Quick Links

Summary

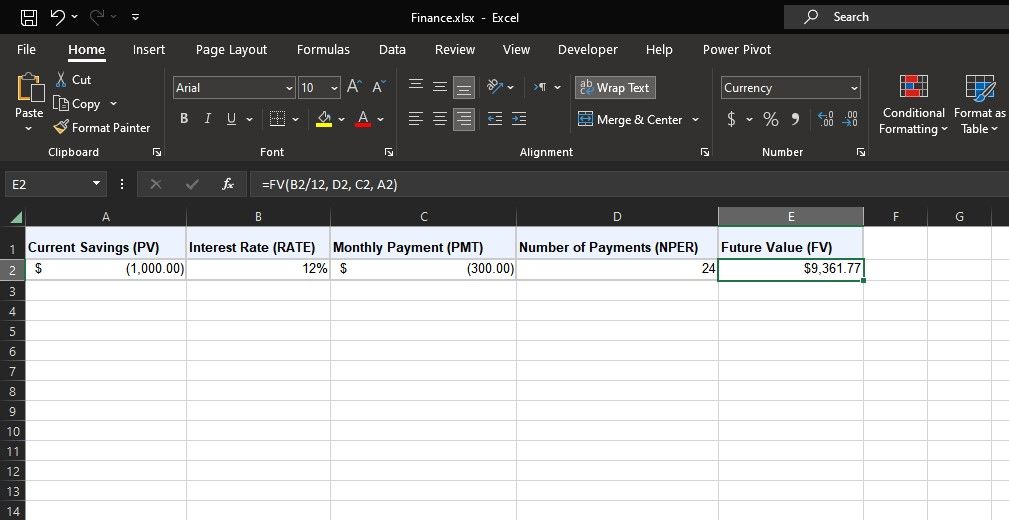

Excel’s FV function is a useful tool for financial planning.

Let’s delve into the intricacies of the FV function and see its utility in different scenarios.

What Does Future Value (FV) Mean?

This is primarily because of the potential earning capacity of money and inflation.

you’ve got the option to use the FV function for both loan and savings scenarios.

When you take out a loan, the lender charges interest as the cost of borrowing.

This interest accumulates over the duration of the loan.

FV helps determine how much you will owe in total, including this accumulated interest.

As for savings, the power of compounding is one of their most significant aspects.

The FV function helps in capturing this compound growth.

The concept of FV is not just theoretical; it has tangible implications in the real world.

you’re able to better observe this by trying out acompound interest calculator in Excel.

What Is the FV Function in Excel?

FV is one of the corefinancial functions in Excel.

Just got started with Excel’s financial functions?

Understanding these concepts will make working with these functions much easier.

