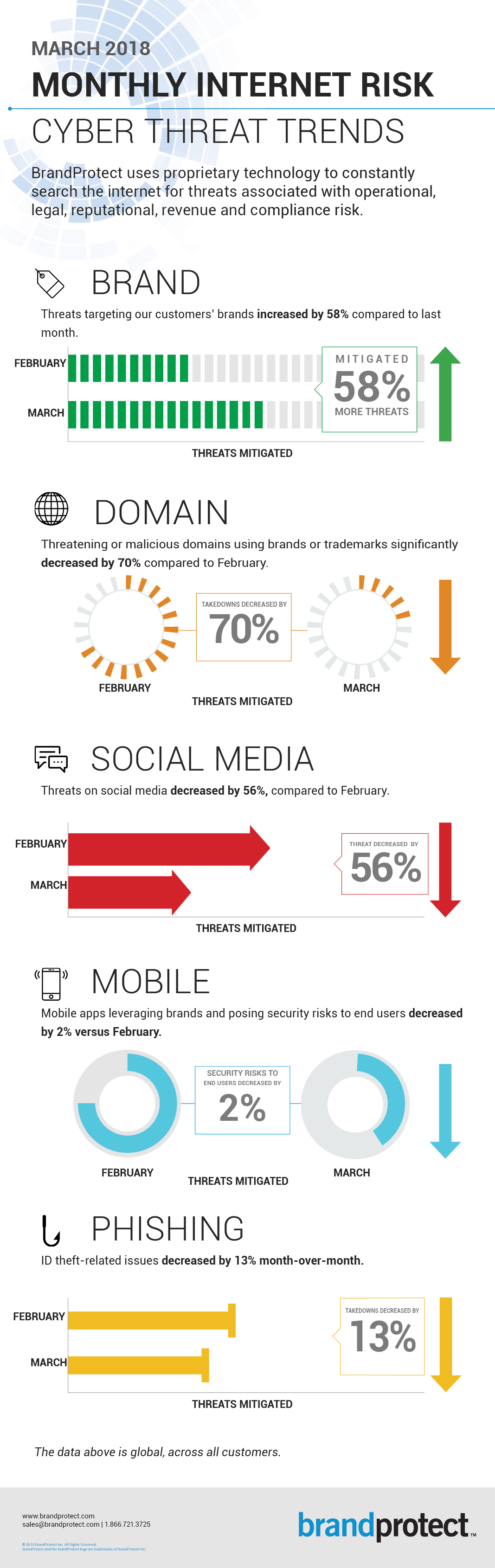

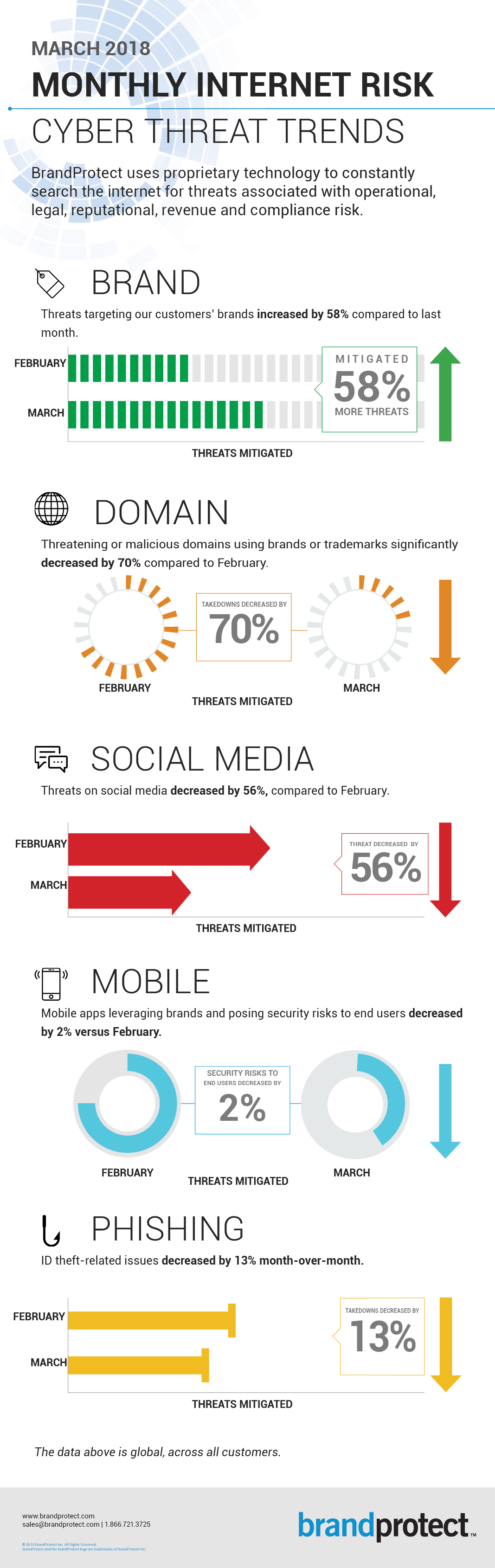

It categorizes the ever-growing number of online threats which circumvent our firewalls.

Thats where BrandProtects proprietary threat assessment software and trained professionals come in.

I worked my way up and have been a director for 5 or 6 years now.

What are the biggest security risks to companies today?

The primary risk to corporations is ransomware.

