Quick Links

Summary

PayPal makes online payment easy; there’s little doubt about that.

So, what causes these limitations, and how do you avoid them?

What Causes PayPal Account Limitations?

(Unfortunately, they are still higher for business accounts and those that make numerous transactions in general).

However, there are several measures you might take to avoid a PayPal account limitation.

Most folks have used PayPal for years and never encountered an account limitation or evenother PayPal issues.

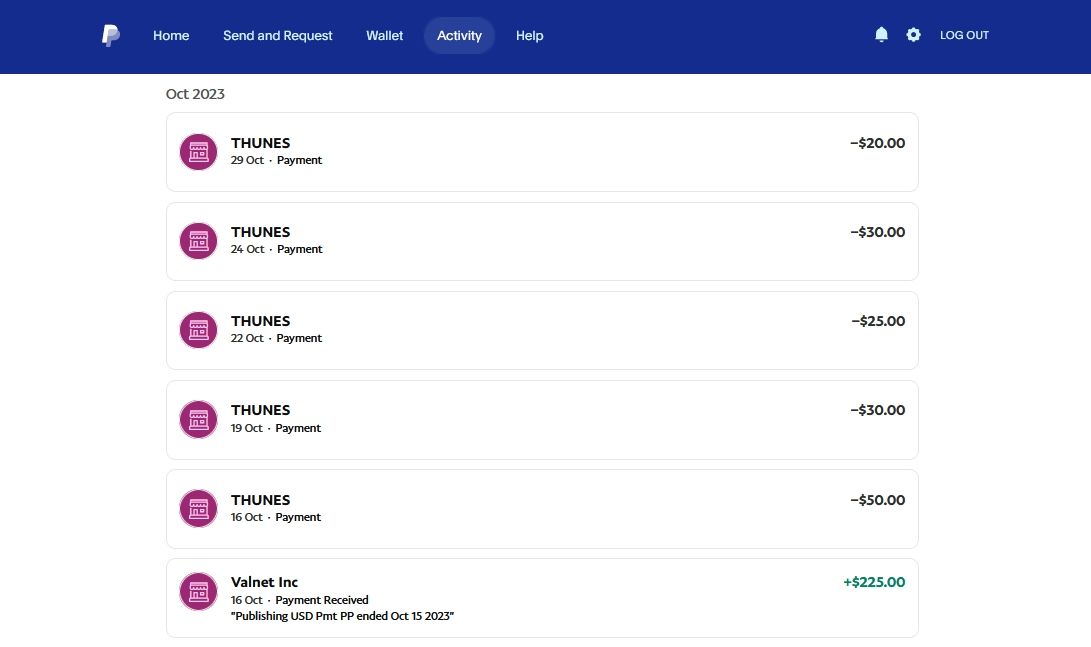

However, PayPal may also perceive the withdrawal of large sums as suspicious.

Instead, consider a steady and consistent withdrawal pattern.

That way, it doesn’t seem like there’s any mischief going on.

Avoid Making Unusual Transactions

PayPal monitors transactions and can automatically identify patterns that deviate from normal.

venture to maintain a consistent transaction pattern to prevent your PayPal account from getting flagged.

Otherwise, you’re free to usePayPal as an alternative Payoneerto process your payments.

Unfortunately, customer malice is out of your control.

You don’t want to deal with disputes from dissatisfied customers, and neither does PayPal.

But as most people use PayPal for its intended purpose, keeping your real customers sweet is a no-brainer.

Also, only deal with people you’re free to trust to avoid losing money toPayPal scams.