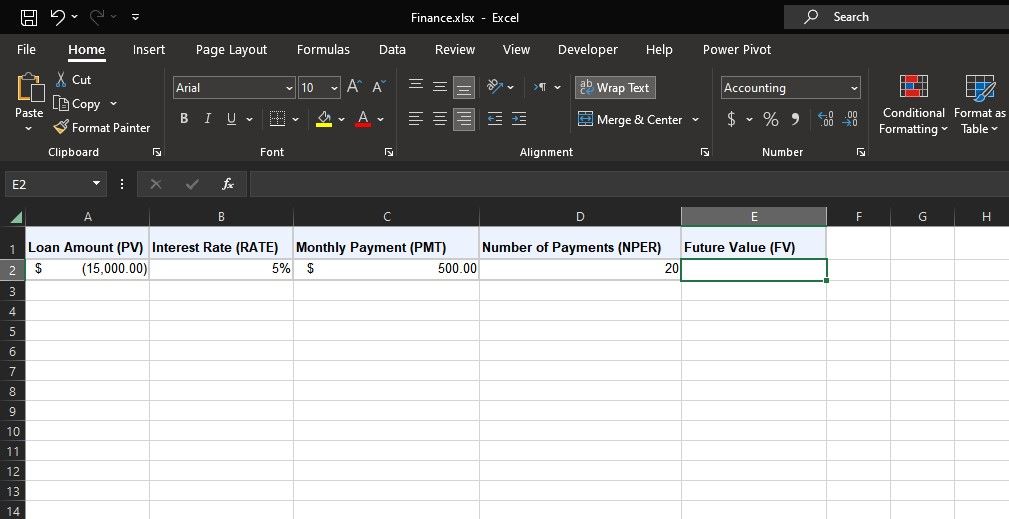

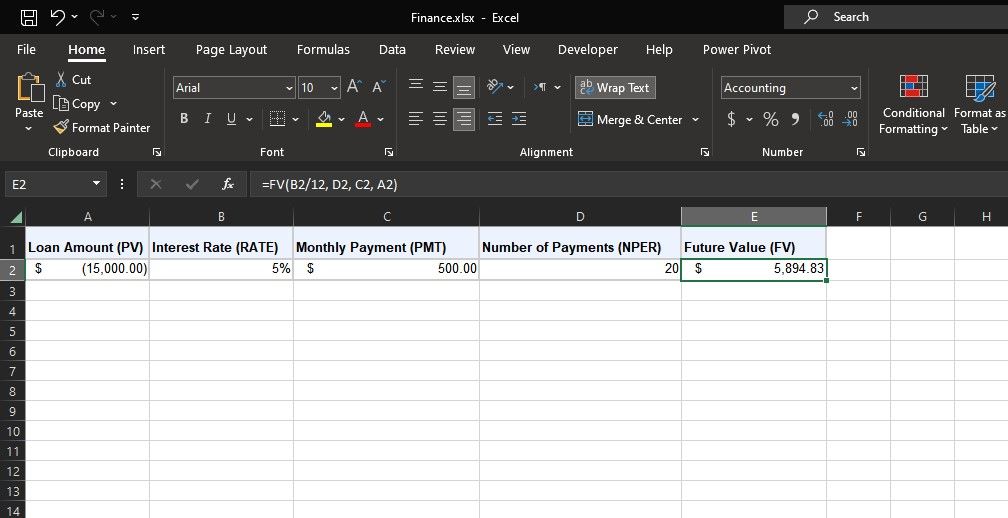

Let’s demonstrate this with the spreadsheet above.

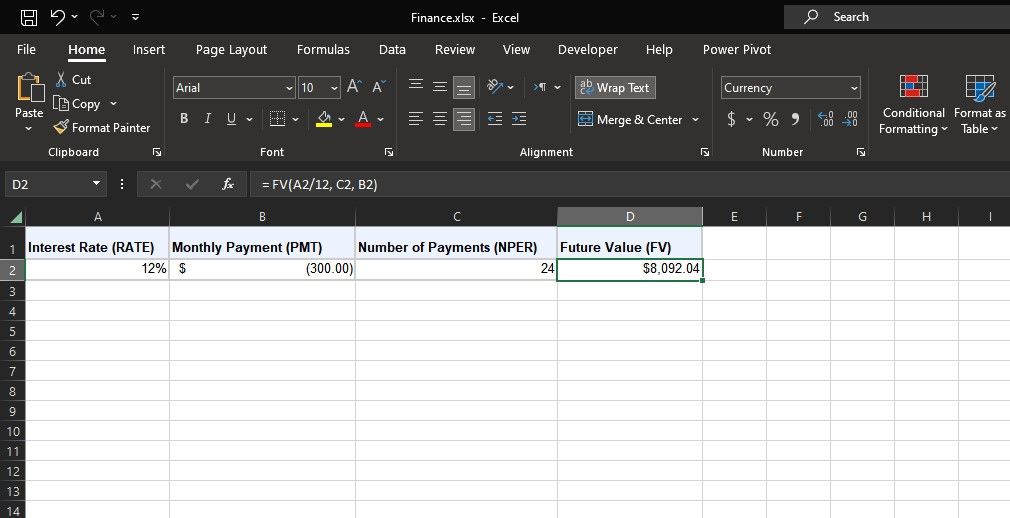

It’s worth noting that, unlike loans, FV can only be positive in savings scenarios.

Another difference is that you should input the PMT value as negative since you are the one lending money.

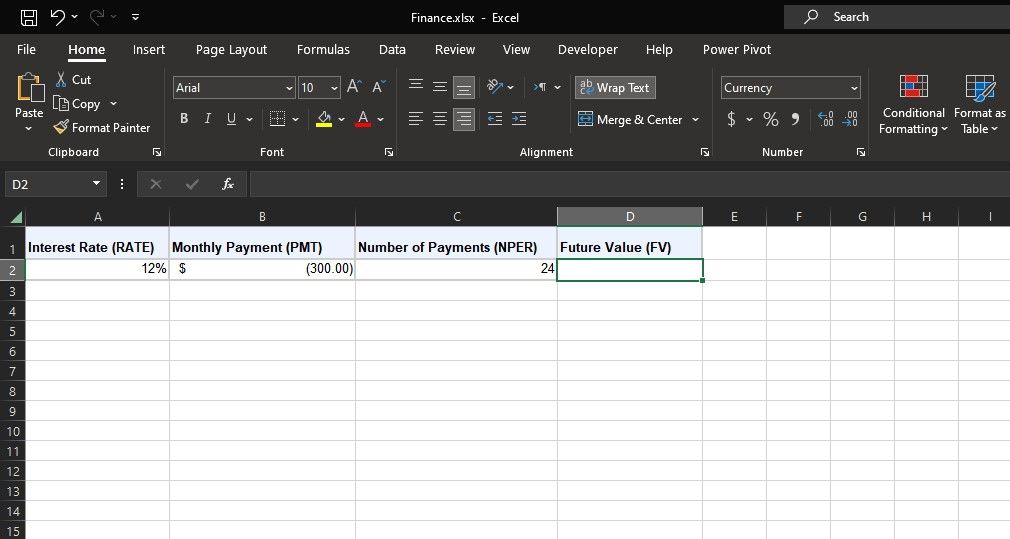

Let’s take an example to understand this better.

If you already have saved a specific amount, you should input the negative value as the PV argument.

This foresight is invaluable, especially when planning long-term financial goals.