Considering the price that is demanded to unlock these systems, this can be a very costly proposition.

We also see a lot of what we call BEC or Business Email Compromise attacks.

With this information, they can ascertain a quasi-reporting structure within that company.

What is an External Threat?

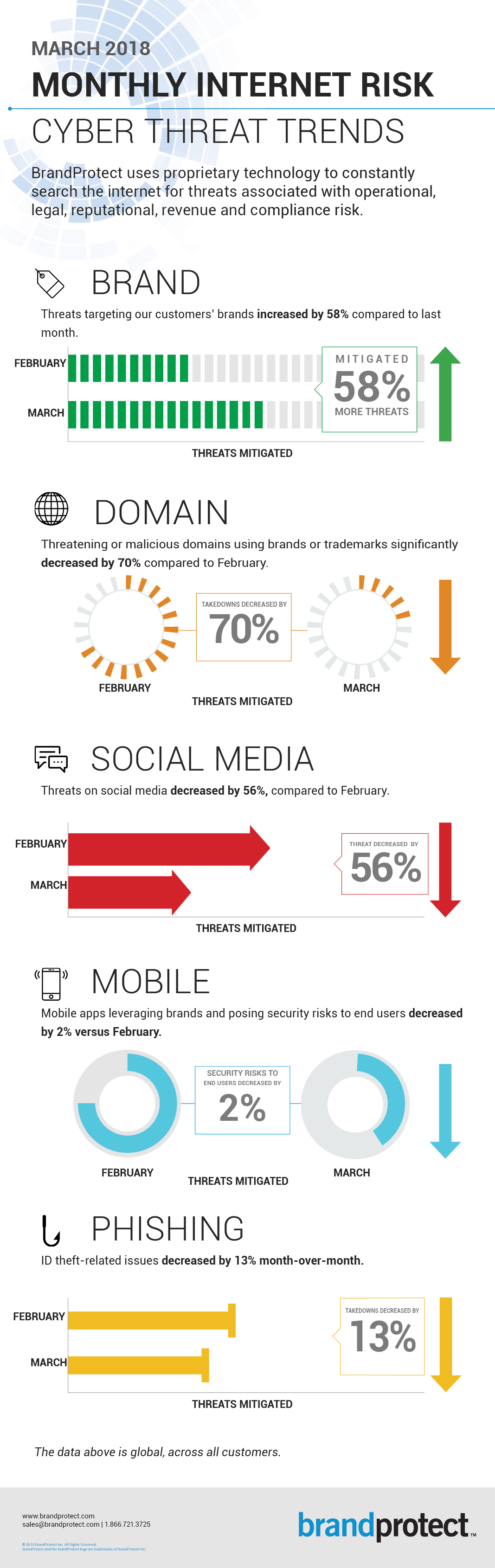

We originally started handling external threats in the form of phishing attacks that were targeting our clients customers.

