Online industries have seen big changes after a rollercoaster ride in 2020.

Generally, though, online companies have flourished during the pandemic.

So don’t go anywhere, because here are 50+ stats on the largest internet companies in 2021.

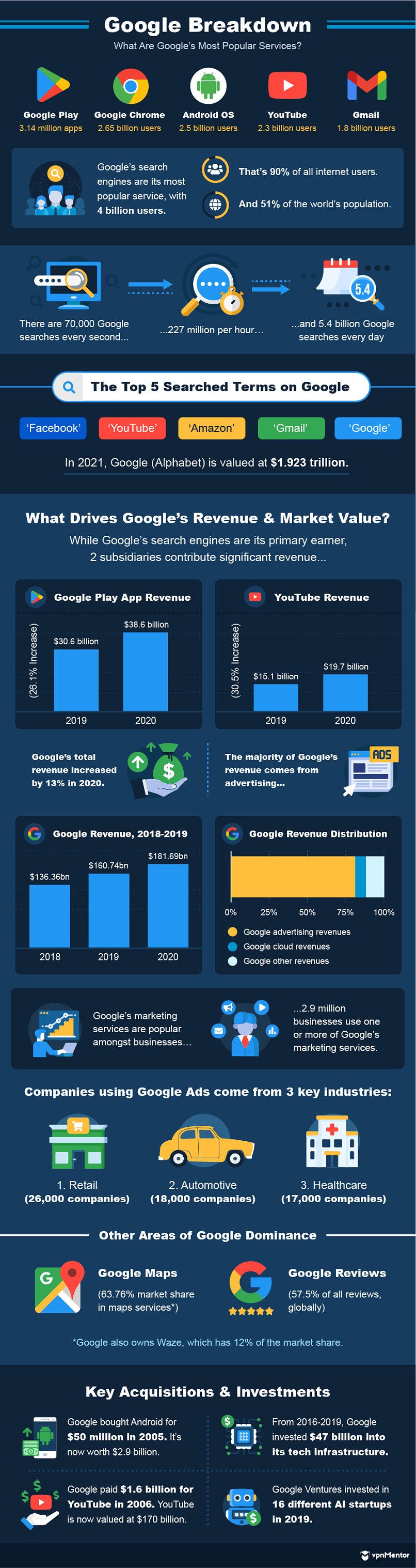

Google and Amazon are constantly battling it out for the top spot as the biggest online company.

Amazon is influential in several industries, but perhaps this is where Google excels.

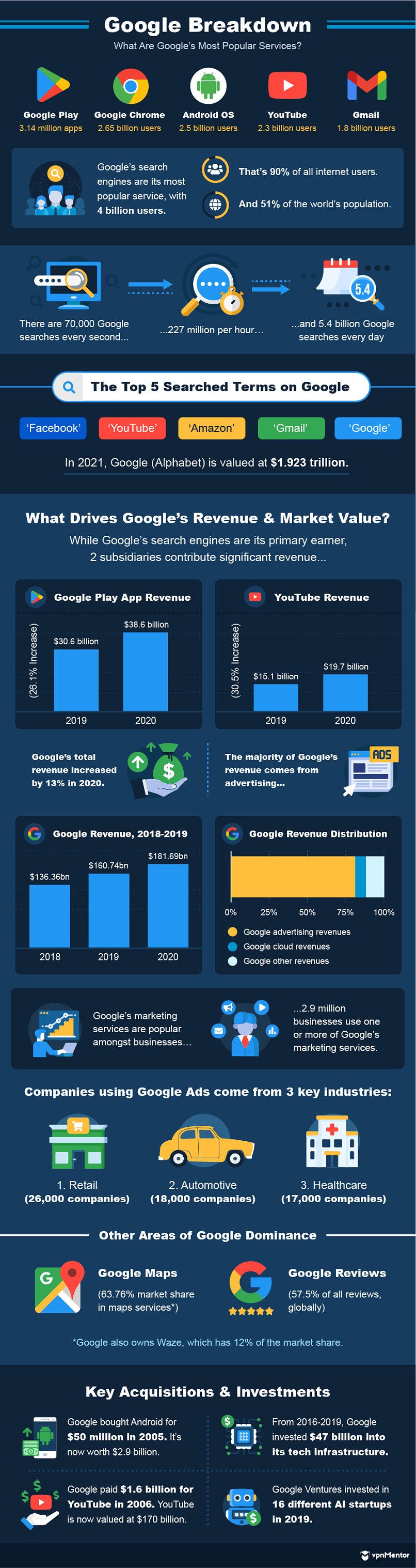

In fact, there are over 271 Google products and services.

So what are the key statistics on Google?

How has it performed financially over the last few years?

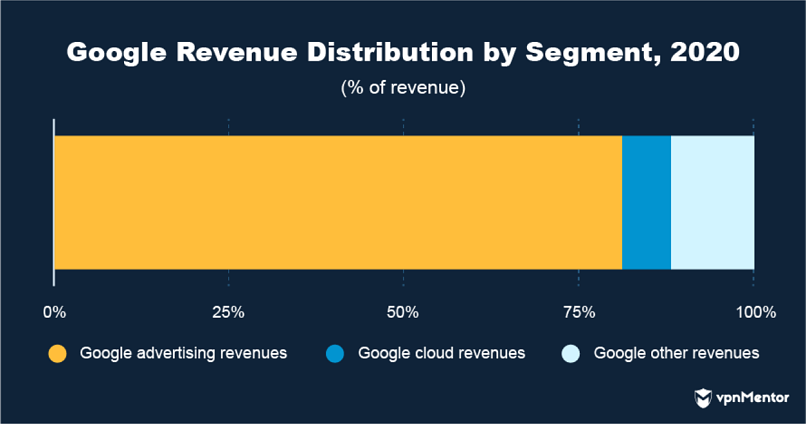

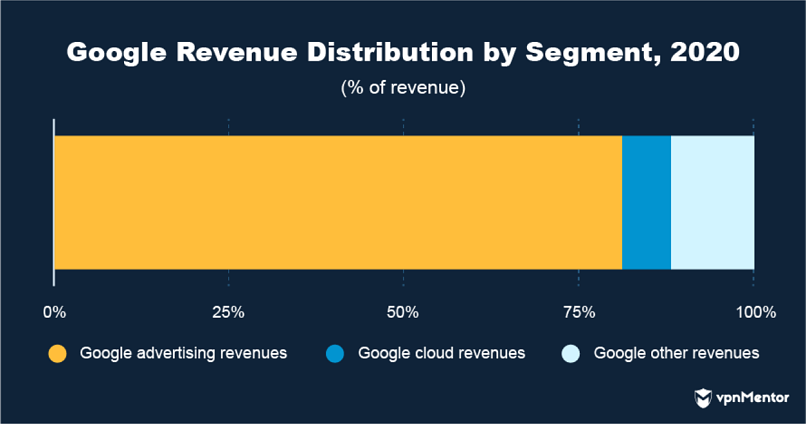

What services make up the bulk of its revenue?

And how does the company invest?

Biggest Winners & Losers of 2020

2020 wasnt a good year for many of us.

That is, unless you own a top online company.

In which case, theres every chance the pandemic has been very kind to you indeed.

Here are the biggest winners and losers of 2020.

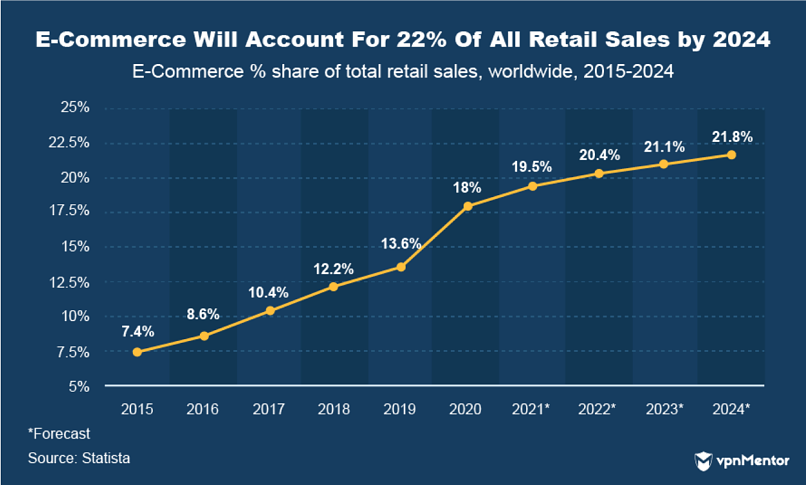

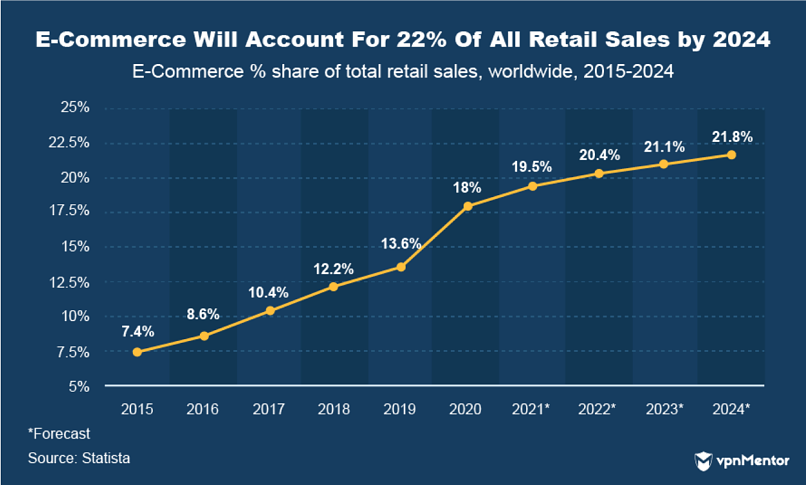

The Rise of E-Commerce

E-commerce is one such industry that has benefited greatly from the COVID-19 pandemic.

E-commerce accounted for 35.2% of all UK retail in January 2021.

Thats a 74% growth in share compared to January 2020.

The number of purchases made online is only expected to increase over the next few years.

Nasdaq even estimates that, by 2040, 95% of all retail sales will be through e-commerce platforms.

A market that should reach $4.97 trillion in 2021.

Thats a growth of nearly 400% in 7 years.

So, yeah, e-commerce is doing very well and dont expect that to change anytime soon.

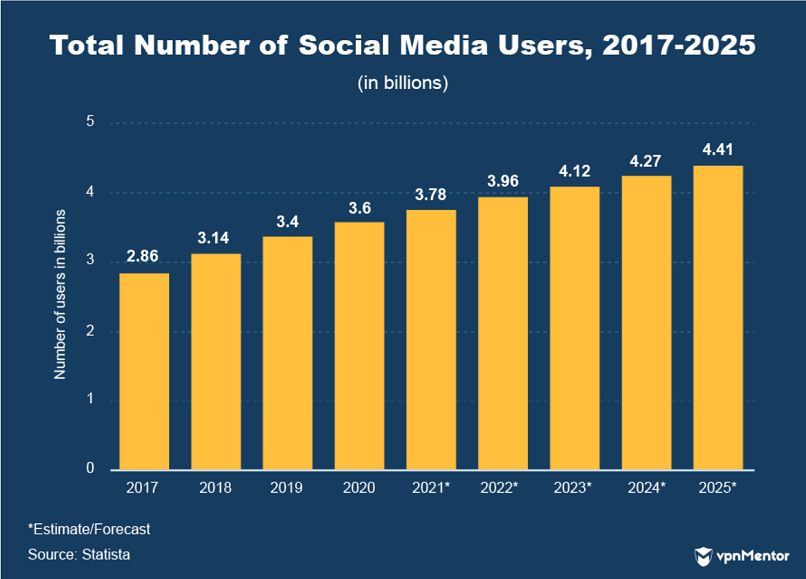

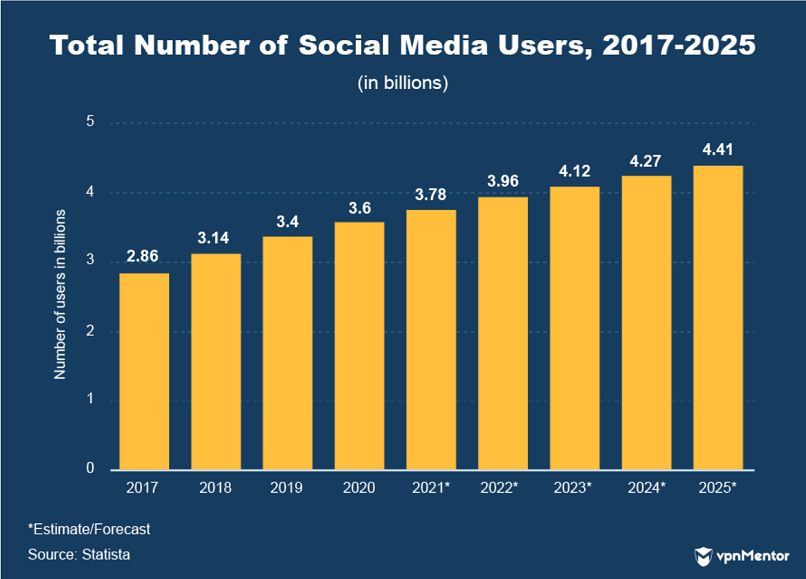

2020 saw one of the biggest jumps in social media use in recent memory.

3.8 billion users are expected to hit platforms in 2021.

That means social media users will account for 49% of the global population.

Nearly 4 billion users are forecasted for 2022.

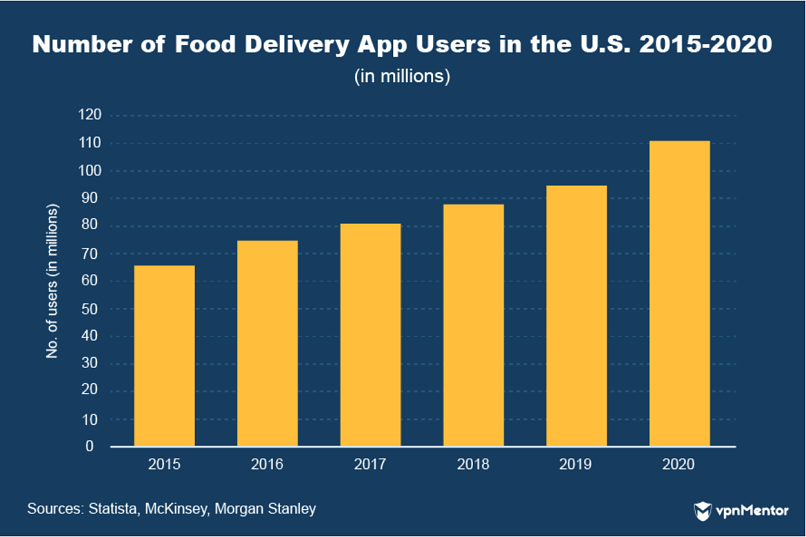

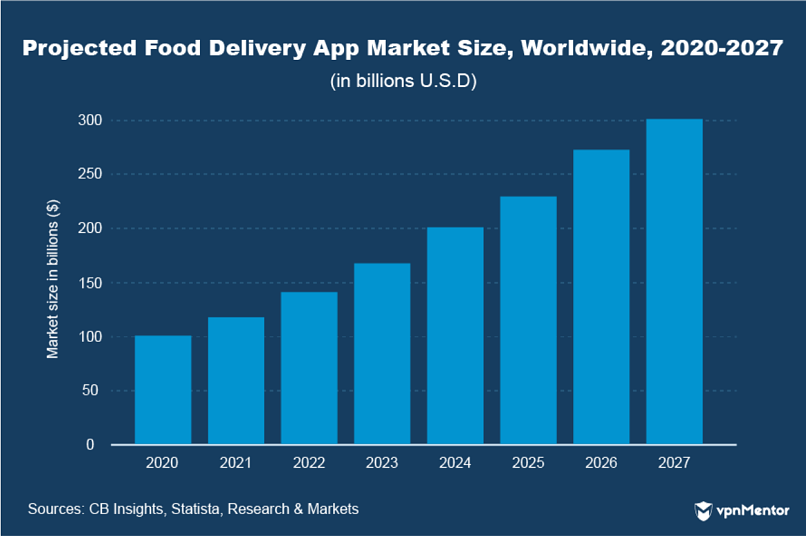

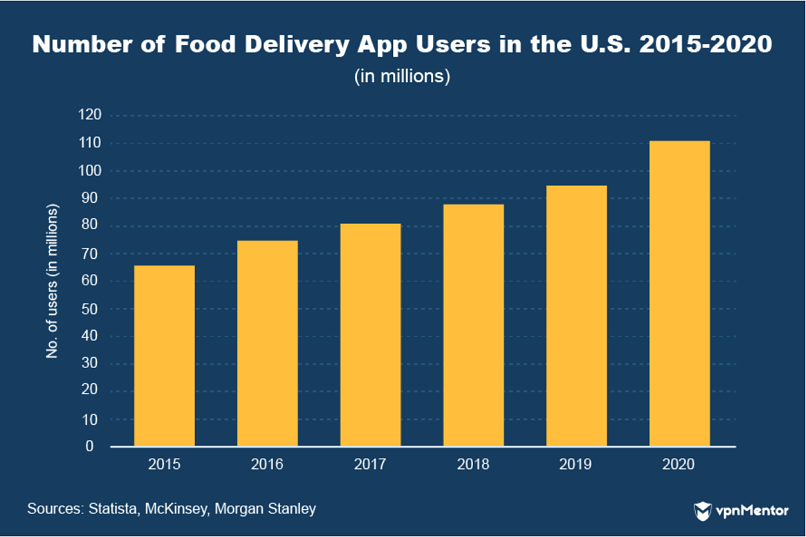

Food Delivery Apps Profit

People ordered a lot of food during the pandemic.

As such, food delivery apps have enjoyed record numbers.

Regular restaurants were closed across many countries as social distancing measures rendered public spaces unusable.

Thats a 20.5% increase in revenue compared to 2019.

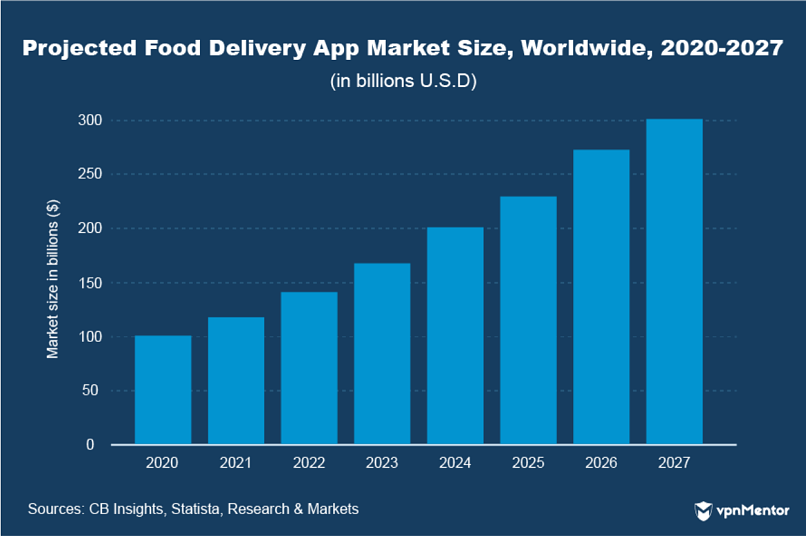

No sooner than 2027, the food delivery app market will be worth $300 billion.

