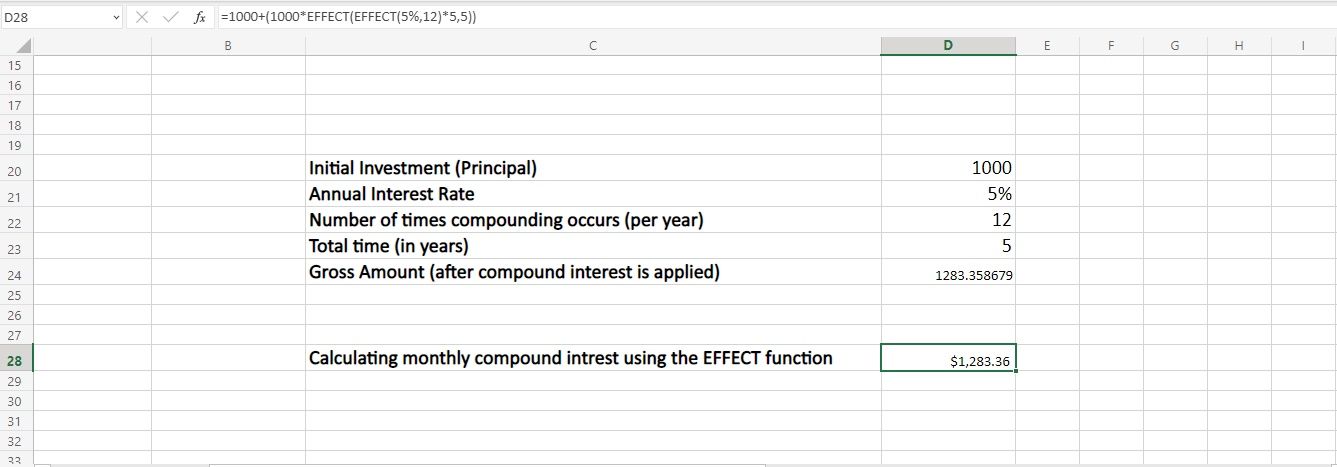

But often, we want to calculate quarterly, monthly, or even daily compound interests.

It’s time to understand how to calculate compound interest for an intra-year period.

In our initial example, we put N=1 because compounding happens only once per year.

Similarly, for the daily compound interest, we’ll put N=365.

you’re free to use it to calculate the compound interest for an intra-year period.

But why stop there?