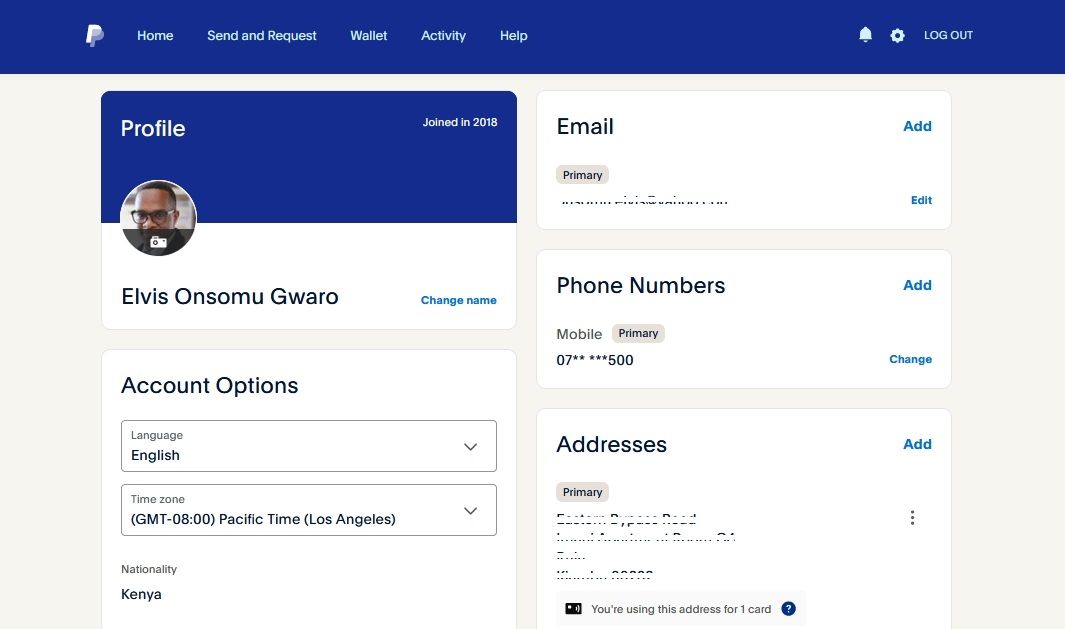

If you have to change a few details later, only do it occasionally.

This way, you’ll not fall under the radar of PayPal’s security.