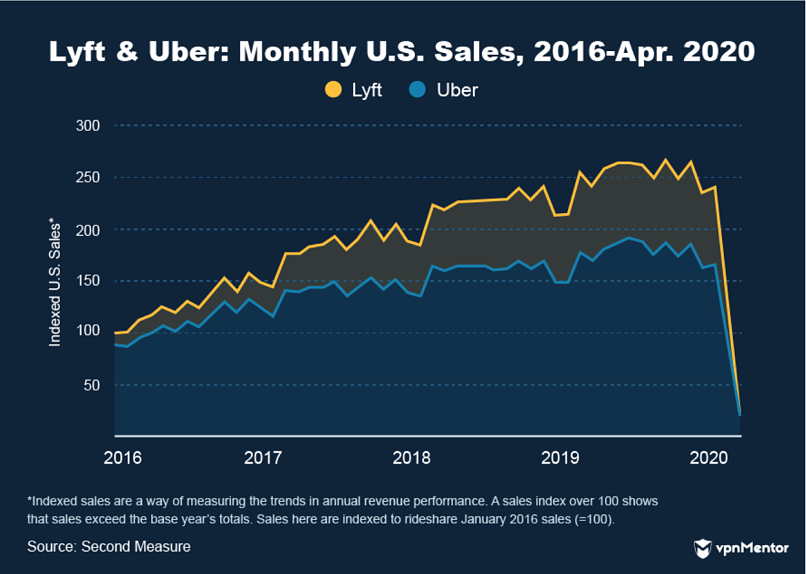

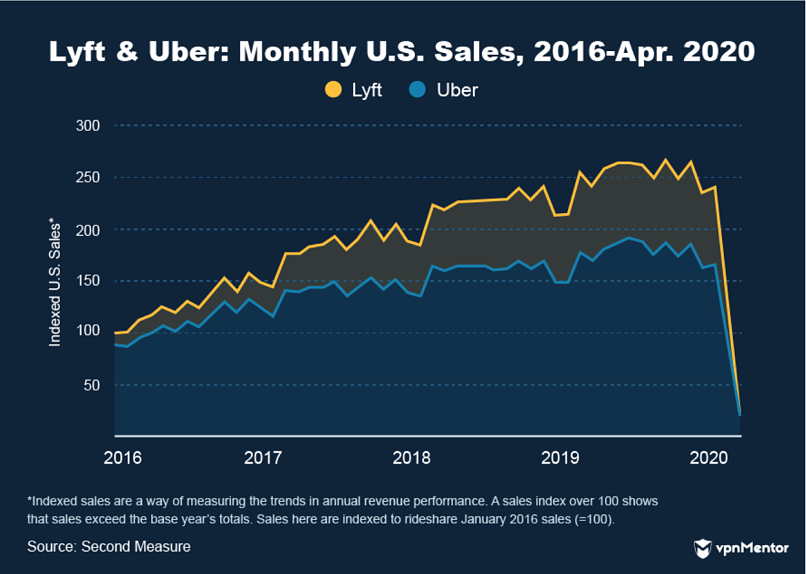

Ride-Hailing Services Plummet

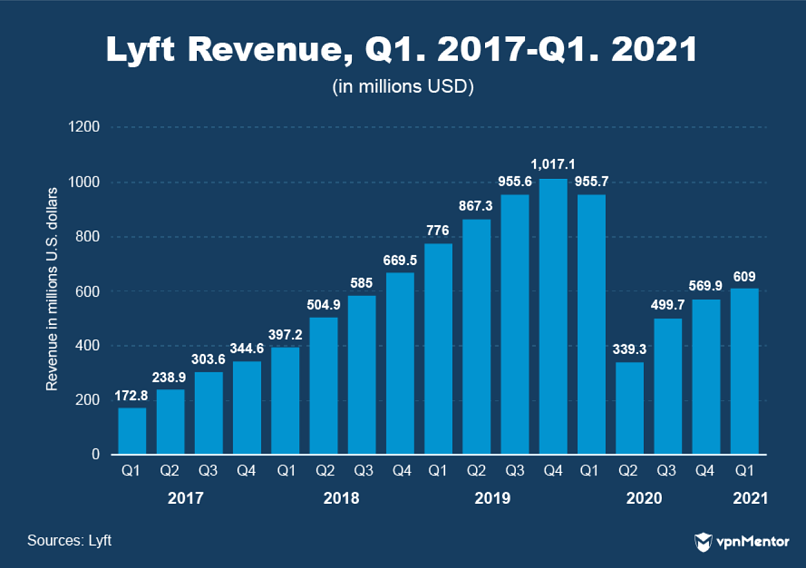

Lyft and Uber are the 2 primary players in the U.S. ride-hailing market.

Again, Lyft and Uber are fine examples of the losses seen by ride-hailing services.

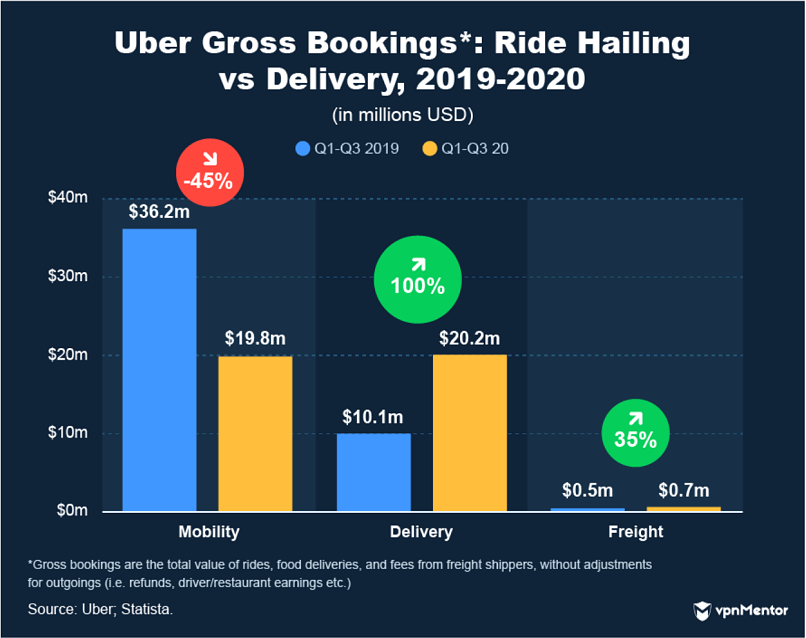

Uber suffered losses of 21%, sinking to $11.1 billion of revenue by the end of 2020.

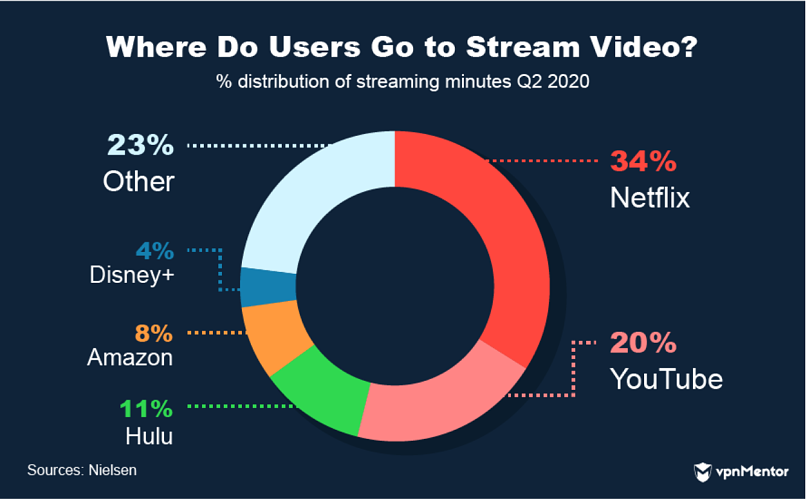

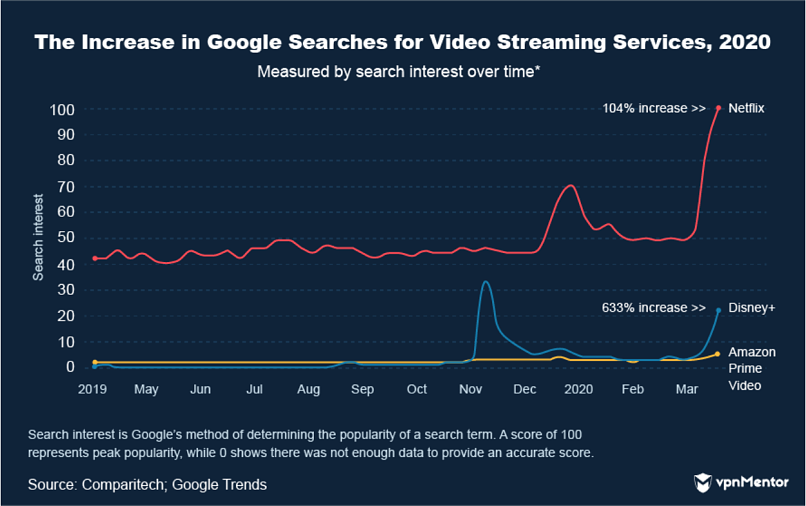

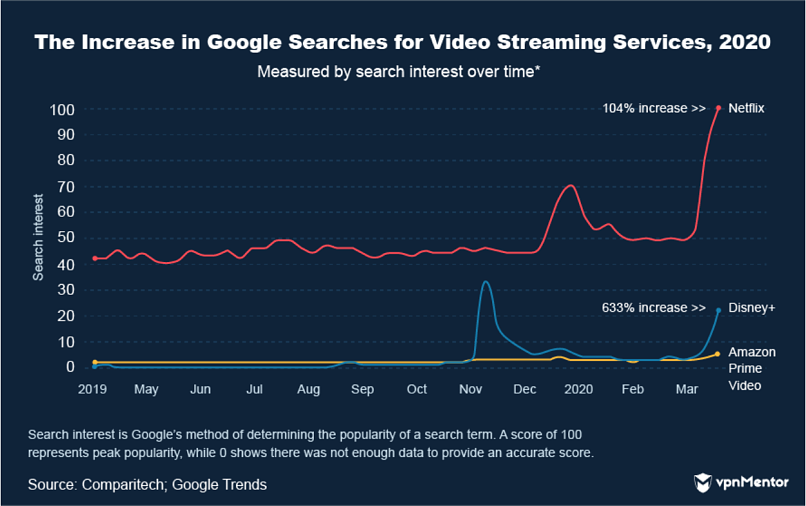

People Are Streaming More Video

Video streaming is another obvious winner amongst internet companies.

Netflix wasnt the only video streaming service to benefit either; nearly all streaming platforms did.

Overall, the market is expanding at a pretty-rapid compound annual growth rate (CAGR) of 21%.

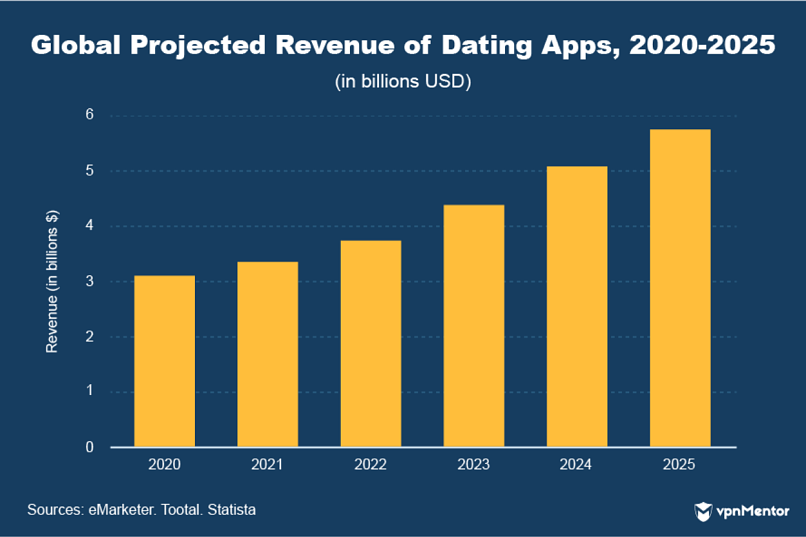

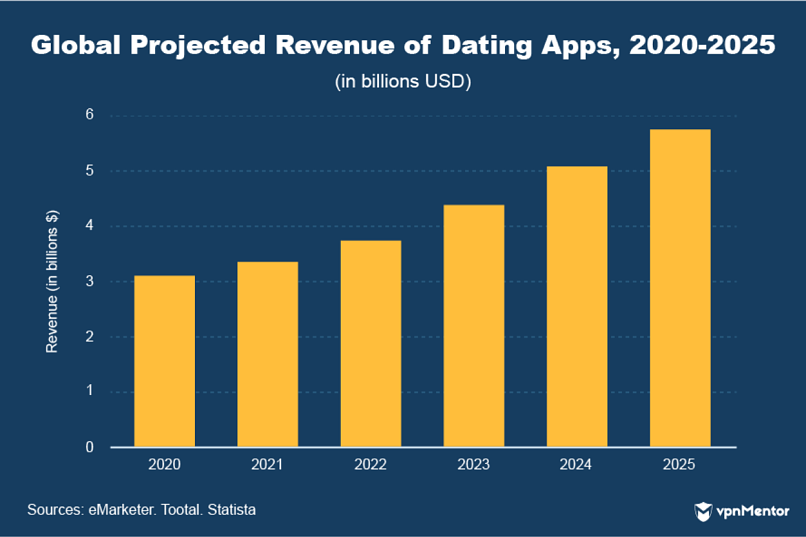

Dating Apps Perform During COVID-19

Looking for love has never been easier than it is today.

Technology has allowed us to enjoy greater social connectivity.

Dating apps like Tinder and Bumble allow you to meet a host of potential companions every day.

Just swipe right to show youre interested, and if the person you liked does the same, voila!

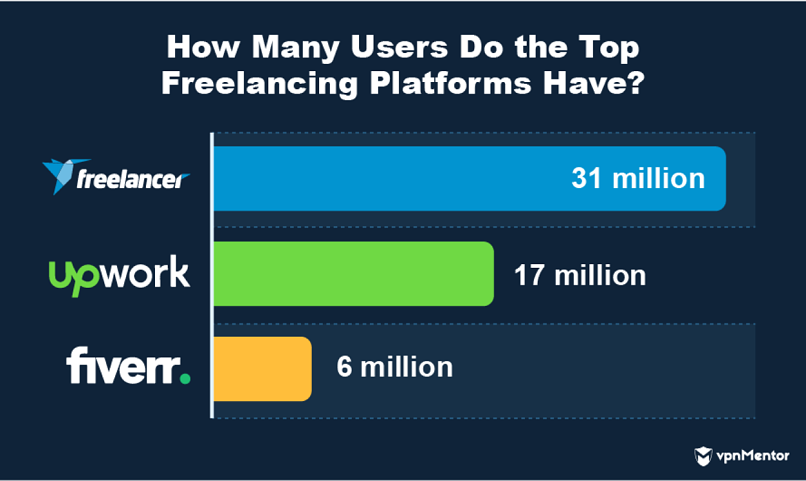

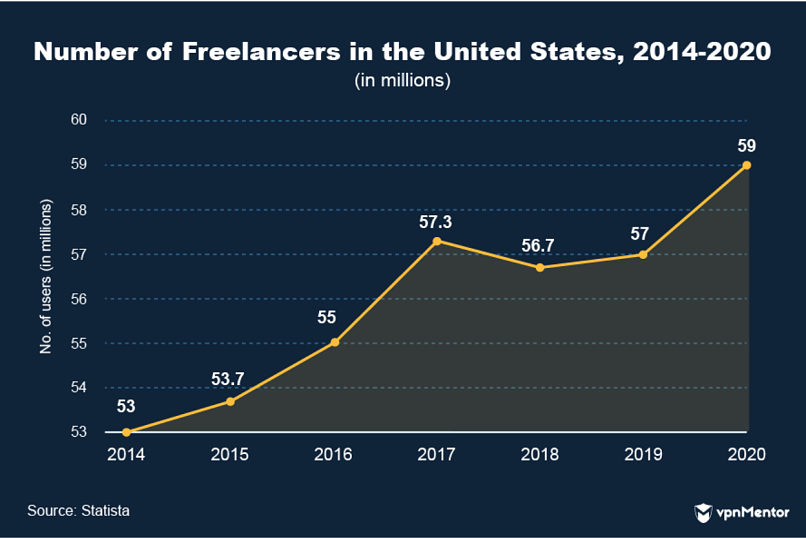

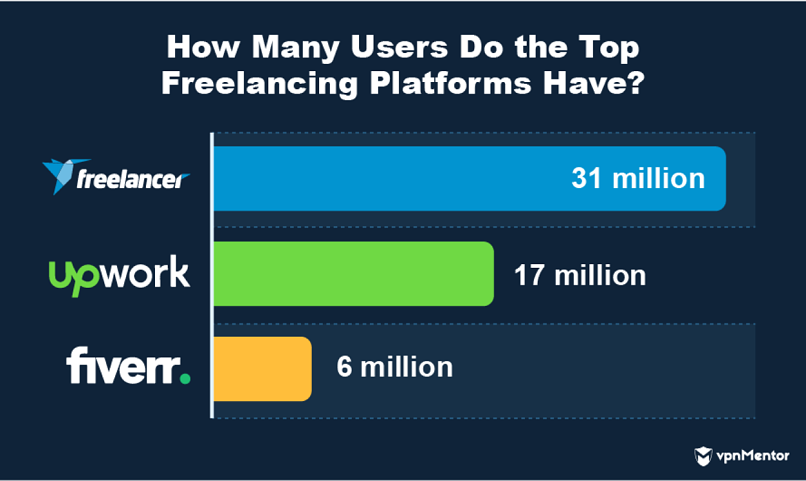

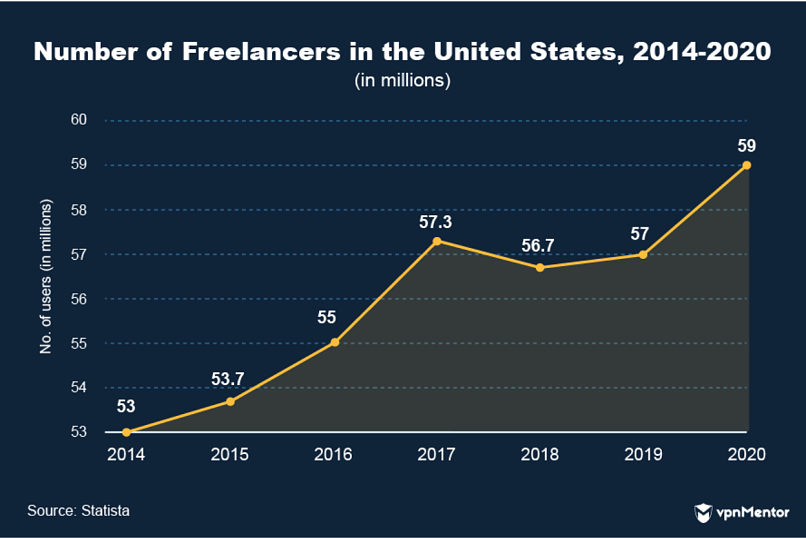

Many employees were either furloughed or relieved of their jobs during the outbreak of COVID-19.

And where do new freelancers go to find work?

So, more businesses were using these services too!

