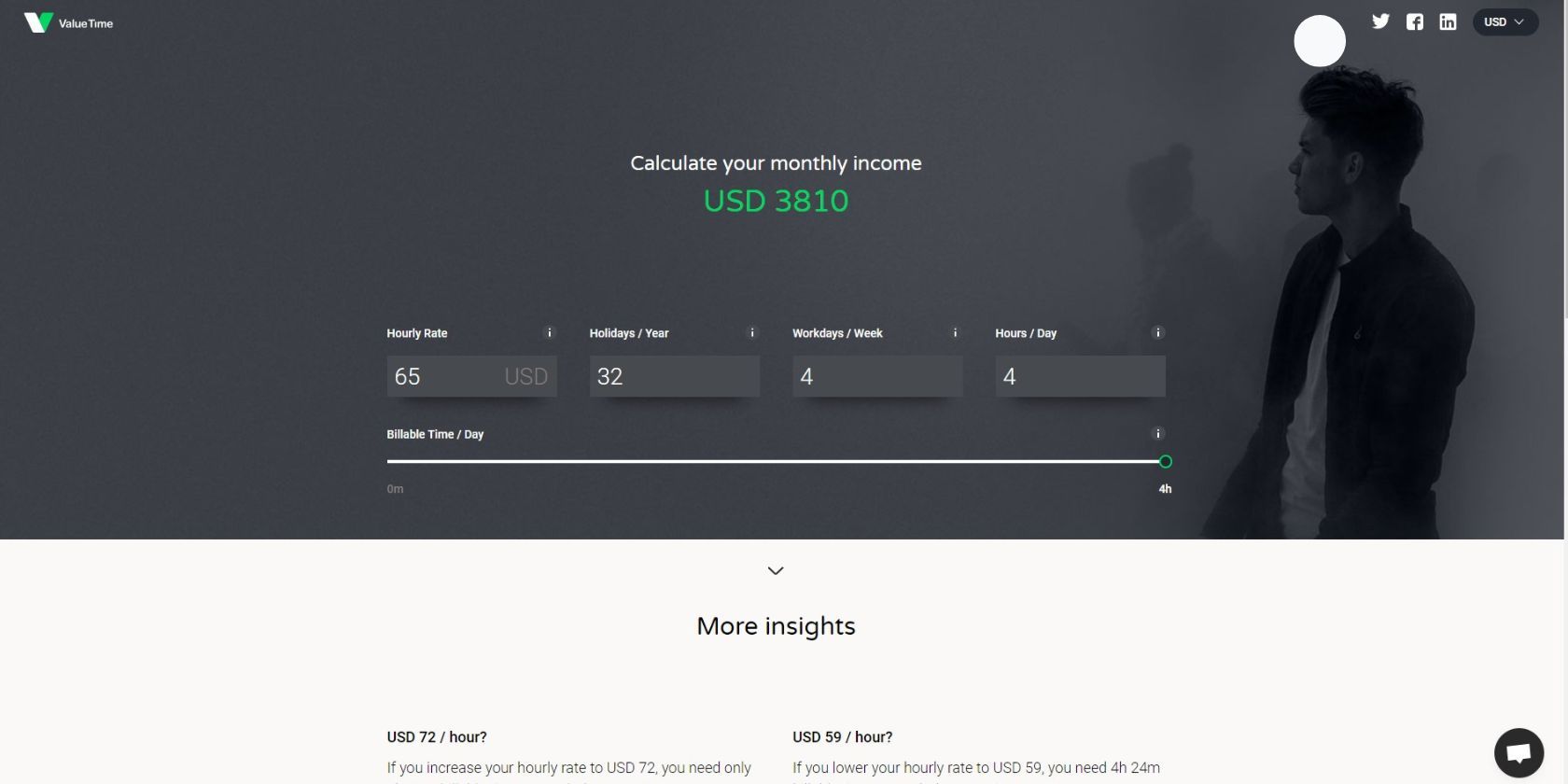

How much are you earning as a freelancer?

To compute your monthly income, choose the correct currency in the dropdown menu in the upper-right-hand corner.

you might try somefree time-tracking apps to maximize your deep work.

