Most people do not understand the concept and process of Bitcoin.

Its almost a rhetorical question in todays market.

Bitcoin continues to gain mainstream popularity and is discussed constantly in the media.

However, that doesnt mean everyone understands what it is.

In fact, most people dont.

The nature ofthe technology on which Bitcoin operates the blockchain can be too intimidating.

In 2009, Nakamoto completed the Bitcoin softwares code and invited other people from the open-source community to contribute.

He mined the first block himself on January 3, 2009.

No one knows who Satoshi Nakamoto is, though many journalists have investigated.

While it sounds ridiculous, some have even claimed that Satoshi Nakamoto is a time traveler from the future.

But how many of us actually know why these transactions work?

Why does everyone accept that our plastic credit cards and paper money have any value?

For anyone interested in modern financial mechanisms, understanding how Bitcoin works could offer a fresh perspective.

Instead,the currencys value is determined by supply and demand and is sustained by trust in the economy.

In recent decades, all the worlds major currencies have been converted to the fiat system.

Another problem with fiat currencies is thatthe system is centralized and requires a lot of regulation.

you’ve got the option to read more about decentralized currency inthis article.

How Bitcoin Works to Solve Centralized Currency Problems

Bitcoin aims to solve the problems associated with fiat currencies.

Using Bitcoin, you could transfer funds to anyone within seconds and with minimal transaction fees.

This is possible because the Bitcoin system is decentralized.

Understanding Bitcoin involves recognizing thatit operates as a distributed, decentralized ledger on which all financial transactions are recorded.

This ledger is implemented through a technology known as the blockchain.

Each block on the blockchain represents a series of transactions.

Once enough transactions have been carried out, the block is completed and cannot be altered.

2. How Bitcoin Works at the Transaction Level

1.

You may do this with your drivers license, social security card, or handwritten signature.

If someone tried to impersonate you, they would be caught (hopefully).

In contrast, Bitcoin uses a public ledger on which everyone records their transactions.

But whats to keep people from adding fraudulent transactions that benefit them?

For instance, Bob could simply add to the ledger that Alice sent him money.

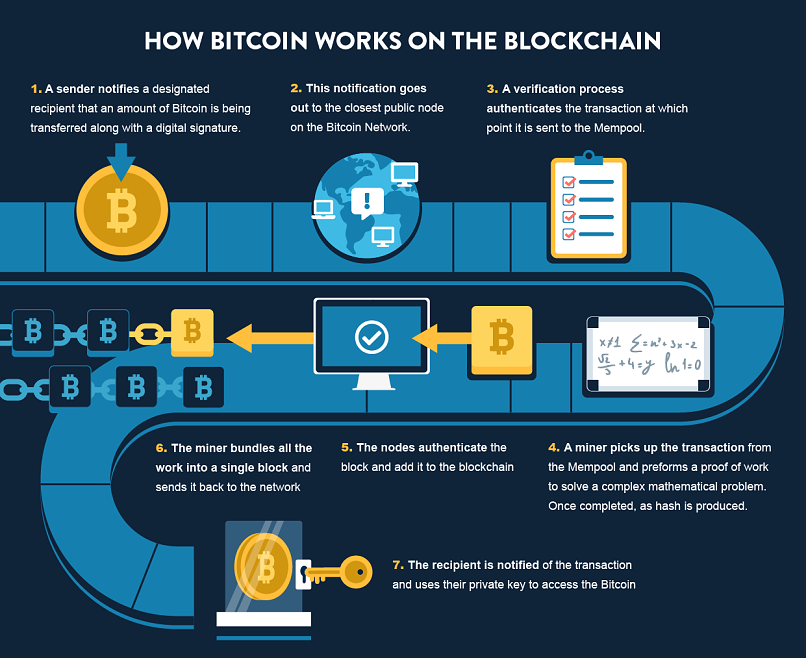

To prevent this, Bitcoin transactions are broadcast to the web link along with adigital signature.

A digital signature ensures two things:

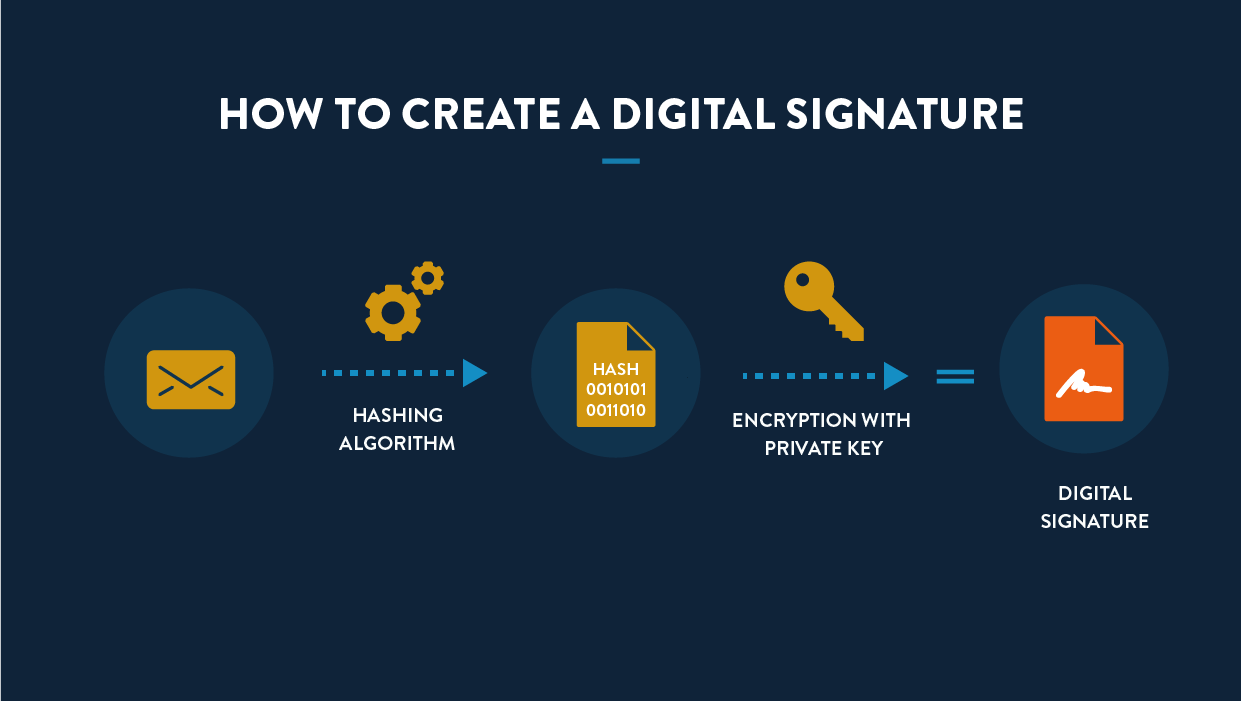

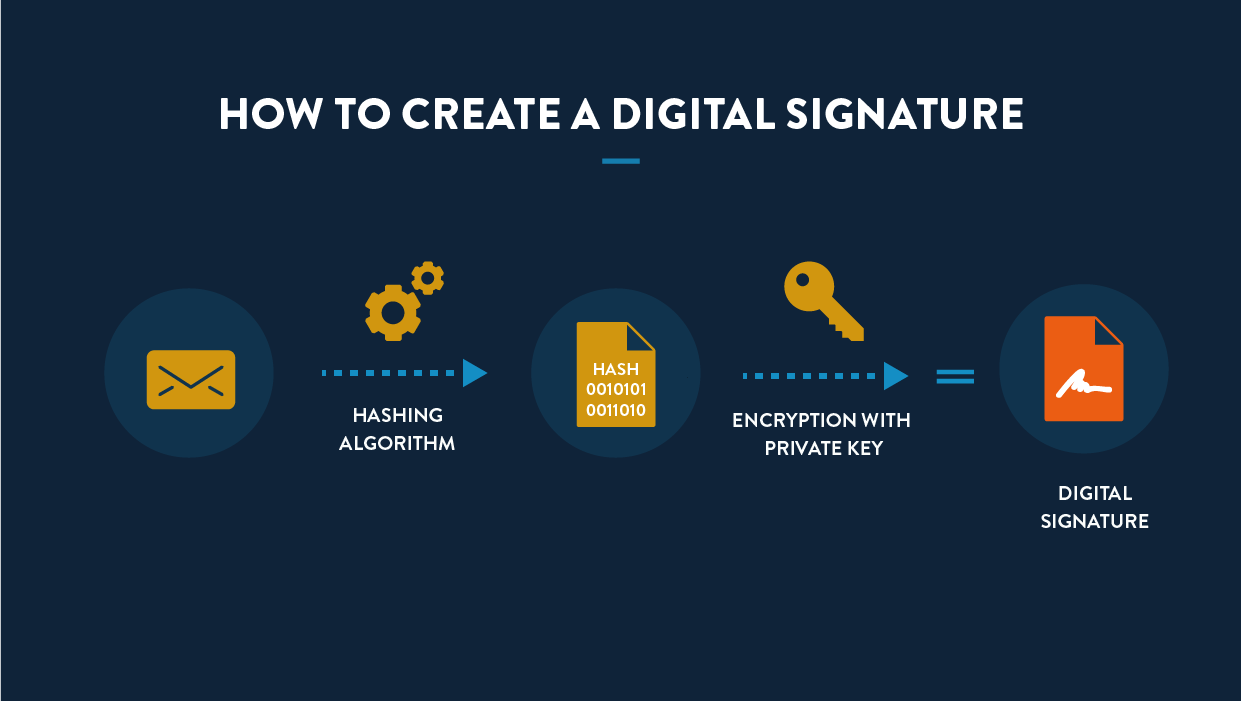

This digital signature is created using a hashing algorithm and asymmetric encryption.

One way to conceptualize this is by making a cake.

The input is flour, sugar, eggs, etc., and the output is the finished cake.

The algorithm is the oven that turns the raw ingredients into the finished product.

when you land the cake, you cant turn it back into the raw ingredients.

Its also impossible to determine exactly what the raw ingredients were and how much of each was used.

To create a digital signature,the message broadcast to the web link first needs to be hashed.

Then, the hash needs to be encrypted.

Asymmetric encryption works because each person has a public and private key that correspond with one another.

The private key belongs to one person, and no one else has access to it.

In contrast, you’ve got the option to give anyone your public key.

Say Alice wants to send Bob a private message.

Alice encrypts the message using Bobs public key that he gave her.

Bob is the only one with his private key, so hes the only one who can decrypt it.

With Bitcoin, the aim isnt to send a private message remember, the ledger is public.

Lets say Alice wants to send Bob one Bitcoin.

If they are, it proves that nobody tampered with the message.

How Bitcoin Stores Information

Another potential problem with a decentralized data pipe like Bitcoin is storage.

To understand how Bitcoin works, you oughta consider how this web connection manages and stores data.

Where can we store everyones balances and their transaction histories?

Bitcoin does this by employing a peer-to-peer distributed internet.

The data is distributed across thousands of participating computers connected via the internet, known asnodes.

These transactions are carried out according to a set of rules, known as the Bitcoin protocol.