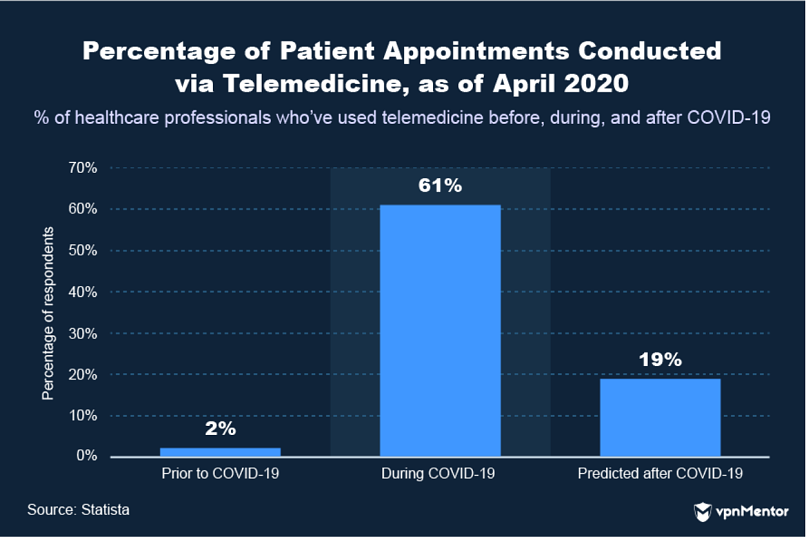

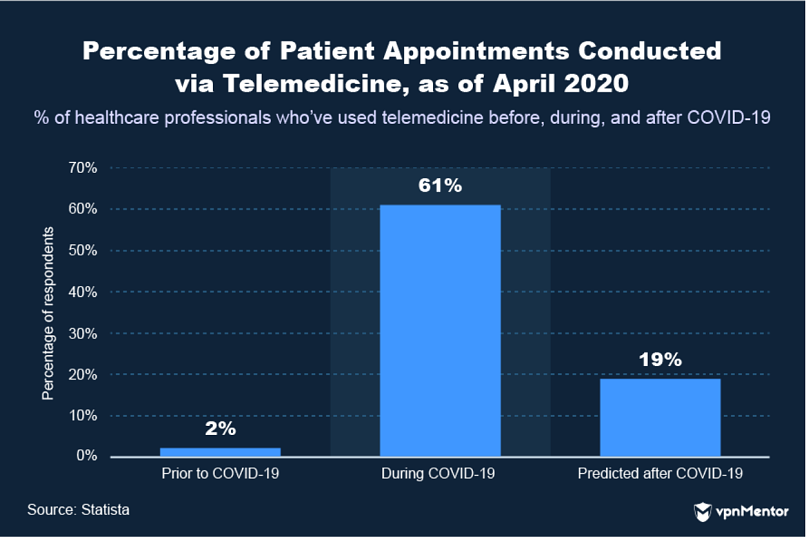

Telemedicine platforms let you access medical information, consultation, products, or other health-related services online.

Its basically a way to get checked up without having to go into the hospital.

Now, for a multitude of reasons, telemedicine did very well in 2020.

Hospital admissions dropped across the world as many patients were too afraid to visit a clinic.

Telemedicine provided a source of support to these people, and the industry profited as a result.

The global telemedicine market grew to just under $60 billion in 2020.

That growth should now continue at a rate of 22.4% between 2021 and 2028.

Social Media

Social media is a key beneficiary of the recent prevalence of online communications.

There are some big movers here, while top companies like Facebook have continued to perform.

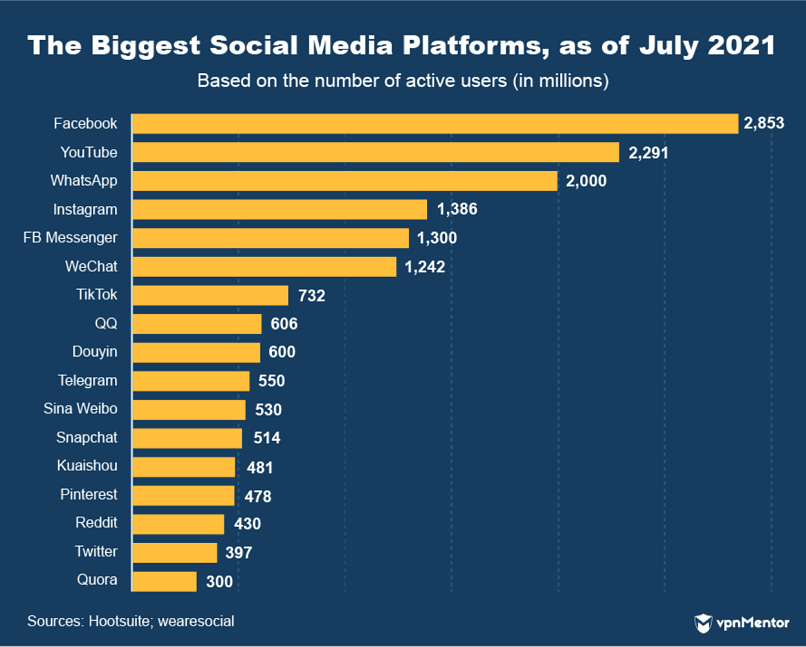

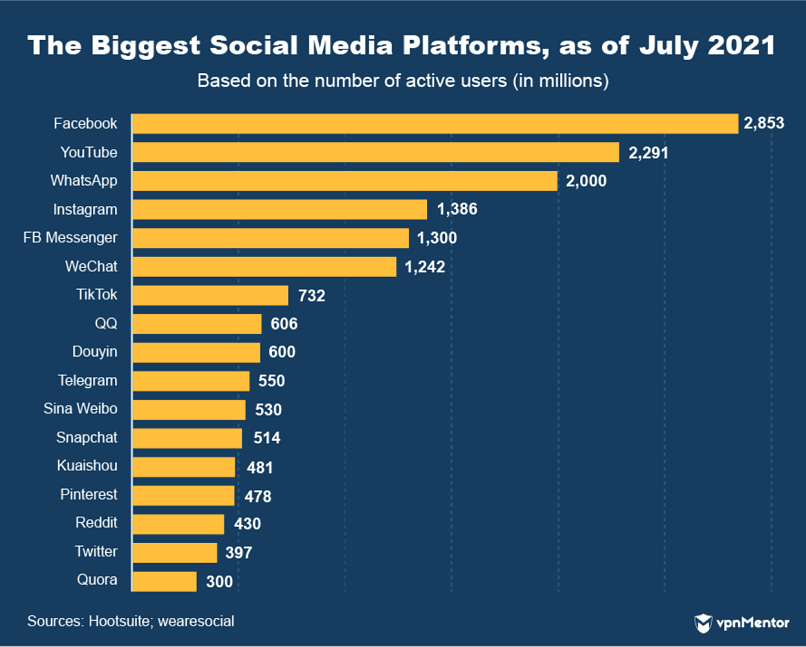

Which Socials Get Used the Most?

So which social media site do people love the most?

TikTok Is the Biggest Mover

TikTok gained more popularity in 2020 than any other social media app.

Actually, its gained more popularity than any other app, full stop.

None more so than TikTok, however.

Thats a 450% increase from the $180 million TikTok posted the year before.

Undoubtedly, TikTok is the biggest social media mover at this moment in time.

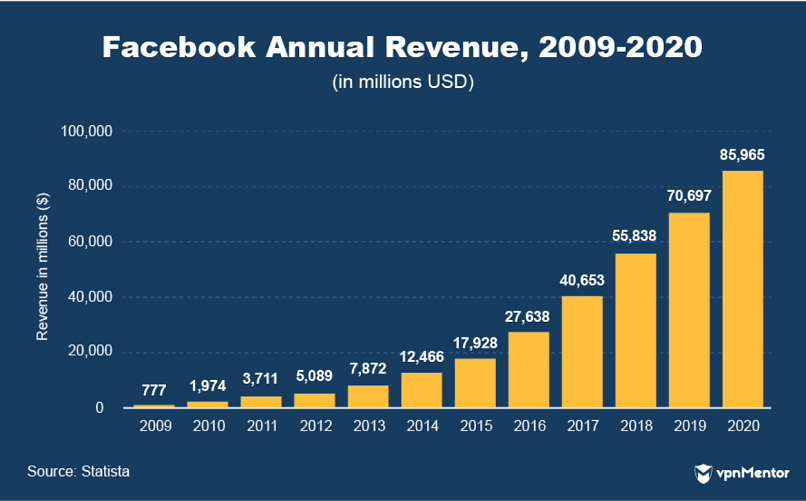

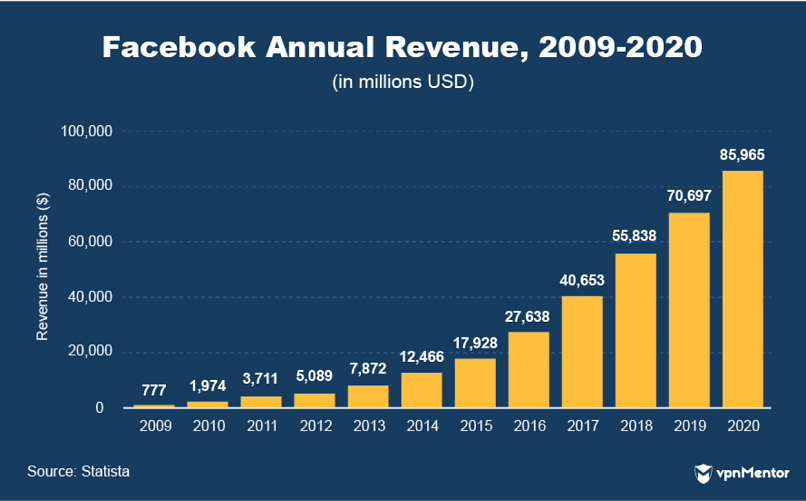

Facebook Still Number One

Mark Zuckerbergs social media juggernaut continues its relentless domination.

Facebook is home to some 2.85 billion active monthly users.

Thats 36% of the worlds population logging on to Facebook every month.

1.3 billion users access Facebooks messenger app.

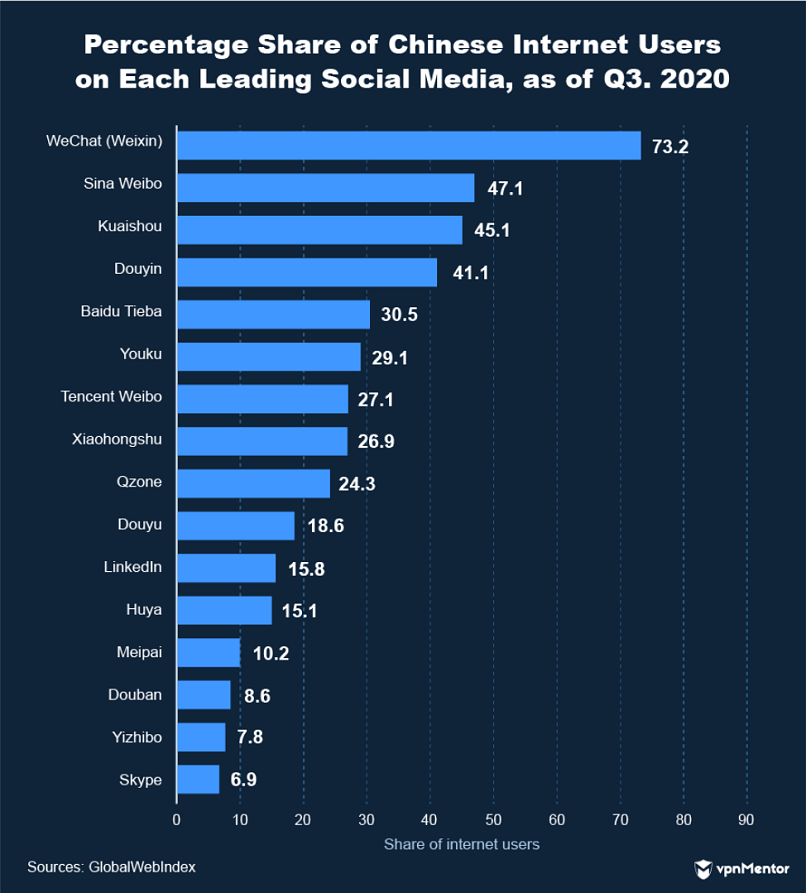

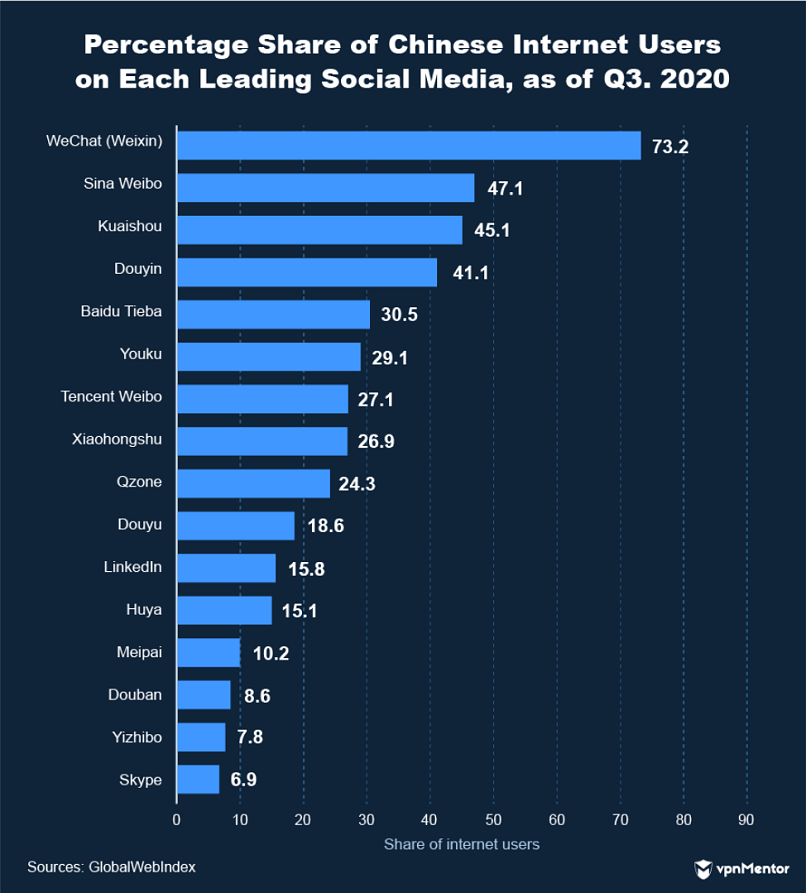

Founded in Shenzhen in 2011 by Allen Zhang, WeChat attracts 1.24 billion monthly active users in 2021.

This kind of fame has led the app to post stupendous financial results.

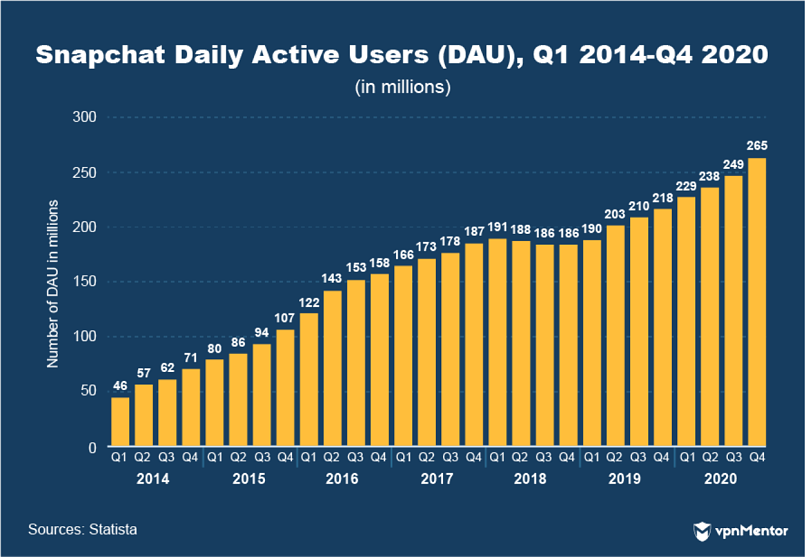

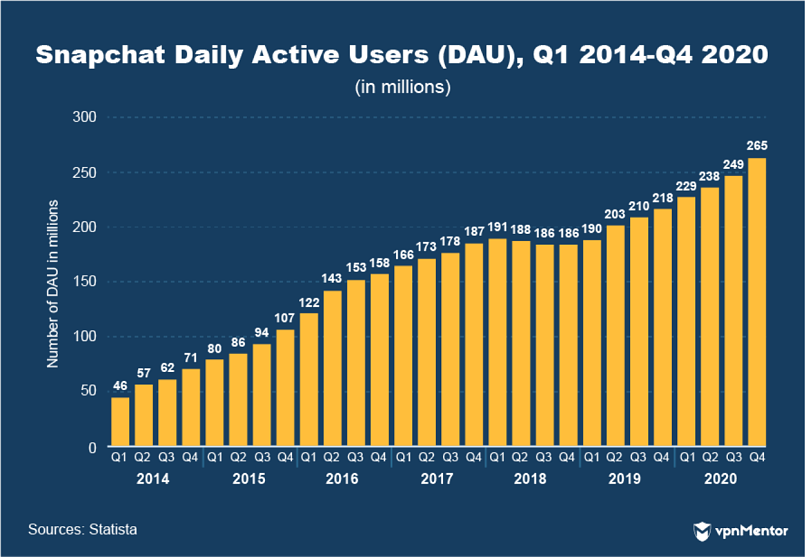

Snapchat Is Resurgent

Snapchat was founded in 2011 by Evan Spiegel.

Snapchats user base is generally younger too.

60% of Snapchat users are aged between 13 and 24-years old.

Many thought Snapchat was declining in 2018 as its user base began to steadily diminish throughout the year.

But in 2019, Snapchats user base once again started to climb.

Fast-forward to 2020, and Snapchat was one of the biggest beneficiaries of the pandemic.

Both of these elements are key to Snapchats service.

Some 18 billion videos are now consumed on the platform every day.

This emphasis on 2 trending characteristics means Snapchat is also benefiting financially.

In 2020, Snapchat made $2.5 billion in revenue.

Thats a 47% increase from 2019 ($1.7 billion).

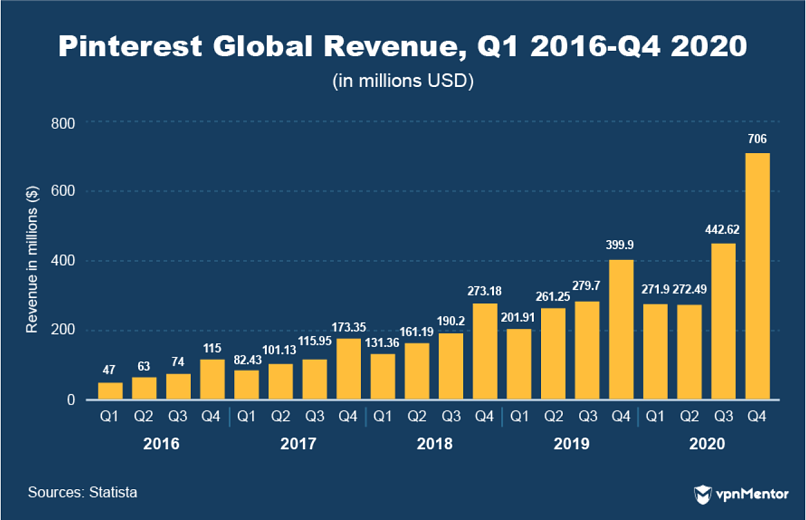

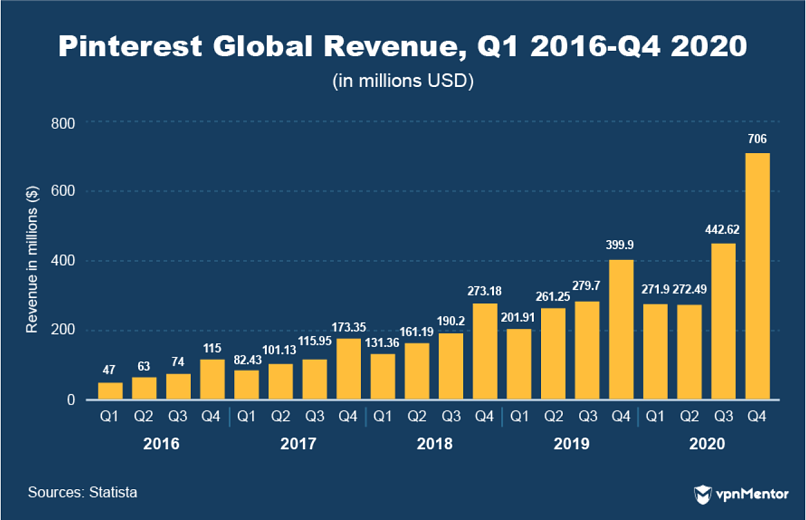

Video Helps Pinterest

Pinterest is another online social media company thats enjoyed an upward trajectory in 2020.

A 37% increase from the year before.

Amongst other reasons, this rise in users has facilitated a massive leap in revenues in late 2020.

In the fourth quarter of 2020, Pinterest posted $706 million in revenue.

Thats a 76.5% increase compared to the year before.