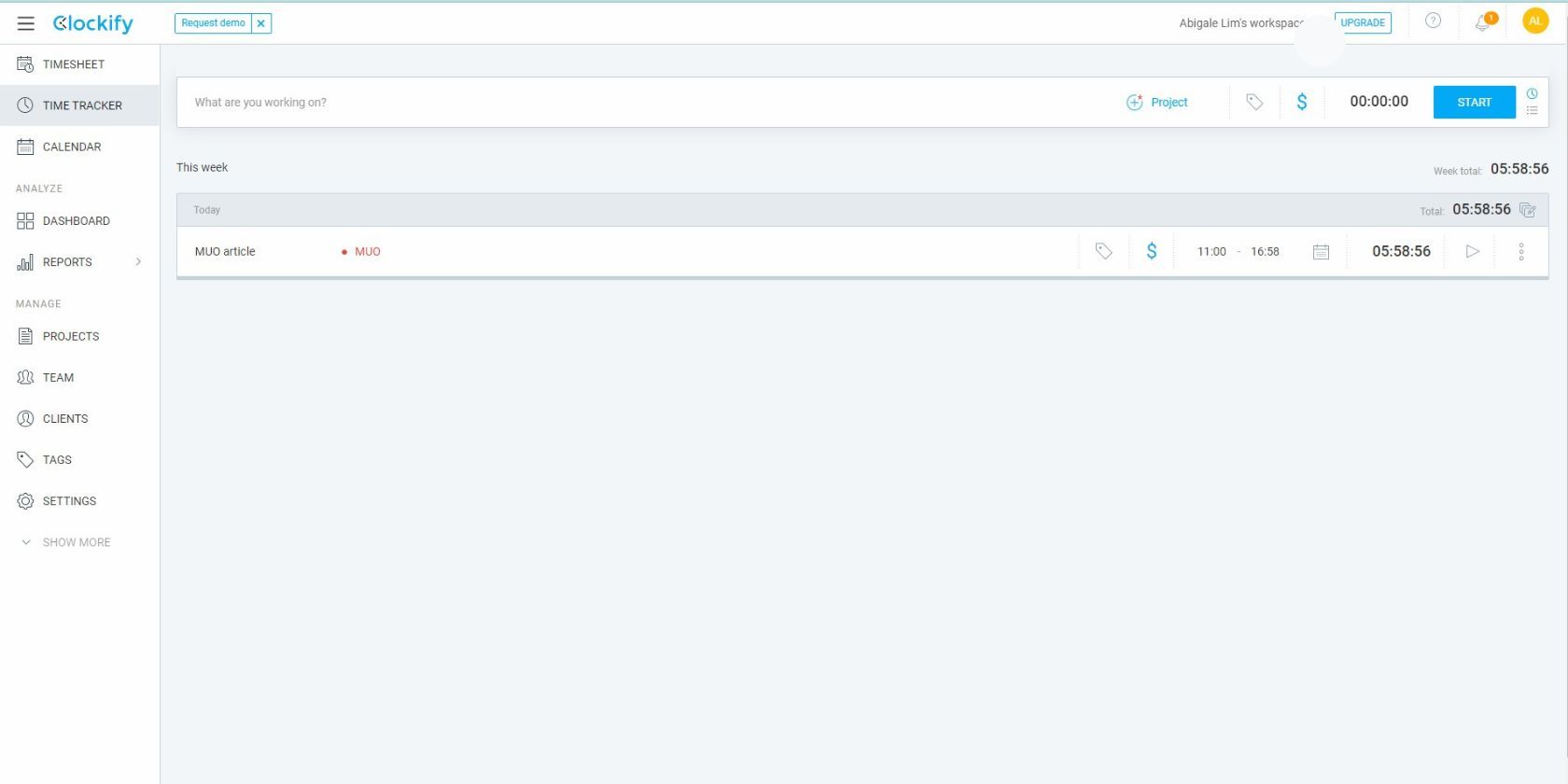

2.Clockify Time and Expense Tracking App

Clockify is one of the most popular time-tracking apps for freelancers.

Use this tool to know your income per hour and learn if your project is profitable.

For instance, a client might give you $300 for a one-time project.

If it takes 30 hours to complete it, you only earn $10 per hour.

Before you even pay the bills, you’ll know if you’re earning enough.

Use this data to decide on and negotiate your rates on freelancing platforms.