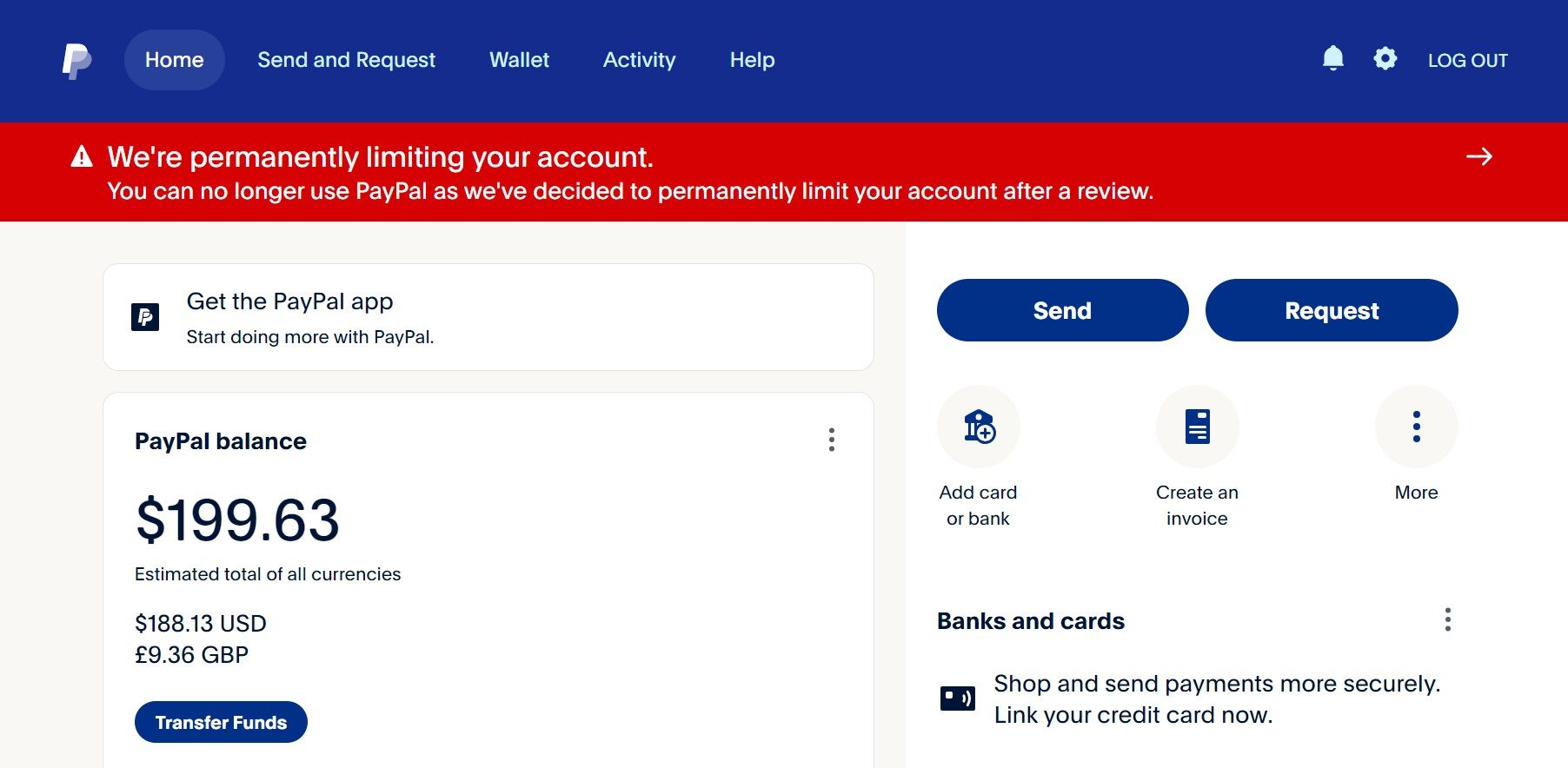

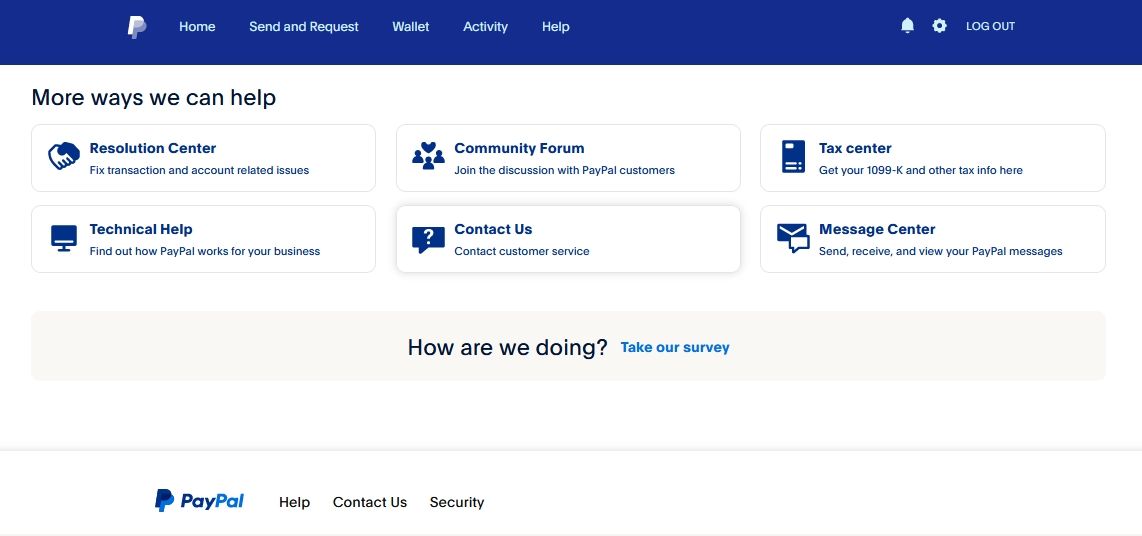

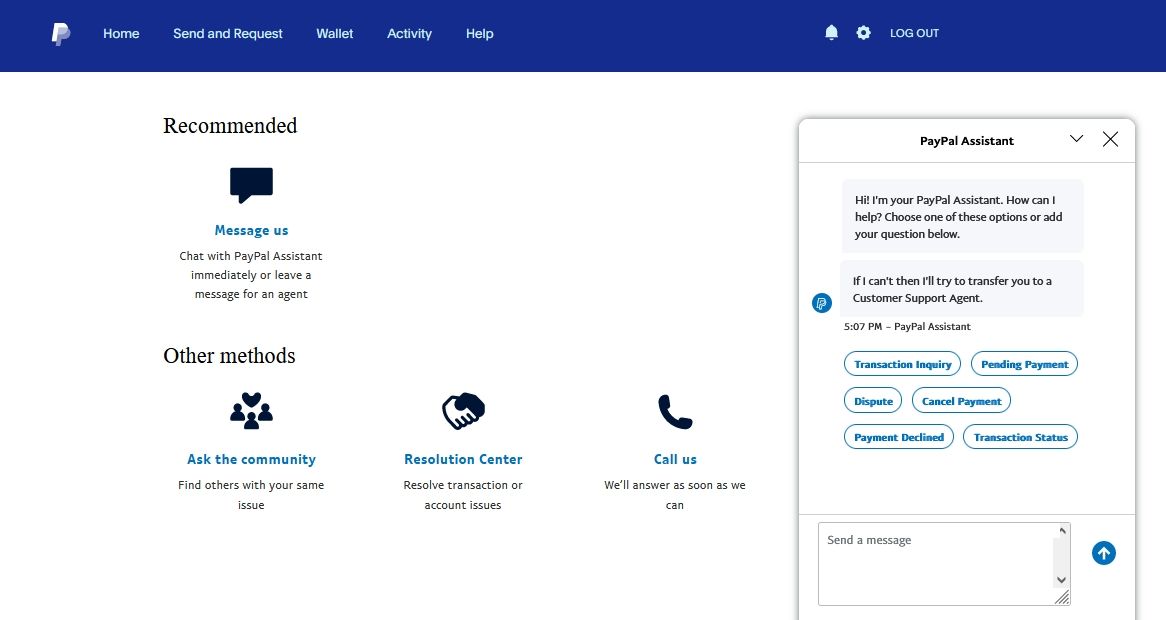

If it happens, you must inquire about the limitations with a PayPal customer care agent.

PayPal account limitation issues often take some time to resolve, so be patient as they get onto it.

For best practice, provide enough information to quicken the resolution process, especially when requested.

There’s no guarantee your PayPal account will face a limitation strike.

Doing so gives you a fallback plan to continue transacting online as PayPal fixes an account limitation.