Pinterests new features are playing a role in its current success too.

Pinterests Gen Z audience grew by 40% after the platform added fresh video elements.

Video is also contributing to record amounts of ad revenue.

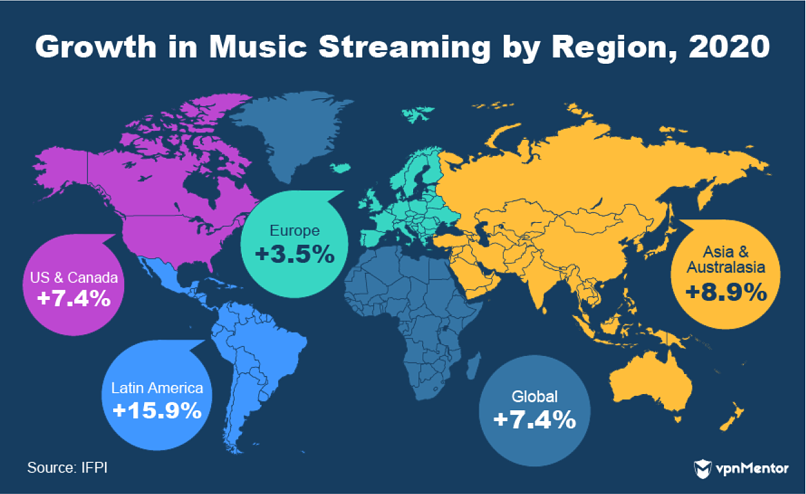

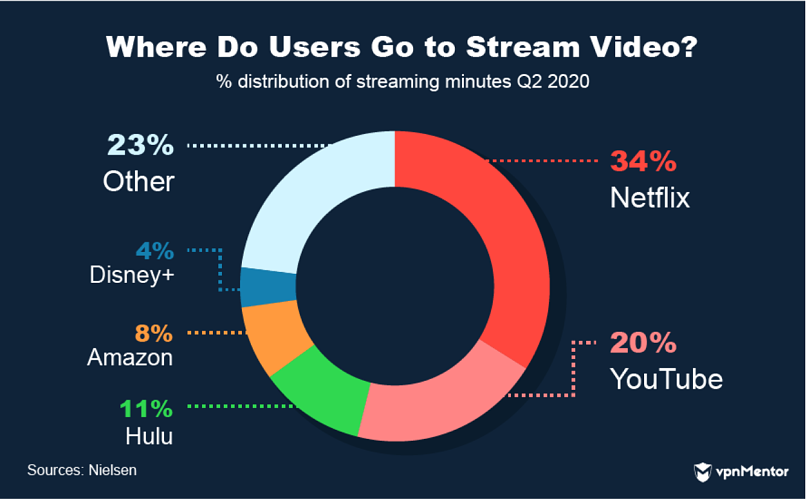

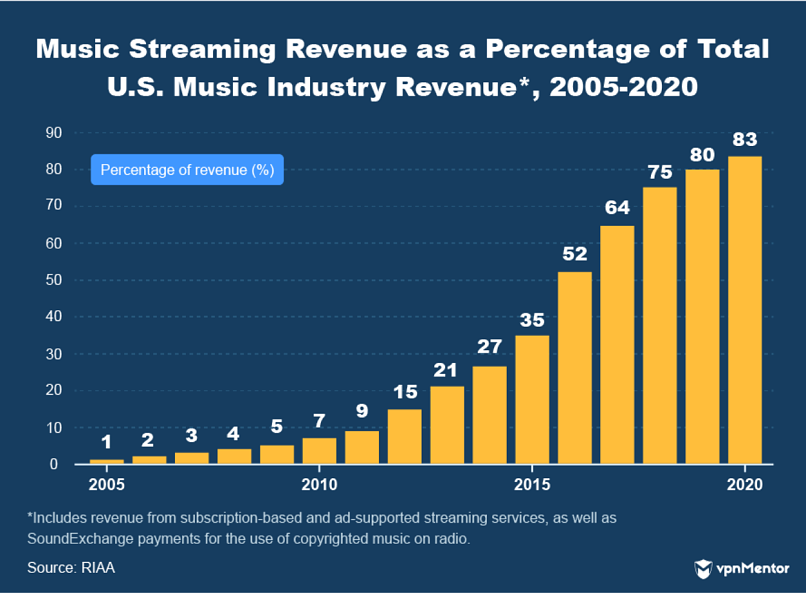

Streaming

Streaming is another market thats thriving in 2021.

The increased downtime resulting from COVID-19 has boosted just about every growth metric for streaming platforms.

People love to stream their content right now.

Hulu, Disney+, and Amazon Prime account for a little less than a quarter of users time.

Meanwhile, significant growth in several other platforms demonstrates how the market as a whole has benefitted.

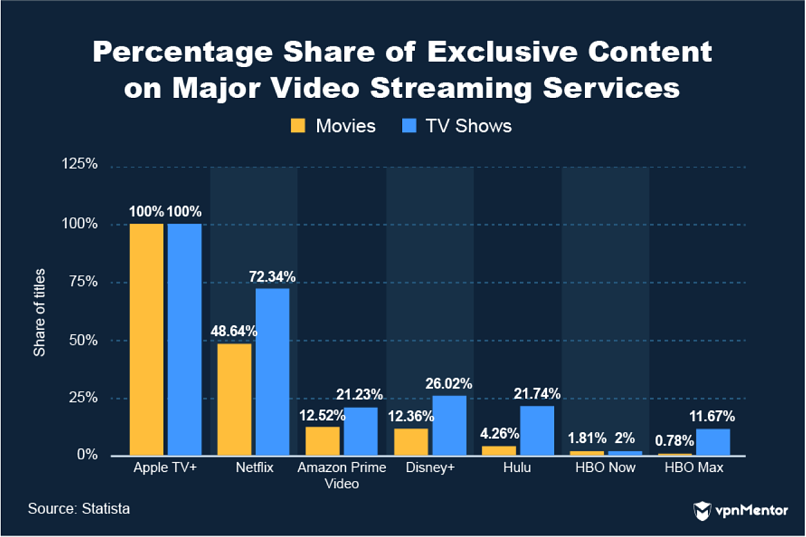

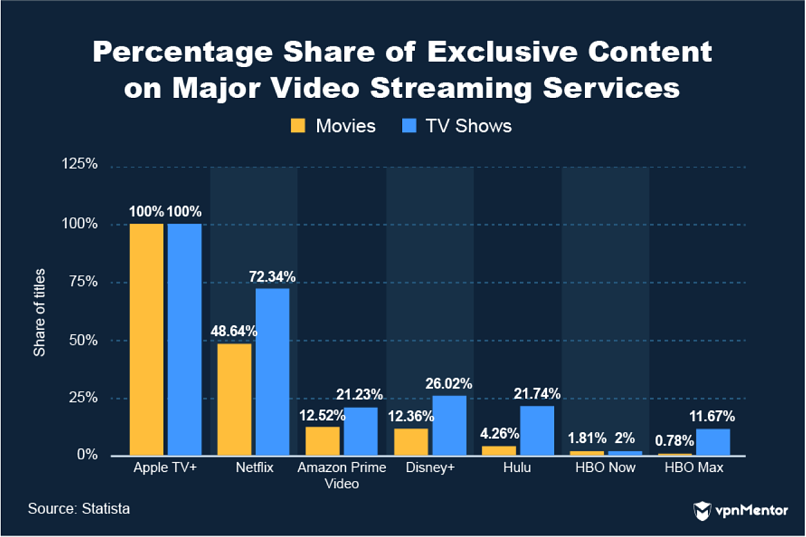

Exclusive content is any content only shown (or licensed to be used) on that single platform.

Still, that doesnt make them any less impressive.

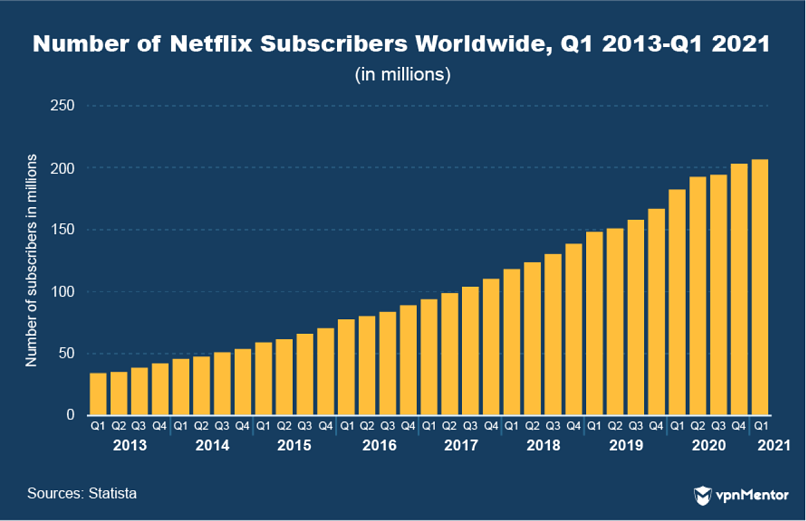

In the fourth quarter of 2020 alone, Netflix generated $6 billion of revenue.

An increase in revenue of 21.5% compared to the same period in the year before.

Netflix users clocked up to 6 billion hours of streamed content per month in 2020.

Thats 288GB of data per month, per user.

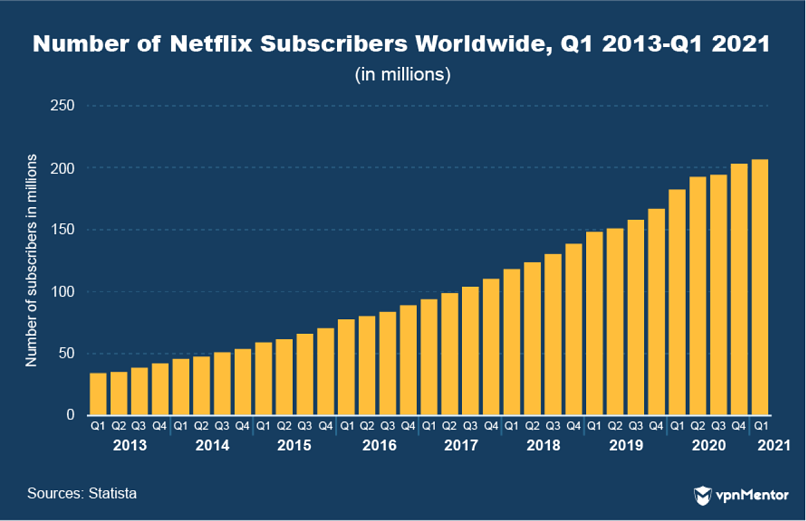

Netflixs success is, perhaps, in part, down to the emphasis they place on producing original content.

In total, Netflix spent $17.3 billion on content in 2020.

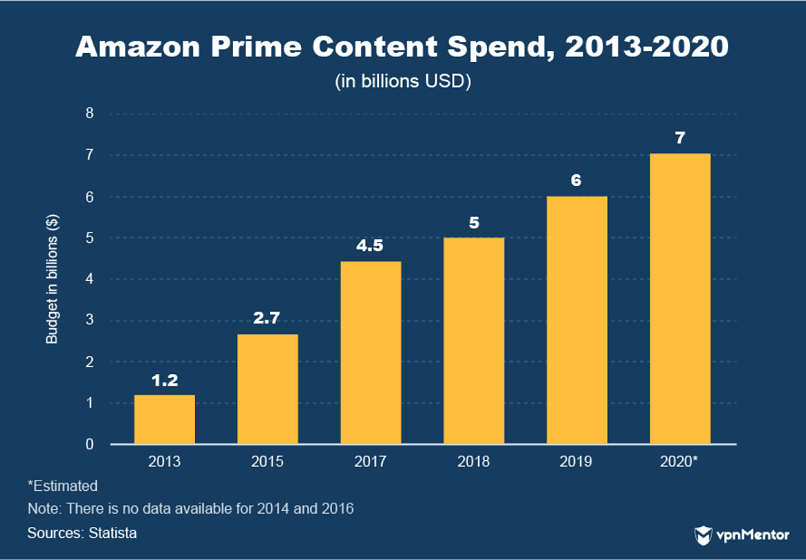

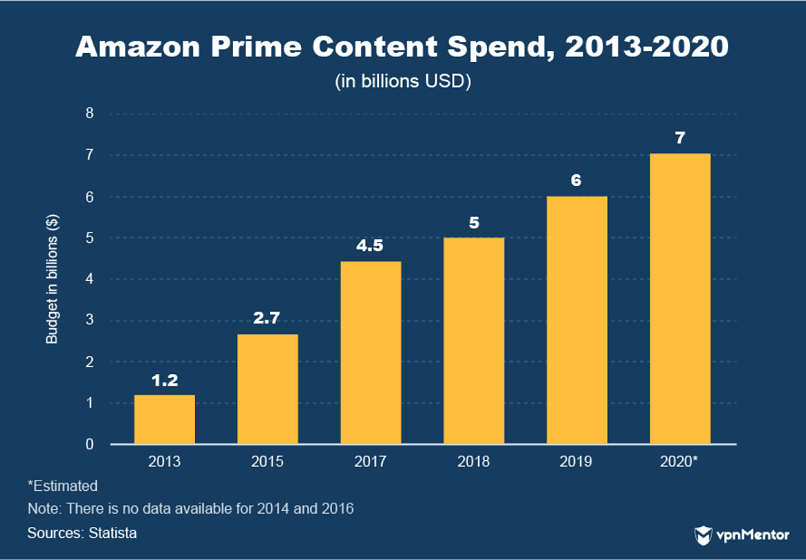

Amazon Prime generated $25.21 billion of revenue from its subscription service in 2020, comparable numbers to Netflix.

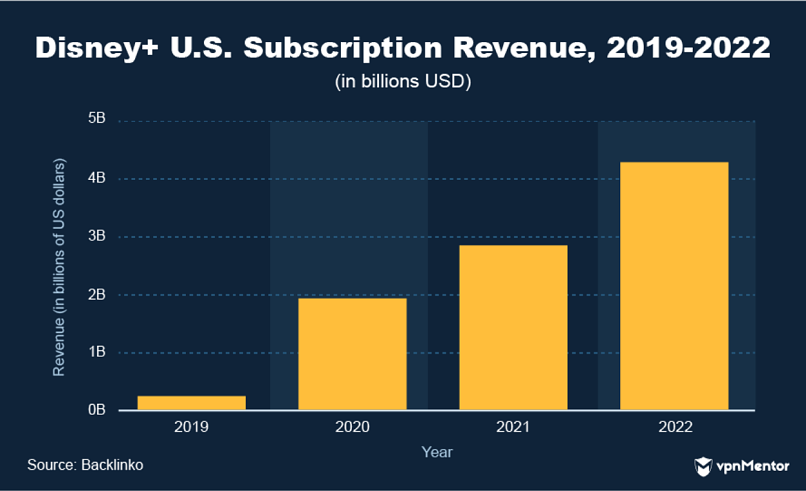

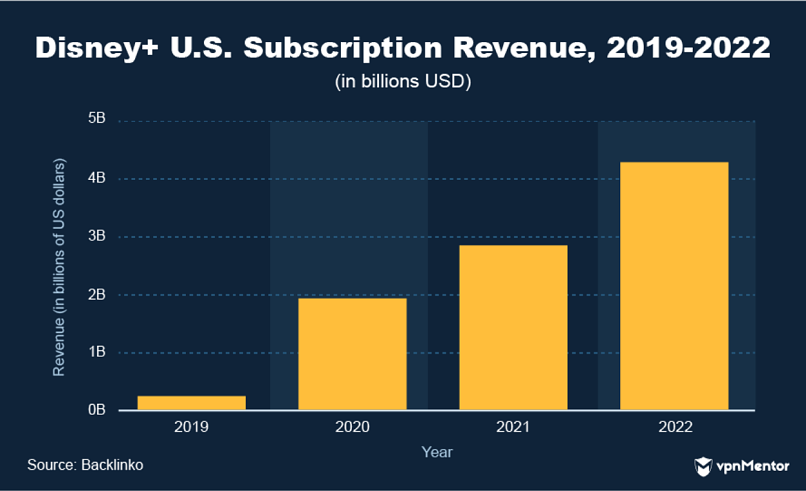

Disney+ Is a Big Mover

One of the biggest movers amongst streaming platforms in recent times is undoubtedly Disney+.

Those numbers will contribute over $4 billion of subscription revenue in 2022.

In turn, the unique content on the platform means viewers are sticking around to see whats next.

78% of Disney+ users retain their subscriptions.

And its still rising!