How to Carry Out Bitcoin Transactions

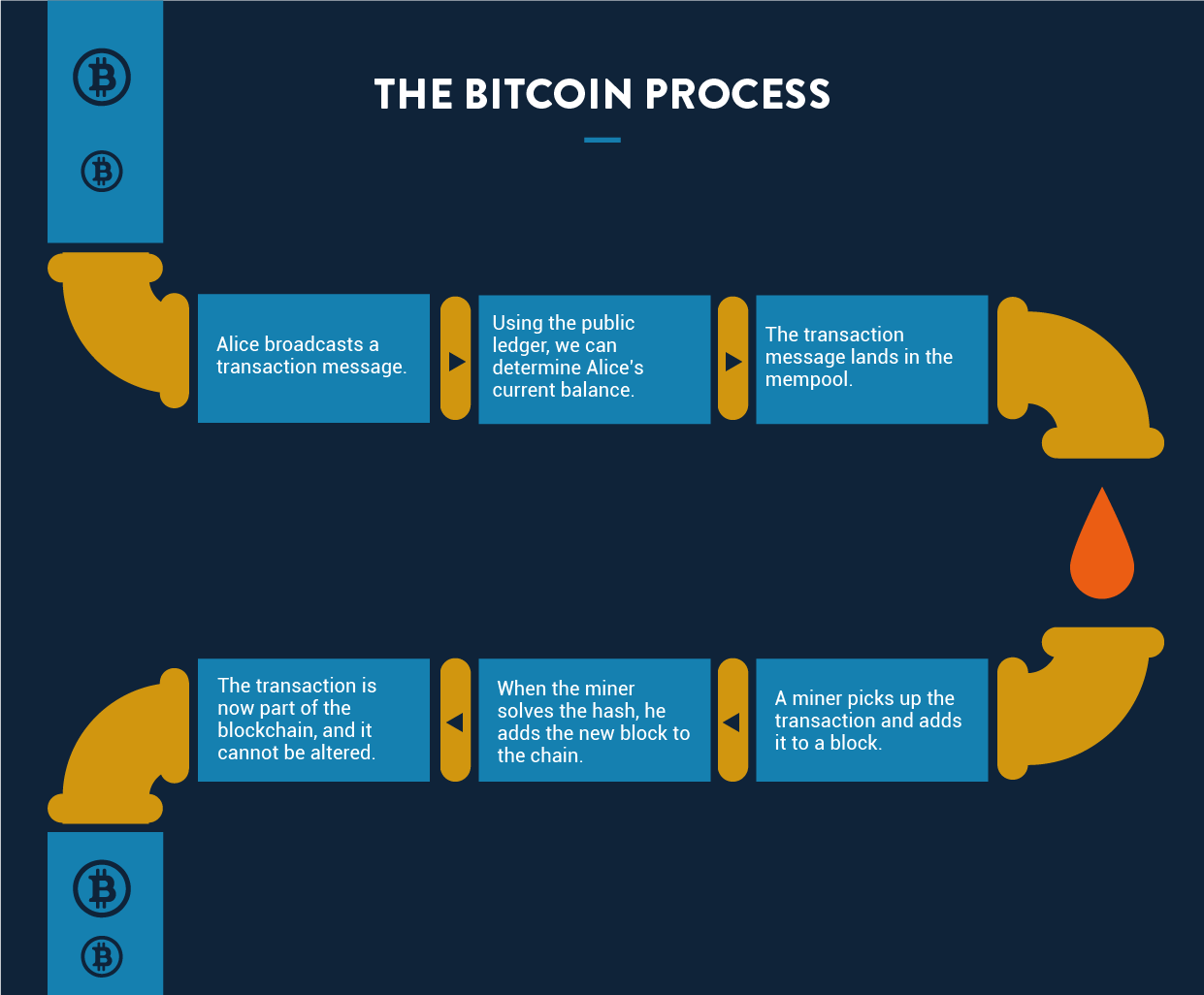

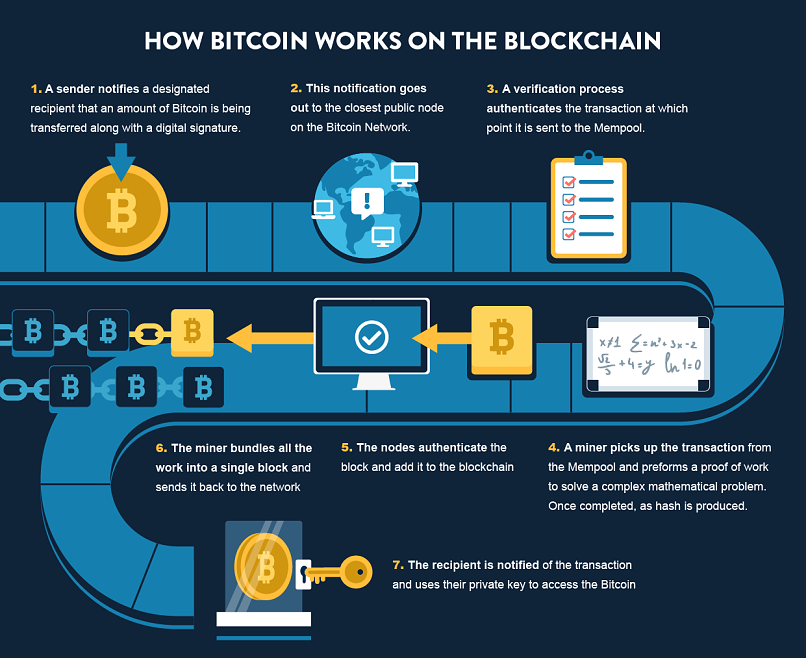

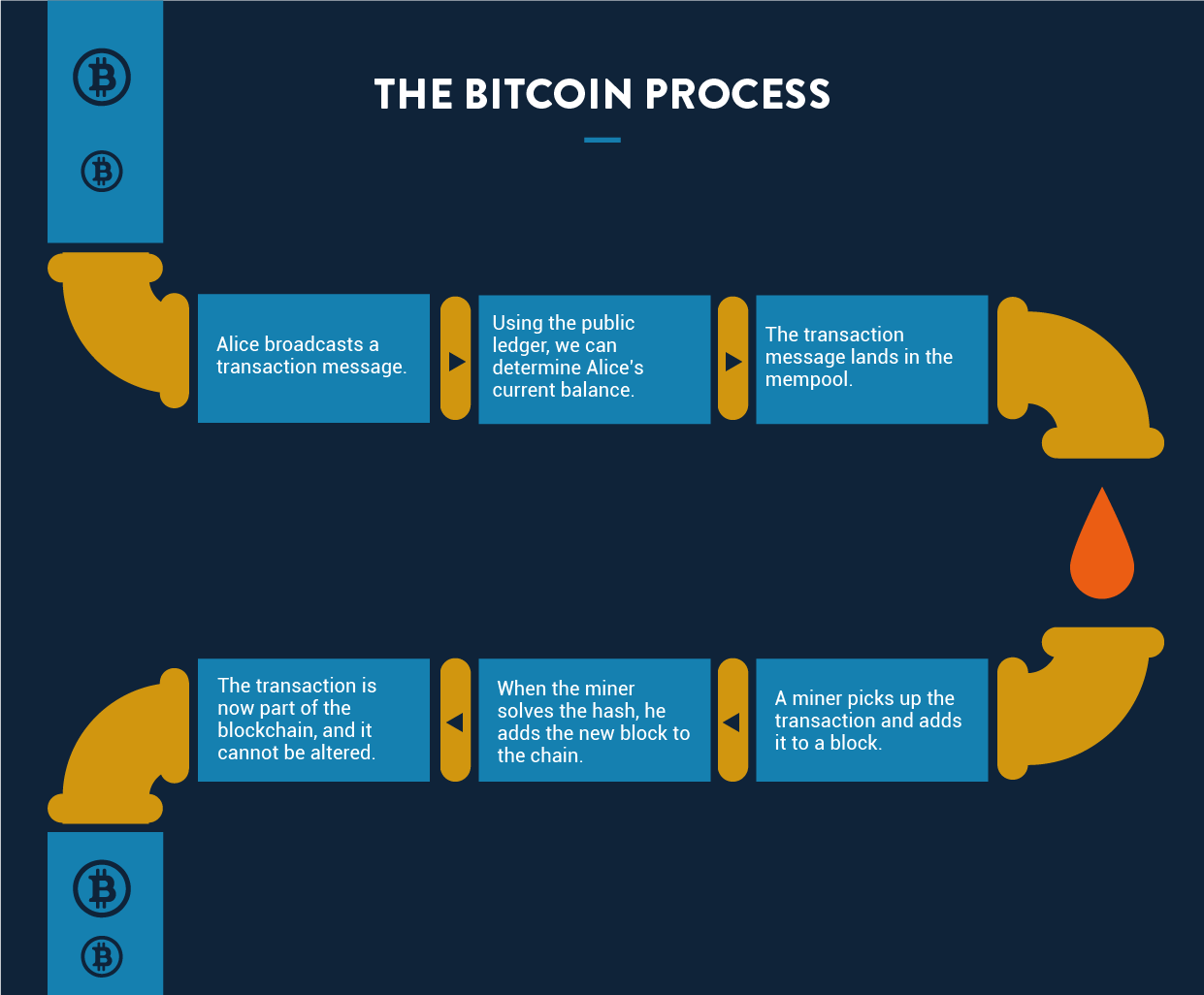

Suppose Alice wants to send one Bitcoin to Bob.

First, we need to verify that Alice owns at least one Bitcoin.

Instead,the balance is derived by calculating all previous transactions,known as the transaction chain.

once you nail the transaction chain, determining Alices current balance is easy.

From there, its picked up by miners.

Miners are basically the mediators who validate transactions (Bitcoin mining will be explained in more detail below).

Once the transaction is validated, the miner adds it to the newest block.

The current block is linked to the previous block, forming a blockchain.

But who decides which transactions should next be added to the latest block?

Typically, miners are free to pick or leave whichever transactions they wish.

To incentivize them to choose yours, you might pay them a small part of the transaction.

When the transaction becomes a part of the blockchain, it is officially executed.

But how do we know that the new transactions are legitimate?

Miners must perform aproof-of-work.

This is done using the hashing technique detailed earlier in this Bitcoin guide.

Heres how Bitcoin mining works:

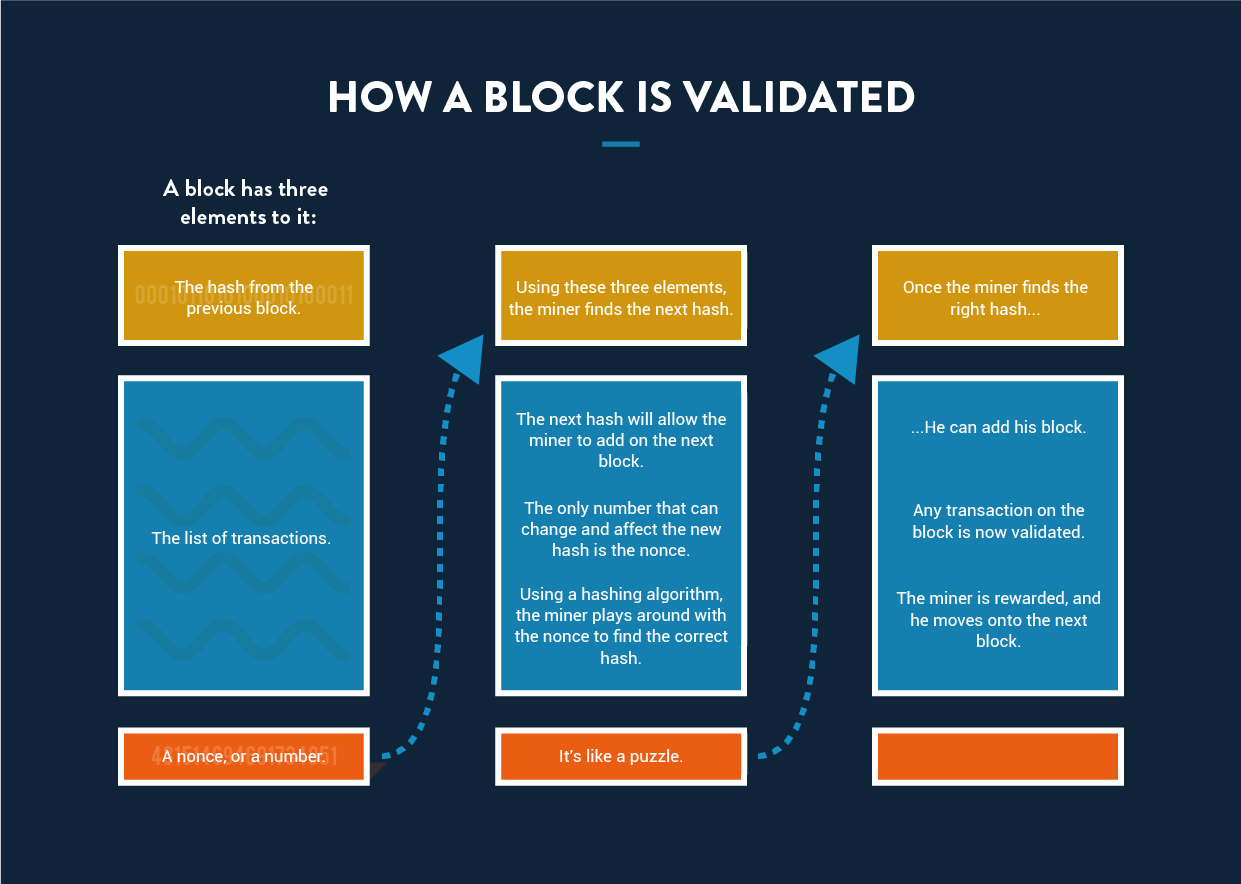

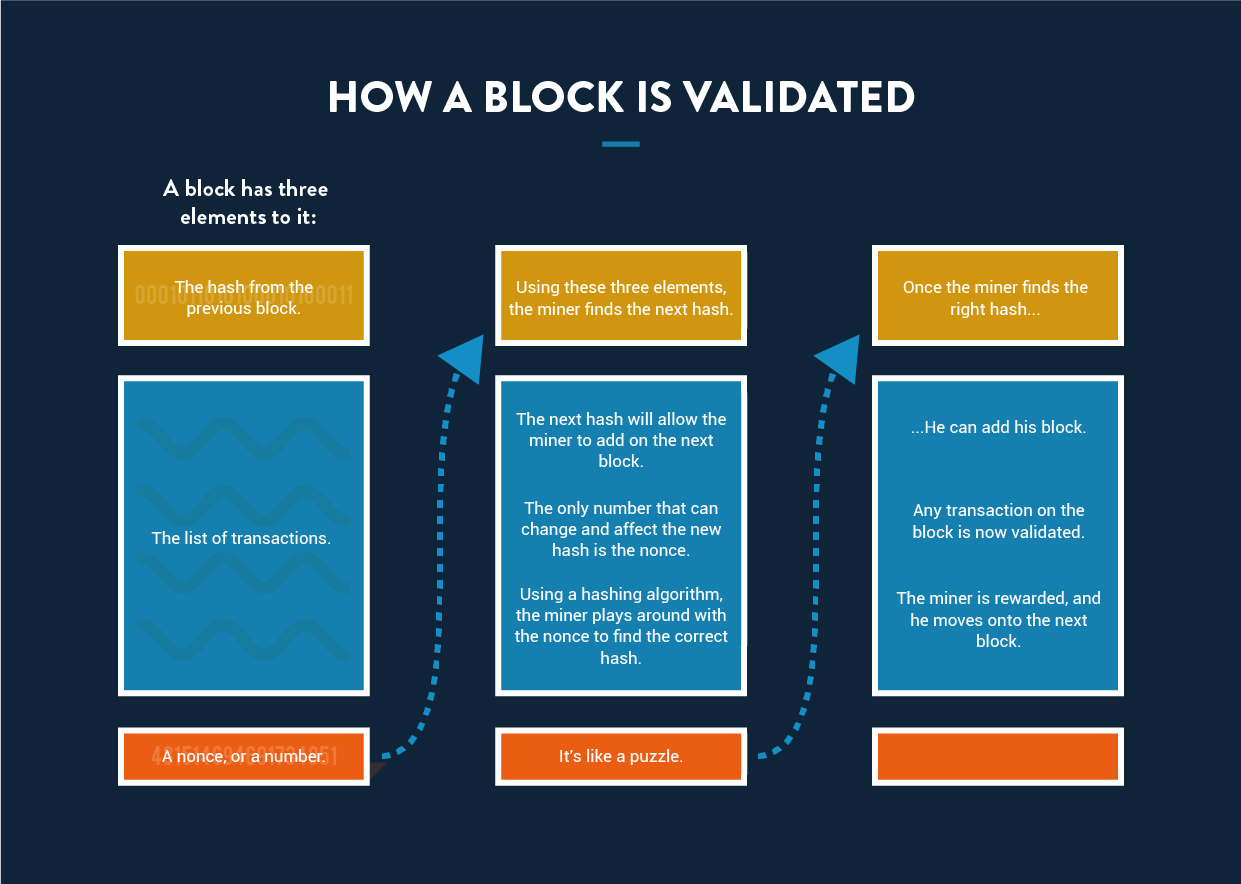

Say a miner is working on a block.

At the top of this block is the hash of the last block on the blockchain.

Beneath that are all the transactions that the miner has picked up.

Beneath that, the miner adds a number called anonce.

Then he performs a hash algorithm on the entire block.

As mentioned, his goal is to get a hash that begins with a certain number of zeros.

If you recall, if the input changes even slightly, it will result in a completely different output.

To get the correct number of zeros, the miner needs a precise number at the bottom.

So how does the miner know which number to put there?

He has no choice but torandomly guess different numbers until he gets the correct hash.

Whichever miner manages to do this first gets his block added to the blockchain.

According to the Bitcoin protocol, this whole process should take about 10 minutes.

This adjustment is a key element of how Bitcoin works and ensures that the online grid remains balanced.

It also means thateach time a new block is added, the blockchain gets more secure.

How Proof-of-Work Prevents Double Spending

Suppose Alice has an online shop that accepts Bitcoin payments.

Bob comes to her website and places an order for an iPhone.

If Bob chooses Bitcoin as the payment option, understanding how Bitcoin transactions work becomes crucial for both parties.

Alice would, of course, wait for the payment confirmation before sending the iPhone.

Once Alice sees the transaction message sending her the money, she would ship the product.

But actually, not even that is good enough.