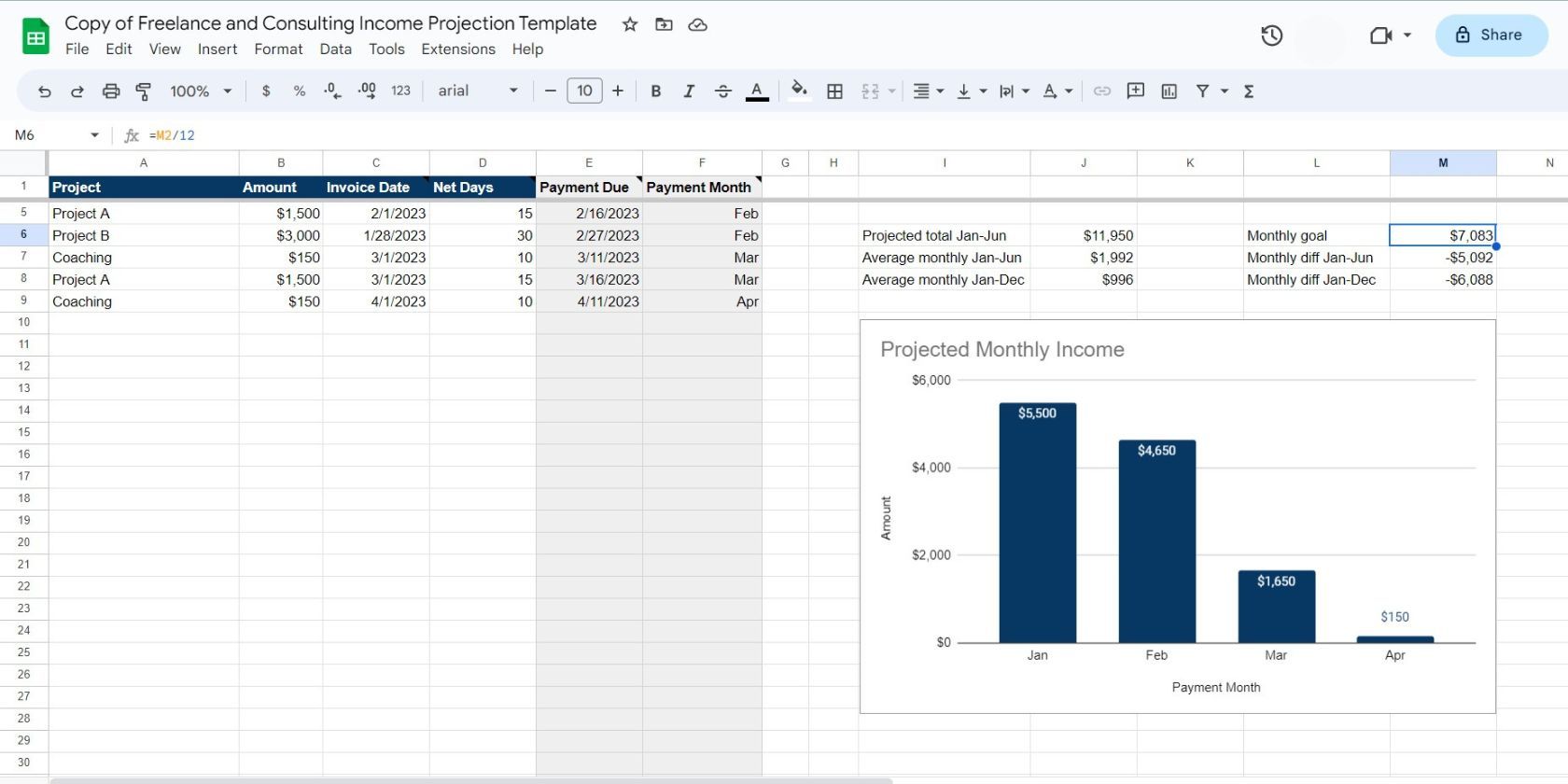

The template also includes a bar graph of your projected monthly income.

As Christy says, a freelancer’s income can fluctuate every month.

Using this template helps you assess your financial situation.