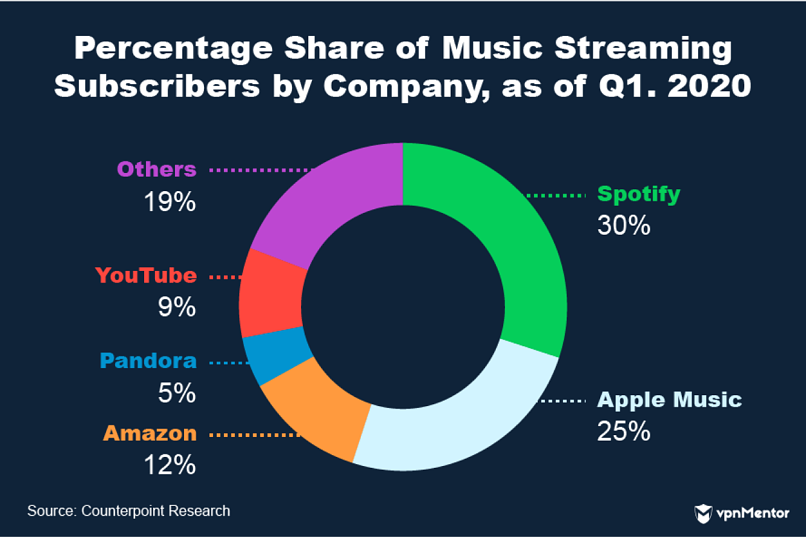

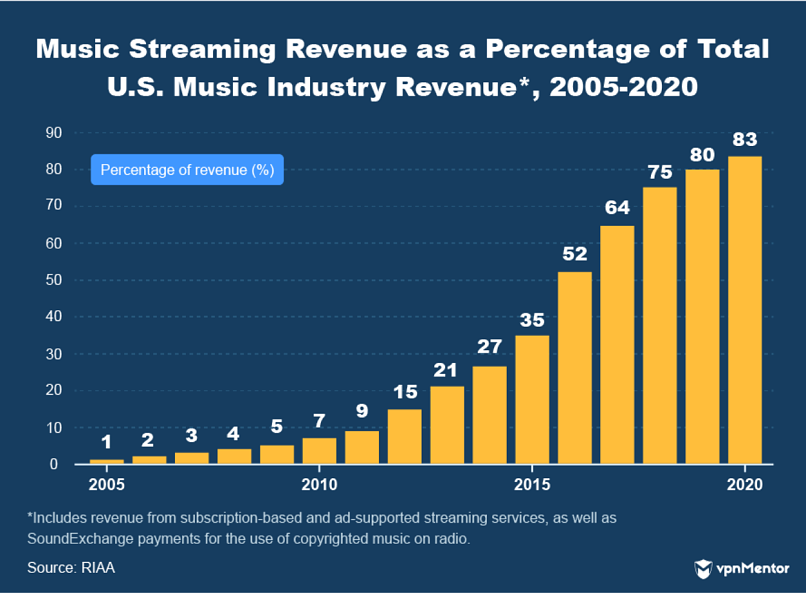

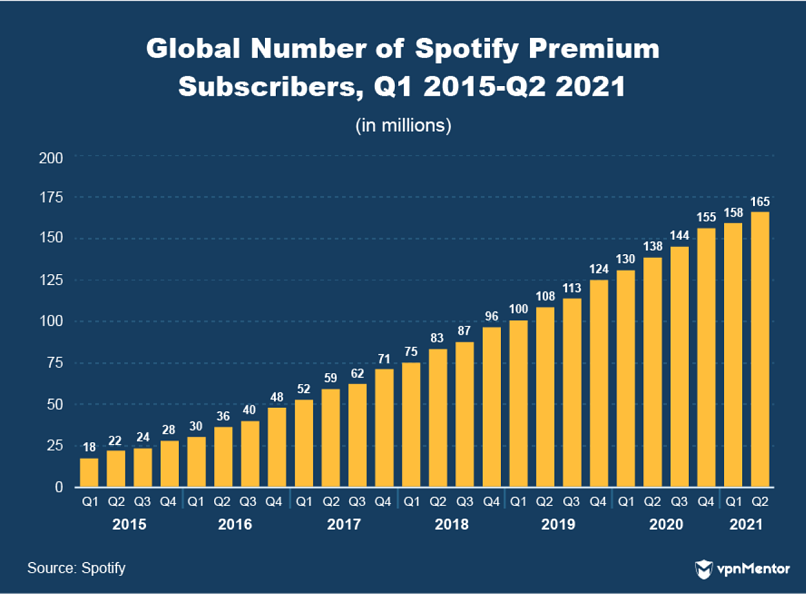

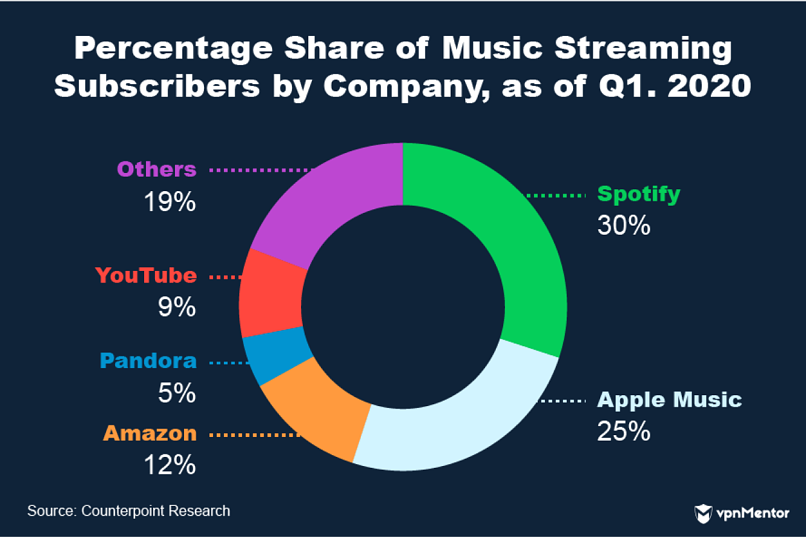

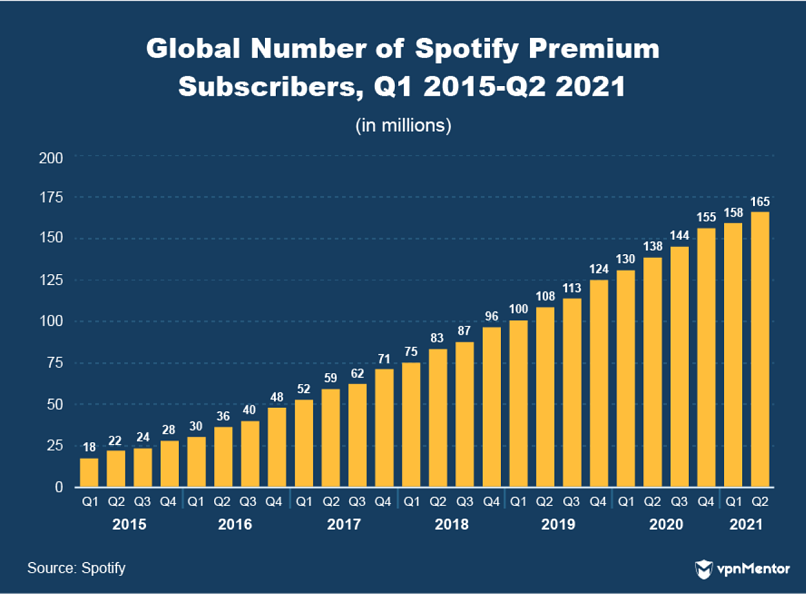

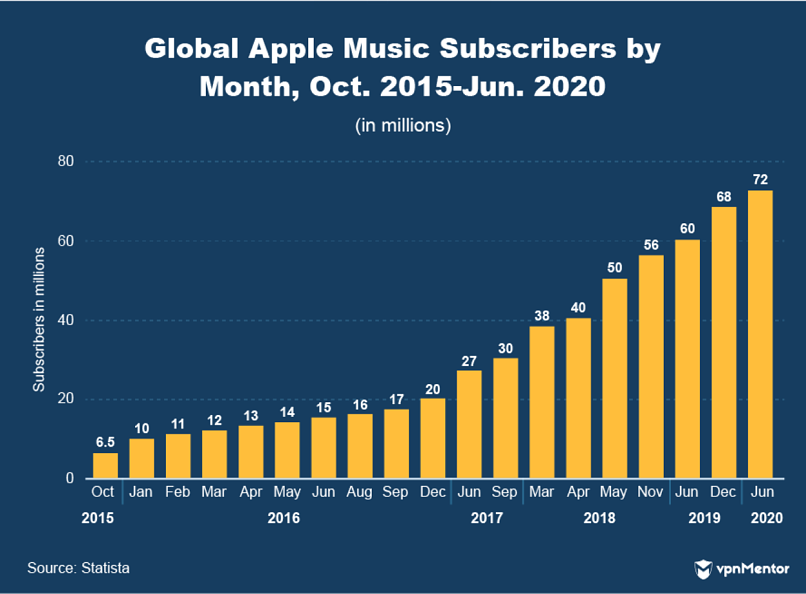

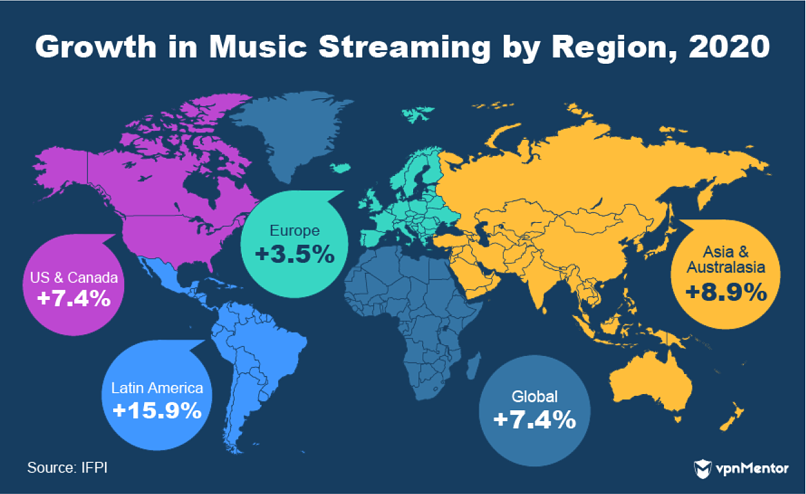

Clearly, the accessibility that streaming provides is too difficult to ignore for many lovers of music.

Part of the platform’s success is likely down to its emphasis on discovering new music and emerging artists.

Thats an 11 million increase from the previous quarter.

It generated revenue of over $2.17 billion in this same period.

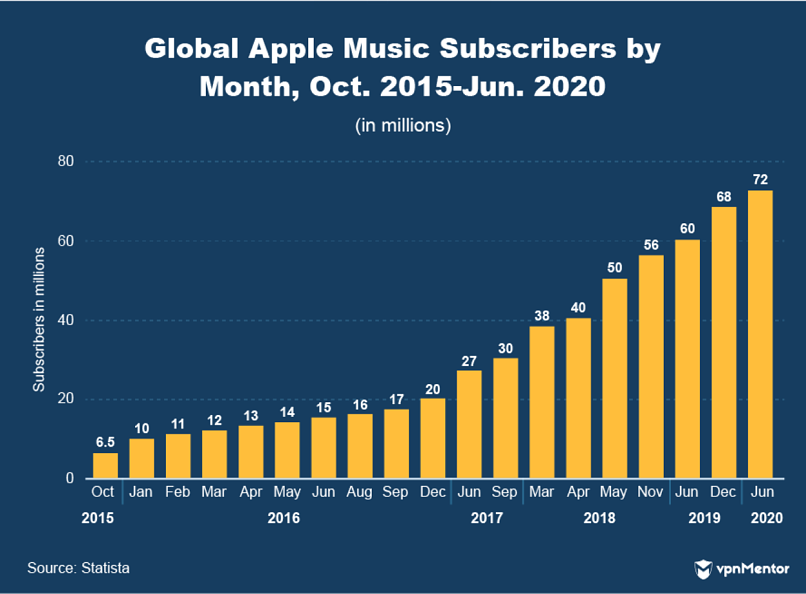

Thats not to say that Apple Music isnt still thriving from a recent boom across all streaming services.

Apple Musics also available in 167 countries.

Considerably more than Spotify’s 79.

Although, Spotifys popularity elsewhere still means it is growing at a faster rate.

Here are some key stats for e-commerce sites in 2021.

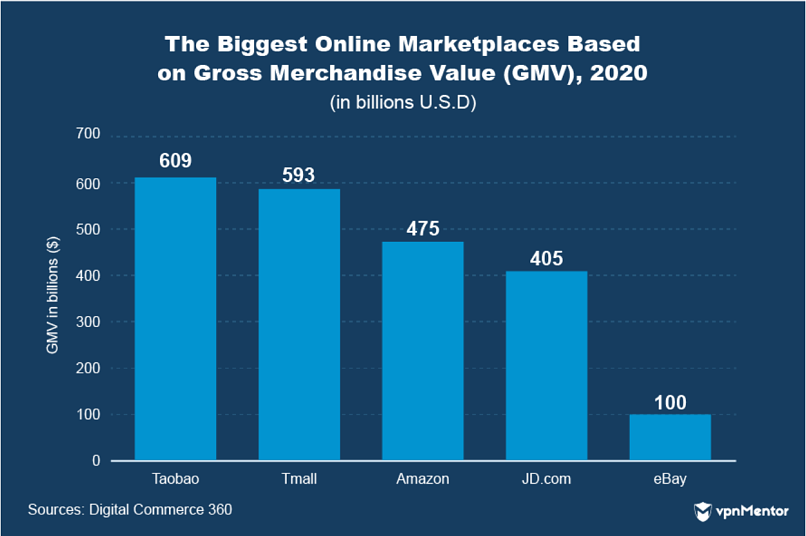

Amazon had a record year which saw the company become the biggest retailer on the planet.

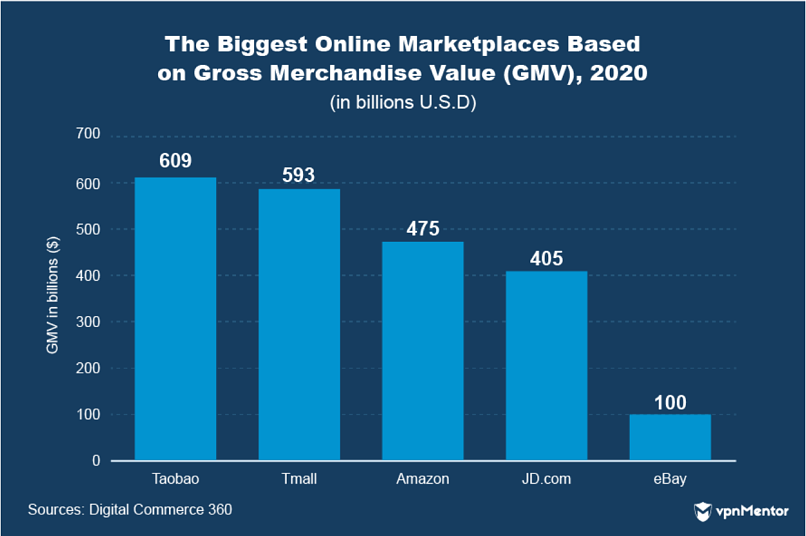

Amazon and its users sold around $475 billion of merchandise in 2020.

Meanwhile, Chinese platforms Taobao and Tmall each had a phenomenal year.

Over $1 trillion worth of merchandise was sold through both platforms combined.

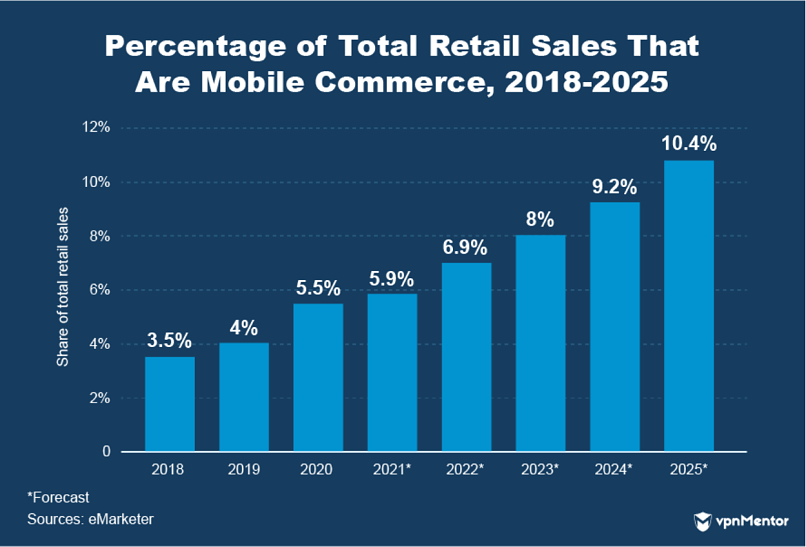

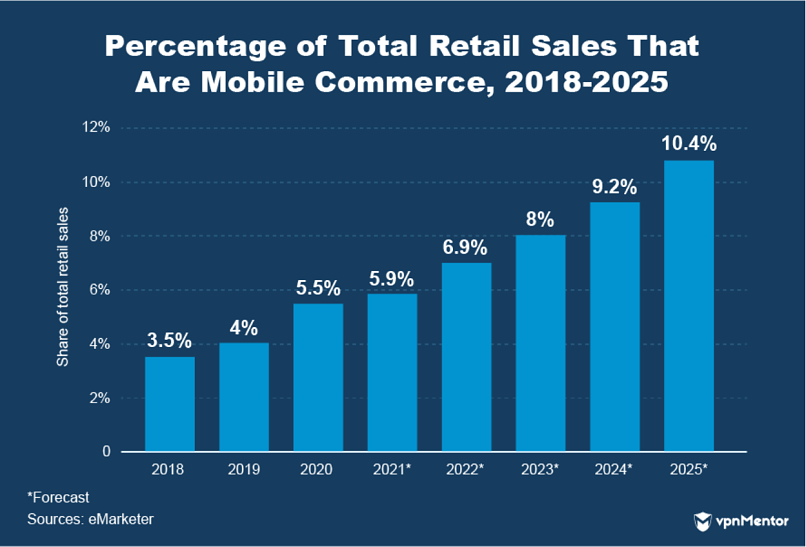

E-commerce finds itself thriving at a time when mobile retail is also gathering momentum.

On Cyber Monday in 2017, mobile retail hit a record landmark of 2 billion sales.

The mobile retail market has only grown in dominance since.

93.5% of internet users have purchased a product online.

That development should see mobile account for a 10.4% share of all retail sales by 2025.

Platforms that cater to mobile users should profit accordingly.

E-commerce allows consumers to view, compare, and purchase products on the other side of the world.

A Nielsen study found that 57% of all consumers buy products from overseas retailers.

In Europe, this number is as high as 63.4%.

That makes sense, given the close proximity of so many different nations.

Amazon accounts for 44% of all e-commerce sales.

9/10 consumers check prices on Amazon before purchasing something.

These crazy stats are typified by Amazons performance in recent years.

Shopify Offers Options

Shopify is one of the leading online rivals to Amazon.

Shopify aims to be the worlds first global retail OS.

Shopifys array of customization options are contributing to rapid success.

Thats an 86% increase in turnover compared to 2019.

At the root of this upturn is Shopifys prominence as an e-commerce platform for the everyday person.

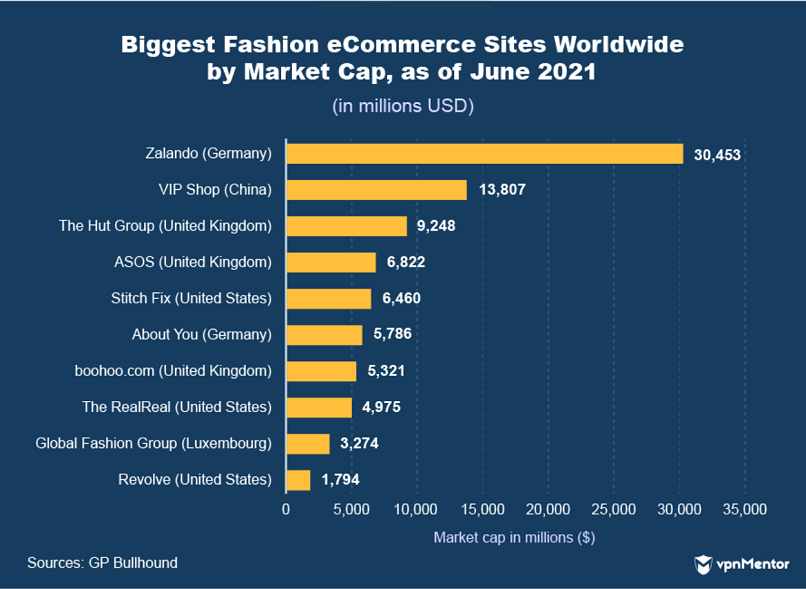

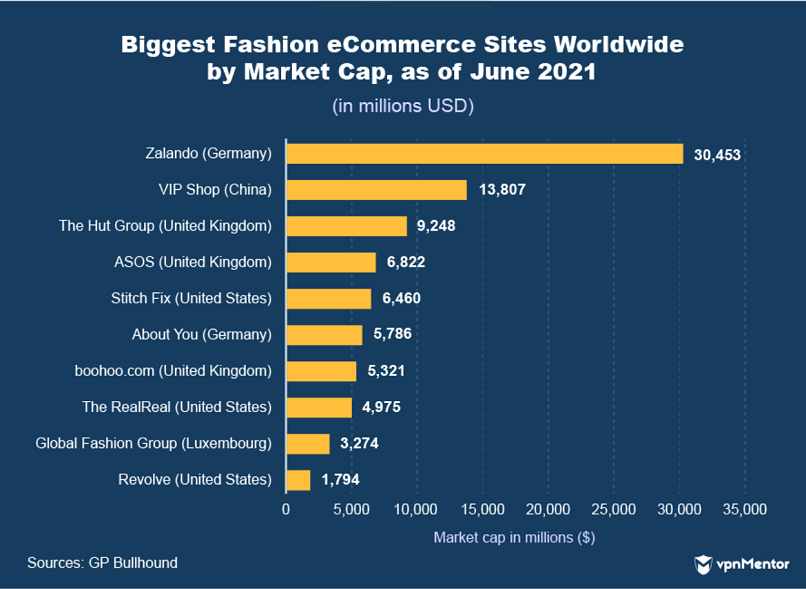

Zalando is a Berlin-based online fashion store founded in 2008 by Robert Gentz and David Schneider.

Its home to over 1,500 brands, delivering 200,000 listed products across 15 different active countries.

The site receives around 730 million visits and 29 million orders per quarter.