We then expanded even further and handle threats to our clients branding on social media and customer review sites.

On social media we deal with risks including threats targeted towards executives.

Additionally, weve discovered fraudulent posts by people trying to recruit money mules.

We also monitor for brandjacking which includes unauthorized use of our clients branding.

We typically see a third-party organization create an online store that is a duplicate of our customers official website.

How does BrandProtect monitor social media sites?

Based on the client’s requirements, we incorporate these industry-specific terms into social media searches.

This practice enhances detection accuracy and significantly reduces the number of false positives.

Our account managers then perform a second level validation.

Once that is completed, the information is turned over to the customer for review and action where necessary.

Our unique and thorough process ensures that our clients see only the incidents that matter to their business.

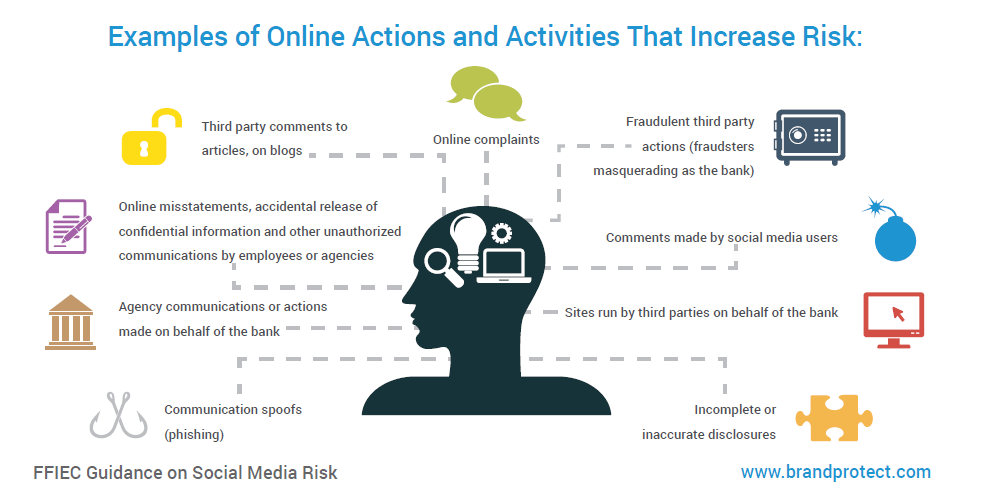

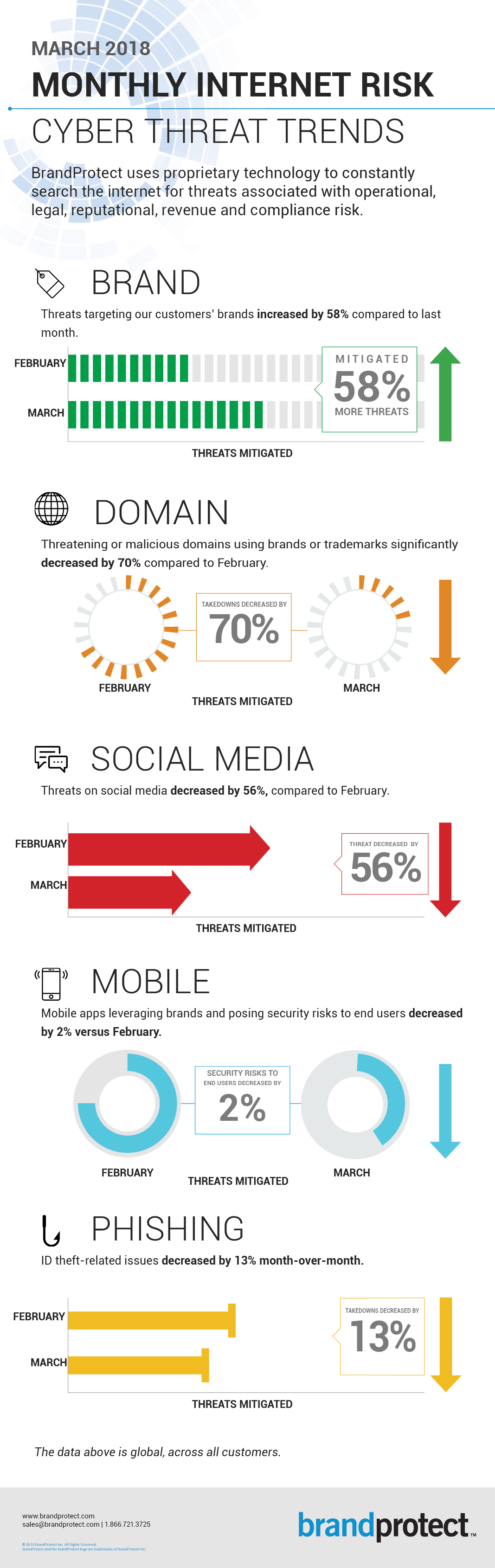

What is the FFIEC (Federal Financial Institutions Examination Council) Guidance on Social Media Risk?

Content created and shared on social media can have a damaging effect on financial institutions and their customers.

is obviously very dangerous.

Additionally, there are risks of document and data leakage.

We have seen employees posting customer information or advertising customer data for sale.

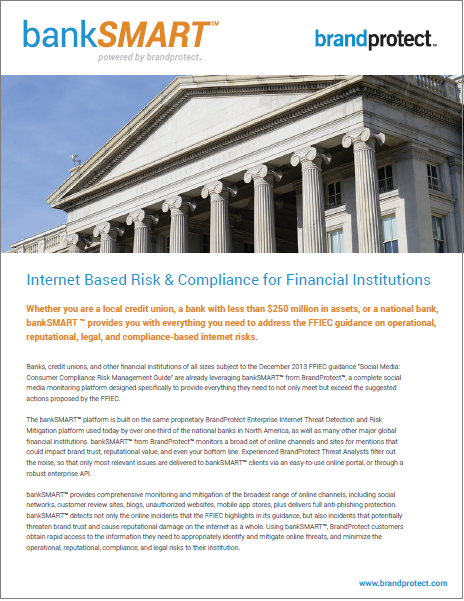

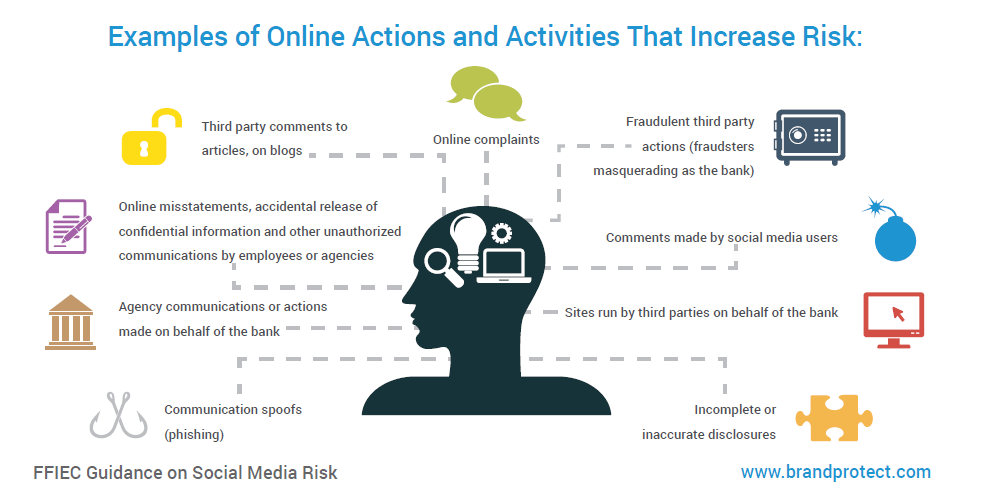

How does bankSMARTTM address the unique needs of financial institutions?

It supplies financial institutions with a comprehensive solution, including any takedowns of content that we find.

Unflattering or critical posts do not come under the possible takedown process.

Someone is certainly entitled to say, I dont like this bank because they wouldnt give me a loan.

We have contacts at hundreds of social media platforms around the world.

yo, comment on how to improve this article.