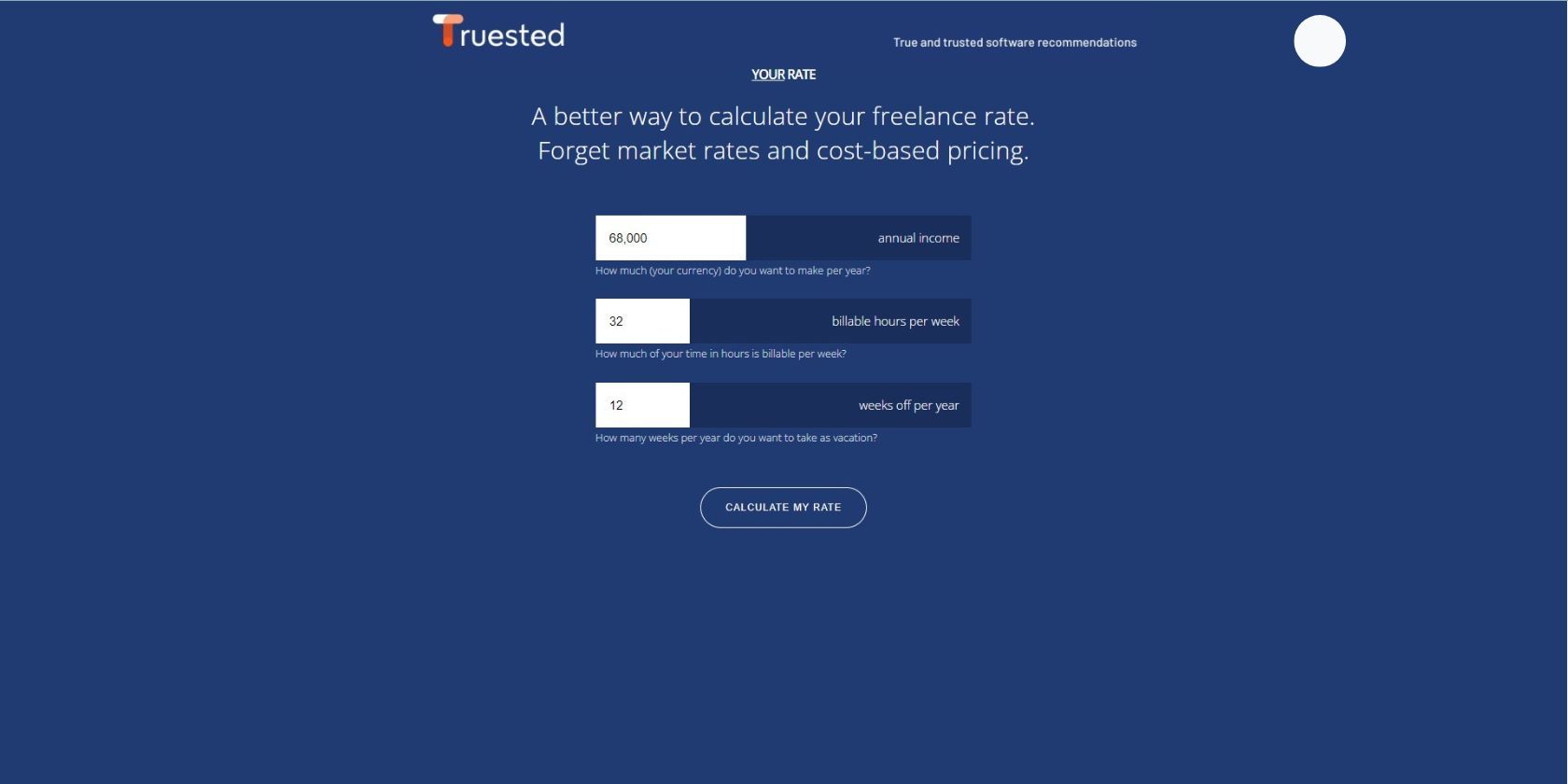

5.Truested Your Rate

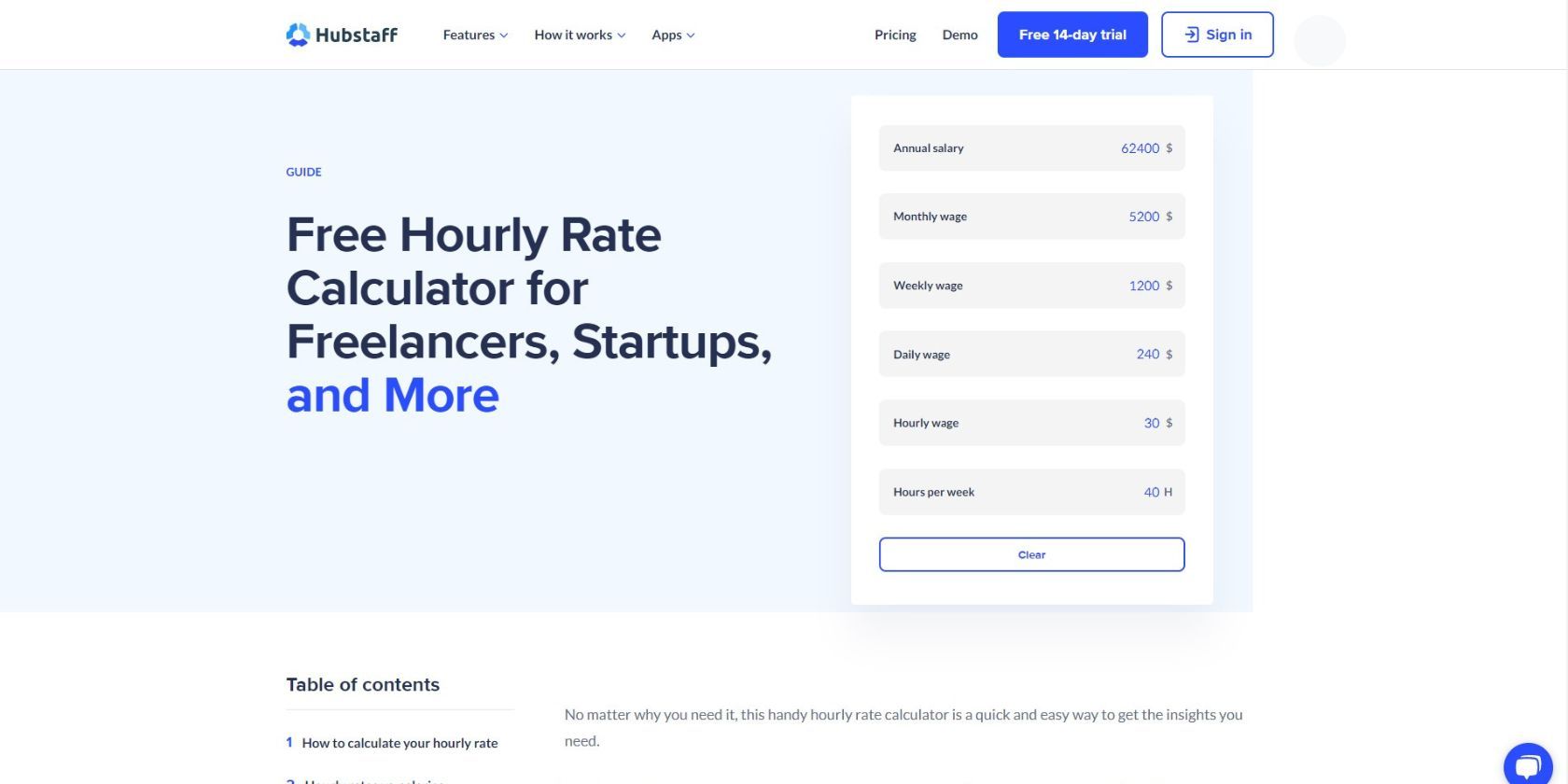

Truested Your Rate is a straightforward freelance income calculator that works in any currency.

Note that the rates are multiplied by two to account for taxes and savings.

Use this calculator if you don’t need a detailed breakdown of your finances.

With the results, you might decide whether you’re earning enough.

Learnhow to negotiate a higher freelance rateif your income falls short of your expectations.