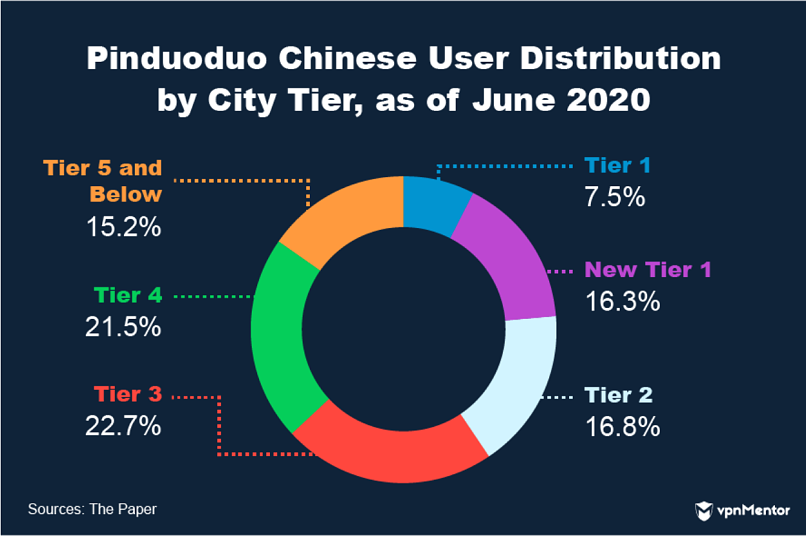

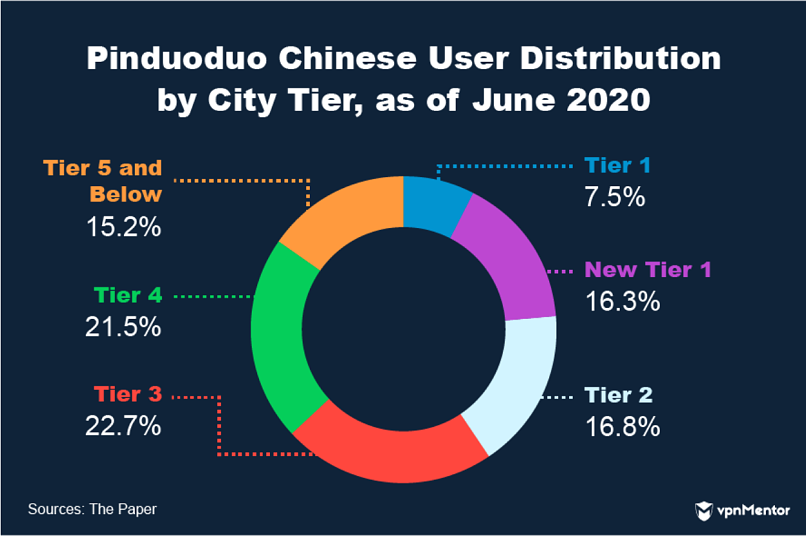

36.7% of this user base live in tier 4 or lower Chinese cities.

This means Pinduoduo users generally come from lower-income households.

The company has been massively successful at targeting this demographic.

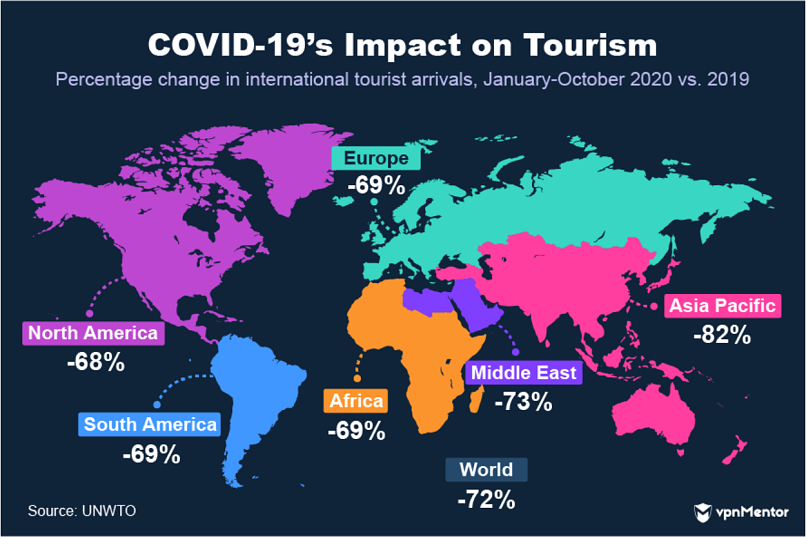

Travel

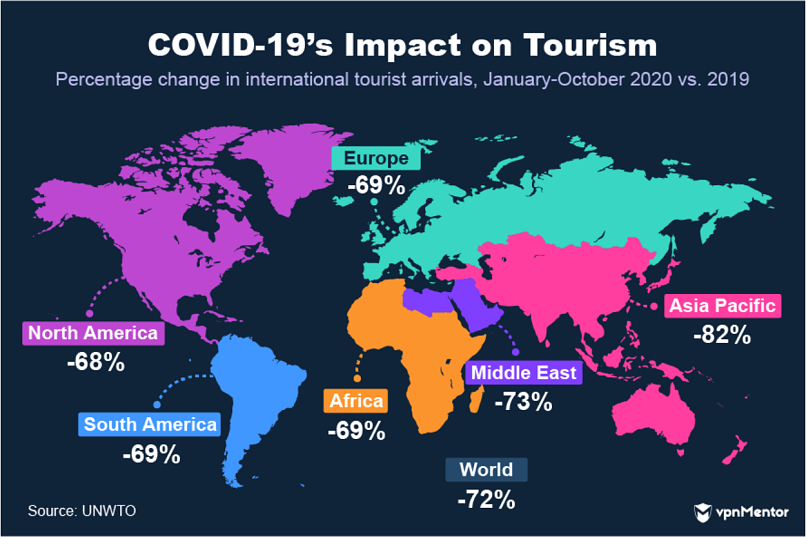

Perhaps no industry was hit harder by the global pandemic than global travel.

Stay-at-home orders and international travel bans combined to bring the travel industry to a standstill in April of 2020.

Here is the current state of online travel in 2021.

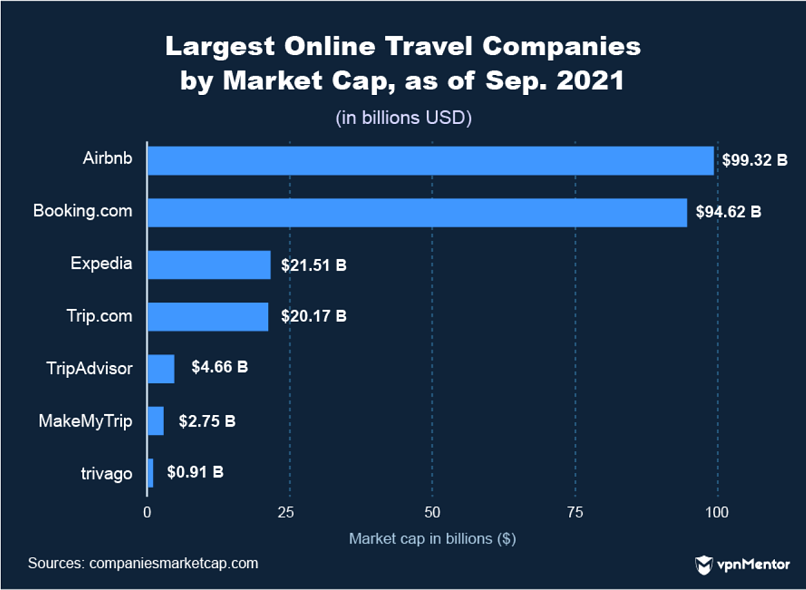

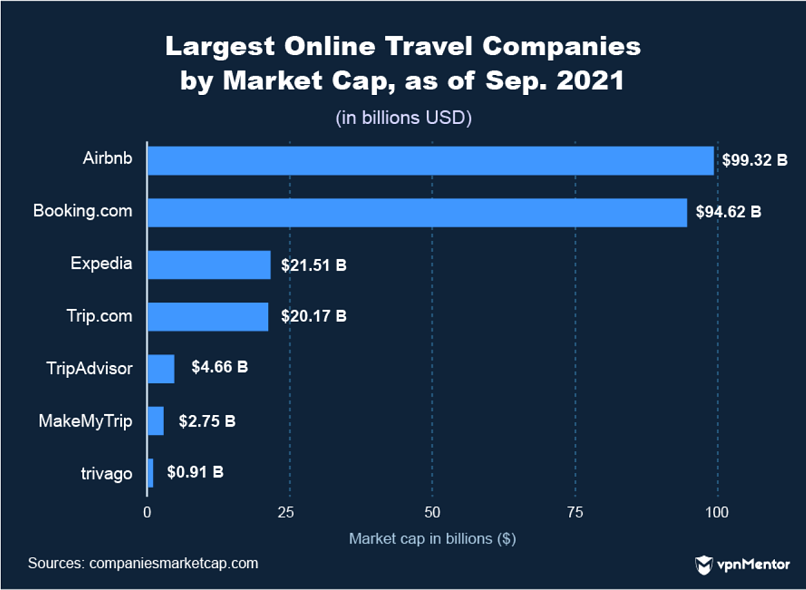

Booking.com was the biggest online travel company in the world in 2020.

Airbnb is now worth a whopping $99 billion.

Other apps such as Trip.com, Trivago, and TripAdvisor feature.

Also, Expedia which has risen to become the third biggest online travel company in 2021.

Expedia has a market value of $21.5 billion, still some way behind Airbnb and Booking.com.

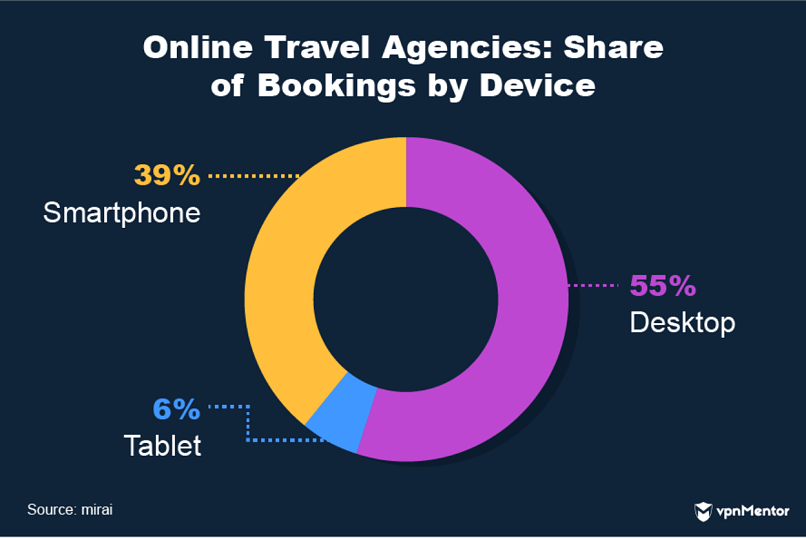

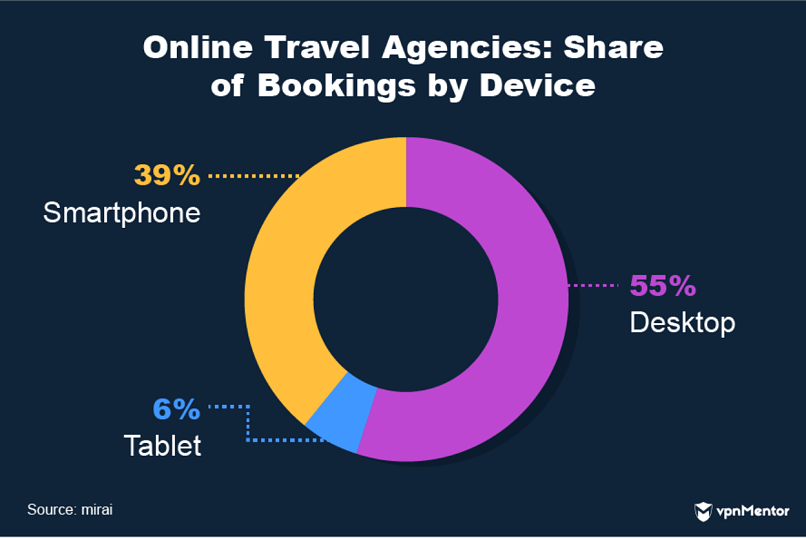

How Do People Make Online Bookings?

So, how do people usually book their holiday with an online travel agency (OTA)?

Well, research shows that people still prefer to book their holiday via a desktop.

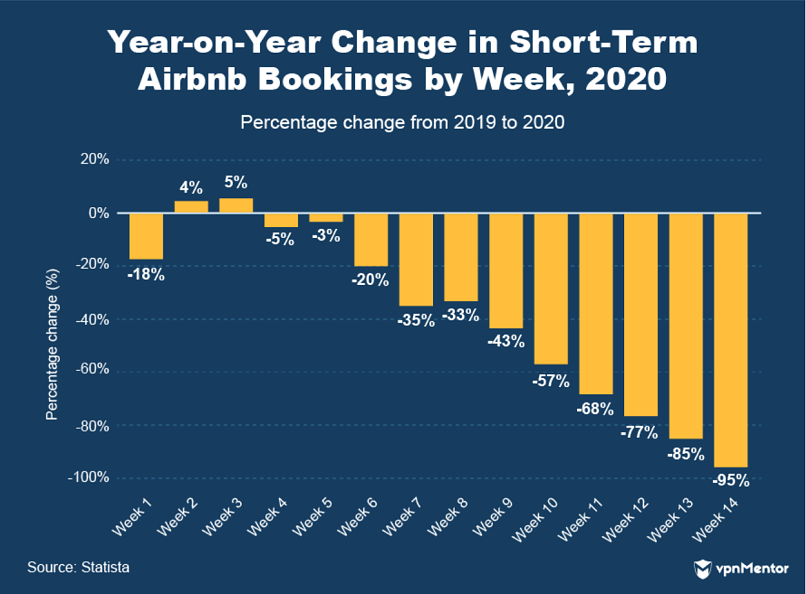

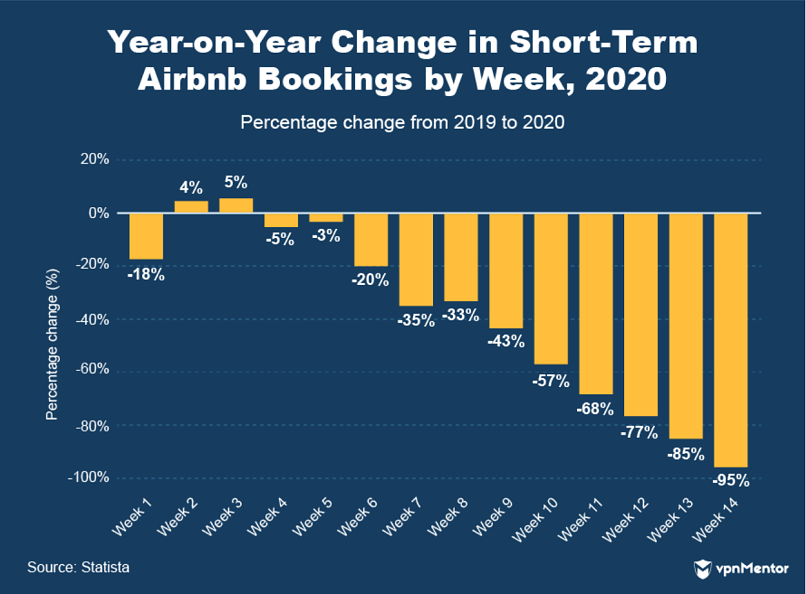

Airbnb Loses All Business

Let’s start with one of the biggest online travel companies around: Airbnb.

The company experienced a 95% decrease in bookings following the imposition of lockdowns.

Revenue was badly damaged for Airbnb throughout 2020.

Its $3.4 billion turnover represented a 30% decrease from the year before.

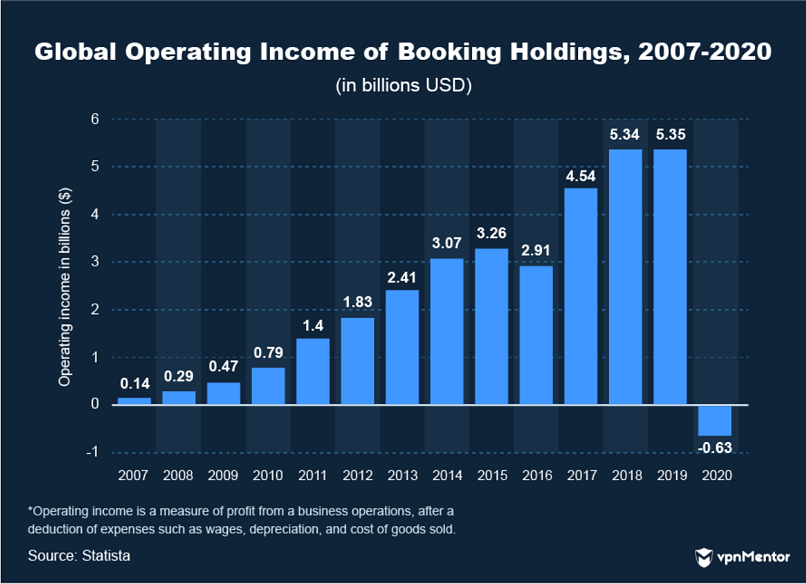

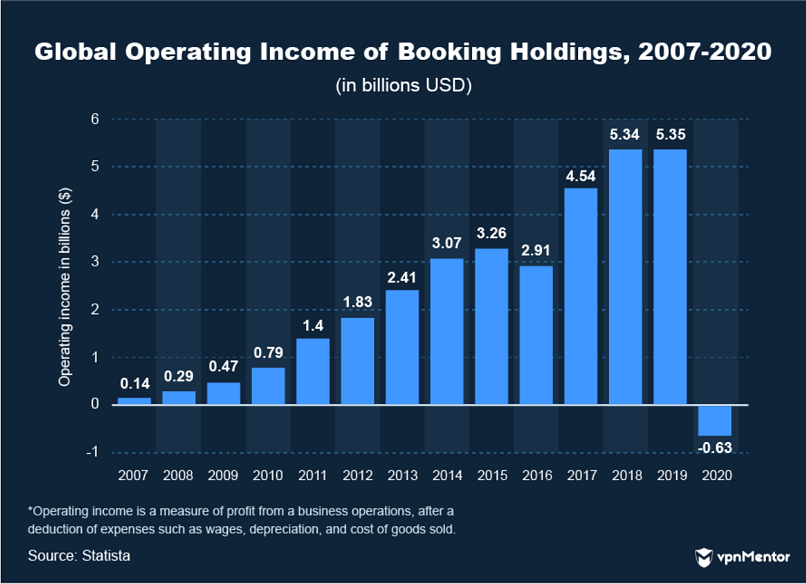

No Bookings for Booking.com

Booking Holdings experienced a similarly difficult 2020.

Booking Holdings gross travel bookings plummeted 63% from the previous year in 2020.

But Booking Holdings (and all of its associated services) would suffer horribly in a tumultuous 2020.

Thats a $6 billion difference from the year before.

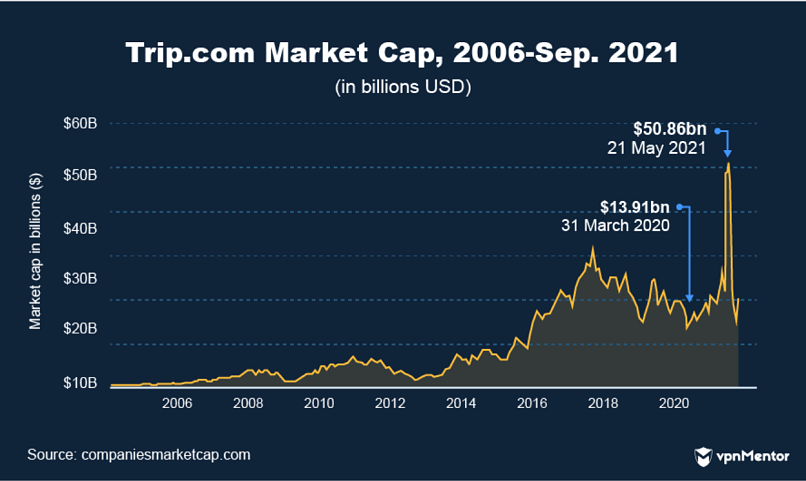

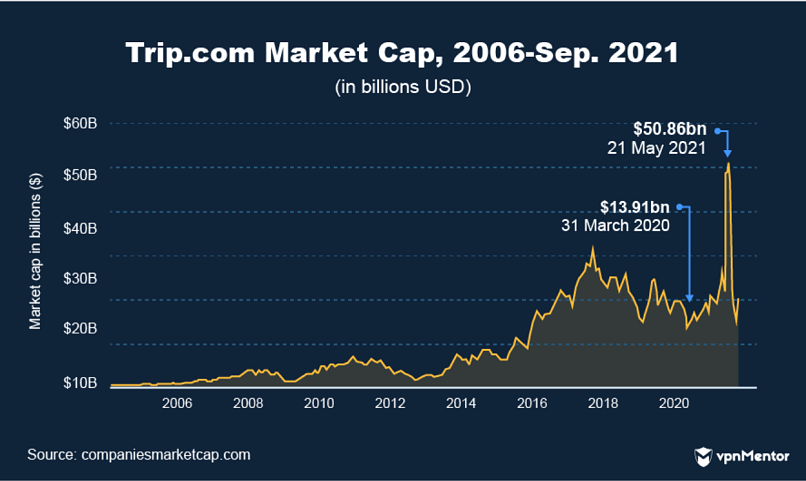

Like every other online travel company, Trip.com saw huge losses in 2020.

