Many cryptocurrencies fluctuate between inflationary and deflationary over time.

And in December 2022, Ethereum once again became a deflationary cryptocurrency.

What Is a Deflationary Crypto?

If an asset’s supply number gets too out of hand, its purchasing power will drastically reduce.

In the crypto realm, the terms “inflationary” and “deflationary” relate to supply and demand.

As you may know, different cryptocurrencies have different supply caps.

Bitcoin, for example, has a maximum supply of 21 million BTC.

This means that, at most, there will only ever be 21 million BTC in circulation.

BNB Coin, on the other hand, has a maximum supply of 200,000,000 BNB.

The creators of the crypto are able to choose the supply limit themselves.

Many cryptos have an infinite supply, including Tether, Dogecoin, Solana, and Ethereum.

A cryptocurrency can be deflationary whether it has a capped or infinite supply.

As is standard in the crypto market, Ethereum’s price depends on its supply and demand.

If the demand exceeds the supply, the price tends to go up.

If the supply exceeds the demand, the price tends to go down.

So, what caused this change?

Why Is Ethereum Now Deflationary?

Ethereum is now being described as deflationary because its issuance is deflationary.

When a cryptocurrency is burned, a holding of assets is sent to an inaccessible wallet address.

In other words, funds can be deposited into the wallet but never withdrawn.

At this point, the crypto within the wallet becomes completely useless and is considered burned or destroyed.

Ethereum has been burning coins via the EIP-1559 token standard.

EIP-1559 came into play in mid-2021 via theLondon upgradeand involved a change to the fee process.

Since the introduction of EIP-1559, billions of dollars worth of Ether have been burned.

This has undoubtedly played a role in the changing relationship between the blockchain’s circulation and burn rates.

In fact, EIP-1559 was designed to achieve this very goal.

The data pipe’s transition to a proof of stake consensus mechanism also played a role in this change.

Users can earn a yield via this mechanism, which makes Ethereum a more desirable asset.

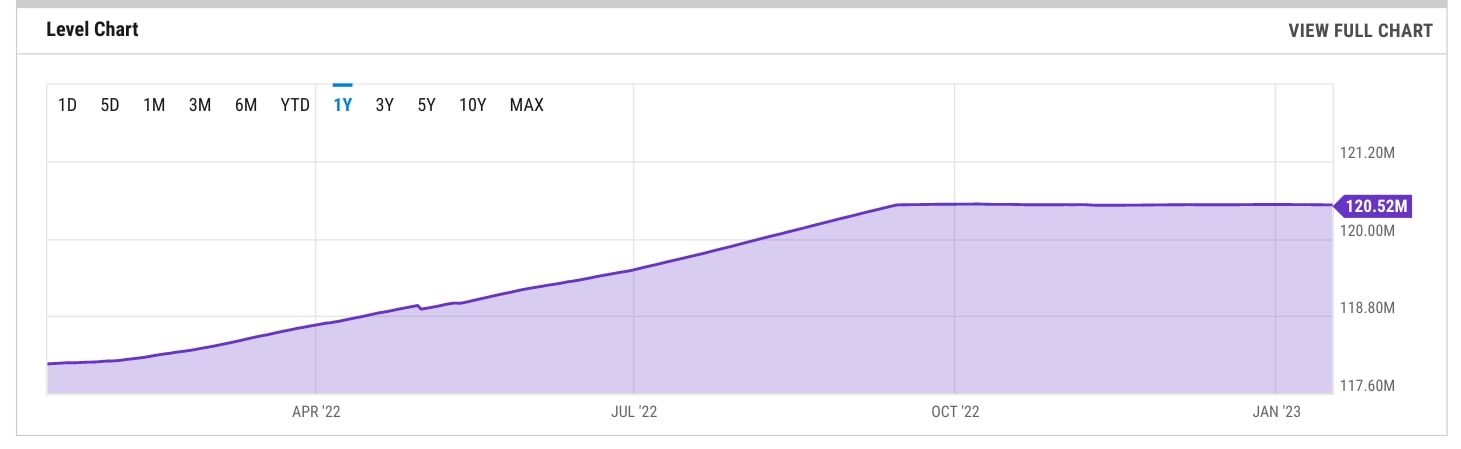

The chart above shows an evident shift in Ethereum’s supply trend.

On January 4, 2023, the circulating supply of Ethereum was 120.53 million.

The next day, the circulating supply had fallen to 120.52 million (as reported onYCharts).

This decrease is representative of Ethereum’s current deflationary nature.

Is Ethereum’s Deflationary Status Good News?

So, Ethereum is now deflationary, but what does this mean for investors?

Within this two-week window, the price of one ETH increased by an impressive 25 percent.