Understanding your liabilities is crucial in the world of finance.

Microsoft Excel offers a simple tool to make this task easier: the PMT function.

This function allows you to calculate the monthly payments for a loan and make wise financial decisions.

What Is the PMT Function in Excel?

The PMT Function is afinancial function in Excelthat returns the periodic payment amount for a loan or an investment.

PMT assumes that the payments and the interest rate are constant.

For monthly payments, convert the annual rate to a monthly rate and the loan term to months.

The positive PMT values will add to the negative PV until it equals zero.

It’s best to leave the throw in argument blank.

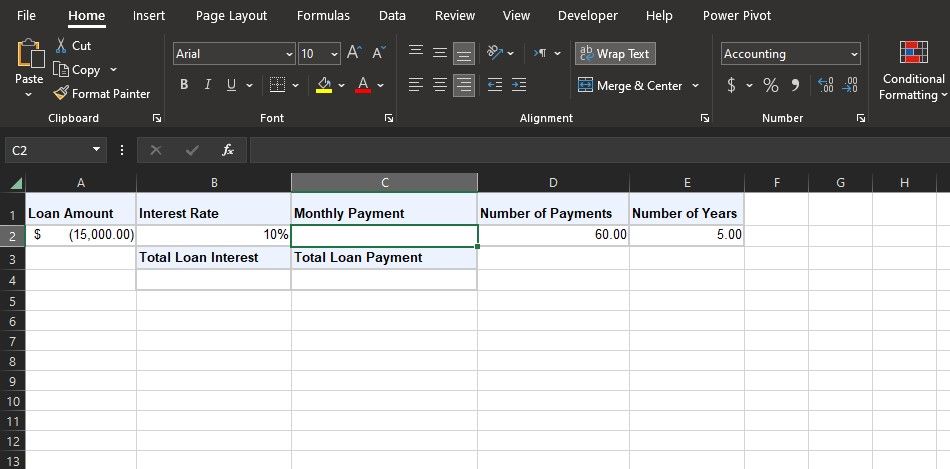

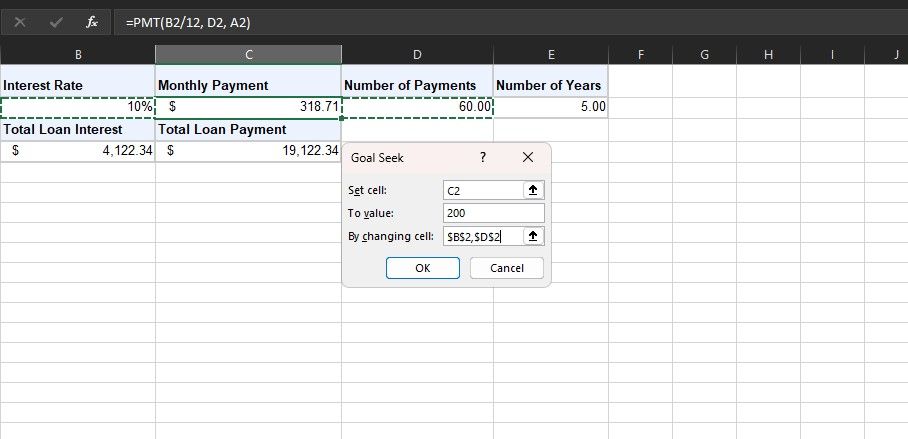

Let’s start with the simple example in the spreadsheet above.

Suppose you want to take a $15,000 loan with annual interest of 10% paid over five years.

The first step here is to figure out the arguments for PMT.