Accommodation reservations accounted for 39% of Trip.coms revenue in 2020.

Significant revenue losses resulted in Trip.coms lowest valuation in years.

The Chinese company had a market cap of $13.91 billion at the beginning of lockdown in 2020.

Trip.coms statistics are starker than most.

Overall, the gig economy saw a 33% increase in participation throughout 2020.

Gig workers made a collective $1.7 trillion a 29% increase from 2019 ($1.2 trillion).

A fantastic 2021 seems to have set the wheels in motion for a prosperous future in the gig economy.

Fiverr Attracts Buyers

Fiverr is a freelancing website founded in 2020 by Micha Kaufman.

The website allows businesses (buyers) to hire freelancers (sellers) to provide services across several industries.

Fiverr has a market cap of around $6.6 billion.

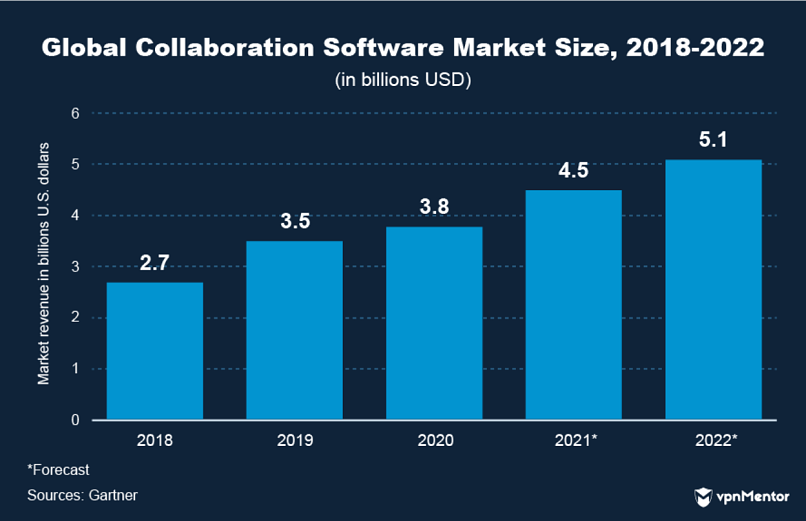

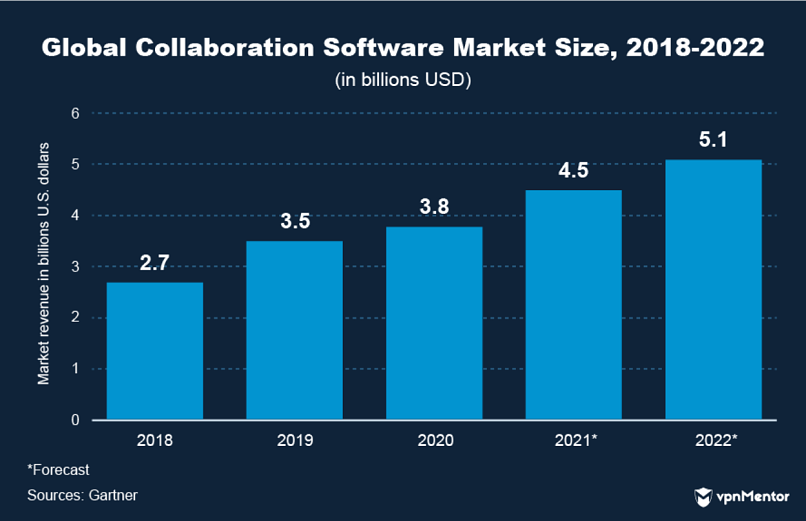

The collaboration software market reached $3.8 billion in 2020.

2021 should be an even better year for the sector with $4.5 billion of forecasted revenue.

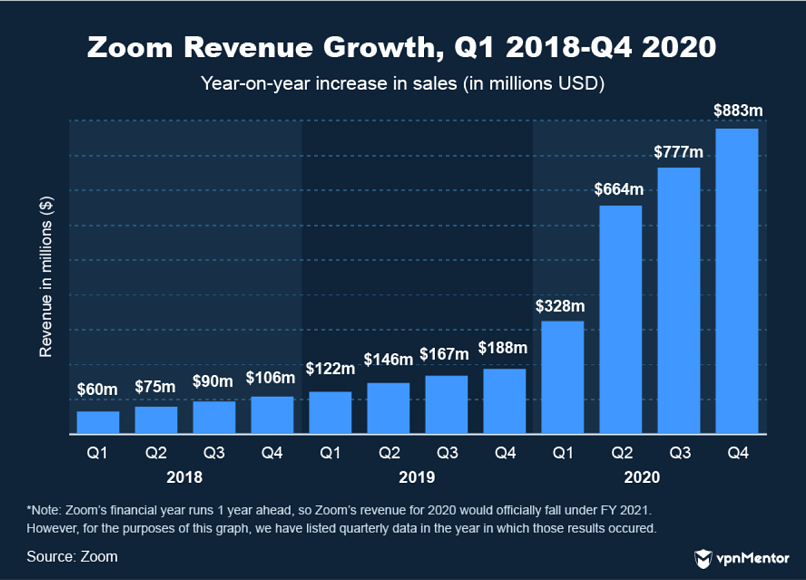

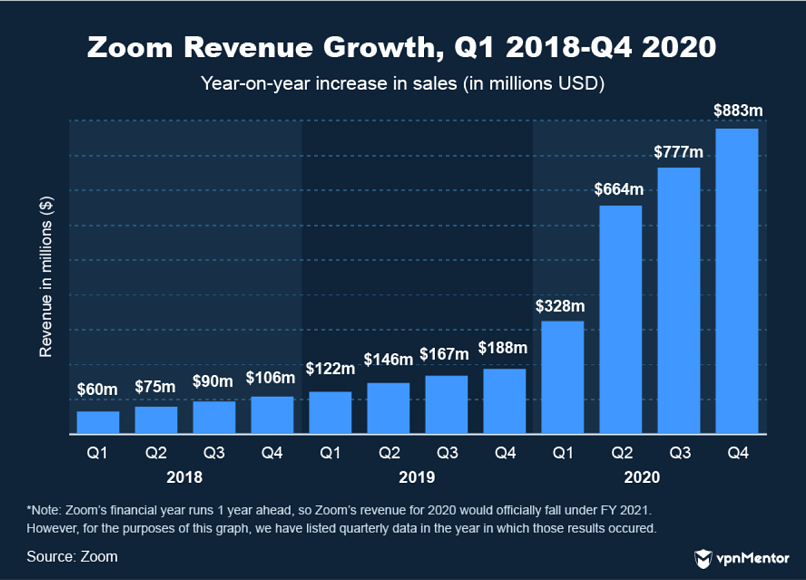

Zoom Revenue Increases 700%

Zoom is undoubtedly one of the biggest winners in the collaboration software market.

The platform grew by 300 million new users in April 2020, as many industries moved their operations online.

The crazy numbers from Zooms 2020 keep coming.

Overall, Zoom generated $2.652 billion in revenue in 2020.

An enormous increase of 702% from 2019.

Zoom may be the biggest mover on this list.

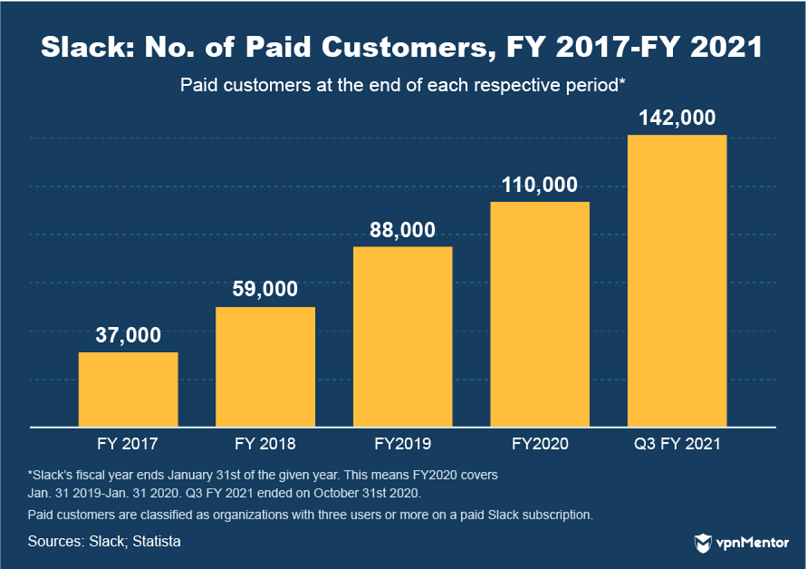

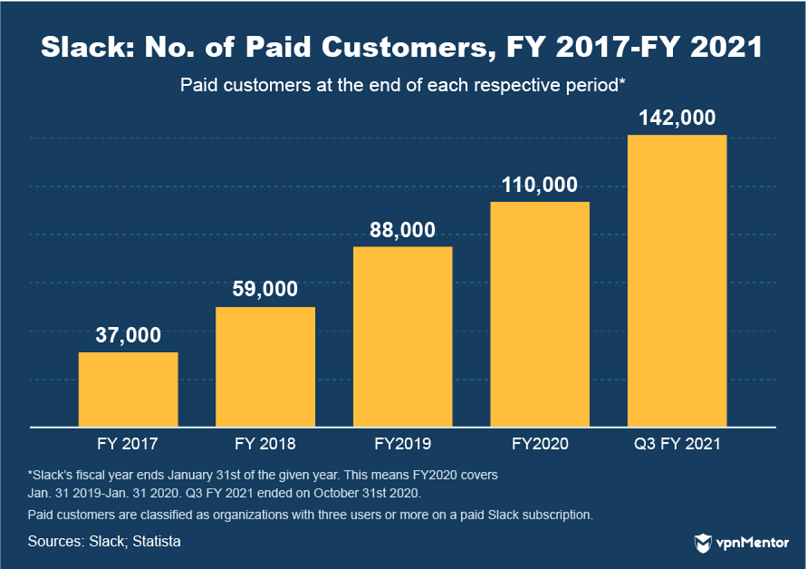

Slack currently has more than 12 million active users and 140,000 paid corporate users.

In September 2021, Slacks value hit an all-time high of $26.5 billion.

People really like Slack, which is why the platforms upward trajectory is expected to continue.

According to industry estimates, Slacks active monthly user base could reach 79 million by 2025.

Twilio Stocks Rise

Twilio is niche compared to Slack.

The app saw a similar boom in 2020 compared to many other work collaboration platforms.

Twilios user base grew from 179,000 to 220,000 in late December 2020, generating $1.75 billion in revenue.

The share price remains on a generally upward trajectory, too, reaching $443.49 in mid-February 2021.

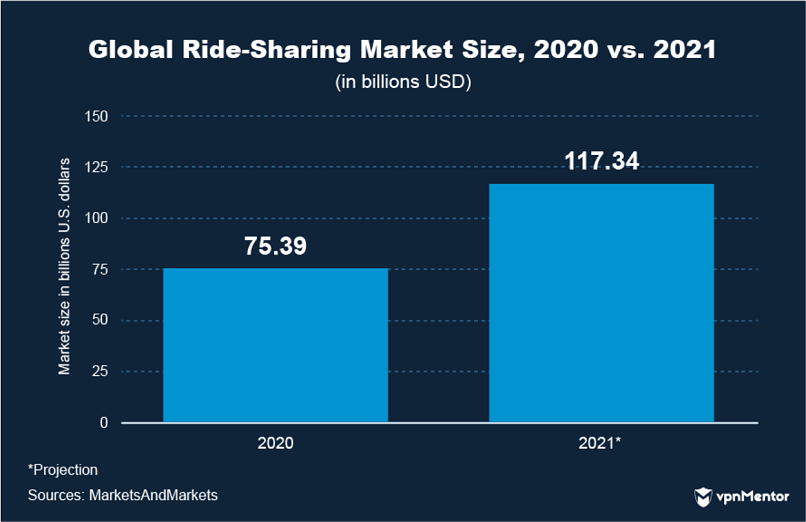

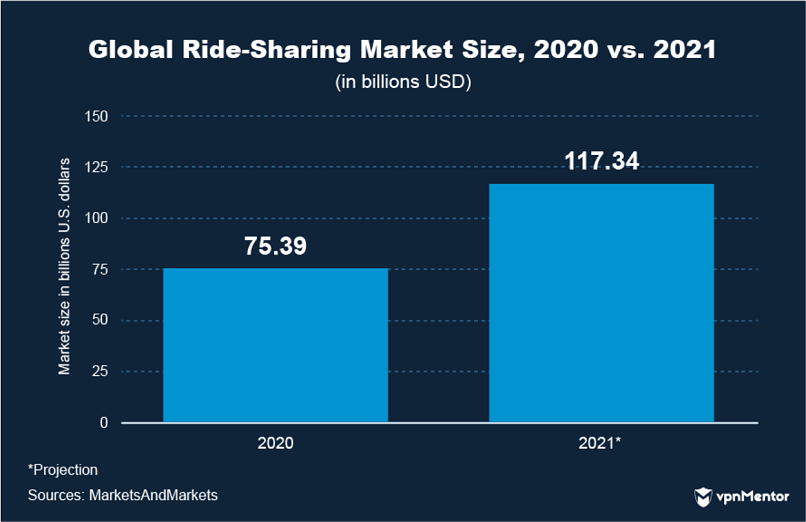

Ride-Sharing & Delivery

Ride-sharing and delivery are 2 similar industries with contrasting fortunes.

Delivery, on the other hand, had its best year yet.

A boom in food delivery app usage has placed the entire market on an upward trajectory.

Chinas only ride-sharing service DiDi has 377 million active users and holds 90% of the nations market.

Elsewhere, things are looking up for ride-sharing companies in general.

The market is expected to reach over $115 billion by the end of 2021.

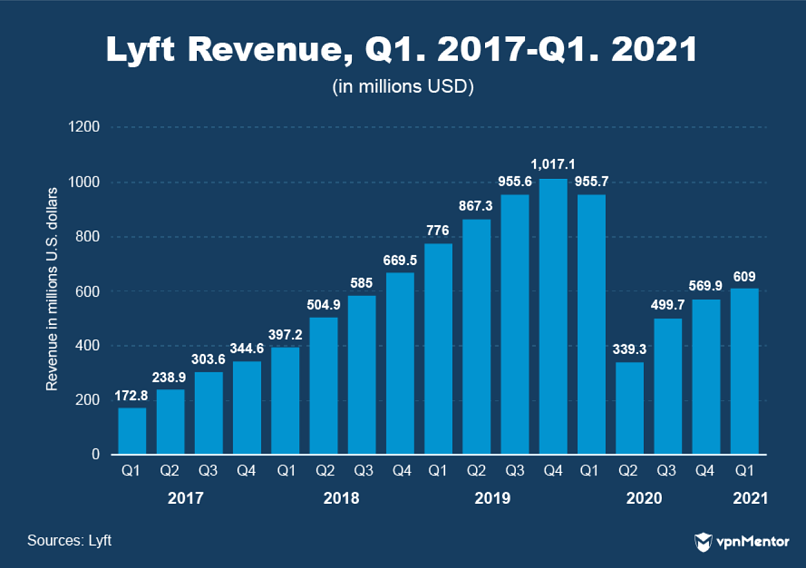

There arent too many online companies that have faltered recently, but services like Lyft certainly rank amongst them.

Founded in 2012, the peer-to-peer transportation service struggled as COVID-19 lockdown diminished the need for transportation and ride-sharing.

The company is still impressively far-reaching, though.

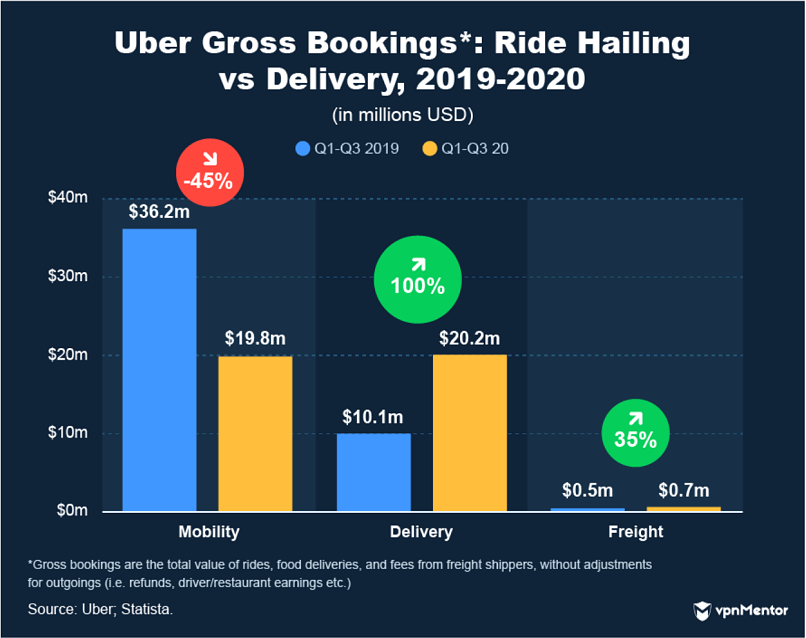

Ride-hailing has suffered terribly, whereas food delivery apps have enjoyed their best period.

While ride bookings fell by 38%, food delivery bookings through Uber Eats rose by 166%.