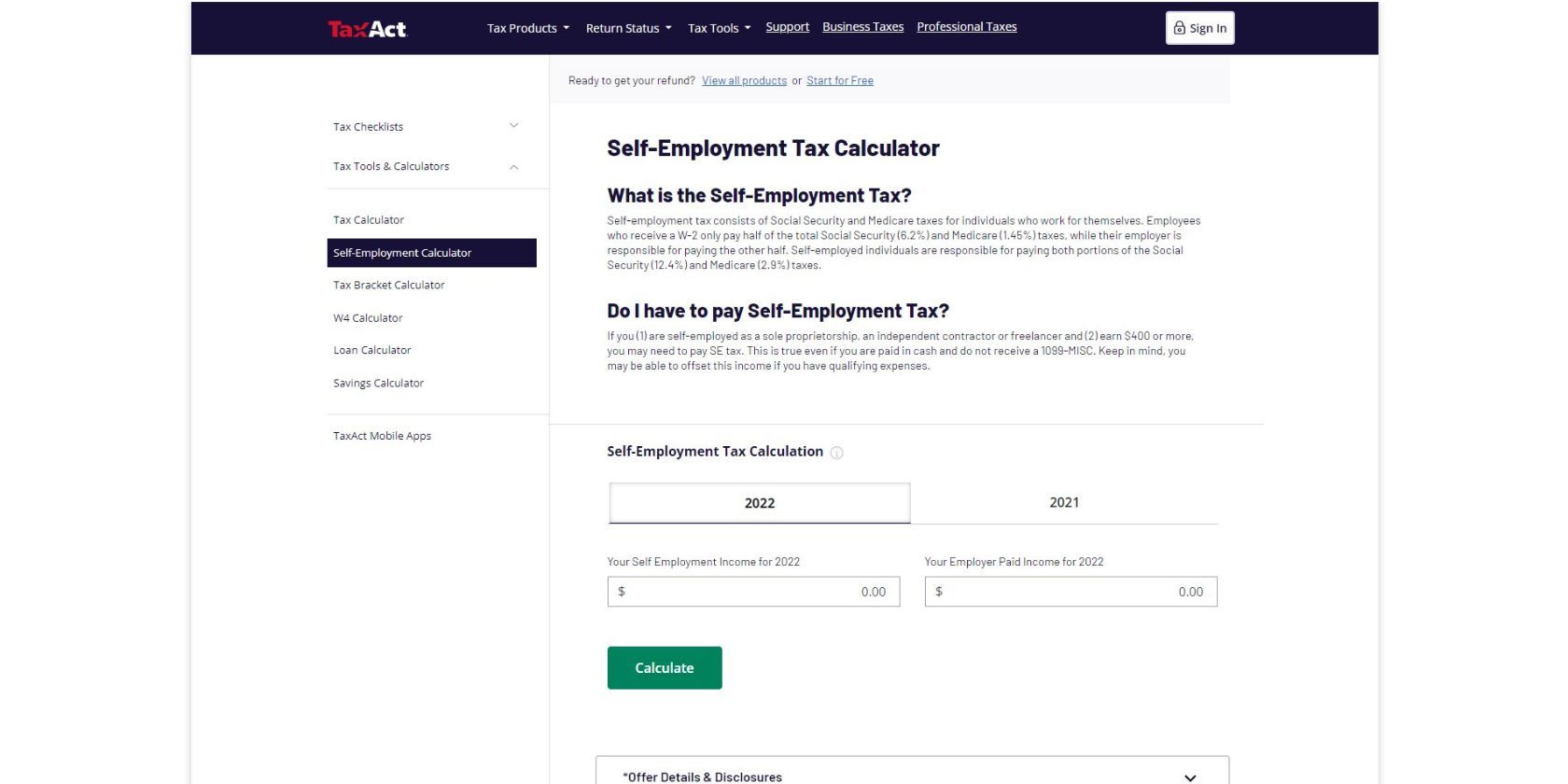

Self-Employment Tax refers to the Medicare and Social Security tax rate for freelancers.

Use this calculator to know how much you better pay for the said tax.

Employers automatically deduct your self-employment tax and pay for half of it if you’re employed.

However, you’ll have to calculate and fully pay your taxes yourself if you own a freelance business.

Freelancers and independent contractors with a net income of at least $400 must file a self-employment tax.

To avoid tax evasion charges, use this Self-Employment Calculator and thetop bookkeeping software for small businesses and freelancers.