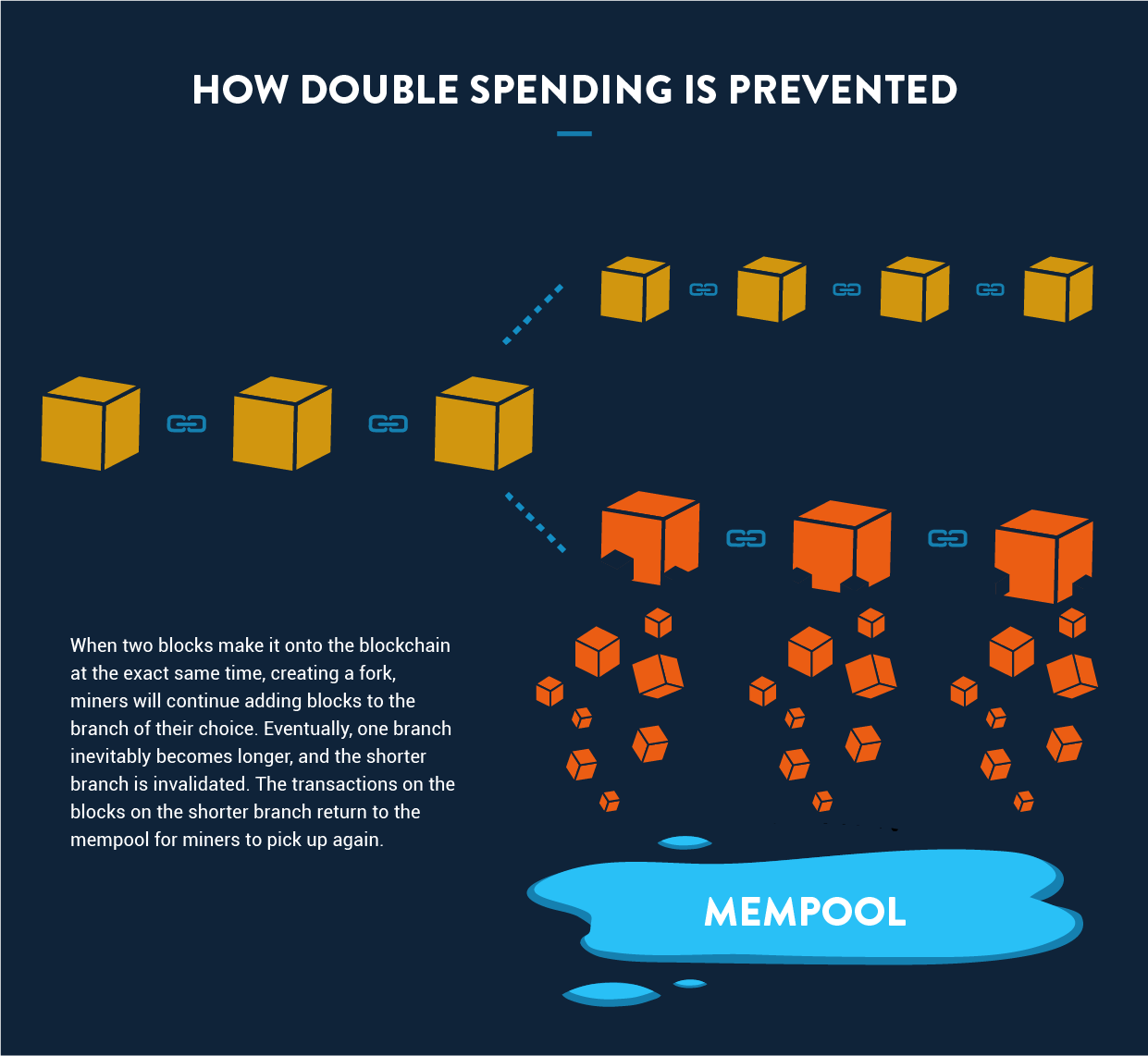

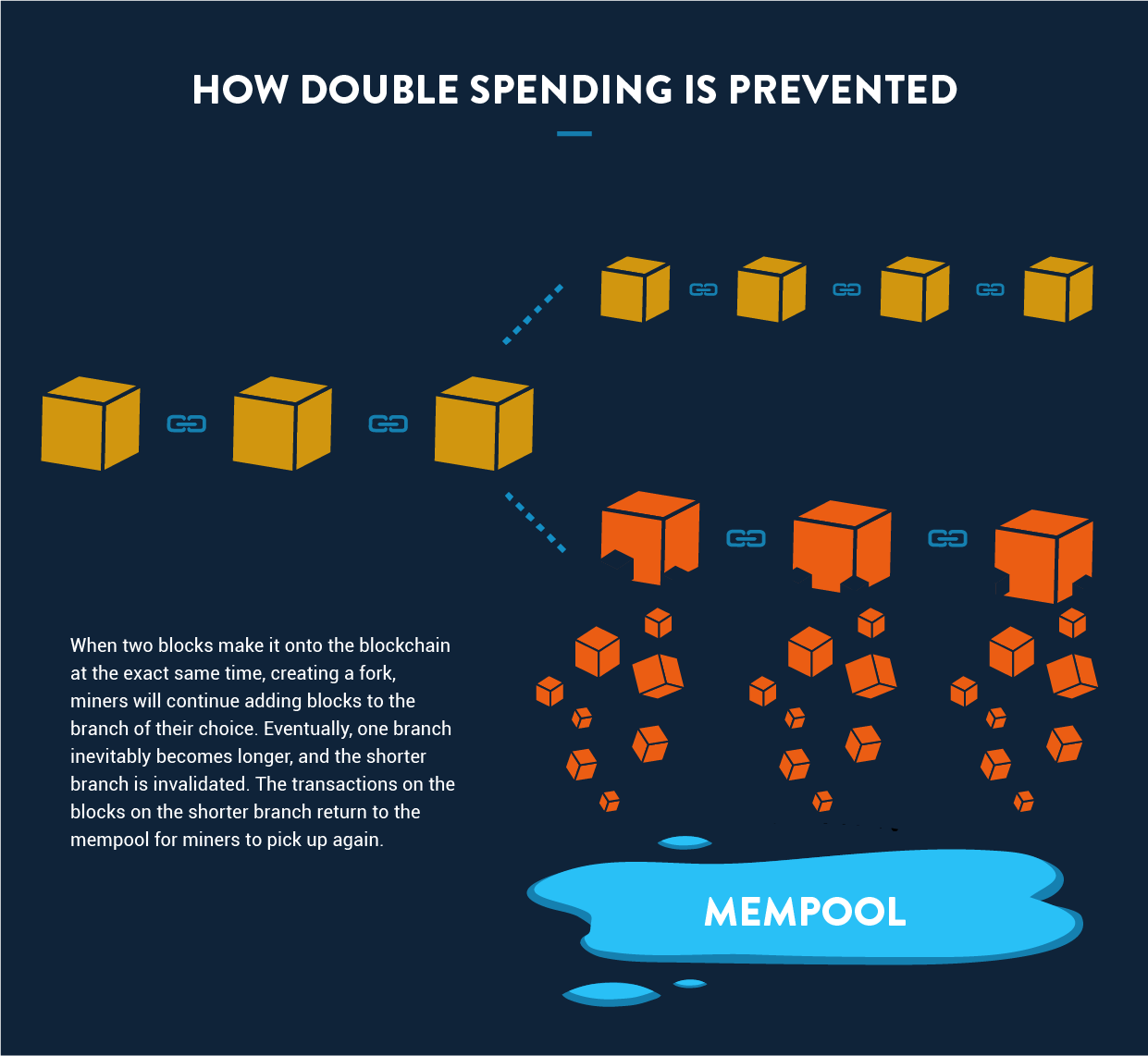

Pretty quickly, one branch will become longer than the other.

From this, we again see how proof-of-work i.e., doing more computational work secures transactions.

Bob also then added to the fraudulent branch at the same rate other miners added to the legitimate one.

Eventually, Bob could make his chain longer, sending the legitimate transaction back to the mempool.

Its an interesting hypothetical, and in theory could work.

But in reality its impossible.

This is because it takes computational power and time to solve and add a block.

Thats why this concept is sometimes referred to as a 51% attack.

He would earn more Bitcoin simply by mining according to the rules.

Lets look at the steps one by one.

This is because exchanges dont have the liquidity to facilitate such large transactions.

Although OTC trades arent regulated like exchanges, a reputable broker will ensure that no fraud occurs.

Some high-profile brokers include Interactive Brokers, eToro, and Robinhood.

Exchanges are straightforward to navigate.

Note thatmost exchanges require personal information such as your name, email, and phone number.

As mentioned earlier in this Bitcoin guide, this private key allows you to encrypt digital signatures.

You receive a private key when you are issued a Bitcoin address.

The key is a 256-bit length of data, which can also be represented alphanumerically.

So, how do you protect your private keys and your coins?

One option is tostore your coins offline.

However, if you lose that drive or if someone manages to steal it physically youre out of luck.

Another option is to store your Bitcoin with a third-party provider or client that offers a Bitcoinwallet.

This is a bang out of software that stores the addresses and key pairs for all your Bitcoin transactions.

Experts recommended you store your keys offline.

How to Use Bitcoin for Transactions

How Bitcoin works when making transactions is very simple.

For wallets installed on mobile devices, they often provide a QR code to scan with your phone.

That move was just the beginning of a long-term strategy to incorporate digital currencies into PayPals operations.

That same year, PayPal announced it would enable cryptocurrencies on Venmo, its popular peer-to-peer payment app.