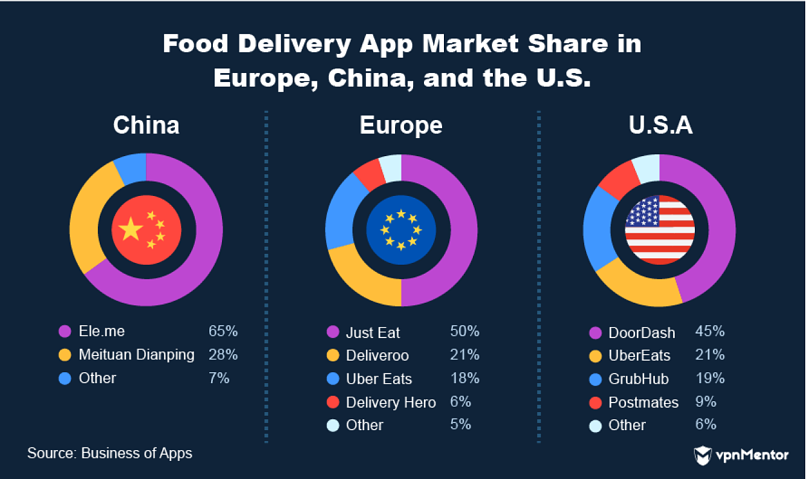

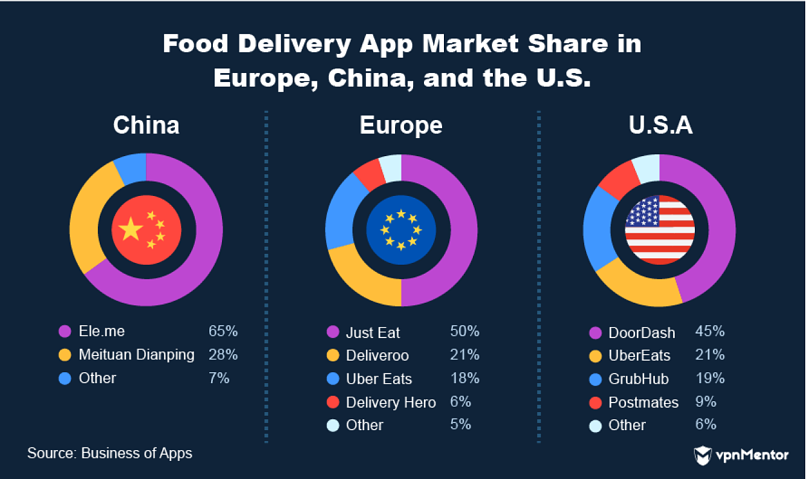

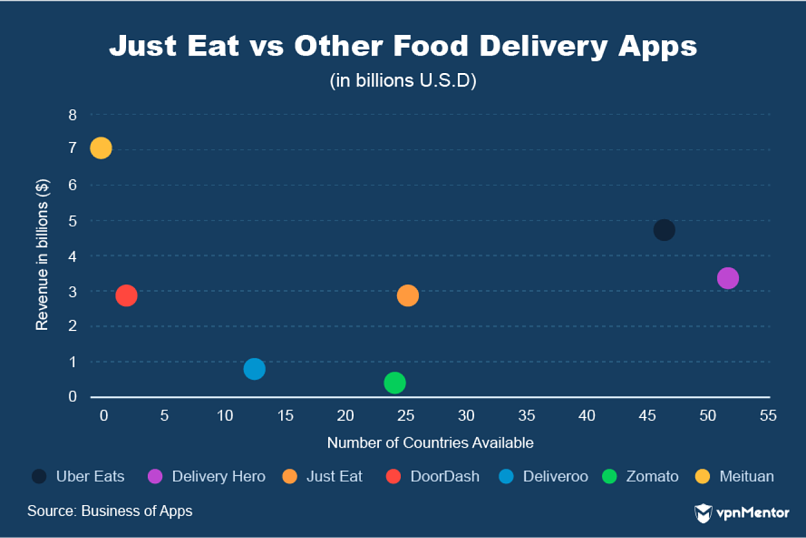

DoorDash is the biggest food delivery app in the United States and has a market share of 45%.

In China, a completely different cast of services makes up the market.

Meituans app is by far the biggest in China, with a market share of 65%.

Food App Market Size Forecast

The COVID-19 pandemic has accelerated the development of the food delivery app market.

Thats pretty impressive growth.

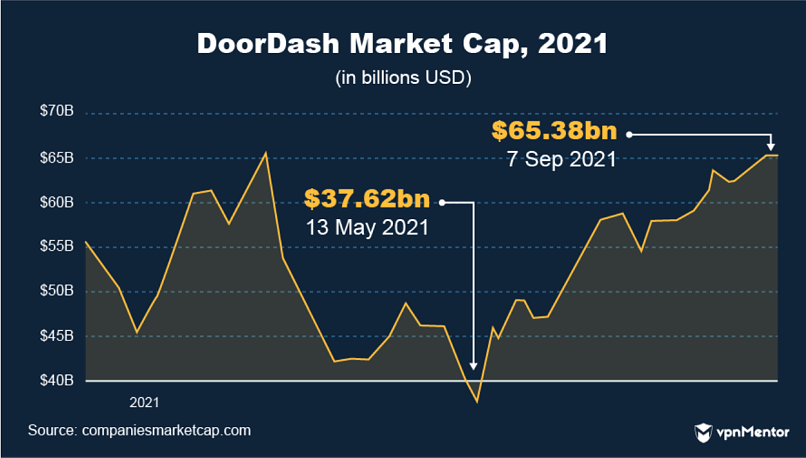

DoorDash on an Upward Trajectory

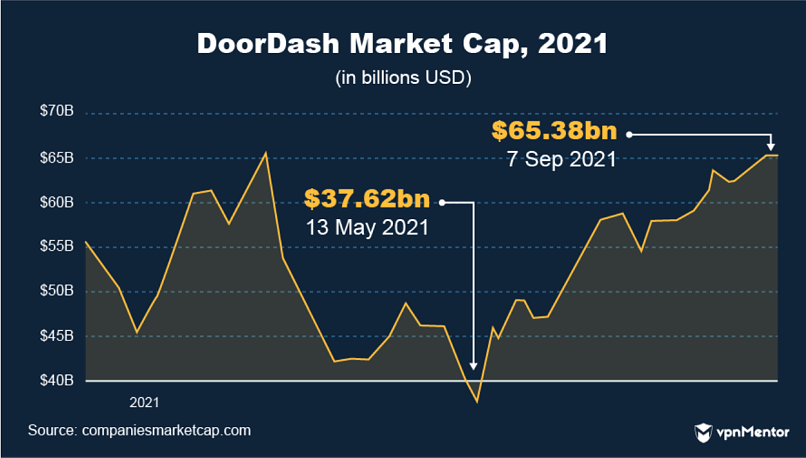

The biggest player amongst food delivery services in America is DoorDash.

DoorDash posted record revenue of $2.9 billion in 2020, a 241% increase from 2019.

Its success was partly down to an aggressive acquisition strategy.

The apps popularity meant it entered the market with a massive $72 billion valuation in late 2020.

This was ridiculous to some as many felt the success of DoorDash was primarily attributed to the COVID-19 pandemic.

Despite record numbers, DoorDashs aggressive strategy and overall outlay meant it failed to register a profit in 2020.

Nonetheless, the company has seen its valuation climb after a massive drop in May 2021.

A large portion of that drop in value was sparked by a sell-off.

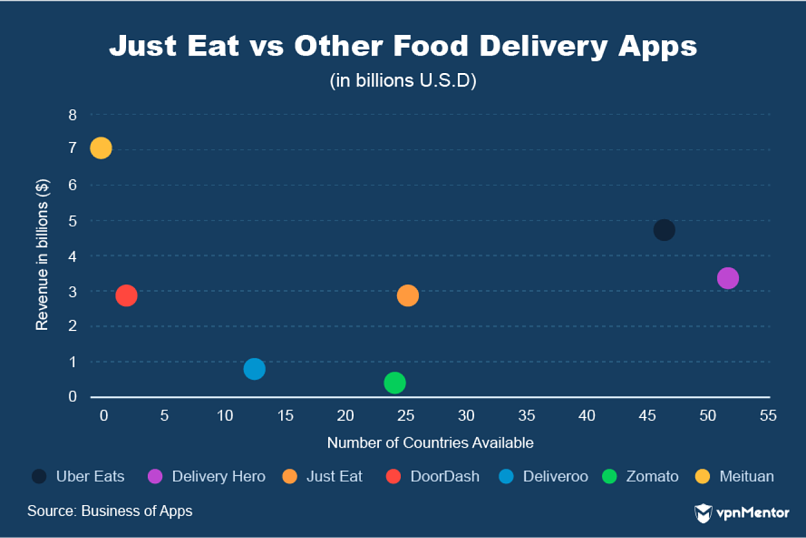

Since then, Just Eat has grown into a dominant food delivery brand.

Thats a 61% increase from 2019.

So, 2020 was a pretty good year all around for Just Eat.

Nonetheless, here are a few more companies from other industries that have made it big.

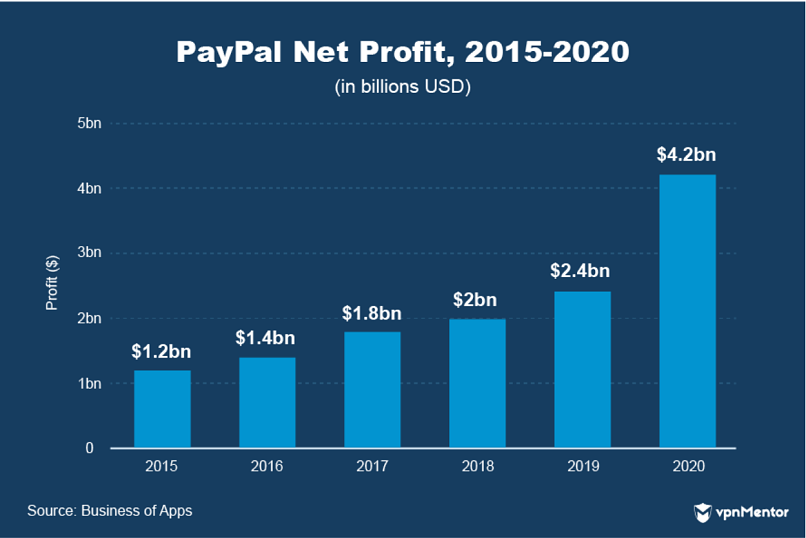

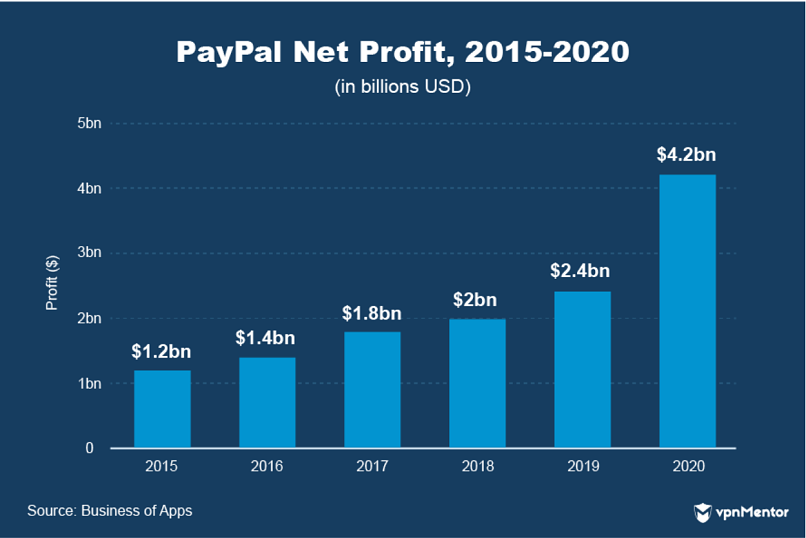

PayPal Sees Record Profit

PayPal was one of the first payment solutions that tried to fix online transactions.

Though the platform has missed opportunities for further growth over the years, it is now seeing record performance.

The ensuing emphasis on online payments and e-commerce during COVID-19 has propelled the platform into new territory.

Thats not only in the form of revenue, either.

PayPal is now turning big revenues into massive profits.

Revenue rose by 20.9% in 2020 to $21.4 billion.

Net profit, meanwhile, rose to $4.2 billion in 2020.

Thats an increase of 75% from the year before.

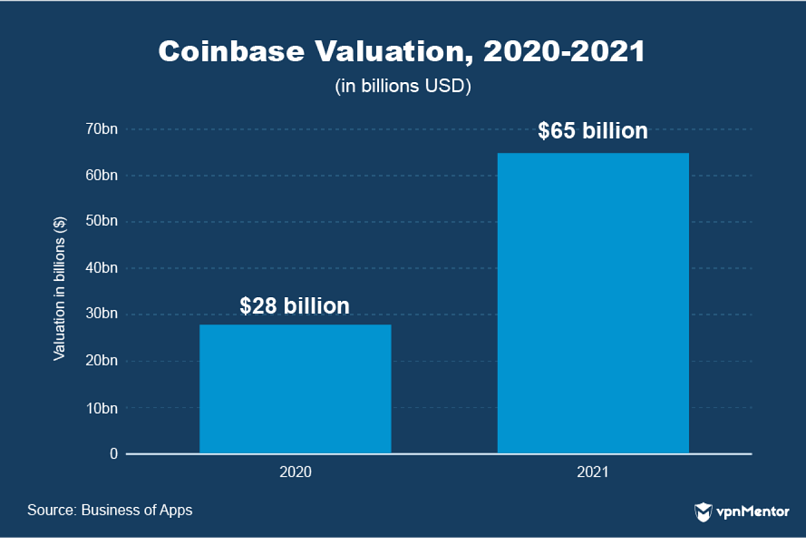

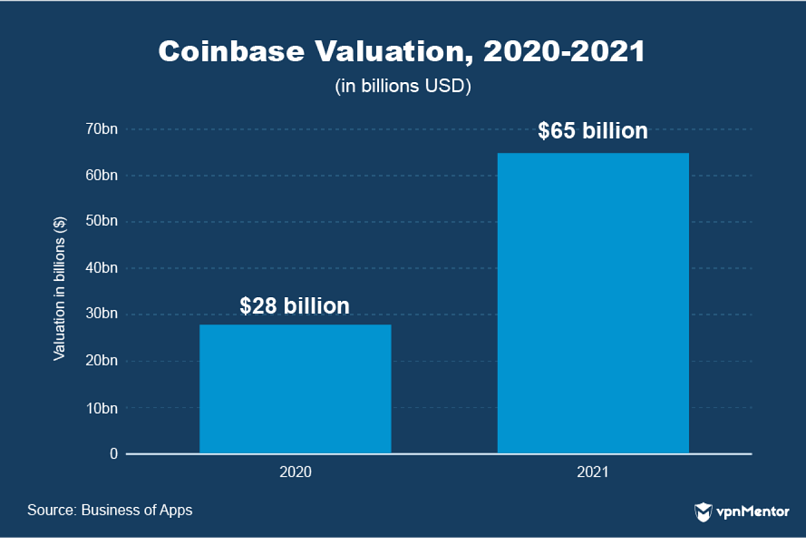

Coinbase has been the leading crypto-exchange platform since 2012.

For this reason, its been the biggest beneficiary of a recent rise in cryptocurrency value.

In the second quarter of 2020, Coinbases revenue increased from $585 million to $1.14 billion.

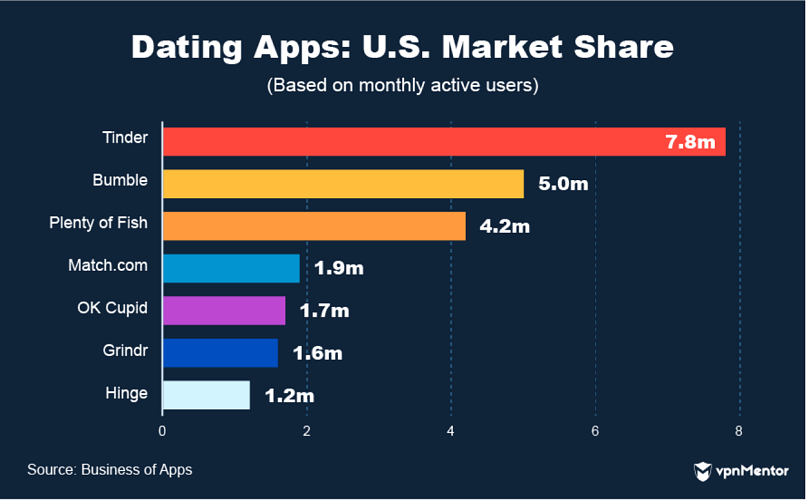

Match Group Monopoly

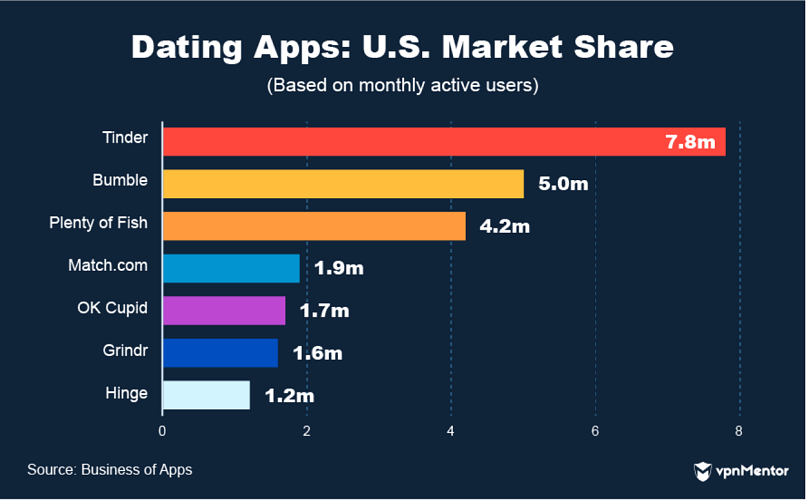

These are all of the prevailing dating apps in the U.S. market.

Now, what if I told you that Match Group owns all but 2 of them?

In fact, the groups monopoly consists of 45+ dating services in total.

Bumble and Grindr are the only 2 major apps not within its management.

A massive increase in revenue coincided with a massive increase in users of Matchs services.

In 2020, revenue rose to $2.4 billion, up from $2 billion in 2019.

Revenue data shows that people jumped on dating apps after lockdowns were eased, too.

Q3 revenues increased by 15% compared to the second quarter of 2020.

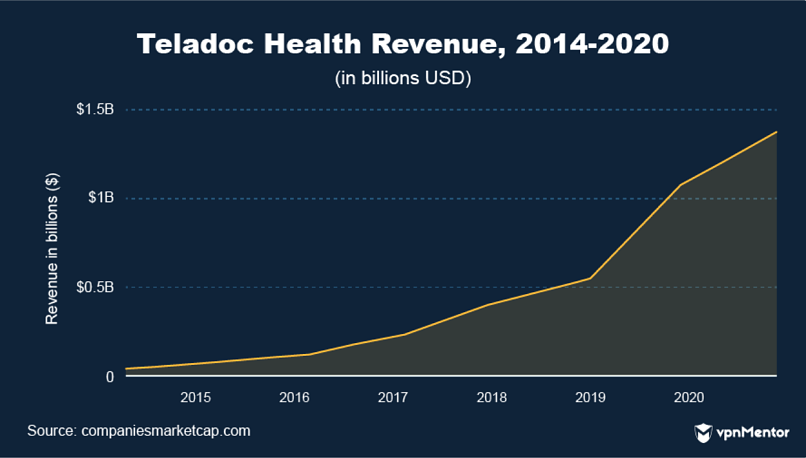

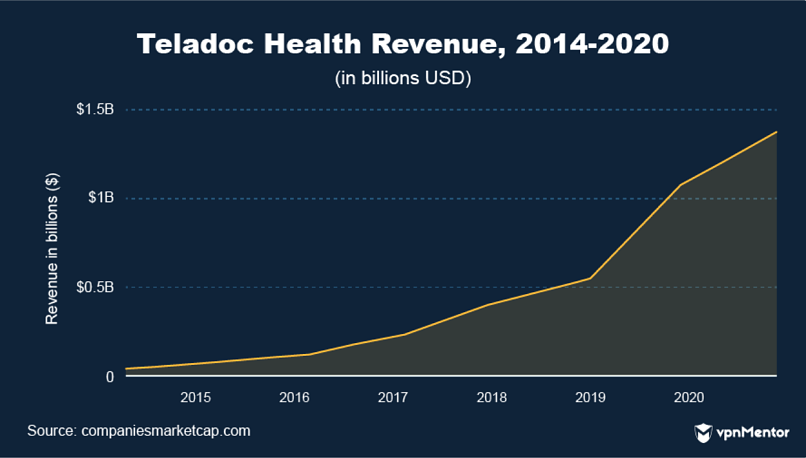

Teladoc Health operates within a novel and emerging subsector of the healthcare industry.

Throughout the first 9 months of 2020, 7.6 million people used the Teladoc Health platform.

Thats a 163% increase in user base compared to the previous year.

Teladoc Health looks as though it has been the main beneficiary of the telehealth industrys rise.

Overall, Teladoc Health has prospered recently, posting a record revenue of $1 billion in 2020.

Some industries have struggled, though.

In many ways, online sectors like travel and ride-sharing have been desperately unlucky.

No one could have predicted the unfortunate events of 2020.

As for the winners, these internet companies have been launched into unparalleled levels of success.

Surely now the business worlds transition online is already well underway!

kindly, comment on how to improve this article.