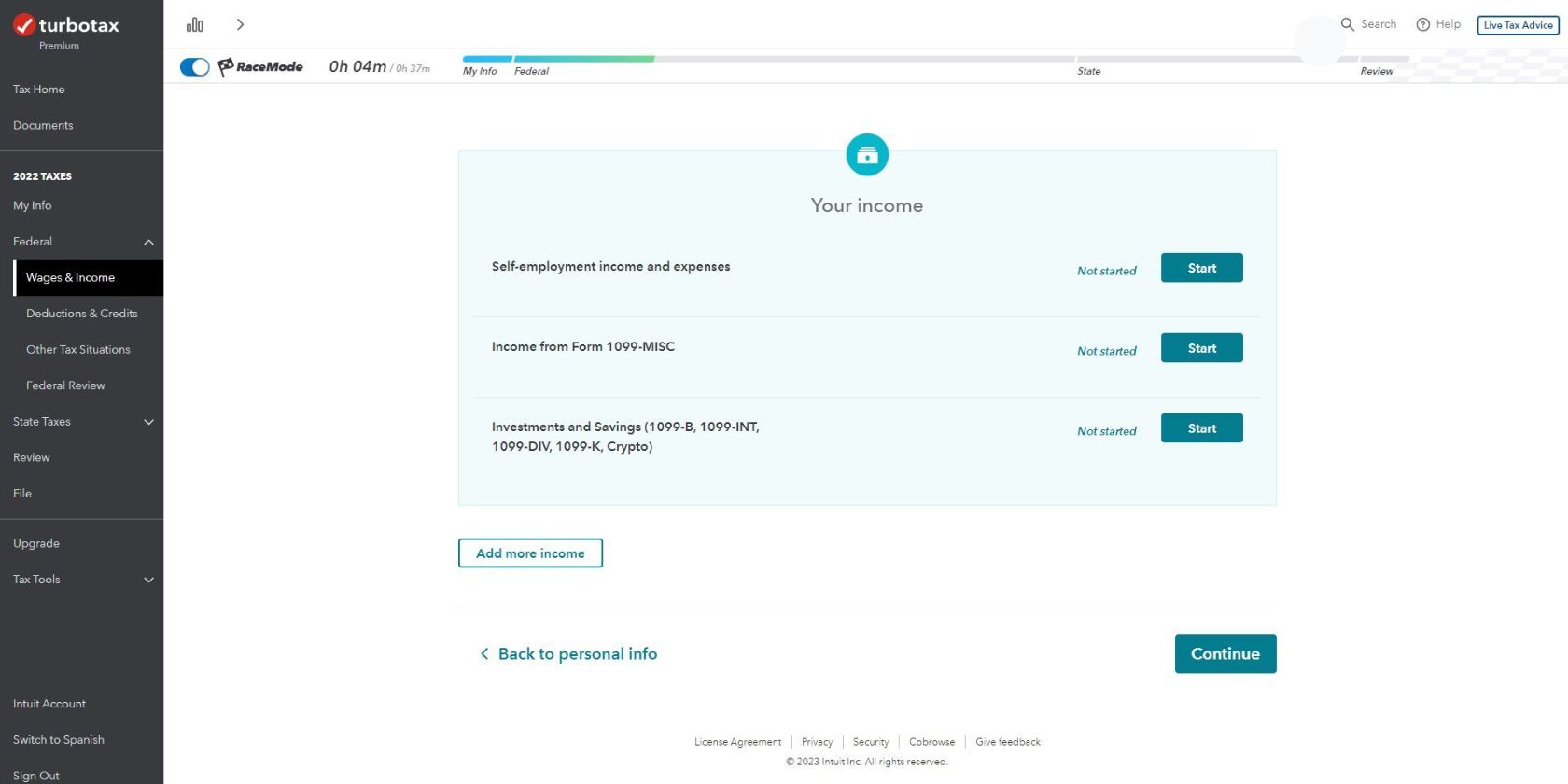

7.TurboTax

According to theIRS, self-employment tax is just one of the taxes freelancers have to pay.

Considering these factors will give you a more accurate view of your freelance income.

TurboTax helps you calculate your net income and guides you through the whole tax filing process.

However, filing a return or getting expert advice would require a subscription.