Additionally, PayPalpartnered with crypto.comto provide more crypto payment options for users.

That investment represented one percent of Squares total assets through the second quarter of 2020.

Even establishment financial institutions such as Fidelity Investments are dipping their toe into the cryptocurrency pool.

In August 2020, Fidelity announced the launching of its first Bitcoin Fund.

Through PayPal, Bitcoin traders can purchase Bitcoin and store it in PayPals digital wallet.

They can do this as an investment or as an alternative means of payment for any online purchase.

This serves as an easy entry point for those learning how to use Bitcoin.

Ultimately, these efforts proved to be too little, too late.

Just months before the credit card boycott, Pornhub announced that Bitcoin and Litecoin would be accepted as payment.

The fallout from the NY Times article bodes well for Bitcoins future value.

Its unlikely Pornhubs 76 million active paid members are going to go away.

More likely, they will use Bitcoin (as the best-known cryptocurrency) as a payment method.

There are several examples of the porn industry driving innovation in technology.

In the late 1970s, Betamax and VHS were fighting for videocassette supremacy.

Betamax had the superior quality but VHS cassettes were better for producing and distributing feature-length videos.

The porn industry was largely responsible for the boom of online payment technology around the turn of the millennium.

In 1999, online users spent more than USD 1.3 billion on porn sites.

This worked out to more than people were spending on books and airfare.

There are basically two ways: mining and investing.

Bitcoin Mining Explained

Mining is a slow but safe method of earning money from Bitcoin and other cryptocurrencies.

This will depend on the country youre in and the cost of electricity.

AnASIC(program Specific Integrated Circuit) is the general term used for such a gadget.

With the combination of an ASIC and cheap electricity, you could find the mining business profitable.

In a mining pool, members are paid in proportion to the amount of CPU power they contribute.

Generally, pools are created as soon as a currency starts gaining traction.

How to Invest in Bitcoin

Direct investment is a quick but risky way to make money from cryptocurrencies.

At that time potential investors assess the project and decide whether to invest in it.