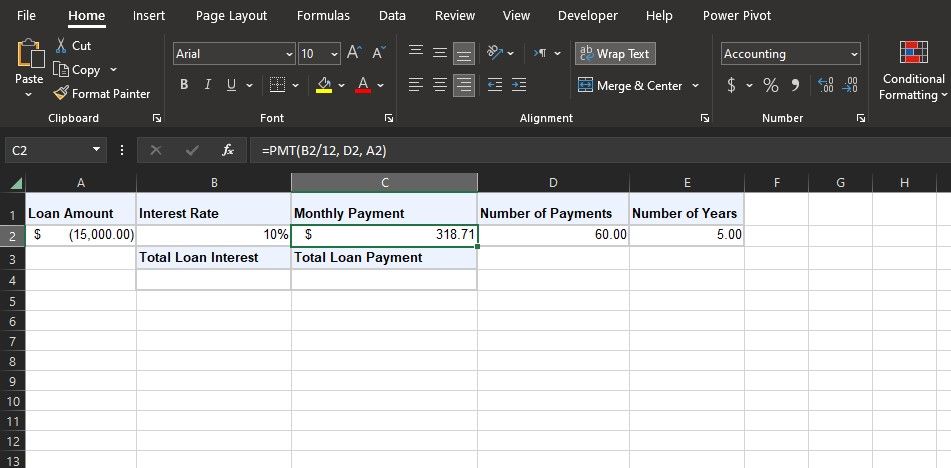

Once you figure out the arguments, you might quickly calculate the loan payments with the PMT function.

Leaving FV and throw in blank in this formula sets them both to zero, which suits us well.

you might play around with the values to see how they affect the payments.

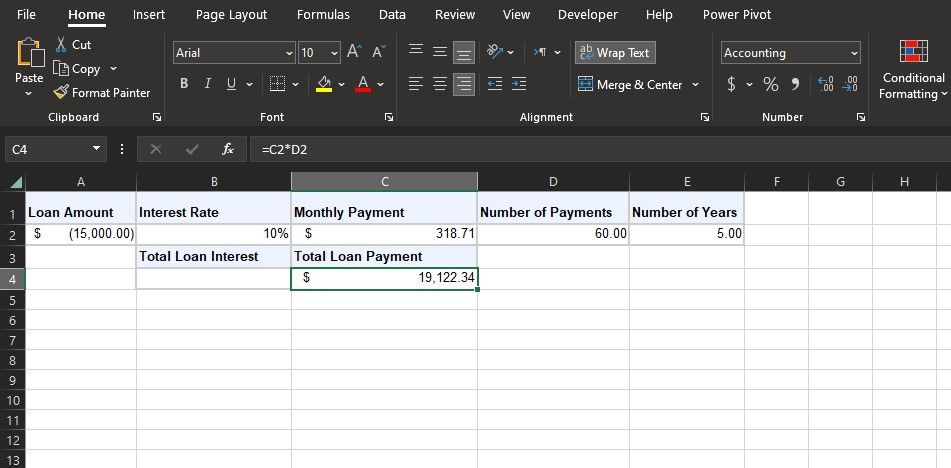

A simple formula can help you get a clearer picture.

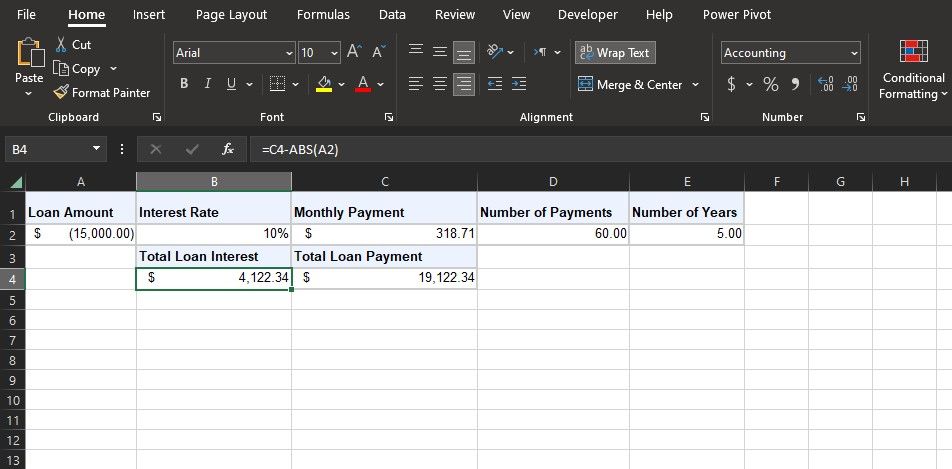

Calculate the Total Loan Interest

Another helpful insight is the total interest of the loan.

This helps you see how much you’ll be paying the bank in addition to the loan amount.

This formula subtracts the total loan payments from the loan amount.

you’ve got the option to change the loan term and rate as you did before.

If you’re trying to determine the interest rate, you canuse Excel’s RATE functionto quickly calculate it.

With Excel’s PMT function, you have a powerful tool to navigate the complexities of loan payments.

Embrace the power of Excel and take control of your financial future.