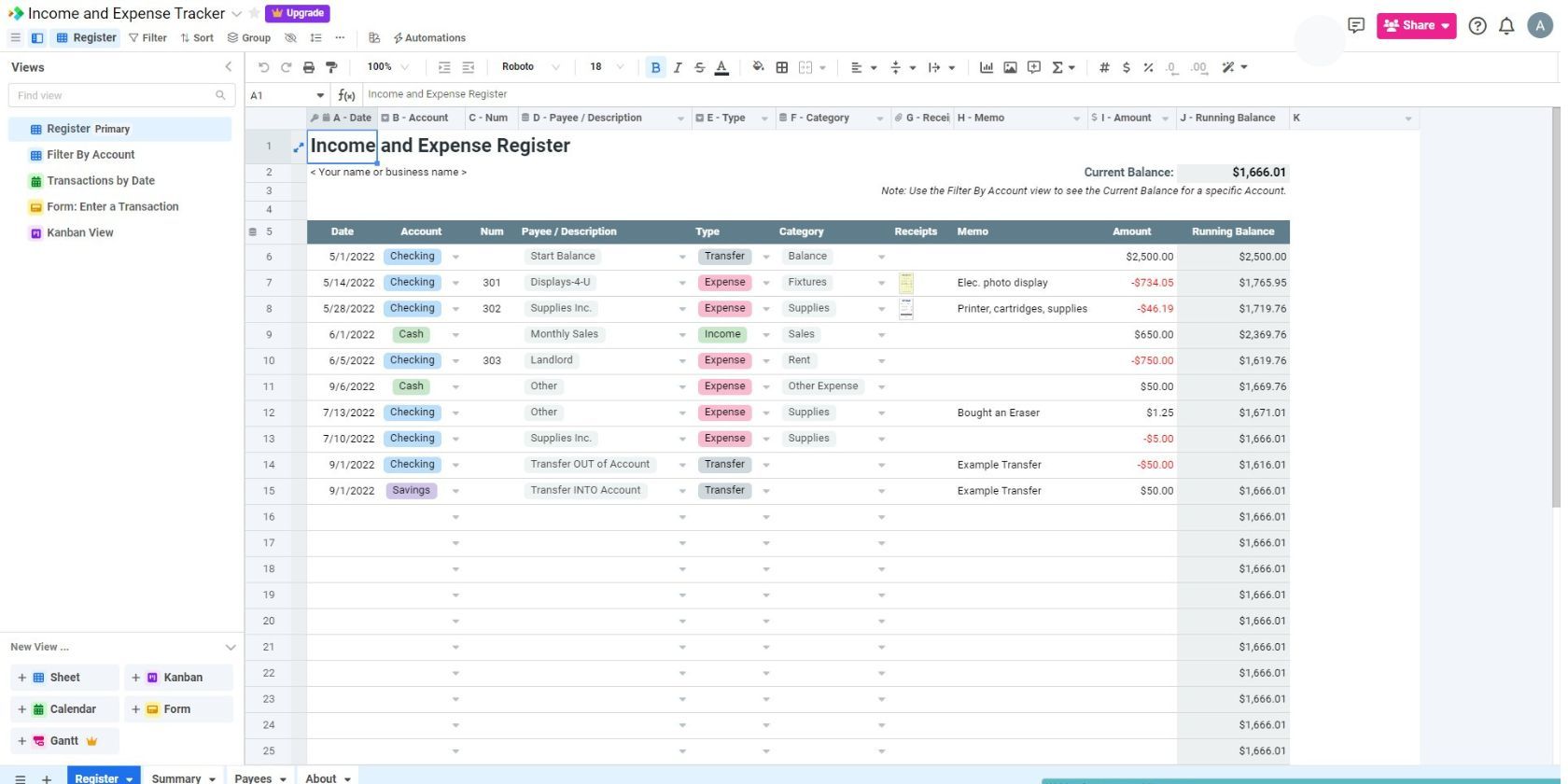

8.Spreadsheet Income and Expense Template

This tracker keeps a detailed record of your income and expenses.

It comes in a familiar spreadsheet format but with added project management capabilities.

This template divides the columns into ten categories:

You’ll see aViewscolumn on the left-hand side.

you’re free to view the income and expense template in different formats from here.

To easily add a new transaction to the spreadsheet, clickForm: Enter a Transaction.

Financial management is a challenging task for freelancers.

it’s possible for you to always hire an accountant to lessen the burden.

However, sharpening your financial skills is also a worthy investment.

If you want to succeed as a freelancer, take time to boost your financial literacy.