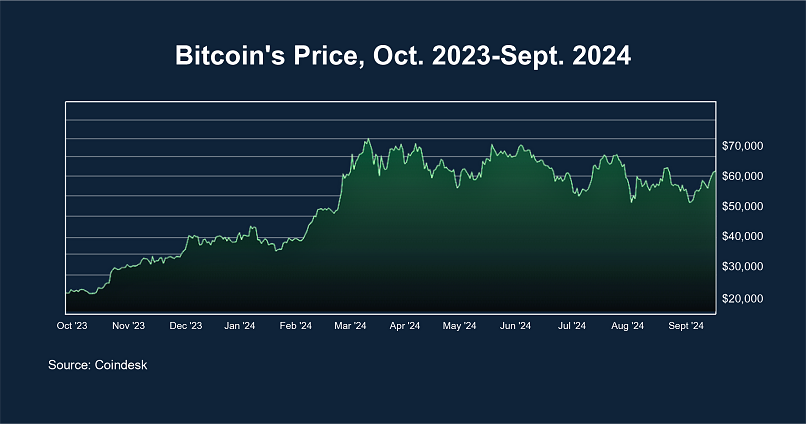

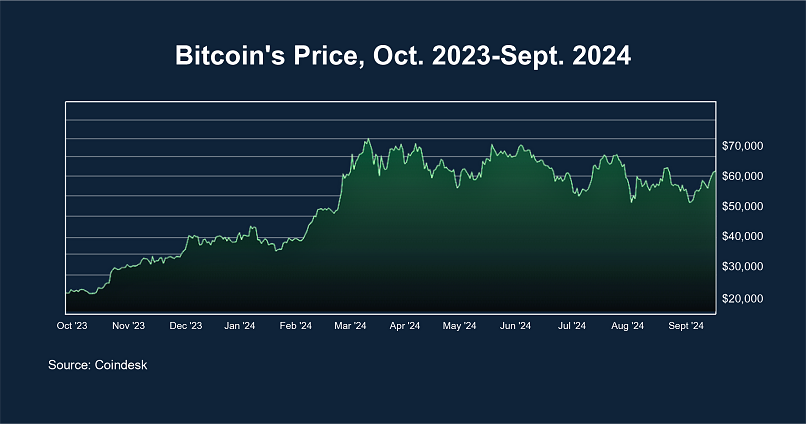

For example, between October 2023 and September 2024, Bitcoins value has risen and fallen unpredictably.

Cryptocurrencies in general are highly volatile, and past performance is no guarantee of future success.

Thats why potential investors need to understand the process of how Bitcoin works before they begin investing.

Our advice is to not invest more than you’ve got the option to afford to lose.

DO NOT shell out all or even a major chunk of your hard earned money hoping for great returns.

it’s possible for you to see the latest Bitcoin exchange rates on ourBitcoin calculator.

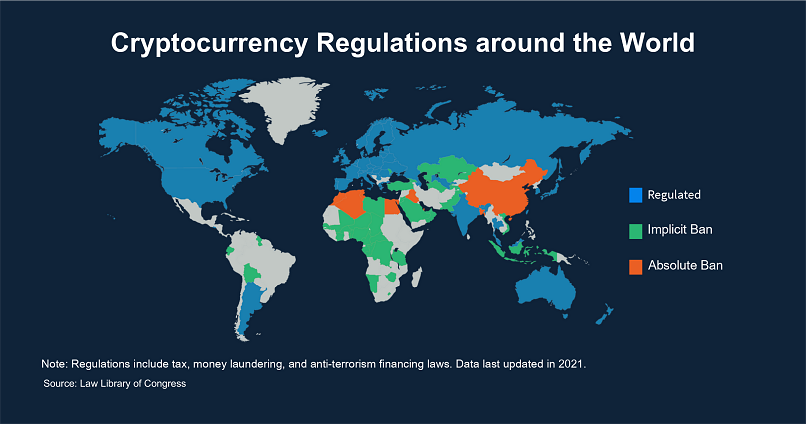

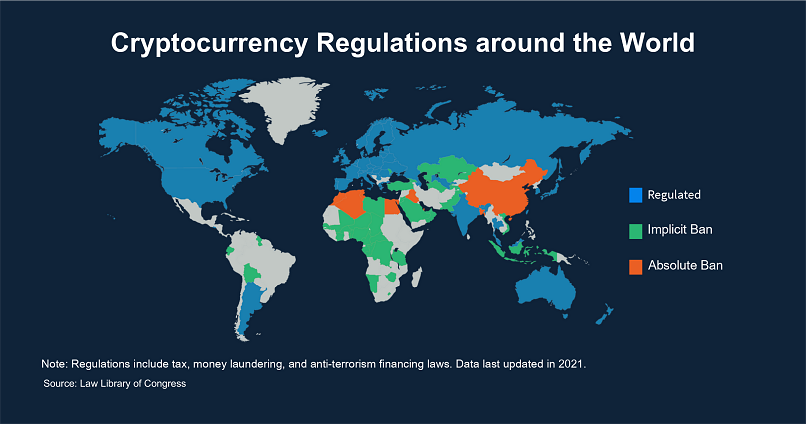

Unlike counterfeit fiat currency, which is illegal,in most countries Bitcoin itself is legal.

Holding Bitcoin in Algeria, Columbia, Nepal, Bangladesh, and several other countries is illegal.

Regarding taxes, the rules are similar to any other asset.

This often leads to questions about how the Bitcoin process works and how it is regulated.

Some criminal elements look to take advantage of all the excitement and media hype surrounding Bitcoin.

For instance, there are cyber criminals who launch Ponzi schemes promising astronomical returns on investments.

Onecoin turned out to be a Ponzi scheme designed by its founders,Ruja Ignatova, and Sebastian Greenwood.

Onecoin appeared to be completely legitimate with all the protocols and safeguards investors would expect.

Coins were obtained through mining with Onecoin acting as a central online grid.

The coins could later be exchanged for Euros through OneCoin Exchange xcoinx.

It also laid claim to being the first cryptocurrency with a monthly audit of its blockchain.

But people have found a number of ways to use the technology.

Cryptocurrencies

One way people have used blockchain is to create variations on Bitcoin.

These often advertise themselves as better or enhanced versions of Bitcoin, and are collectively known as altcoins.

This resulted in its market cap climbing 380% in just 24 hours to $6.9 billion.

What was behind this incredible surge?

Dogecoin was caught in the wake of the most famous stock pump and dump scheme in recent memory.

The shockwaves reverberated through the financial and political circles.

Wall Street establishment called for immediate action, resulting in a lock on Gamestop trading.

Looking for another target for a similar move, WSB turned to Dogecoin.

Unfortunately for Dogecoin, the new heights were short-lived.

Within days the stock fell approximately 72% to $0.022.

The stock would rebound once again in early February thanks to a single tweet by Elon Musk.

There are many other novel ideas based on the construct that are worth billions of dollars.

However, that doesnt mean we should abandon it altogether.

Did you find this beginners guide to Bitcoin helpful?

If so, share it with your friends and colleagues onFacebookandTwitter.

kindly, comment on how to improve this article.